Funtay

The US saw tremendous growth in oil production from 2017 to 2019 when oil prices were lackluster. Prices are much higher today, which should be a greater incentive for ramping output, but US production is growing moderately. Why is US oil production not growing more? This is a question that has confounded many people from politicians in Washington to anyone that has experienced sticker shock at fuel pumps this year. Today’s note digs into US oil production trends, the factors limiting growth, and how this is arguably a good thing for energy infrastructure companies.

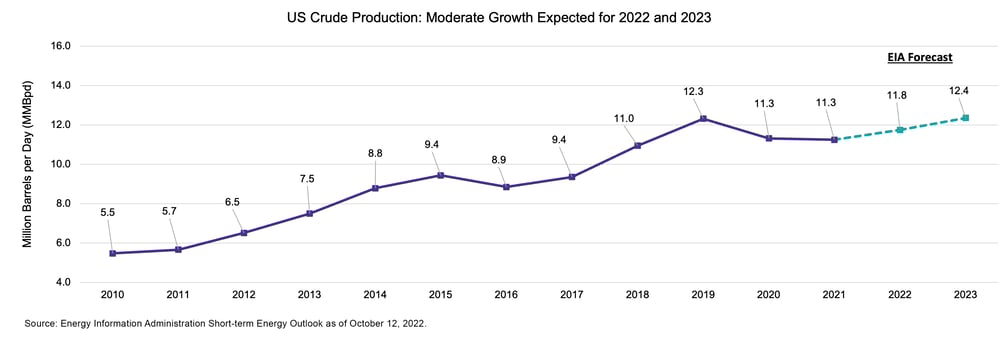

US oil production: heydays of growth give way to moderation.

The transformation of the US into a major oil producer and exporter within a period of ten years is truly remarkable. Perhaps it goes without saying, but the price spike this year in the wake of Russia’s invasion of Ukraine would have been much more severe if not for the significant oil production from the US. In the years leading up to the pandemic, US oil production saw a meteoric rise, with annual output growing by about 3.0 million barrels per day (MMBpd) from 2017 to 2019 as shown below. Production reached an all-time monthly high of 13.0 MMBpd in November 2019 before collapsing to just 9.7 MMBpd six months later in the wake of the pandemic and oil’s price crash. Annual production was essentially flat in 2021, but volumes have increased in 2022 with higher prices. The latest monthly production numbers from August came in at 12.0 MMBpd – still well off the prior high but up 0.7 MMBpd from August 2021. Production is expected to achieve a new annual high in 2023 as shown in the chart below, but monthly production is forecast to only reach 12.6 MMBpd in December 2023.

Why isn’t US oil production growing more at today’s high prices?

Despite ample reserves, significant industry expertise in shale production, and financial incentive from higher oil prices, US oil production is only growing modestly for several reasons. Public exploration and production companies (E&Ps) have committed to capital discipline with modest growth after years of destroying value by growing production too aggressively. Along with commodity price volatility, the growth for growth’s sake dynamic put energy stocks in the penalty box for many years. Having learned their lesson, management teams are complying with investor mandates to focus on returning cash to shareholders and keeping a tight rein on production (i.e., flat to 5% growth). Without pressure from public shareholders, private oil and gas producers have had more leeway to grow volumes and have helped drive much of the growth seen so far in 2022.

Beyond capital discipline from public producers, labor and supply chain constraints are also obstacles for production growth. On its recent earnings call, oilfield services firm Liberty Energy (LBRT) highlighted the tight market for fractionation and ongoing challenges in securing heavy equipment. Cost inflation for materials and labor have also increased the cost of drilling a well. Diamondback (FANG) talked about well costs being up 15% year-over-year on their 2Q22 earnings call in early August. Higher prices arguably help offset higher well costs, but if a producer is trying to stick to a certain capex budget and prices are up 15%, then activity may have to be more modest than planned.

Disclosure: © Alerian 2022. All rights reserved. This material is reproduced with the prior consent of Alerian. It is provided as general information only and should not be taken as investment advice. Employees of Alerian are prohibited from owning individual MLPs. For more information on Alerian and to see our full disclaimer, visit Disclaimers | Alerian.

Be the first to comment