onurdongel/E+ via Getty Images

Pembina Pipeline Corporation (NYSE:PBA) is one of the largest midstream companies in Canada, boasting a commanding position in the incredibly resource-rich Western Canadian Sedimentary Basin. The company proved to be one of the stronger names back in 2020 when oil prices collapsed following the institution of the COVID-19 lockdowns, although the company did see its stock price decline along with the rest of the sector. The company’s stock price has since more than recovered and is up a respectable 13.66% over the past twelve months. Admittedly, this is nowhere close to the twelve-month gain that some of its peers delivered but Pembina Pipeline also never declined to the same degree. Pembina Pipeline also never cut its dividend in response to the crisis and in fact has increased it annually every year since 1998. This alone should prove attractive to many and offset the fact that the company’s 5.11% current yield is quite a bit less than its peers. Overall, Pembina Pipeline may still have enough to offer that it is worth adding to an income-focused portfolio.

About Pembina Pipeline

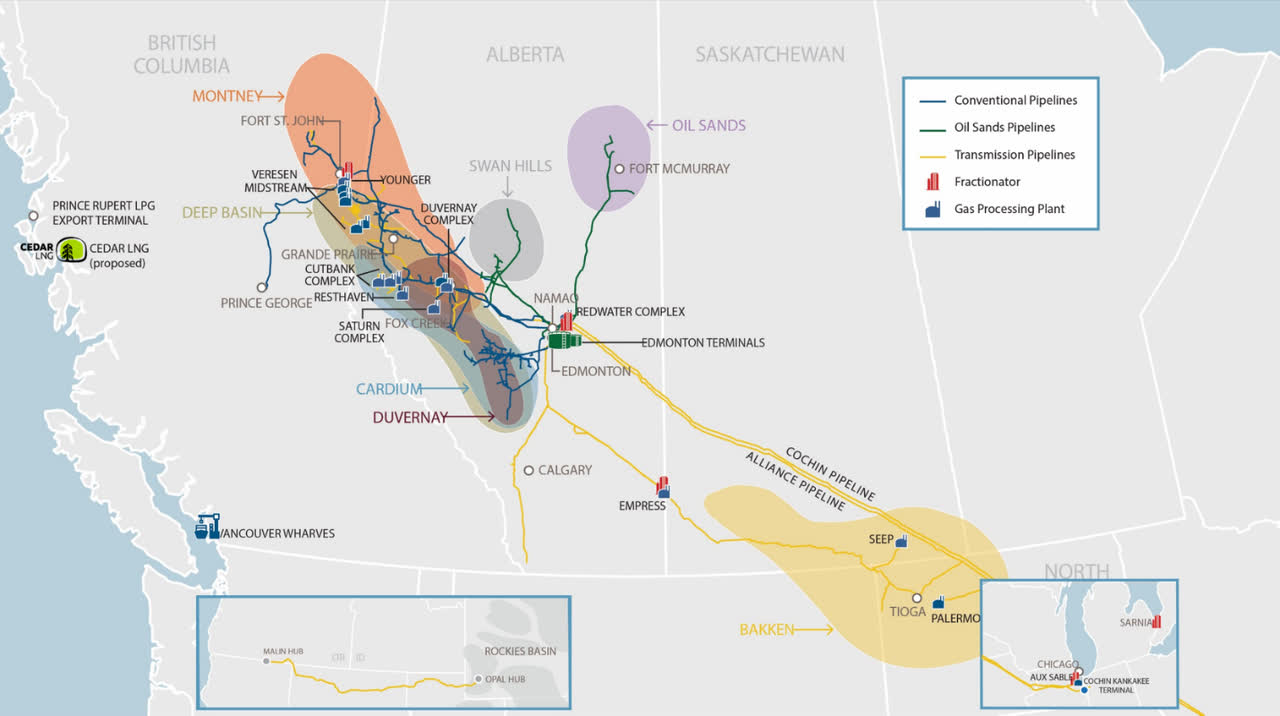

As stated in the introduction, Pembina Pipeline is one of the largest midstream operators in Canada. Its infrastructure is primarily located in the province of Alberta, although it does extend further than that and even down into the United States:

Pembina Pipeline

At first glance, this makes the company look much smaller than some of its American peers but this is far from the case. This is because these operations ultimately span the breadth of the Western Canadian Sedimentary Basin, which has long been the focal point of oil and natural gas production in Canada. Indeed, the region is believed to contain 143 trillion cubic feet of recoverable natural gas (similar to the Marcellus shale) despite having produced for decades. However, Pembina Pipeline is a midstream company and does not actually produce liquids or natural gas so it benefits from the region’s resource production in a different way. Basically, Pembina Pipeline enters into long-term (typically five to ten years in length) contracts with its customers under which Pembina Pipeline provides transportation and storage services for the customer’s resources and is paid a fee that is based on the volume of resources handled. As the company is not compensated based on the value of the resources, Pembina Pipeline enjoys a great deal of protection against fluctuations in resource prices. There may admittedly be some readers that point out that upstream companies tend to cut back on their production when energy prices decline and that could cause Pembina Pipeline’s handled volumes to decline. However, the company has a way to protect itself against this as well. The contracts that it has with its customers include minimum volume commitments that specify a minimum volume of resources that the customer must send through Pembina Pipeline’s infrastructure or pay for anyway. Overall, this model gives Pembina Pipeline a great deal of protection against changes in energy prices, especially because 88% of its cash flow comes from these contracts. We can see this in the fact that the company has grown its adjusted EBITDA consistently on a year-over-year basis, including in 2020, despite the crash in energy prices:

|

2022 (G) |

2021 |

2020 |

2019 |

|

|

Adjusted EBITDA |

C$3.45-C$3.60 billion |

C$3.43 billion |

C$3.28 billion |

C$3.06 billion |

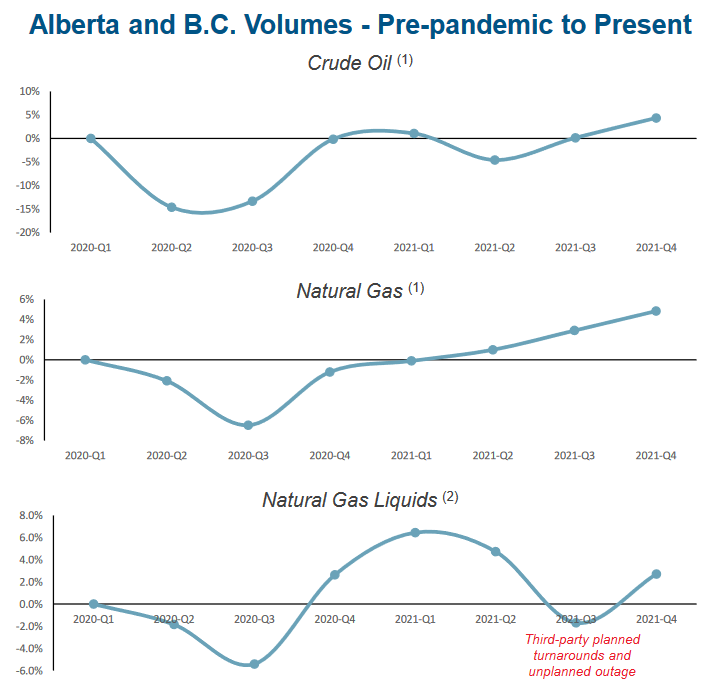

Pembina Pipeline expects to continue this streak in 2022 and has guided for a full-year 2022 adjusted EBITDA of C$3.45 billion to C$3.60 billion. The company’s first-quarter 2022 earnings results do support the likelihood that Pembina Pipeline will deliver growth this year as it reported an adjusted EBITDA of C$1.006 billion compared to C$835 million in the first quarter of 2021. As might be guessed, Pembina Pipeline expects that this growth will come primarily from growing resource volumes flowing through its infrastructure. As we can see here, upstream production of both liquids and natural gas in the Western Canadian Sedimentary Basin has completely recovered from the 2020 crash and is in fact higher than what existed prior to the pandemic:

Pembina Pipeline

As a dominant force in the basin’s midstream infrastructure, Pembina Pipeline should benefit as producers need to bring this incremental production to the market. With that said, Pembina Pipeline did see its volumes decline slightly in the most recent quarter compared to the first quarter of 2021 but the decline was small enough that it can easily be excused away as something simple like the timing of a well coming online. Over the course of the year, Pembina Pipeline should see higher volumes than in 2021 as long as energy prices remain high and upstream producers try to take advantage of the situation. As we will see in just a bit, that is very likely to be the case. Unfortunately, though, the company’s ability to generate growth in this way is limited. That is because its existing infrastructure has a finite capacity of resources that it can handle and once that limit is reached then Pembina Pipeline will no longer be able to grow its volumes even if the customers demand it.

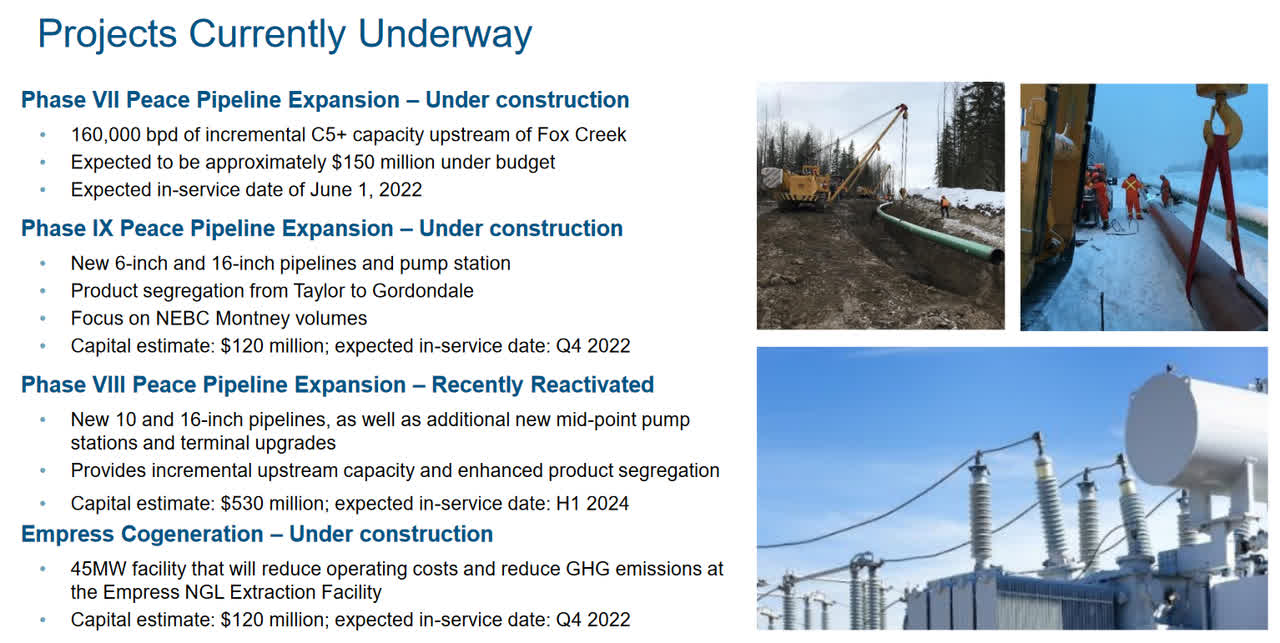

In order to overcome this problem, Pembina Pipeline will need to construct new infrastructure. That is exactly what the company is doing as it currently has C$4.9 billion worth of projects underway at various stages of development. Of these, approximately C$900 million worth will be starting operation this year:

Pembina Pipeline

As we can see, the three projects that are scheduled to come online this year are Phase VII and IX of the Peace Pipeline Expansion project and the Empress Cogeneration facility. Unfortunately, the only one of these that will be able to materially contribute to Pembina Pipeline’s 2022 results is Phase VII of the Peace Pipeline Expansion since the other two will not come online until the fourth quarter. As such, it may be prudent to take a look at this project.

For several years now, Pembina Pipeline has been working to expand the Peace Pipeline system to meet the needs of today’s operators in the Western Canadian Sedimentary Basin. This is understandable since the system was one of the original pipeline systems in Canada, constructed back in the 1950s, so obviously it has needed to be expanded over the years as production growth in the area drove the need for more capacity. As the name implies, Phase VII is the seventh phase of Pembina Pipeline’s most recent effort to meet this desire for more capacity. This phase includes the installation of a new 20-inch pipeline running the approximately 200-kilometer distance between La Glace and Fox Creek in Alberta. The pipeline will be capable of carrying about 160,000 barrels of natural gas liquids per day, directly increasing the number of resources that upstream producers in the region are able to transport to the market. One of the nicest things about this project is that Pembina Pipeline has already secured contracts for the use of this new capacity. Thus, we can be certain that the company is not spending a great deal of money to construct infrastructure that nobody wants to use. More importantly, we can be confident that this project will begin generating cash flow for Pembina Pipeline as soon as it comes online, which should have been earlier this month. As such, we should expect to see an impact from it on the company’s second-quarter results with a much larger impact on the third-quarter results.

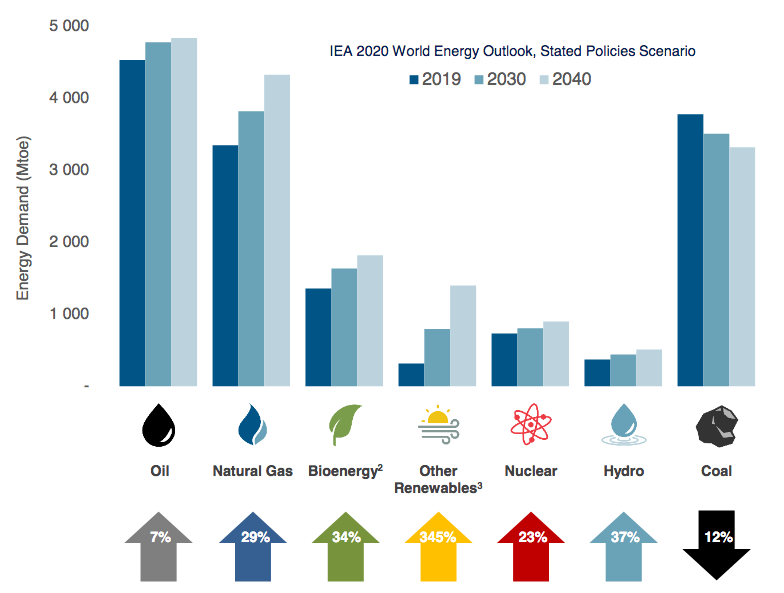

Fundamentals Of Energy

As stated earlier, the fundamentals currently point to the likely situation of high energy prices going forward. This is mostly due to the demand for both crude oil and natural gas outstripping the supply of these resources over the coming years. According to the International Energy Agency, the global demand for crude oil will increase by 7% and the global demand for natural gas will increase by 29% over the next twenty years:

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

Perhaps surprisingly, the demand growth for natural gas is being driven by global concerns about climate change. This might be stunning because natural gas is a fossil fuel. However, it burns much cleaner than other fossil fuels, which has prompted many nations and businesses to include it as part of their carbon reduction efforts. The biggest reason for this is that renewables alone are not reliable enough to support a modern economy given current technology. After all, solar power does not work if the sun is not shining and wind power does not work if the air is still. Thus, the current solution to ensure a reliable electric grid is to support renewables with natural gas turbines. As the renewable capacity and the natural gas-fired power plants are generally replacing old coal-burning power plants, this solution still has the desired effect of reducing air pollution and carbon emissions.

The case for crude oil demand growth may be somewhat harder to understand because the governments of many developed markets are working hard to reduce the consumption of crude oil within their own countries. However, the situation is somewhat different if we look at the various emerging markets around the world. These nations are expected to see tremendous economic growth over the projection period, which will have the effect of lifting their citizens out of poverty and putting them securely into the middle class. These newly middle-class people will naturally begin to desire a lifestyle that is much closer to what their counterparts in the developed nations enjoy than what they have now. This will require increased consumption of energy, including energy derived from crude oil. As the populations of these nations are larger than the populations of the developed nations, the growing consumption of crude oil here will more than offset the stagnant to declining consumption in the developed nations.

The upstream producers in North America, including Canadian ones, are some of the few that can increase their production in order to satisfy this demand. As Pembina Pipeline makes its money based on the volume of resources that it handles, we should be able to see how it will benefit from an increase in upstream production. We have already discussed how the producers in the Western Canadian Sedimentary Basin have begun to increase their production in order to take advantage of today’s high energy prices. The question is how much they will increase production since that could prove to be a natural limit to Pembina Pipeline’s growth. According to Moody’s, the energy industry must immediately increase its upstream spending by $542 billion in order to avoid a global supply shock. It seems highly unlikely that the industry will do this considering that it is under enormous pressure from politicians and activists to improve the sustainability of its operations and from investors to improve its returns. Thus, we appear to have a situation in which demand will grow faster than supply, which economic law states will result in rising prices. With that said though, it does still seem likely that Canadian producers will increase their output in order to profit from the high prices but not quickly enough to bring down energy prices. Overall, this should still benefit Pembina Pipeline going forward as the production growth should still result in incremental volume growth for the company.

Dividend Analysis

One of the biggest reasons why investors purchase shares of midstream companies is that they tend to boast higher yields than most other things in the market. Pembina Pipeline is no exception to this as the company’s 5.11% current yield is quite a bit above the 1.55% current yield of the S&P 500 index (SPY). As already mentioned though, Pembina Pipeline’s yield is somewhat lower than many other midstream companies but fortunately, it does have a long track record of increasing its dividend annually and, unlike most other midstream firms, pays its dividend monthly. These two factors help to offset the relatively low yield.

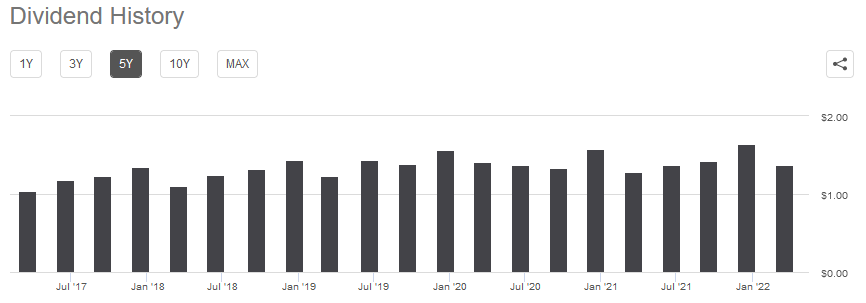

Admittedly, some sources show the dividend fluctuating a bit over time. We can see that here:

Seeking Alpha

This is because Pembina Pipeline pays its dividend in Canadian dollars but many people actually purchase the American-traded shares on the New York Stock Exchange, which pay in U.S. dollars. Thus, fluctuations in the exchange rate between the two nations are the cause of the fluctuations in the dividend that is sometimes reported.

As is always the case, we want to ensure that Pembina Pipeline can actually afford the dividend that it pays out. After all, we do not want the company to suddenly be forced to reverse course and cut its dividend since that will reduce our income and almost certainly cause the stock price to decline. As many regular readers know, the usual way that we judge a midstream company’s ability to pay its dividend is by looking at its distributable cash flow, but Pembina Pipeline does not actually report one. Fortunately, there are other methods that we can use to analyze its sustainability.

The standard method for determining any company’s ability to pay its dividends is by looking at its free cash flow. This figure basically tells us how much money the company generated through its ordinary operations that was left over after it paid all of its bills and made all necessary capital expenditures. This is therefore the amount that is available to do things such as reduce debt, buy back stock, or pay a dividend. In the first quarter of 2022, Pembina Pipeline reported a free cash flow of C$476 million but its dividend only costs C$347 million per quarter. Thus, it does appear that the company is generating enough money to cover its dividend with some left over for other things. Overall, the dividend does appear to be sustainable.

Conclusion

In conclusion, Pembina Pipeline may be one of the better companies in the midstream space, despite the fact that its yield is somewhat less than many other companies possess. The company boasts a dominant position in one of the wealthiest resource basins in the world, which has positioned it well for both near-term and long-term growth. Indeed, we should see some of this growth show up in the company’s results over the remainder of the year. This is nice when we consider the company’s long history of growing its dividend annually because it positions it well to continue that track record over the next year. Despite the relatively low yield, this company may therefore deserve a position in your portfolio.

Be the first to comment