omersukrugoksu

The iShares MSCI Poland Capped ETF (NYSEARCA:EPOL) may appear a benign way to invest in a developed eastern European economy, but ETF investors need to take care. Large elements of the portfolio are exposed to legal risks, and there is a decent risk related to refinery product margins associated with further macroeconomic softening. This is probably not the ideal way to get exposure in eastern Europe, and isn’t really the profile that ETF investors would be interested in, we’d think.

Breaking Down EPOL

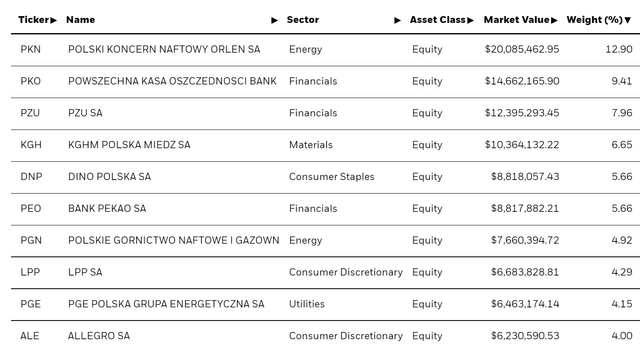

The first 20% of the allocations already provide plenty discussion.

The first is ORLEN (OTC:PSKOF), which is primarily a refinery. While refiners are in a structurally decent position, we do acknowledge that the sector might face some volatility related to macro. Being a global market, oil is already being affected by the situation with China in APAC, and run-cuts are happening at refineries as margins there fall. While regionality matters a fair bit for refiners, especially now that high logistic costs have fragmented markets a bit, petrochem could see a turn. Yes, concurrently falling crude is a nice backstop but macro, where we could be ready for unfavorable corporate developments soon, might be the next leg of margin and volume decline for the company.

There’s not too much wrong with ORLEN, besides the potential for some volatility. The bigger concerns come with the financials. PKO (OTCPK:PSZKY), Poland’s biggest lender with 80% retail business. The issues facing several polish retail banks focuses on the use of Wibor to price loans, where a legal case is being brought against them on the basis that due to illiquidity in long-term interbank loan markets the banks are overcharging retail borrowers on their money. This has become more poignant due to a particularly difficult inflationary pressure on Polish households and an aggressive rate hiking policy coming. Also, as Polish banks, much like elsewhere, are still not raising savings rates and creating pretty strong spreads. With quite a lot of financials in EPOL, the potential expansion of this legal exposure is something investors should keep in mind.

Conclusions

Whether particularly likely or not, these legal risks might be some that ETF investors would like to avoid. However, we should point out that there is some reward for it. The ETF has a pretty big earnings yield of around 18% thanks to the highly compressed PEs in the portfolio. This is partly due to a rather heavy financial exposure, where retail banks in general trade quite cheaply taking ING (ING) as an example, and also the rather idiosyncratic risks that might be faced by Polish banks over this lawsuit. Nonetheless, this is not our favorite way to get exposure to Poland. We’d flag Asseco Poland (OTCPK:ASOZF), a rather low multiple, high growth tech consulting and software holding company with a good yield around 4% that follows healthily its double digit revenue growth.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment