B4LLS

GIC Focuses On Margin improvement

My previous article discussed Global Industrial Company’s (NYSE:GIC) strategies, including diversification, digital e-commerce platform, and other marketing efforts and brand leveraging. Its actions on a digital e-commerce platform can enhance its digital footprint and improve customer experience. The healthcare market holds significant potential because GIC has had low penetration. The commencement of operations at the new distribution center in Canada can strengthen its presence in that region in 2023.

At the operating profit level, the company has endured a severe cost hike in inventory following supply chain constraints. The earlier price hike advantage seems to be losing steam as it goes into 2023. Cash flows can recover as inventory cost is expected to decline in 2023. The company also has an advantage over its peers because of its strong balance sheet. Because the relative valuation multiples are reasonably placed, I think the investors may continue to hold the stock, although returns can be low in the near term.

Marketing Focus And Target End Markets

In Q3, GIC invested heavily in pricing intelligence and analytics to monitor inventory cost inflation. As witnessed over the past few quarters, the supply chain disruption resulted in higher inventory levels. The other area of interest is the hospitality and healthcare large markets which can provide a significant opportunity to gain market share. The company plans to provide its core offerings in storage and shelving, furniture and decor, and carts and trucks.

Its digital e-commerce platform focuses on auto-reorder functionality, mobile navigation, faster checkout, and personalized recommendations. It has also commenced operations at the new distribution center in Canada, strengthening its presence. These facilities can enhance its digital footprint and improve customer experience.

The Pricing Dynamics

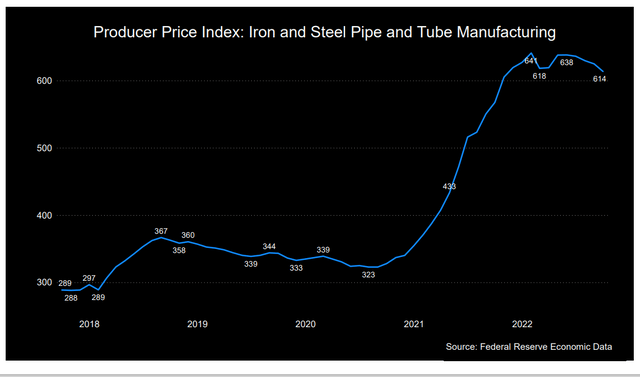

The Producer Price Index (iron & steel products) increased 8% in the past year until October 2022. However, it has declined since its recent high in June. As a result of higher commodity prices, GIC kept its inventory level high as excess and seasonal stock. Such promotional pricing impacted its cost structure. In Q3, the company benefited from the FIFO inventory sell-through as it rationalized its selling price.

However, a lower selling price can adversely affect its operating margin. Also, the ocean freight costs and landing costs remain elevated. To counter this, the company will look to strengthen its long-term margin. It will increase the share of private brand sales, invest in pricing analytics, and optimize fulfillment and freight profile.

Q3 Drivers And Margin Analysis

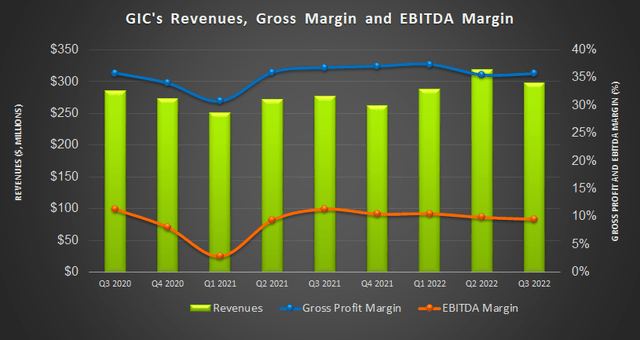

The company’s revenues decreased by 6.3% in Q3 2022 compared to Q2. Much of the topline loss can be attributed to a weaker demand environment, as evidenced by slow GDP growth or a decline in the past three quarters. However, revenues increased in Q3 compared to a year ago due to a higher share of private brand offerings following the supply chain normalization.

The company’s gross profit increased by 20 basis points quarter-over-quarter. Its adjusted EBITDA, however, decreased (40 basis points down) from Q2 to Q3. An adverse impact of promotional pricing on excess and seasonal stock and high-cost inventory caused the EBITDA margin to shrink.

Cash Flows And Dividends

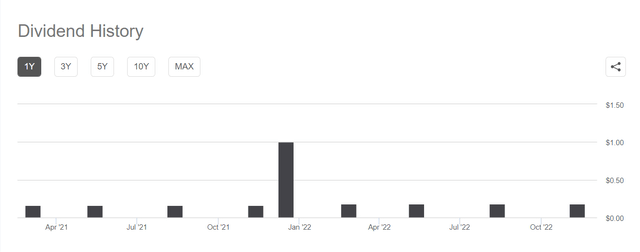

In 9M 2022, GIC’s cash flow from operations (or CFO) decreased due to higher working capital requirements compared to a year ago. So, free cash flow (or FCF) declined by 61% in 9M 2022. The management expects accounts receivable, inventory, and accounts payable balances to fluctuate, which can increase working capital requirements if the activity level rises.

GIC’s annual dividend ($0.72) translates into a 2.87% dividend yield. Its debt-to-equity ratio was much lower (0.05x) than its peers (FAST, MSM, and MRC). Its liquidity was $81 million as of September 30, 2022. Its debt level can improve further because working capital decreases as the inventory level normalizes.

Relative Valuation And Analyst Recommendations

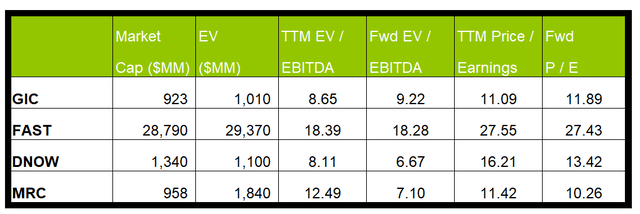

The company’s EV/EBITDA multiple (8.7x) is lower than its peers’ (FAST, DNOW, and MRC) average multiple of 13x. GIC’s forward EV/EBITDA multiple is expected to expand versus the current multiple, which is in contrast to the contraction of multiples for its peers. This suggests the stock should have a lower EV/EBITDA multiple than peers. So, the stock is reasonably valued. However, I think it has a negative bias at this price level.

Seeking Alpha data shows one Wall Street analyst rated GIC a “buy.” One recommended a “hold.” None rated it a “sell.” The analysts’ estimates suggest a 92% upside at the current price.

Why Do I Keep My Rating Unchanged?

My previous article discussed how GIC was poised to gain from an increased share of large enterprise accounts. However, higher costs related to the Canadian distribution network could mitigate operating profit growth and result in negative free cash flow. In the article, I wrote:

Apart from the traditional small and midsized customer base, it saw rapid growth in the larger enterprise accounts. The healthcare channel, which started in May, can become a significant growth driver. Following the impact of high-cost inventory, the company undertook modest pricing hikes, which allowed it to drive some additional capacity. Commodity price inflation, as evidenced by the producer price index, seems to have diminished lately.

By Q3 2022, slow GDP growth in the US following a decline in the previous two quarters softened GIC’s topline as the demand wobbled. The supply chain normalization partially mitigated the cost overrun and helped stabilize the margin. High seasonal stock and inventory costs can reduce further as the supply chain eases.

What’s The Take On GIC?

GIC is building a long-term competitive position through investment in private branding, digital marketing, pricing analytics, and distribution. Healthcare is one such market that holds significant potential because GIC has had low penetration in this market.

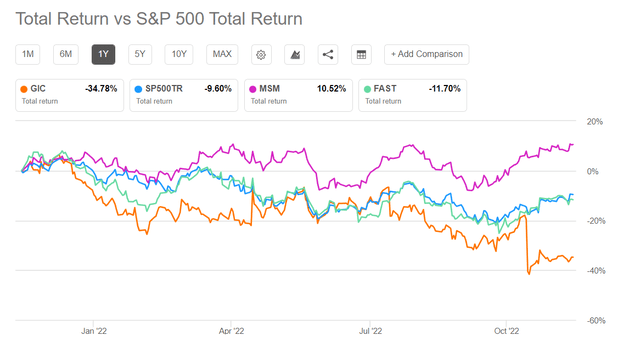

Despite the promises, uncertainty over GDP growth and customer spending raises concerns over the near-term future. Cash flows declined steeply in 2022. The SPDR S&P 500 Trust ETF (SPY) outperformed the stock in the past year. As a result of the inventory cost push, its topline contracted in Q3 while the operating margin growth tapered off. Working capital can decline in 2023. I think the stock price will be range-bound in the near term.

Be the first to comment