yokeetod/iStock via Getty Images

Over the last couple of years, I’ve spent a bit of time following the portfolio movements at ARK Invest. Cathie Wood and her team saw the firm’s assets soar during 2020 as its ETF holdings surged with the markets. The last year plus has not been kind though, with the flagship ARK Innovation ETF (ARKK) losing more than 75% from its peak. Recently, the fund started selling one of its smaller components, which could be the first true sales test for an ARKK name.

In recent quarters, Cathie Wood has trimmed down the number of holdings in its flagship fund, as she says the focus is turning to their highest conviction names. That means that about a dozen names have seen their positions either trimmed or exited completely. Even when an entire position was liquidated, many of these names like Twitter (TWTR), DocuSign (DOCU), and Palantir (PLTR) were all large companies. Even when she sold out of a smaller name like Skillz (SKLZ), there was plenty of daily trading volume to handle her stock sales.

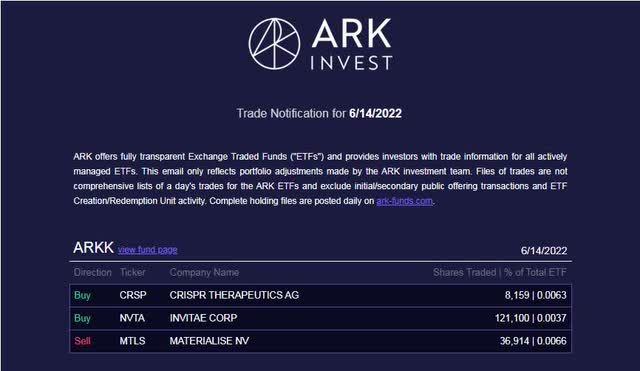

On Monday, the ARKK ETF reported an allocation sale of Belgian software and 3D printing services firm Materialise (NASDAQ:MTLS). There were 15,404 shares sold on that day, with another nearly 37,000 shares sold as shown in the graphic below for Tuesday’s action. This is the first allocation trade for this name (which doesn’t involve inflows, distributions, or redemptions) since last December, when ARKK was involved in a roughly 6 week buying spree of Materialise, scooping up hundreds of thousands of shares.

ARKK June 14th Trades (Ark Invest)

Going into Monday, Materialise was the 30th largest holding out of 35 in the ARKK ETF. This was a holding value of about $56.7 million, more than 4.23 million shares, which resulted in a weight of 0.73%. ARK Invest also owns another nearly 1.5 million shares between its ARK Autonomous Technology and Robotics ETF (ARKQ) and the 3D Printing ETF (PRNT). However, those two funds are not currently involved in allocation sales of this name.

I bring up Materialise today because this is a smaller company with a market cap of only about $750 million as of Tuesday’s close. However, the more important part is that the ARKK ETF itself owned about 7.15% of the company’s total outstanding shares going into Monday’s sales (around 9.65% total if you include the other two exchange traded funds). We haven’t seen Cathie Wood and her team try to sell a name it owns so much of in the flagship ETF during this major downturn, which is why I’m arguing this could be a major test.

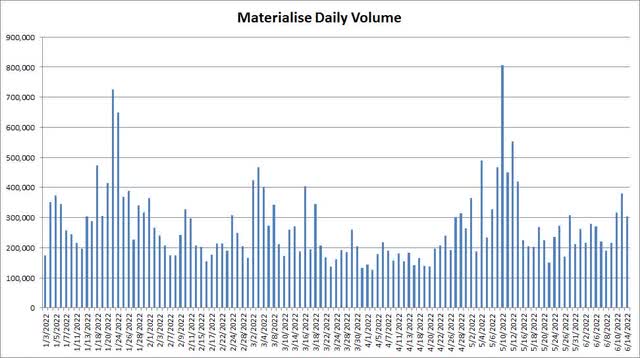

Let’s assume for a minute that ARKK is going to sell all of its position, a bit over 4 million shares currently. There have been 113 trading days so far in 2022, and the average daily trading volume for this stock has been less than 270,000 shares according to Yahoo! Finance. In the chart below, you can see volume by day, and there have only been about a dozen or so days where total shares traded even topped 400,000.

Materialise Daily Volume (Yahoo! Finance)

If you take a look at Yahoo! data, the stock traded almost 304,000 shares on Tuesday. Based on the ARKK sale of nearly 37,000 shares, that meant that the ETF accounted for roughly 1 in every 8 shares traded. It’s one thing to sell tens or hundreds of thousands of shares in big names like Twitter that trade millions of shares per day. However, if you are trying to get rid of more than 4 million shares when a name averages less than 270,000 a day, you might have some issues. At the current average volume and assuming that ARKK accounted for 25% of daily volume, it would take almost 63 trading days to completely exit this position.

Materialise isn’t exactly the normal high growth story that many of ARKK’s components are. The name is only projected to show single digit revenue growth (percentage wise) this year and low to mid double digits moving forward. Unlike many names in the ETF though, it does have limited profitability and positive free cash flow. ARKK makes these buy and sell decisions based on potential upside derived from its proprietary models. Recently, the ETF had been selling chunks of its holding in Spotify (SPOT) to add to positions in other components, but these last two trading days the selling has shifted to Materialise.

In conclusion, Cathie Wood’s ARKK ETF has started to sell shares of Materialise. If these sales continue, it could provide an interesting test for her flagship fund. Unlike previous components that were trimmed or exited, ARKK owns more than 7% of the entire company, with its more than 4.2 million share position representing more than 15 full trading days worth of the stock’s average daily volume for this year. Should the Materialise position be exited completely, it will be interesting to see how long it takes to do so and if selling this large of a stake adds meaningful downward pressure on the stock.

Be the first to comment