CloudVisual/iStock via Getty Images

Note:

I have previously covered Seanergy Maritime Holdings (NASDAQ:NASDAQ:SHIP), so investors should view this as an update to my earlier articles on the company.

Earlier this week, Greece-based Capesize pure play Seanergy Maritime Holdings or “Seanergy” reported respectable third quarter results and declared a quarterly cash dividend of $0.025 per common share.

Average daily time charter equivalent (“TCE”) rate came in at $20,614 thus representing a substantial premium over the average Baltic Capesize Index (“BCI”) for the period thanks to a mix of above-market time charters and scrubber profit sharing for some of the company’s vessels.

The company recorded Adjusted EBITDA of $19.0 million and generated $10.1 million in cash flow from operations.

While results were down sequentially and year-over-year, Seanergy managed to stay profitable despite a substantial increase in daily vessel operating expense and very weak Capesize market conditions.

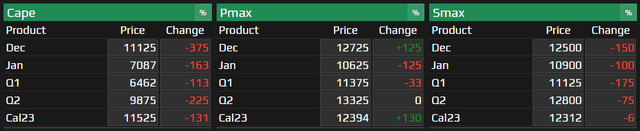

Lackluster Chinese iron ore demand and rapidly easing port congestion have been the main drivers behind the disappointing charter rate environment which is likely to persist until at least Q2 of next year as forward freight agreement (“FFA”) rates look just plain ugly:

That said, on the conference call management provided a decisively optimistic outlook for next year:

We continue to believe that the market weakness will be short-lived and we expect within the first half of 2023, a sustainable recovery of the Capesize sector with a long-term duration.

Particularly new environmental regulations are expected to impact vessel supply in the near future:

One of the most important issues that will affect the vessel supply in the coming years is the introduction of the EEXI and CII regulations in January 2023, which is effectively next month.

While the EEXI has a one-off effect, the CII will have a progressive impact of the global fleet. The combination of these regulations will be a continuous speed reduction that will affect one way or another the majority of the Capesize vessels. Hence, the effective vessel supply will start to contract in the following periods.

We believe that the effect will be more severe in the next few years and this has been grossly underplayed by a number of market participants. The healthy vessel supply fundamentals combined with the gradual improvement of demand in 2023 will lead to a positive Capesize market in the near future.

During the Q&A session of the call, management also discussed FFA rates:

We strongly believe that the first half of 2023 futures are very, very low. (…) So, in our opinion, it doesn’t make any sense to fix at this very low rates, which we believe will — the actual market will be much higher than those presented on the forward rate.

So, we believe that now there has been a big over-sell in the market for various reasons that I don’t want to comment on and I strongly believe that we will see much stronger rates, much higher rates than those denominated by the future contracts in the first half.

Management also pointed to potentially improved demand out of China based on anticipated easings of COVID restrictions and improvements in industrial production as well as increased infrastructure investments.

Quite frankly, I would advise to take these statements with a huge grain of salt, particularly after what happened to the dry bulk market this year.

In addition, the initial impact from EEXI and CII might not be material as most vessels are already steaming slowly due to a persistent lack of demand.

Moreover, should China continue its zero-COVID policy, iron ore demand is likely to remain subdued next year.

Looking ahead to the company’s fourth quarter results, Seanergy projects its daily TCE rate to decrease by approximately 16% sequentially which would translate to an estimated $6.5 million quarter-over-quarter cash flow hit with Q1 likely to be even weaker.

On the flip side, the company recently received approximately $15 million in cash from the redemption of convertible preferred shares issued by spin-off United Maritime (USEA) and a favorable loan refinancing last month so after adjusting for dividend payments, debt service and the recent warrant tender offer, I would expect Seanergy’s cash position to increase to approximately $35 million by year-end.

Going forward, the company will also benefit from improved profit sharing agreements for some of its scrubber-fitted vessels:

In addition, we managed to improve the scrubber profit sharing scheme for the scrubber-fitted vessels that were due for renewal. Within the next two quarters several of our scrubber-fitted vessels will start earning a considerably higher share of the scrubber premium, further strengthening our operational revenues.

Unfortunately, based on current FFA rates, the company might experience material cash outflows in Q1 and even Q2 of next year which doesn’t bode well for a continuation of the generous quarterly dividend.

Please remember also the requirement to regain compliance with the Nasdaq $1 minimum bid price requirement by January 30, 2023. If the company fails to secure a second 180-day extension, investors would be facing the risk of a near-term reverse stock split.

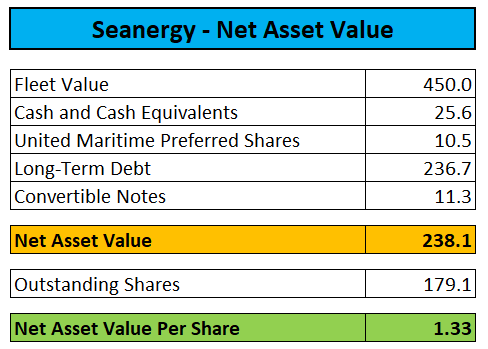

The ongoing charter rate weakness has also started to impact the second hand vessel market in recent months thus resulting in Seanergy’s net asset value (“NAV”) per share taking an almost 35% hit from my late August estimate.

Company Press Release / MarineTraffic.com

That said, shares are still trading at a massive 60% discount to NAV thus reflecting poor industry conditions and market participants’ expectations for a near-term dividend cut/cancellation and potential reverse stock split.

Bottom Line

Highly speculative investors with some faith in management’s expectations for Capesize charter rates to recover sooner rather than later should consider scaling into Seanergy Maritime’s common shares at the current 60% discount to net asset value.

That said, the beaten-down share price very much reflects the poor charter rate environment and associated risks of a dividend cut and potential reverse stock split early next year.

Given the increased risks to the investment thesis, I have reduced my position in recent months but decided to keep some exposure to a potentially improving Capesize charter market next year.

Be the first to comment