B4LLS/iStock via Getty Images

Intro

Franklin Covey Co. (NYSE:FC) (training & consulting firm) is expected to deliver $0.18 in GAAP earnings on sales of $64.27 million in its fiscal third-quarter results which will be announced after the close on the 29th of June. If these numbers are met or indeed exceeded and guidance remains strong (guidance was already raised after the reporting of Q2 numbers), then we believe Franklin Covey will be a strong buy post the announcement.

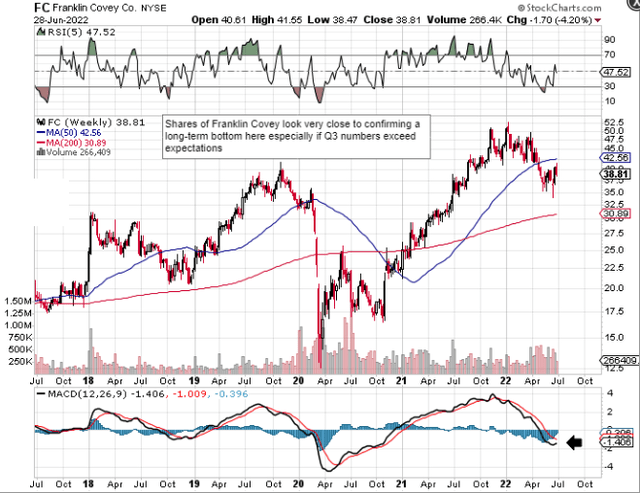

As we can see from the technical chart below, shares are very close to giving a buy signal through the popular MACD technical indicator. Again, further bullishness from the company’s third-quarter numbers should enable shares to rise once more above their 50-week moving average (200-day moving average equivalent) which should lead to a strong trending move once more.

Remember, share-price action on the technical chart is merely the result of the fundamentals of Franklin Covey at this moment in time. Suffice it to say, there are fundamental reasons why shares seem to be honing in on a bottom at present, a bottom which may very well be cemented (MACD crossover) when Q3 earnings numbers are announced.

Franklin Covey Technical Chart (Stockcharts.com)

Strong ROIC Growth

Our bullishness in FC comes back to the following premise. As long as there are sufficient sales and earnings to grow FC’s cash flow, then this very same cash flow can be used to increase the company’s assets which restart the whole profitability cycle all over again. Now, many of the companies we cover suffer growth issues temporarily but continue to have the wherewithal to generate free cash flow which is the REAL driver of profitability going forward.

Franklin Covey, however, does not have growth issues which means re-investment back into the firm can be done at much faster speeds overall. Trailing operating profit growth comes in at 180%+ over a trailing average and 102%+ over a forward-looking basis. In essence, high return on invested capital percentages come from either turning over capital quickly or by earning above-average profits. When a company can combine these two trends as we see below on the flywheel, the market usually quickly reprices shares upward due to the much stronger pricing power of the outfit.

FranklinCovey´s Powerful Financial Cycle (Company Website)

Subscription Sales On The Rise

The market is fully aware of the dynamics taking place in each of the subsets laid out in the flywheel above. Sales of All-Access Pass & Subscription services for example have risen from under $14 million at the end of fiscal 2016 to almost $127 million over the past four quarters. Furthermore, no signs of a slowdown were evident in the company’s recent second quarter with both facets growing by 29% & 28%, respectively.

The extra value being added in subscriptions is not only resulting in growing sales but also in a very stable customer retention rate which once more came in above 90% in the company’s recent second quarter. Moreover, FC’s balance of billed and unbilled sales metrics continues to gain traction and definitely demonstrates to the market the stronger likelihood of sustained sales growth going forward.

Sustained Investment

Suffice it to say, when you have these top-line trends in place along with rising gross margins and bullish SG&A metrics as a percentage of sales, it becomes much easier to drive profits and cash-flow forward. Operating cash-flow increased to $23.2 million at the end of the second quarter and free cash-flow hit $21.2 million. Remember, FC has no debt to speak of on its balance sheet which means the firm will be able to take advantage of this cash to invest aggressively behind the company as well as look after its shareholders.

Therefore, when you tie all of the above trends together, Franklin Covey should be able to keep on investing behind the company aggressively where the speed of which will dictate how fast shares can potentially rally. By bringing onboard more value-adding acquisitions such as Jhana & Strive, management believes Franklin Covey can become the most trusted firm in this space which will lead to even higher customer retention rates which we are seeing at present. The company’s pending Q3 earnings numbers can give us a further glimpse into whether FC is indeed cementing its position as leader in the training & consulting industry.

Conclusion

Therefore to sum up, based on current trends, we expect Franklin Covey to hit its numbers in its upcoming third quarter earnings report. Subscription sales continue to grow and gross margin is also on an upward curve. This bodes well for Q3. We look forward to continued coverage.

Be the first to comment