Antagain

This article is part of a series that provides an ongoing analysis of the changes made to Lone Pine Capital’s 13F portfolio on a quarterly basis. It is based on their regulatory 13F Form filed on 11/14/2022. Please visit our Tracking Stephen Mandel’s Lone Pine Capital Portfolio article for an idea on their investment philosophy and our previous update for the fund’s moves during Q2 2022.

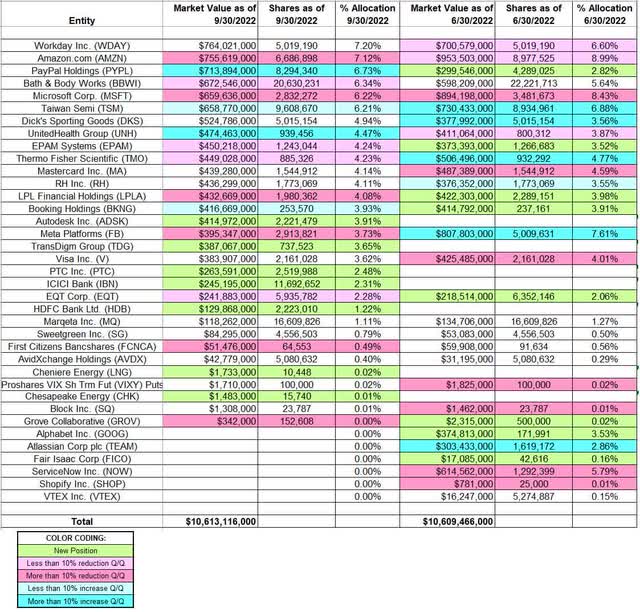

This quarter, Lone Pine’s 13F portfolio value remained almost steady at $10.61B. The number of holdings increased from 30 to 31. The top three positions are at ~21% while the top five are ~34% of the 13F assets: Workday, Amazon, PayPal, Bath & Body Works, and Microsoft.

Note: Stephen Mandel stepped down from managing investments at Lone Pine Capital in January 2019 in a previously announced (September 2017) move. He is currently a managing director at the firm. Stephen Mandel worked at Tiger Management under Julian Robertson for eight years starting in the late 1980s, making him a bona fide tiger cub. To know more about Julian Robertson and his legendary Tiger Management, check out Julian Robertson: A Tiger in the Land of Bulls and Bears.

New Stakes:

Autodesk Inc. (ADSK) and TransDigm Group (TDG): ADSK is a ~4% of the portfolio stake established this quarter at prices between ~$171 and ~$234 and the stock currently trades at ~$197. The 3.65% TDG position was purchased at prices between ~$525 and ~$677 and it is now at ~$615.

PTC Inc. (PTC), ICICI Bank (IBN), and HDFC Bank (HDB): PTC is a 2.48% of the portfolio position purchased this quarter at prices between ~$100 and ~$126 and the stock currently trades at ~$122. The 2.31% of the portfolio IBN stake was established at prices between ~$18 and ~$23 and it is now at $22.85. HDB is a small ~1% of the portfolio position purchased at prices between ~$56 and ~$68 and it now goes for ~$68.

Cheniere Energy (LNG) and Chesapeake Energy (CHK): These are minutely small (less than ~0.02% of the portfolio each) stakes established this quarter.

Stake Disposals:

ServiceNow Inc. (NOW): NOW was a 5.79% stake established in Q2 2017 at prices between $84.50 and $118. The position has since wavered. Recent activity follows. Q2 2020 saw a one-third increase at prices between $250 and $403. Q4 2020 saw similar selling at prices between ~$476 and ~$565. There was a stake doubling in H1 2021 at prices between ~$454 and ~$595. Next two quarters had seen a ~20% selling at prices between ~$545 and ~$702. That was followed with a ~35% reduction last quarter at prices between ~$412 and ~$598. The disposal this quarter was at prices between ~$370 and ~$516. The stock is now at ~$396.

Alphabet Inc. (GOOG): GOOG was a 3.53% of the portfolio stake established last quarter at prices between ~$106 and ~$144. It was sold this quarter at prices between ~$96 and ~$123. The stock is now at ~$94.

Atlassian Corp (TEAM): TEAM was a 2.86% of the portfolio position established in Q1 2022 at prices between ~$239 and ~$350. This quarter saw the stake sold at prices between ~$185 and ~$289. The stock is now at ~$136.

Shopify Inc. (SHOP): SHOP stake was built in Q2 2019 at prices between ~$20 and ~$33. There was a one-third increase in Q4 2019 at prices between ~$29 and ~$41. Q1 2022 saw a ~25% reduction at prices between ~$51 and ~$136. Last quarter saw the stake almost sold out at prices between ~$30 and $73. The stock currently trades at $38.64. The remainder stake was sold this quarter.

Fair Isaac Corp (FICO) and VTEX (VTEX): These two minutely small (less than ~0.15% of the portfolio each) positions were disposed during the quarter.

Stake Decreases:

Amazon.com (AMZN): AMZN is currently the second largest 13F stake at ~7% of the portfolio. It was established in Q4 2017 at prices between ~$48 and ~$60. The position has wavered. Recent activity follows. The three quarters through Q4 2020 saw a ~55% reduction at prices between ~$95 and ~$172 while next quarter there was a ~90% stake increase at prices between ~$148 and ~$169. Q3 2021 saw a ~25% selling at prices between ~$159 and ~$187 while next quarter there was a ~70% stake increase at prices between ~$160 and ~$185. The position was reduced by ~30% in Q1 2022 at prices between ~$136 and ~$170. That was followed with a ~25% selling this quarter at prices between ~$106 and ~$145. The stock is now at ~$90.

Bath & Body Works (BBWI) previously L Brands: The large (top five) 6.34% BBWI stake was purchased in Q1 2020 at prices between ~$9 and ~$25 and it is now at $42.15. There was a ~15% selling in the last three quarters.

Note: Lone Pine Capital has a ~9% ownership stake in Bath & Body Works. Their implied cost-basis is understated in the prices above as ~$14 per share in value came back to them with the Victoria’s Secret (VSCO) spinoff transaction (one share of VSCO for every three shares held) in July.

Microsoft Corporation (MSFT): MSFT is now at 6.22% of the portfolio. It was established in Q2 2017 at prices between $65 and $72.50. There was a ~15% trimming in Q4 2017 at prices between $74 and $87 while next quarter saw a ~26% increase at prices between $85 and $97. The five quarters thru Q4 2019 had seen a ~63% selling at prices between $98 and $159 while next quarter saw a ~17% stake increase at prices between ~$135 and ~$189. Q1 2021 saw a ~25% stake increase at prices between ~$212 and ~$245 while in the next two quarters there was a ~40% selling at prices between ~$242 and ~$305. That was followed with a ~43% reduction in the last two quarters at prices between ~$233 and ~$315. The stock is now at ~$247.

Note: MSFT has had a previous round-trip: It was a large (top five) 4.93% of the portfolio position in Q4 2016. The bulk of the position was from H1 2015 at prices between $40 and $48. The five quarters thru Q3 2016 had seen a combined ~50% selling at prices between $43 and $58. The elimination in Q1 2017 happened at prices between $62 and $66.

LPL Financial Holdings (LPLA), EPAM Systems (EPAM), EQT Corporation (EQT): LPL is a ~4% of the portfolio stake established last quarter at prices between ~$168 and ~$219 and the stock currently trades at ~$222. There was a ~14% trimming this quarter. The 4.24% EPAM position was purchased last quarter at prices between ~$265 and ~$348 and it is now at ~$346. There was a minor ~2% trimming this quarter. The 2.28% EQT position was purchased last quarter at prices between ~$33 and ~$50 and it now goes for $35.69. There was a ~7% trimming this quarter.

Thermo Fisher Scientific (TMO): TMO is a 4.23% of the portfolio position established in the last two quarters at prices between ~$500 and ~$645 and the stock currently trades at ~$568. There was a ~5% trimming this quarter.

Meta Platforms (META): The 3.73% of the portfolio META stake was established in Q1 2022 at prices between ~$187 and ~$339 and it is now below that range at ~$115. There was a ~37% increase last quarter at prices between ~$156 and ~$234. This quarter saw a ~52% reduction at prices between ~$134 and ~$183.

First Citizens BancShares (FCNCA) and Grove Collaborative (GROV): These two very small (less than ~0.20% of the portfolio each) stakes were reduced during the quarter.

Stake Increases:

Booking Holdings (BKNG) and PayPal Holdings (PYPL): The 3.93% BKNG position was purchased last quarter at prices between ~$1749 and ~$2375 and it is now at ~$2011. There was a ~7% stake increase this quarter. PYPL is a 6.73% of the portfolio stake established during the last two quarters at prices between ~$69 and ~$122 and it currently trades at ~$74.

Taiwan Semi (TSM): TSM is a fairly large 6.21% of the portfolio position purchased in Q1 2022 at prices between ~$99 and ~$141 and the stock currently trades well below that range at ~$81. Last two quarters have seen a ~20% stake increase.

UnitedHealth Group (UNH): The 4.47% UNH stake was established in Q2 2017 at prices between $164 and $187 and increased by ~160% the following quarter at prices between $185 and $200. The position has wavered. Recent activity follows. There was a ~20% reduction in Q4 2020 at prices between ~$304 and ~$357. That was followed with a ~25% selling in Q4 2021 at prices between ~$387 and ~$506. Last two quarters saw a roughly two-thirds reduction at prices between ~$452 and ~$546. The stock is now at ~$548. There was a ~17% stake increase this quarter.

Kept Steady:

Workday Inc. (WDAY): WDAY is currently the top position at 7.20% of the portfolio. It was established last year at prices between ~$221 and ~$301 and it is now well below that range at ~$169. Last two quarters saw a ~15% trimming.

DICK’S Sporting Goods (DKS): The 4.94% DKS stake was purchased in Q1 2022 at prices between ~$98 and ~$118 and the stock currently trades at ~$122. Last quarter saw a ~34% increase at prices between ~$71 and ~$108.

Mastercard (MA) and Visa (V): These fairly large stakes were established in Q4 2021. MA is a 4.59% of the portfolio position purchased at prices between ~$306 and ~$370 and the stock currently trades at ~$351. The position was reduced by ~70% over the last two quarters at prices between ~$309 and ~$397. The 3.62% of the portfolio V position was established at prices between ~$190 and ~$234 and it is now at ~$209. The stake was reduced by ~55% over the last two quarters at prices between ~$189 and ~$235.

RH (RH): The 4.11% of the portfolio RH stake was purchased in Q2 2021 at prices between ~$588 and ~$720. Next quarter saw a ~25% stake increase at prices between ~$652 and ~$739. Q4 2021 saw a similar increase at prices between ~$527 and ~$690. Last two quarters also saw a ~12% further increase. The stock is now well below their purchase price ranges at ~$266.

Note: Lone Pine Capital has a ~7.8% ownership interest in RH Inc.

Block Inc. (SQ) previously Square: The SQ stake was established in Q3 2020 at prices between ~$113 and ~$165. The position was almost sold out in Q4 2021 at prices between ~$158 and ~$265. The stake was rebuilt next quarter at prices between ~$89 and ~$164 but again sold down last quarter at prices between ~$58 and ~$145. The stock is now at $63.37.

Note: Square had a previous round-trip. It was a ~2% position built from Q2 2019 at prices between $57 and $82 and sold in Q2 2020 at prices between ~$44 and ~$105.

AvidXchange Holdings (AVDX), Marqeta Inc. (MQ), ProShares VIX Sh Trm Fut (VIXY) Puts, and Sweetgreen Inc. (SG): These are small (less than ~1.25% of the portfolio each) positions kept steady this quarter.

Note: Lone Pine has ~7% ownership stake each in VTEX and Marqeta.

The spreadsheet below highlights changes to Mandel’s 13F stock holdings in Q3 2022:

Stephen Mandel – Lone Pine Capital’s Q3 2022 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Lone Pine Capital’s 13F filings for Q2 2022 and Q3 2022.

Be the first to comment