stockcam

Thesis

Snapchat (NYSE:SNAP) crashed as much as 27% following a worse than expected Q3 2022 report. And no surprise: investors needed to stomach lots of negativity, including slowing topline growth, widening operating losses and a depressed outlook for digital advertising.

But did markets overreact? I do not think so. Although Snap stock is now down more than 90% from all time highs, the valuation is not yet necessarily cheap. Investors should consider that SNAP is still trading at x3.5 EV/Sales and around x45 EV/EBITDA.

If an investor would like exposure to social media, and/or digital advertising, I argue Meta Platforms (META) is a much better opportunity – given that Meta’s valuation is competitive (in fact, better) and Zuckerberg’s media empire offers a much better growth outlook and monetization potential.

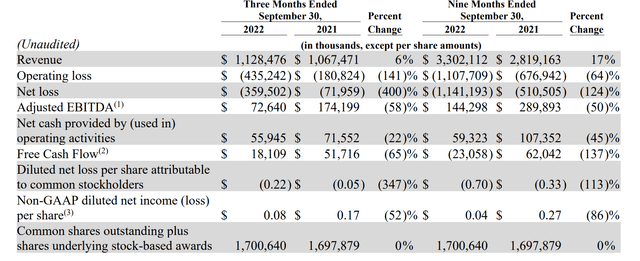

Snap’s Q3 Report

During the September quarter, Snap recorded the slowest pace of growth since the company’s IPO: revenues increased by only 6% year over year to $1.128 billion. Analyst consensus had expected about $100 million more sales, about $1.4 billion in total (Source: Bloomberg Terminal, EEO).

But arguably, the revenue miss was not as bad as the widening operating loss, which increased by about 400% year over year to $360 million. The loss includes a $155 million restructuring charge that is expensed in relation to an unprecedented workforce cut of about 1,100 – 1,300 employees.

Evan Spiegel, Snap’s founder and CEO commented:

This quarter we took action to further focus our business on our three strategic priorities: growing our community and deepening their engagement with our products, reaccelerating and diversifying our revenue growth, and investing in augmented reality

As a consequence of the ‘uncertainties related to the operating environment‘ Snap did not give any guidance for Q4 2022.

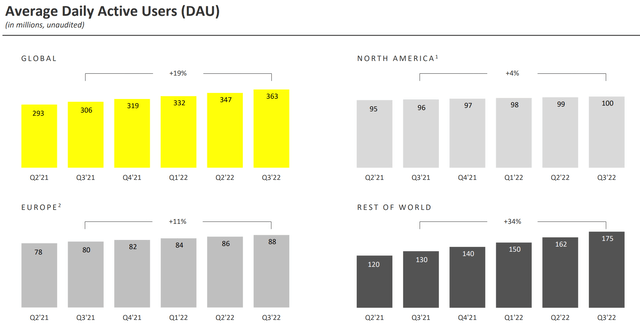

DAU Growth & Engagement Remain Strong

Snap managed to increase daily active users (DAU) by about 19% year over year, to 363 million in Q3 2022 (about 57 million net new users). The company also highlighted that user growth was noted in all major regions, including North America, Europe, and Rest of World.

Also, engagement remained strong, with exciting developments for specific initiatives. Notably, the total time users have been watching Spotlight content jumped by 55% year over year. And for users who are 35+ years, the daily time spent watching Shows and publisher content increased by more than 40% respectively.

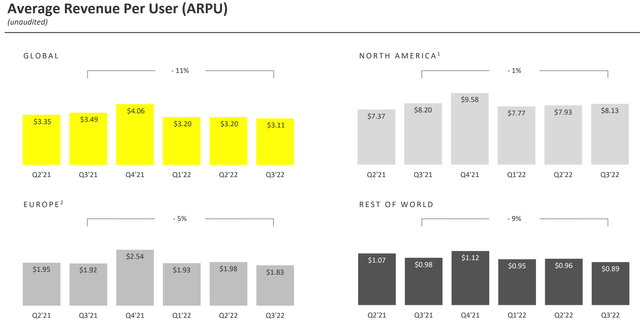

Monetization Disappoints

Given that Snap’s user growth and continued strong engagement, the problem for the bad quarter was clearly related to user monetization. During the September quarter, Snap’s average revenue per user fell to as low as $3.11, which compares to $3.49 in Q3 2021 (and to a cyclically adjusted ARPU of about $8 for Meta).

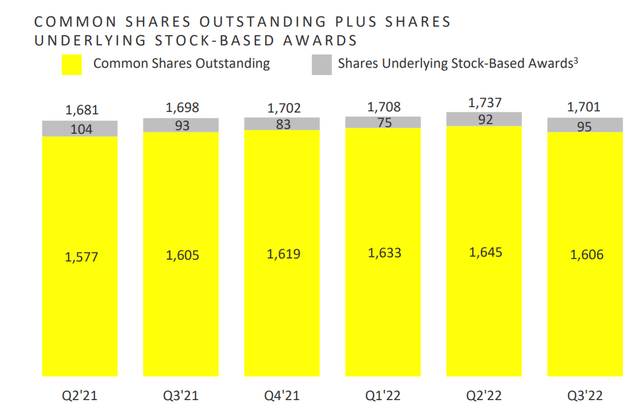

Beware of The Dilution

One of Snap’s most striking financial metrics is the continued shareholder dilution. Investors should know that Snap has a history of diluting shares outstanding by more than 5% per quarter – which is almost incredible. In Q3 2022, Snap granted stock-based awards equal to about 95 million, which compares to $1,701 million outstanding.

Snap justifies such an action saying that stock-based awards are designed to ‘foster an ownership culture’. But such an argument is hardly credible given how fast employees are selling their shares, as soon as the lock-up period expires – see here.

In addition, the company also tries to neutralize the stock-awards with equity buybacks. In Q3, the company announced a program of up to $500 million of its Class A common stock. But how long can this strategy continue? Investors should consider that Snap is slowly approaching being a net-debtor, with net-cash now being $668 million and with annually $700 – $800 million of negative cash from operations, excluding stock-based compensation.

Valuation Not Yet Attractive

Although I must admit that buying the dip after a 90% sell-off is attractive, I don’t believe Snap stock is yet attractive. Investors should consider that Snap currently trades at a one-year forward x3.5 EV/Sales and around x45 EV/EBITDA. This compares to x2.8 and x6.5 for Meta Platforms respectively.

In my opinion, it is hard to justify that Snap should trade at a x3.5 EV/Sales, given the challenging advertising environment and the increasing competition in the social media space (TikTok, BeReal, etc) as well as the increasing competition for digital advertising dollars (TikTok, Netflix (NFLX), Pinterest (PINS), Twitter (TWTR), etc).

Moreover, I don’t see that Snap should trade at a premium to Meta Platforms. I would like to point out that with WhatsApp, Instagram, Messenger, Facebook and Oculus, Meta has a much broader diversified value proposition. And given that the ad ROI on Snapchat ads lags the respective metric for Meta, Snapchat’s monetization struggles will likely persist.

Anchored on the arguments made above, in my opinion, Snap could fall to as low as $5.5/share, which would be in line with a x2 EV/Sales.

Conclusion

After a 90% sell-off from all time highs, it is hard to argue that Snap stock remains a ‘Sell’ – the thesis would simply be too late. But given valuation concerns, as well as a slowing business growth/monetization on the backdrop of challenging macro-environment, it is equally hard to argue that Snap stock is a ‘Buy’.

Accordingly, in my opinion, investors are well advised to remain on the sidelines with Snap. If an investor would like exposure to social media, and/or digital advertising, I argue Meta Platforms provides a much better business and valuation opportunity.

Be the first to comment