krblokhin/iStock via Getty Images

Thesis

Whirlpool Corporation (NYSE:WHR) is currently a “buy”, despite a bearish outlook on the housing market. The company boasts consistent growth in revenue, net income, free cash flow, dividend yield, and ROIC. They also buy back shares at reasonable prices. Currently, a massive dividend yield nearing 5%, and superb valuation with 50% upside, this stock screams “buy” for any long-term investors looking for value and dividend plays in a sticky company.

Business and Competition

Whirlpool Corporation is committed to being the best global kitchen and laundry company and manufacturer. They own many brands we see in our everyday appliances.

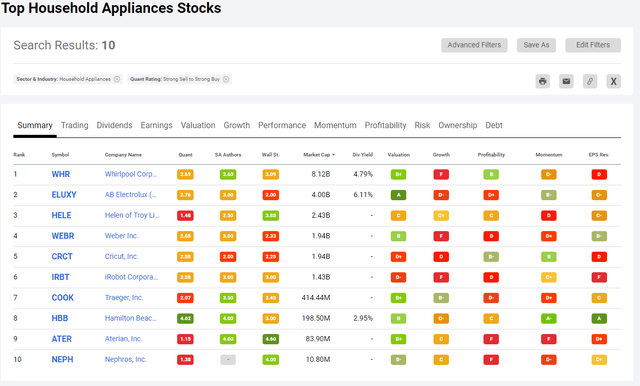

Competition is strong with WHR through companies like Arcelik, BSH (Bosch), Electrolux, Haier, Hisense, LG, Mabe, Midea, Panasonic and Samsung. However, WHR sets itself apart from the mega cap companies by focusing on almost strictly kitchen and laundry products. And if we zoom in on the appliance market alone, WHR is twice as large as the next company in line at 8.12B Market Cap.

Appliances Market Cap (Seeking Alpha)

This puts WHR in a unique position where they are hyper focused on the appliances market, unlike Samsung, Panasonic, Bosch, yet still have economies of scale advantage over the other focused appliance stocks. Because of this, I see WHR having a decent moat, along with the great resume of household names.

Industry Outlook

I’ve been buying up manufacturing stocks related to the housing market in previous article for OC and other articles for AYI with good success this year. As the housing fearmongering continues, these pickaxe tool makers are dropping in deep value territory. I could see them dropping more, but I believe buying on the way down is the right move. For WHR’s sake, a housing slowdown may negatively affect future sales in the short term, but it does not put the companies out of business. People will always need and replace appliances through WHR, lights through AYI and shingles through OC, whether they are buying a house or holding. CAGR for home appliance research shows anything from less than 4% to 4.4%, to 9.4%. During the valuation segment, I stick to the very low end of this industry outlook for a margin of safety,

Financials

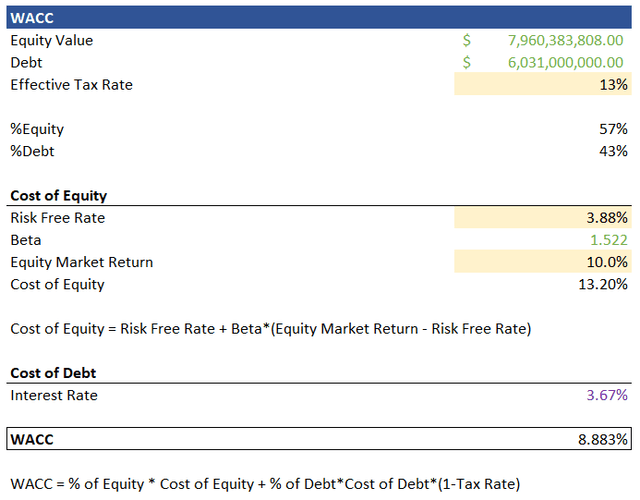

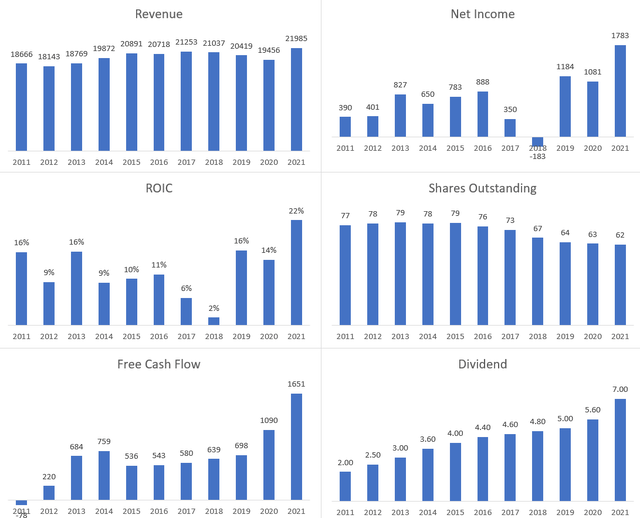

WHR excels in six key metrics when judging the performance of a company. While a very small percentage, they have top line revenue growth over the last ten years with an average of 1.77% YoY. Their Net income has 4.5X in 2021 compared to 2011. They consistently repurchase shares at (-2.2%) rate YoY at a reasonable price. They also more than tripled their annual dividend since 2012 and also boast a decent ROIC of 12% average over the last ten years. WACC in a later segment to be around 8.88%. Though WACC changes over time, their ROIC has been higher on most years which tells me management is efficient at investing capital. Their Free cash flow has also grown generously over the years. Overall, WHR’s financials are very compelling.

Valuation

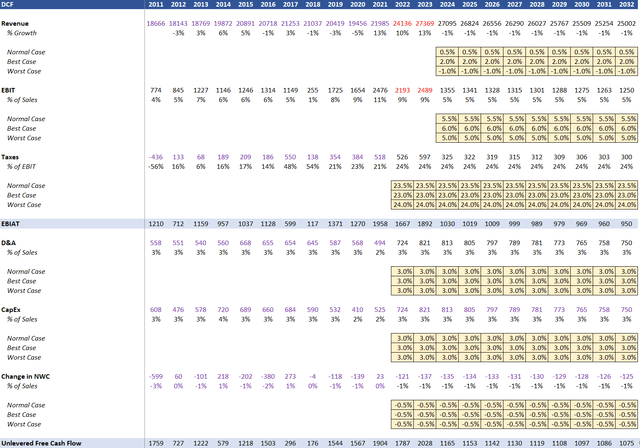

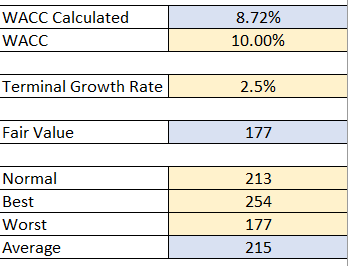

A fair value of $215 per share was calculated by a 10-year Unlevered Discounted Cash Flow (“DCF”) analysis using CAPM with a 2.5% terminal growth rate (“TGR”) and a 10% weighted average cost of capital (“WACC”) discount. Note that WHR’s WACC was actually calculated to be 8.72%, but I decided to discount by 10% to match the market. A worst-case, best-case, and normal-case scenario were averaged to arrive at the fair value. Revenue and EBIT projections were used from average results of (18) analysts for 2022 and (9) analysts for 2023 from Financial Modeling Prep (Red Text). Personal projections were used thereafter, with the following conservative assumptions in the tan boxes.

WHR DCF Assumptions (Author) DCF Fair Value Cases (Author) WHR WACC Calculation (Author)

Risks, Catalysts, and Conclusion

There are always risks in competition and quality of other products. Although, WHR is in a good position. They focus on their appliances and brands and are not reaching in non-confident territory. And when it comes to appliances niche market, they are king by a long shot. There is also risk in the stock dropping due to further house market fearmongering, but I predict massive sell offs will not be tied to actual financials and valuations, but feelings. Now is a good starting point to build a position and buy more if it dips. I could see this being an easy double in a couple years and you get to enjoy juicy dividends and share buybacks along the way.

Be the first to comment