Brian Ach

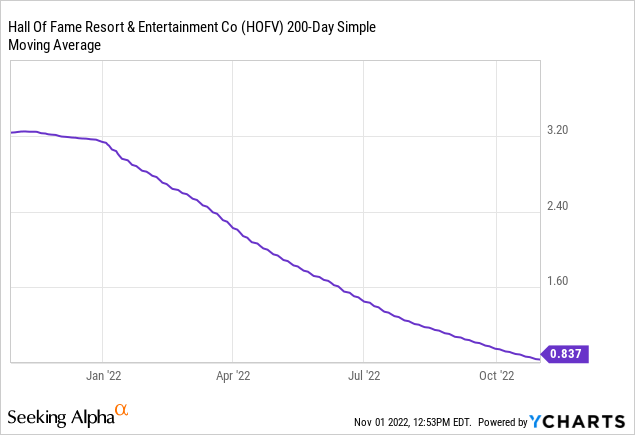

Hall of Fame Resort & Entertainment Company (NASDAQ:HOFV) currently owns and is continuing to build a compelling set of American football themed entertainment and competitive athletic assets around the Pro Football Hall of Fame in Canton, Ohio. Once completed, the Company will own the largest set of football-themed entertainment assets in the world, which are expected to attract millions of customers and drive meaningful value for HOFV shareholders.

- We initiate with a Buy–Venture rating.

- 12-Month Price Target of $1.30.

|

52-Week Range |

$0.522-$3.14 |

Total Debt |

$137.4M |

|

Shares Outstanding |

114.00 million |

Debt/Equity |

139.4% |

|

Insider/Institutional |

47.70%/0% |

ROE (LTM) |

NM |

|

Public Float |

80.09 million |

Book Value/Share |

$1.87 |

|

Market Capitalization |

$66.02 million |

Daily Volume (90-day) |

780,266 |

|

FYE Dec |

FY 2021A |

FY 2022E |

FY 2023E |

||

|

EPS ($) |

ACTUAL |

CURRENT |

PREVIOUS |

CURRENT |

PREVIOUS |

|

Q1 Mar |

$(1.67)A |

$(0.08)A |

$(0.11)A |

||

|

Q2 Jun |

$0.14A |

$(0.08)E |

$(0.09)E |

||

|

Q3 Sep |

$0.08A |

$(0.10)E |

$(0.07)E |

||

|

Q4 Dec |

$0.10A |

$(0.08)E |

$(0.06)E |

||

|

Year* |

$(1.03)A |

$(0.33)E |

$(0.32)E |

||

|

P/E Ratio |

NM |

NM |

NM |

||

|

Change |

NM |

NM |

NM |

||

|

FYE Dec |

FY 2021A |

FY 2022E |

FY 2023E |

||

|

Revenue ($ mil.) |

ACTUAL |

CURRENT |

PREVIOUS |

CURRENT |

PREVIOUS |

|

Q1 Mar |

$1.92A |

$2.11A |

– |

$2.67E |

– |

|

Q2 Jun |

$2.36A |

$2.69A |

– |

$4.07E |

– |

|

Q3 Sep |

$3.48A |

$8.08E |

– |

$11.81E |

– |

|

Q4 Dec |

$3.01A |

$7.30E |

– |

$9.83E |

– |

|

Year* |

$10.77A |

$20.17E |

– |

$28.37E |

– |

|

Change |

51.7% |

87.3% |

– |

40.6% |

– |

* Numbers may not add up due to rounding and changes in diluted shares outstanding.

Investment Thesis

Hall of Fame Resort & Entertainment Company is in the process of building out a premier set of American football-themed entertainment and competitive athletic assets in the United States. With the Pro Football Hall of Fame as its backdrop and business partner, HOFV is creating a football-themed entertainment empire that NFL fans will be excited to experience. With its combination of physical assets in Canton, Ohio, and its growing media and gaming businesses, the Company seeks to capitalize on the immense popularity of the NFL.

Building a Football-Themed Entertainment Business

Everyone familiar with the NFL knows that the Pro Football Hall of Fame is located in Canton, Ohio. Dedicated on September 7th, 1963, the Pro Football Hall of Fame commemorates those players that reached the pinnacle of career performance in American professional football. HOFV is building out a multi-use sports and entertainment destination centered around the Hall of Fame’s campus. To be clear, HOFV does not own or operate the Pro Football Hall of Fame. The Pro Football Hall of Fame is a 501(c)(3) not-for-profit educational institution. However, HOFV does own the stadium that hosts the Hall of Fame Game annually, as well as most of the assets adjacent to the museum. Additionally, the Company is building a media and gaming business centered around the popularity of the NFL.

HOFV already has a diversified revenue stream, driven by football-themed assets, and the Company’s sources of revenue will continue to grow as the gaming vertical is further developed and new physical assets come online. Exhibit 1 below illustrates management’s vision of the Company’s revenue opportunity.

Source: Hall of Fame Resort & Entertainment Company

While the majority of the Company’s revenues are currently being derived from the physical assets located in and around the Village in Canton, over time, as media offerings, fantasy sports and more importantly, sports betting, emerge as meaningful revenue streams for the Company, there will be more revenue opportunities that will not require a customer’s physical presence in Canton.

To understand the investment thesis behind HOFV, it is critical to first understand the existing assets, and then understand the vision underlying the buildout of the incremental assets expected to come online over the next couple of years.

Tom Benson Hall of Fame Stadium

Located just behind the Hall of Fame itself is the Tom Benson Hall of Fame Stadium. Wholly-owned by HOFV, the stadium has seating capacity of 23,000. The Company leases the land from a school district under a 99-year lease. The stadium hosts the annual NFL Hall of Fame Game, Enshrinement ceremony, and Concert for Legends during the Pro Football Hall of Fame Enshrinement Week. But beyond this marquee NFL exhibition game that kicks off the NFL’s preseason, the stadium hosted over 70 other events in 2021 and management continues to seek ways to further utilize this core asset throughout the year. Some of the other notable events hosted in the stadium in 2022 included the USFL semi-final playoffs and championship games, the Black College Football Hall of Fame Classic, Women’s Football Alliance Division Championships, the Amos Alonzo Stagg Bowl – NCAA Division III championship game (hosted in 2021 and will return in 2023), the Ohio High School Athletic Association (OHSAA) football championships, Fatherhood Festival, the Hall of Fame Marathon, as well as several concerts and other major gathering events. This constant stream of events brings a captive audience to the Company’s headquarters in Canton, and as HOFV continues to develop adjacent assets, the opportunity to capture a larger share of visitors’ wallets will continue to expand. An image of the stadium from a prior year’s Hall of Fame Game is shown in Exhibit 2 below.

ForeverLawn Sports Complex

The wholly-owned ForeverLawn Sports Complex is geographically situated behind the stadium and houses eight athletic fields – seven turf and one natural grass – capable of hosting an array of athletic competitions. HOFV leases the land under several of the fields from a local school district. The sports complex hosted over 100,000 attendees in 2017 and that number is projected to grow close to 300,000 in 2022 – almost 200% growth in attendance in just six years. The facility did have a challenging year during 2020, as the result of the COVID-19 pandemic and the associated social distancing mandates. However, attendance not only bounced back in 2021, but exceeded 2019 levels and has continued to grow in 2022. The facility hosts camps and tournaments for football players, as well as athletes from across the country in other sports such as lacrosse, rugby, and soccer. During calendar 2022, the Complex has hosted or will host nine notable soccer events, three notable flag football events, and two notable lacrosse events, pulling visitors into Canton, and driving revenues across the Company’s assets. Images of the Sports Complex are shown in Exhibit 3 below.

Source: Hall of Fame Resorts & Entertainment Company

DoubleTree by Hilton Hotel, Canton

In November, 2020, the Company opened its DoubleTree by Hilton Hotel in downtown Canton. Located at 320 Market Avenue South, just 2.9 miles from the Village, the full-service hotel has 164 guest rooms and boasts a full suite of amenities travelers would expect from a similar property. Guest amenities include: a heated indoor pool, a fitness center, a business center, meeting rooms, an on-site restaurant, streaming TV service, and connecting guest rooms. The 330 Bar & Grill offers breakfast, lunch, and dinner seven days a week plus Sunday brunch. The hotel offers eight separate meeting rooms and over 11,000 square feet of total event space. The property can host a larger-scale meeting, with the largest possible meeting room setup of 5,985 square feet, capable of hosting a group as large as 470 people. Easily able to accommodate weddings and corporate meetings, the DoubleTree immediately became a material contributor to HOFV’s revenues, which are expected to continue to grow as the Company builds out the balance of its featured attractions at the Village. Exhibit 4 shows some images of the DoubleTree.

Source: www.hilton.com/en/hotels/cakcodt-doubletree-canton-downtown/gallery/

Constellation Center for Excellence

The Constellation Center for Excellence opened in October, 2021. This 75,000 square foot mixed use facility includes a variety of sports-centric research and programming, office and meeting space, and retail space. Constellation, an Exelon company, plans to use the Center to host regional energy conferences and other events. Exhibit 5 shows an artist rendering of the completed Center for Excellence.

Source: Hall of Fame Resorts & Entertainment Company website

HOFV Media Business

Complimenting the Company’s physical assets, HOFV has a media business that has already shown the potential to generate significant value. The Company’s innovative content studio will produce football-themed series, films, documentaries, podcasts and other dynamic media events to increase brand awareness. A pilot for a title called Inspired, a show highlighting inspirational NFL figures using their platform to help those in need, aired across 63 markets in June, 2022 and was the number one broadcast within the 25-54 age group in the time period. The Perfect Ten, a show profiling the exclusive group of NFL athletes who are both Heisman Trophy winners and Pro Football Hall of Fame inductees, will air in early 2023 on FOX Network, leading up to the Super Bowl. Gone Fishin’, featuring Hall of Fame coach Jimmy Johnson and celebrity guests sharing stories amidst fishing competitions is another title that the Company has in development. Additionally, HOFV announced partnerships with the Hall of Fame and I Got It to develop and sell non-fungible tokens (NFTs) based on memorabilia inside the Hall. The Company also produced the 2021 World Chase Tag Championship, which was the number one show on ESPN over the Pro Football Hall of Fame Enshrinement weekend.

HOFV Gaming

The Company has initially developed a gaming business, centered around the incredible popularity of fantasy football. The Hall of Fantasy League, with Pro Football Hall of Fame Enshrinee Emmitt Smith as its commissioner, offers participants season long and weekly prizes. Twelve popular expert fantasy analysts serve as General Managers of the Franchises and fans can purchase premium subscriptions to unlock exclusive insights, weekly and season projections, custom rankings, depth charts, and much more.

Beginning in 2023, the Company is hopeful to offer sports betting, pending the award of a license from the Ohio Casino Control Commission. HOFV has announced partnerships with Rush Street Interactive as its retail gaming partner, and Betr as its mobile sports betting partner. Betr is a unique entrant in the sports betting arena, focusing on “micro-bets,” allowing people to make wagers on outcomes such as whether the next pitch in a baseball game will be a fastball or curveball, and whether the next play in a football game will be a pass or run. Co-founded by social media personality and professional boxer, Jake Paul, and experienced online gaming entrepreneur Joey Levy, Betr is a differentiated entrant into the online sports betting space. Paul has over 20 million subscribers to his YouTube channel, giving Betr a tremendous audience at no additional cost. As part of the agreement, HOFV has acquired an equity stake in Betr. To the extent that Betr is successful in growing into a meaningful player in the sports betting arena, HOFV shareholders will participate in its success.

New Assets Expected to Come Online in H2:22 and FY:23

Center for Performance

The Hall of Fame Village Center for Performance is a domed entertainment and performance facility with 85,000 square feet of exhibition halls and athletic performance space. Construction of the facility will be completed during Q3:22, with a full slate of activities set to kick off in Q4:22. Interestingly, HOFV has not announced a sale of naming rights for this facility, which should provide an incremental revenue opportunity for the Company in its sponsorship revenue area in the near future. An image of the facility is shown in Exhibit 6 below.

Source: Hall of Fame Resorts & Entertainment Company

Tapestry Hotel by Hilton

During Q4:22, HOFV is expecting to begin construction of a full-service, on campus hotel. It will be branded a Tapestry Hotel by Hilton and feature 180 guest rooms, including suites. The upscale, football-themed hotel will have over 10,000 square feet of meeting spaces, excellent food and beverage options, and enable guests to stay in the heart of the Village, where all the action of athletic tournament competitions are taking place. The Company is expecting construction of the hotel to be complete in Q3:23, in time for the Hall of Fame Enshrinement ceremony and NFL exhibition game.

Fan Engagement Zone

The Fan Engagement Zone will feature 82,000 square feet of unique restaurant and retail offerings. The retail offerings are expected to be football-themed, and the Company has already announced the opening of an NFL-themed Build-a-Bear Workshop during Q3:22. Shula’s Steak House has committed to opening a location in the Fan Engagement Zone, which is expected to open in Q4:22, along with TopGolf Swing Suites and SMOOSH Cookies. The retail space will surely be a positive revenue driver for HOFV starting in Q4:22. The Fan Engagement Zone will also contain HOFV’s on-site Sportsbook, assuming the licensing process goes smoothly as expected. The Company is the only applicant in Stark County, Ohio, and the county is projected to be allocated one license by the Ohio Casino Control Commission.

Play Action Plaza

Play Action Plaza is a 3.5-acre green space adjacent to the Fan Engagement Zone. It will be a fun, football-themed recreation area, capable of hosting social gatherings and informal events. The space already contains a football-themed amusement ride, with a large Ferris Wheel expected in the near future. Additional amusement rides and food and retail offerings will provide incremental revenue opportunities in this part of the campus and will likely be added as demand dictates.

Indoor Waterpark

The final major physical asset HOFV is planning to build on its campus is an indoor waterpark. The waterpark will be adjacent to the Tapestry Hotel. It will be a 100,000 square foot, football-themed, experiential attraction, with all the most sophisticated, heart-pounding waterpark rides that prospective visitors would expect in 85,000 square feet of wet space. It would also be expected that this complex will include retail shops, video arcades, and other key potential sources of revenue from families visiting the campus.

Competition

HOFV competes with all other forms of discretionary entertainment spending in central Ohio and surrounding areas. Amusement park operator Cedar Fair, L.P. has its flagship asset, Cedar Point, located just two hours northwest of the HOFV campus. The Rock and Roll Hall of Fame is just one hour away in Cleveland. Pittsburgh, Pennsylvania and Columbus, Ohio, are two hours to the east and west, respectively, and both of those cities also offer significant entertainment and leisure opportunities, in addition to being home to major league sports teams, along with Cleveland, Ohio at just one hour away. But, in and around central Ohio, HOFV will have the largest collection of American football-themed entertainment attractions in the country, making the Company the American football version of, “If you build it, they will come.”

Revenue Drivers and Business Model

Sponsorship

Sponsorship revenues accounted for 56% of total revenues in FY:21 but have declined to 38% in the last twelve months and represented just 17% of revenues in Q2:22. These revenues consist of naming rights and advertising agreements throughout the HOFV campus. Unfortunately, a dispute arose at the beginning of 2022 with the Company’s lead sponsor, Johnson Controls. Both Johnson Controls and HOFV have alleged breach of contract and the parties are in arbitration. The good news is that the Company reports that they have not received any payments in advance, so there should be no cash liability to the Company, and there may be some cash payments due to the Company for leaving the Johnson Controls signage up while the parties are in dispute. However, it is fully expected that sponsorship revenues will resume a growth trajectory in H2:22 and beyond, particularly once the Johnson Controls arbitration is resolved. We would expect the arbitration process to be resolved reasonably quickly.

Events, Rents, and Cost Recoveries

This revenue stream includes fees paid to rent the Company’s facilities as well as revenues derived from events on campus, including Enshrinement week events as well as other events hosted throughout the year. Events, rents, and cost recoveries represented just 9% of total revenues in FY:21 but have grown to 17% of revenues on a trailing twelve-month basis. The reason for the shift is a combination of significant year-over-year growth in this revenue segment, coupled with the decline in sponsorship revenues.

Hotel Revenues

Hotel revenues were 35% of total revenues in FY:21 and represent all the revenue that was realized at the Company’s DoubleTree Hotel, which had a full year of operation in 2021. Hotel revenues represent 29% of trailing twelve months revenues, although they have grown nicely year-over-year.

Management

Michael Crawford, Chairman, President, CEO, and Director. The Company has been led by Chairman, President, and CEO, Michael Crawford, since the closing of the business combination in July 2020. He was previously CEO of HOF Village, LLC from December 2018 through June 2020. Before joining the Company, he was an executive at Four Seasons Hotels & Resorts from 2014 through 2018. Prior to that, Mr. Crawford spent 24 years in various positions at The Walt Disney Company, where his last role was Senior Vice President and General Manager of Shanghai Disney Resort and President of Walt Disney Holdings Company in Shanghai. Mr. Crawford has also served as a Director of Texas Roadhouse (TXRH) since June 2020, where he is on the audit, nominating and governance, and compensation committees. He has a BS in Business Administration from Bowling Green State University and an MBA from the University of Notre Dame.

Benjamin Lee, CFO. Benjamin Lee was appointed CFO in March, 2022. Before joining HOFV, Mr. Lee most recently served as the Chief Financial Officer of the Capital Markets and Debt Products divisions at PNC Financial Services Group where he was employed from November 2014 through March 2022. Prior to joining PNC, he was employed from 2012 through 2014 by The Bank of New York Mellon, culminating in the role of the Managing Director and Controller of the Global Markets business unit, where he directed the team responsible for the global interest rate and foreign exchange hedging programs. Mr. Lee holds a Bachelor of Business Administration from Clarion University and an MBA from the University of Pittsburgh.

Michael Levy, President of Operations. Mr. Levy has served as President of Operations since June 2020. From August 2014 until joining the Company, he served as President of the Canton Charge, the NBA G League franchise of the Cleveland Cavaliers, where he set numerous attendance records and revenue marks and was named the league’s Team Executive of the Year in 2016. Mr. Levy brings over 35 years of sports and entertainment management expertise to the Company, developed through extensive experience working with 11 professional franchises, 11 facilities, and 10 sports leagues, including the NBA, MLB, WNBA, NFL, AFL, and NHL. He is a graduate of Duquesne University.

Tara Charnes, General Counsel. Ms. Charnes has served as General Counsel of the Company since August 2020. From 2015 until joining the Company, Ms. Charnes worked for Big Lots! where she most recently served as Vice President of Litigation. From 2008 until 2015, she worked for The Scotts Miracle-Gro Company, where she most recently served as Director, North America Legal, Securities, and Corporate Governance. From 2003 until 2007, she was a member of the Securities, Competition, and Complex Litigation Group at the international law firm Sidley & Austin LLP. She also served as a law clerk for the Honorable Kenneth F. Ripple of the United States Court of Appeals for the Seventh Circuit. Ms. Charnes earned her Juris Doctor from the Valparaiso University School of Law and earned her Bachelor of Arts from Denison University.

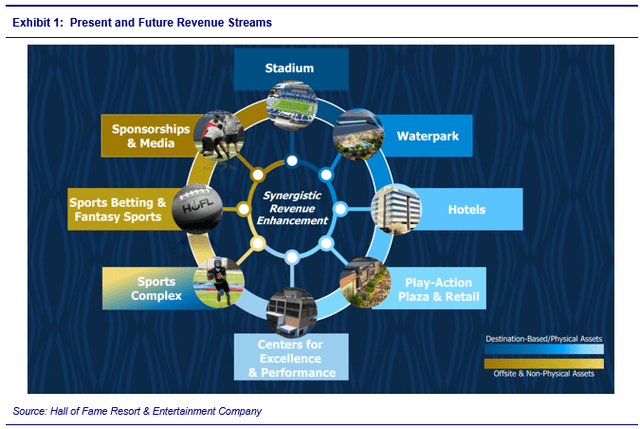

According to the Company’s proxy filed on September 6, 2022, insiders control approximately 47.7% of HOFV’s outstanding common shares. Exhibit 7 below shows a list of insider shareholdings.

Source: Company Filings

Financial Results and Forecast

HOFV’s Q2:22 financial results were somewhat mixed year-over-year, due to the unexpected decline in sponsorship revenue from the claim of breach of contract with the Company’s largest sponsor, Johnson Controls. Revenues were up 13.6% year-over-year, driven by major year-over-year gains in hotel and events revenues, offset by the significant year-over-year decline in sponsorship revenue. We calculate EBITDA in Q2:22 of $(4.7) million, modestly worse than the EBITDA loss of $(4.1) million we calculated for Q2:21. Please note that we add back stock-based compensation in our EBITDA calculation, whereas the Company does not.

For FY:22, management has offered full year revenue guidance in the low $20 million range and a projected EBITDA loss for the year in the low $20 million range. We are projecting FY:22 revenues of $20.2 million and an EBITDA loss of $(14.0) million. We add back our projected $5.3 million in stock-based compensation to arrive at our EBITDA forecast, whereas the Company does not.

HOFV has already announced the raising of $57.8 million, net, in debt capital in Q3:22. We are expecting the Company to need to raise an incremental $50-60 million in capital in FY:23, through a combination of projected debt and equity capital raises and expect one more capital raise to be needed in Q1:24 to help the Company arrive at a free cash flow positive state.

For FY:23, we project revenues will grow 40% to $28.4 million, driven by higher revenues in all the Company’s segments. We are only expecting a modest contribution from the new Tapestry Hotel in FY:23, as we are concerned that it may not be open in time for Enshrinement weekend. We project an EBITDA loss of approximately $(7.1) million for FY:23, which, while still modestly negative, would represent an almost 50% year-over-year improvement. For FY:24, we are projecting revenues of $44.9 million, representing 58% growth versus our FY:23 forecast. We believe the Company will strongly benefit from a full year of operation of the Tapestry Hotel and the Waterpark in FY:24, each of which should help drive incremental sponsorship and events revenues. We project that the Company will generate positive $5.6 million in EBITDA (adding back $5.7 million in stock-based compensation) in FY:24 and turn modestly free cash flow positive in H2:24, as the bulk of the capital expenditures will be over.

Investment Risks

- Due to significant projected capital expenditures, HOFV will be burning a significant amount of cash over the next several quarters. We expect the Company will need to raise a material amount of incremental capital to continue its buildout and continue as a going concern.

- HOFV’s revenues are entirely dependent upon consumer discretionary spending. A material downturn in the U.S. economy could have a catastrophic effect on the Company’s future revenue opportunities and threaten its ability to continue as a going concern.

- HOFV is highly levered. Any violation of the terms of any of the Company’s debt agreements could have a material adverse impact on the Company’s ability to continue as a going concern.

Valuation

Valuing HOFV is quite challenging, as the value in the equity is highly dependent upon significant future revenue and EBITDA growth. However, we believe the incremental physical assets HOFV is building have a high probability of driving meaningful revenue growth and shareholder value. We value HOFV using an average valuation of a Sum of the Parts valuation methodology and our FCF model.

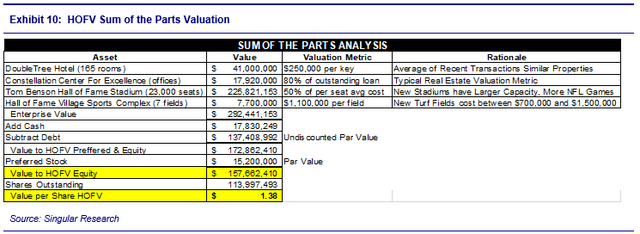

Our Sum of the Parts valuation methodology ascribes a value to each of the completed and fully operational physical assets in the HOFV portfolio as of the end of Q2:22 to arrive at an enterprise value. We then add cash on the balance sheet at the end of Q2:22, subtract debt, and the par value of preferred stock to arrive at a value for the common equity. The next several paragraphs describe the valuation method for each asset.

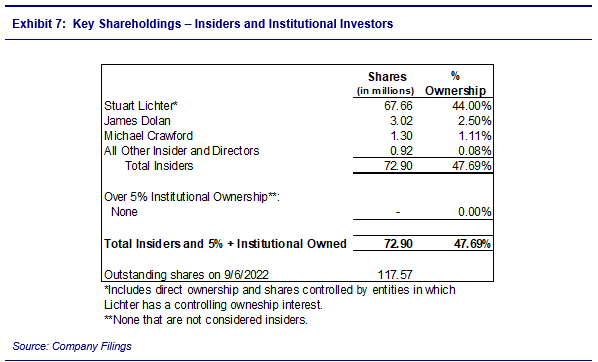

First, we value the DoubleTree Hotel in downtown Canton. In the hotel industry, the most common valuation metric is “value per key.” In other words, the sale price of a hotel is divided by the number of guest rooms in the property to establish a value per key. To value HOFV’s asset, we first looked at the valuation metrics for recent hotel sales, which is detailed in Exhibit 8 below. As shown, the last 13 publicly disclosed sales of single asset hotel properties that we could readily find were at an average price per key of $419,077. We also had discussions with executives in the hotel ownership and management space about the potential cost to build a greenfield full-service hotel, and the answer was that the cost typically ranges from $225,000 to $350,000.

Source: Various investor relations and media outlet publications

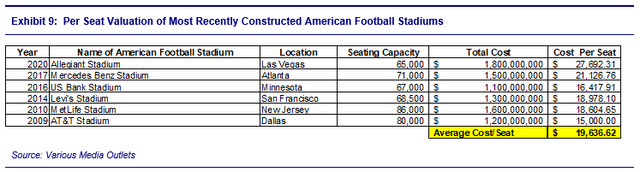

The next asset we value is Tom Benson Hall of Fame Stadium. In order to assess the value of this 23,000-seat stadium that hosts the annual NFL preseason kickoff game, we analyzed the construction costs of the seven most recently constructed NFL stadiums. We threw out the valuation of the Los Angeles stadium, which hosts the Rams and the Chargers, because the per seat valuation metric is an outlier. The Los Angeles stadium total cost is reportedly in the $5 billion range and the stadium has a seating capacity of 93,607, giving it a construction cost value per seat in excess of $53,000, which is completely out of line with the other six most recently constructed stadiums. The other six have an average cost per seat of $19,636.62, with a range from $15,000 per seat for AT&T Stadium in Dallas to $27,692 per seat for Allegiant Stadium in Las Vegas. These values are shown in Exhibit 9 below.

The other two fully constructed assets at the end of Q2:22 are a bit more challenging to value. First, we have the Constellation Center for Excellence, an 85,000 square foot office and retail space adjacent to the stadium. What we know is that the Company has a loan against this asset in the amount of $22.4 million. We also know that lenders typically do not lend 100% of the fair market value of an asset against a real estate property, so that they maintain some cushion should the loan go into default. Nonetheless, we valued this asset at 80% of the value of the loan, so as to ensure a discounted value in case an unforeseen event were to force the Company to unexpectedly sell it. The other fully constructed asset at the end of Q2:22 is the Hall of Fame Village Sports Complex. This asset consists of seven full size turf athletic fields and one natural grass field, which hosts athletic competitions. According to sportsvenuecalculator.com, the average cost of a new artificial turf field typically ranges from $700,000 to $1,500,000. We took a simple average of this range, $1,100,000, and ascribed that value to the seven fields in the sports complex. In order to discount the valuation, we ascribed no value to the natural grass field in the sports complex.

To value the Company’s DoubleTree Hotel, we took a 40% discount to the value of the most recent single asset hotel sales that we were able to identify and factored in the cost of a greenfield full-service hotel to arrive at a value per key of $250,000. This estimate gives us a projected value of the DoubleTree of $41.0 million. For the stadium, we took a 50% discount to the average per seat cost of the six most recently constructed stadiums, excluding the stadium in Los Angeles. The rationale for the discount is that Tom Benson Stadium is significantly smaller and does not host a full slate of NFL games annually. This reasoning gives us a value for the stadium of $225.8 million. We add to this our value of the Center for Excellence at 80% of the loan value, which equates to $17.9 million, and the value of the sports complex at $1.1 million per turf field for a total value of $7.7 million. Altogether we arrive at an enterprise value of $292.4 million. When we add cash on the balance sheet at the end of Q2:22 of $17.8 million, deduct the undiscounted par value of the debt on the balance sheet at the end of Q2:22 of $137.4 million and the par value of the preferred stock of $15.2 million, we arrive at a value to the common stock of $157.7 million. Dividing this result by the shares outstanding at the end of Q2:22 produces a value per share of $1.38. Exhibit 10 below details this valuation technique.

In our DCF model, we estimate the firm would earn a return on capital of 10%, reinvesting 10% of this return into their business and growing EBITDA by 50% in FY:26, and 25% per annum thereafter through the forecast period of 2031. Beyond the forecast period, we assume terminal value EBITDA growth of 5%. We assume a 4.25% risk free rate and a 9% market risk premium, which, given the Company’s capital structure, results in a weighted average cost of capital of 12%. These assumptions lead to a DCF price target of $1.21.

We then equally blend the sum of the parts valuation target, $1.38, and the DCF valuation price target, $1.21, to produce a final target price of $1.29 which we round up to $1.30.

Be the first to comment