Morsa Images

The telehealth business continues to feel the pain of tough comps compared to the last couple of years along with probably less COVID-related demand. Teladoc Health (NYSE:TDOC) is still poised to benefit from the long-term trend towards digital care, but the economic slowdown isn’t a help in closing deals. My investment thesis remains Bullish on the telehealth stock after Teladoc takes a hit back to the recent lows.

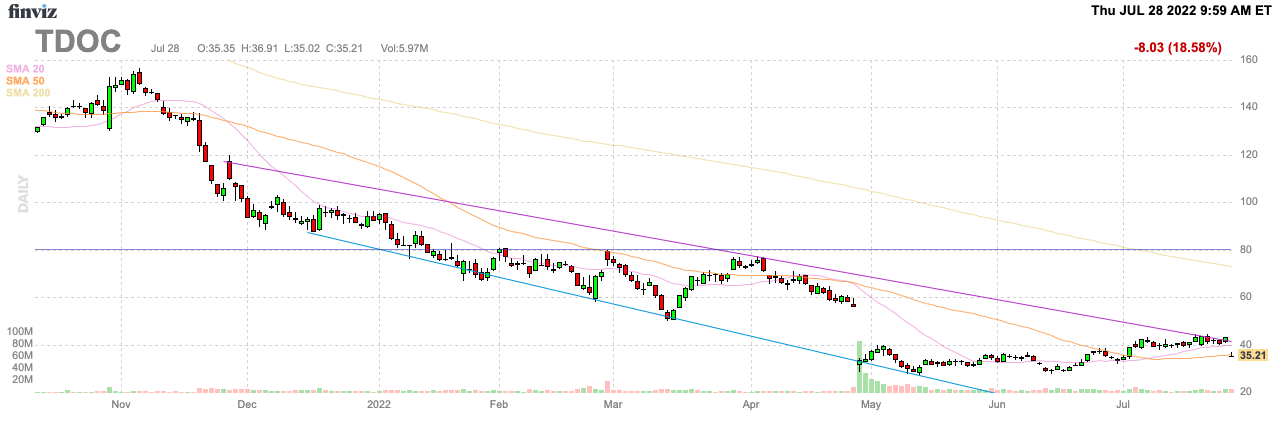

FinViz

Not Such Tough Times

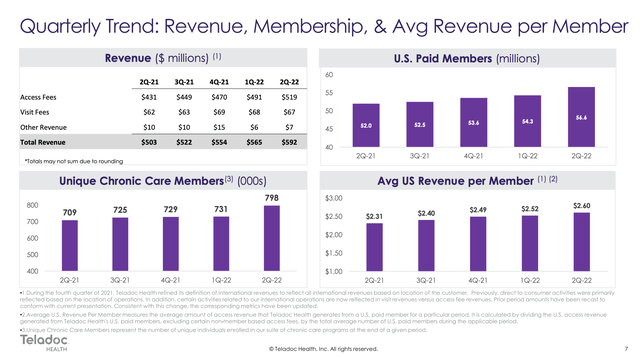

Teladoc just reported a quarter where revenues beat analyst estimates by over $5 million, yet the stock is down 20% in initial trading. The company guided to 2022 revenues at the lower end of full year numbers of between $2.4 to $2.5 billion sending the stock collapsing back to prior lows.

These numbers are hardly shocking considering the environment where COVID is no longer a major threat and economic weakness is likely to cause healthcare clients to not rush into more online services. Besides, analysts only forecast 2022 revenue of $2.43 billion for nearly 20% growth. If Teladoc hits the $2.4 billion figure for 18% growth, the market should actually be very happy.

The company continues to report growing metrics, but investors should’ve already understood the U.S. Paid Members and Visits weren’t likely to rise at similar rates as in 2020 and 2021. The most important figure is the average U.S. revenue per member which jumped to $2.60 in the quarter. The average Access Fees were up $0.31, or 13% from last year, as Teladoc continues to extract more fees from platform members.

The business is far more normalized here, where members for both the telehealth and chronic care platforms barely grew. People using the platform continue to see more benefits from a digital healthcare platform.

Visits were up in the quarter to nearly 4.7 million, but platform-enabled sessions were mostly flat at 1.04 million. Again, the good news is the paid membership is actually up 7% for Q3’22 and total visits are forecast to jump over 20% from the last Q3 to at least 4.8 million. Teladoc Health just isn’t getting any traction in moving the business beyond the levels generally reached in mid-2021 when a lot of the COVID pandemic fears peaked and consumers and health plans interested in online healthcare had made the switch.

As CEO Jason Gorevic stated on the Q2’22 earnings call, the risks exist for Teladoc Health to actually miss the low-end of prior guidance causing a lot of the undue panic in the stock. The economic backdrop isn’t going to help in the short term.

Taking these trends in both chronic care and BetterHelp into account, as well as the impact of a stronger dollar on our international revenue, we believe it’s more likely that our overall financial performance will be towards the lower end of our consolidated revenue and adjusted EBITDA guidance ranges in the second half.

However, there are scenarios in which our results could be above or below this due to the increased uncertainty in the broader economic backdrop, particularly as it relates to trends in consumer spending and its impact on our DTC business. We will continue to watch these near-term evolving dynamics and provide updates as appropriate.

The CEO continued to talk about a strong pipeline when the economy improves. The market will ignore this commentary, but investors shouldn’t ignore this aspect adding to long-term growth.

Bottom Retest

Teladoc hit a low below $30 all the way back in May before this major rally up to $45. The stock is selling off in part due to the big rally heading into earnings based on expectations for better growth ahead, yet the lack of a new low following several warnings is very bullish.

Remember, Teladoc updated 2022 guidance to revenues of $2.4 billion. The stock only has a market cap of ~$5.5 billion following the initial trading sell-off to $34.

The telehealth market has only started here, with years of growth ahead. Even the Teladoc business just has a 24% utilization rate of members despite 2 years of COVID restrictions pushing people into online doctor visits.

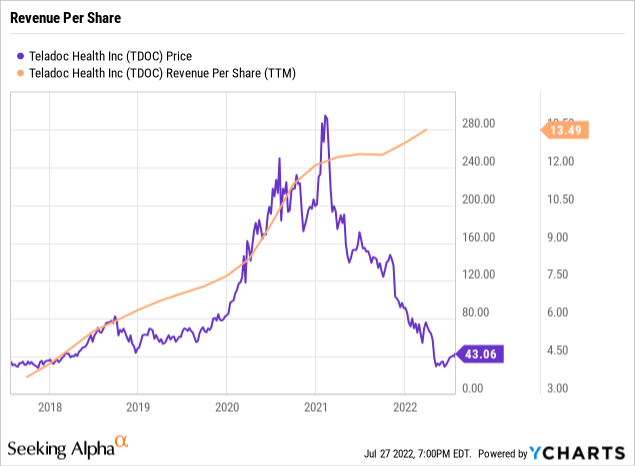

The stock hardly trades at 2x sales here. Teladoc Health regularly traded at metrics closer to 5x sales when the stock traded at similar levels back in 2018.

With the expensive Livongo acquisition being written off to a great extent, investors are probably losing sight that Teladoc Health has boosted revenues per share dramatically over the years. An investor can’t just oversimplify the fact revenue per share has tripled since the stock previously traded at these same levels in early 2018.

Teladoc is just too cheap here, with the business growing in excess of 15% for the year on top of tough comps. The stock trades at about 20x the updated 2022 adjusted EBITDA target of $250 million, but the company still isn’t in the position to focus purely on corporate profits. Hence, Wall St. shouldn’t overly value the stock based on such profit metrics.

Takeaway

The key investor takeaway is that Teladoc should easily hold the previous lows of $27 and actually rally. The guidance wasn’t so horrible to warrant a 20% dip in the first place, and secondly, the stock valuation just becomes too attractive back at these levels.

Be the first to comment