SouthWorks/iStock via Getty Images

The World of “Prevention is Better than Cure” Online Health Companies: Some Skepticism Is Normal

The internet is undoubtedly the first place many people look for answers, especially when it concerns their physical health. Whether to dispel doubt, satisfy a curiosity or shake off fears, the internet is the first place to look.

When it comes to personal health, prevention is better than cure [commonly attributed to the Dutch philosopher Desiderius Erasmus around year 1500]. A sacred principle on which many healthcare companies have built their business model, and all they need to operate is just a website that attracts customer demand. But to prevent the occurrence of pathologies, a healthy lifestyle is not the only thing people can do, because the right behavior can now be supplemented with early knowledge of a person’s genetic predisposition to the risk of developing the pathologies.

In other words, to find out if one is a carrier of genes commonly associated with certain pathologies, there are specific genetic tests that can be performed to cover the need for knowledge.

Therefore, these “prevention is better than cure” online health companies found an interesting opportunity to offer genetic testing at relatively low prices, the results of which can also be viewed online, and with the possibility of even getting indicative information from a specialist.

Of course, the cost of a genetic test depends on the scope of the diagnosis and research, but in general genetic testing can be very expensive, even up to a few thousand dollars.

So frankly, the possibility of ordering a genetic test online to see if someone could develop a serious disease raises some skepticism, other than the fact that such activity could pose a risk of irrational behavior for the interpretation of the results.

Nevertheless, this type of market in which genetic testing kits are sold directly to consumers online appears to be developing strongly.

What is Invitae Corporation’s Role in Diagnostics and Research?

In the universe of US-listed medical genetics stocks engaged in diagnostics and research, Invitae Corporation (NYSE:NVTA) stands out from a multitude of operators. The company is distinguished by the significant volume of its shares that are traded daily, which could mean that traders are quite interested in this stock.

On Aug. 16, Invitae Corporation had exchanged 30.8 million shares during trading hours ranking second in the Diagnostics & Research stocks’ ranking. T2 Biosystems, Inc. (TTOO), ranked first with 100.5 million shares traded, while Bionano Genomics, Inc. (BNGO) was in the third position with 12.2 million shares exchanged. The data was extracted from Finviz.com‘s stock screener after sorting the diagnostics and research industry by volume.

Invitae Corporation, based in San Francisco, California, says it plans to integrate genetic information into mainstream medicine as it aims to improve healthcare for people in North America.

Whether the person wants to have a screening test for cancer, cardiovascular disease, some hereditary diseases or personal feedback from pharmaceutical treatments, Invitae’s website has test kits priced between $250 and $350, plus certain charges but excluding shipping costs.

To submit an online request for a test, the order is placed by a doctor. Then a saliva sample can be given from home. The results are made available on the website user account and can be shared with the doctor. If the Invitae test result is positive, the order entitles the purchaser to a discount on the price. The consumer can also request an interview with a genetic counselor without paying any additional cost.

The company states that the purpose of these tests is not to diagnose either a disease or a medical condition. Furthermore, the company says her tests are not medical advice.

Invitae Corporation’s Market Outlook

Invitae Corporation operates in a rapidly growing market.

Global Market Insights predicts that the direct-to-consumer genetic testing market powered by online platforms will grow significantly over the next few years, globally exceeding $4 billion in 2028.

With a market share of approximately 40% of the total global market, the North American market is expected to continue to be the major contributor to global growth for three main reasons:

- a greater public awareness in the US and Canada of direct-to-consumer genetic testing

- rising Internet usage in the most populous regions of the US and Canada

- the willingness of North American watchdogs to streamline regulations for the direct-to-consumer genetic testing industry in certain cases.

These factors will fuel the market growth as they will stimulate the demand for direct-to-consumer genetic testing.

However, the market is far from easy given the sheer number of competitors and because the more aggressive competitors continue to bring technological innovations into their growth strategies.

Invitae Corporation could do the same to expand the future of its genetic testing, but first the company must solve the problem of spending more money than it can earn.

The Company’s Realignment Plan Amid Uncertain Business Outlook

The company recently informed shareholders of its next strategy, called the Corporate Realignment Plan, through which Invitae Corporation plans to reverse the relationship between cash outflows and cash inflows as the company is currently burning resources.

By taking this action, Invitae Corporation believes it can save up to $326 million in annual costs in the next few quarters to 2023, which will be implemented in part through reductions in personnel costs and other non-essential costs. In addition, the company estimates that it will have approximately 26 months to continue being able to meet its various supplier and financial obligations.

Until then the prospects of the growth projects, aimed primarily at allocating resources to more core and higher-margin operations, are plagued by economic uncertainty. These strategies are unlikely to have the natural momentum due to an unbalanced revenue-expenditure situation, making the task more difficult for the company.

Q2 2022 and Financial Condition: The Realignment Plan Results Were Not in Sight

The results of the realignment plan were still not in sight in the second quarter of 2022. In fact, in the Q2 of 2022 Invitae recorded an exponential increase in total costs and expenses to $2.66 billion [vs. total revenues of $133.18 million], due to which it was forced to write off assets totaling $2.32 billion.

So the company reported a quarterly loss of about $2.5 billion, resulting in a diluted net loss of $10.87 per share, a negative reversal from the same quarter last year when it reported a net income of $133.8 million or a net profit of $0.53 per share.

Looking ahead to 2022, Invitae thinks its total revenues will grow at a low double-digit year over year, rising to 15-25% by 2024, for a guideline that appears to be quite ambitious.

As of June 30, 2022, the company’s financial position does not appear robust and must be dealing with a challenging environment of fast-rising borrowing costs while its balance sheet presents a high debt-to-equity ratio of 4.54.

Stock Valuation and Analysts’ Recommendation

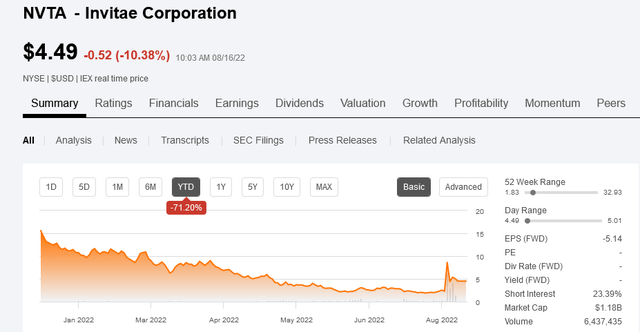

The stock is down more than 70% so far this year, with shares changing hands at $4.49 per unit and a market cap of $1.18 billion as of this writing.

Currently, the stock price is well below the upper end of the 52-week range of $1.83 to $32.93, but this doesn’t make the stock a bargain as the coming quarters are expected to be very difficult for the company’s improvement targets, and the share’s price performance.

The stock has a median recommendation rating of Hold on Wall Street. The average target price is $3.58, reflecting a downward trend of more than 20% from current levels.

Conclusion

Invitae Corporation is active in the US direct-to-consumer genetic testing market, which is expected to show good growth, although it is characterized by fierce competition. The company is in trouble because its operations consume more cash than they can put in, and its balance sheet is highly leveraged. The coming quarters will be a crucial stress test for the future of this company and the share price could potentially fall further.

Be the first to comment