Homebuilding architect and construction worker vitranc

Woeful and confused are the terms most apt in defining sentiment toward homebuilder stocks. We want to alert retail value investors to a potential money-making opportunity, M/I Homes Inc (MHO) about which we are moderately bullish. Our primary concern is company debt and cash flow in a tightening economy.

Low Supply Unyielding Demand

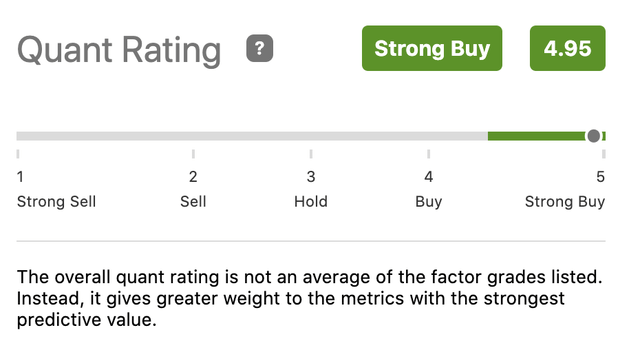

Seeking Alpha, Wall Street analysts, and S A authors are bullish on MHO despite prevailing declining sentiment about the homebuilder stocks. We have written about builders before and leaning bullish because demand outstrips supply.

Quant Rating (seekingalpha.com/symbol/MHO/ratings/quant-ratings)

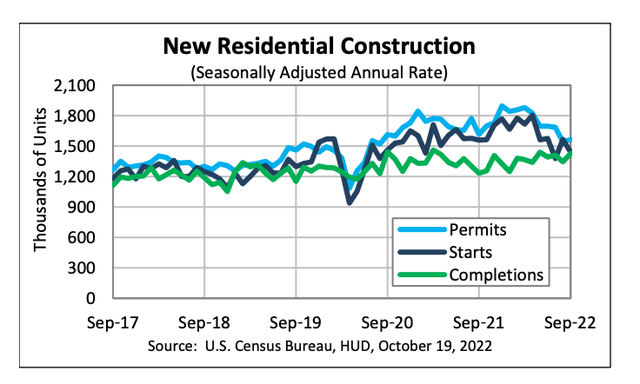

Consumer sentiment about owning a house is positive. Need for houses outstrips the supply. The availability of single-family homes is near a record low. America is short by +5M and the gap is increasing. A March 2022 survey from Bankrate confirms homeownership demand is the American dream, despite challenges.

New Residential Construction (census.gov/construction/nrc/pdf/newresconst.pdf)

The Company

M/I Homes, Inc is based in Columbus, Ohio since 1976. It designs, constructs, and markets single-family homes and townhomes. It operates in Ohio, Indiana, Illinois, Minnesota, Michigan, Florida, Texas, North Carolina, and Tennessee. It originates and sells mortgages, and serves as a title insurance agent.

Mortgage rates hit a 20-year high this month. A 30-year fixed-rate mortgage averaged 6.92% in the week ending October 13; it was 3.05% a year ago and up from 6.66% the week before. For a limited time, M/I Homes is offering APR mortgages below 5%, because of the company’s financial strength and long-time successful reputation with lenders. M/I Homes has built more than 140K homes over 40 years in 16 markets. M/I Homes offers a comprehensive warranty package enticing to consumers.

Six Headwinds

M/I Homes Inc faces six headwinds that might slow revenue. Inflation for materials, rising finished home prices coupled with higher mortgage interest rates, and a looming recession are weaving a tenacious web of macroeconomic conditions. Another headwind for the company is the location of its projects. The company primarily builds in two of the 2022 ten strongest state housing markets. The sixth headwind is online dissatisfaction with M/I Homes’ customer service according to Consumer Affairs; it gives the company 1.5 stars.

Valuation

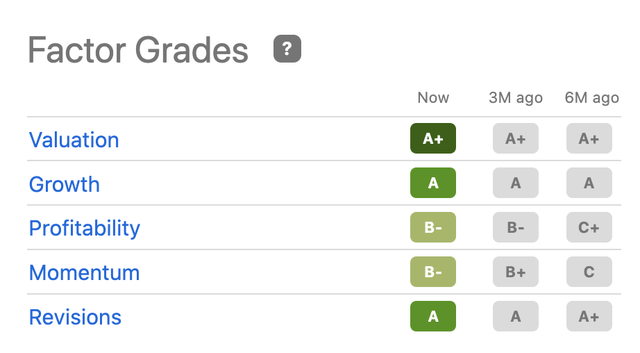

The Factor Grade for momentum on S A has slipped over the last three months but is higher than six months ago. All other grades are holding strong and profitability is up from C+ to B-. Fitch Ratings considers the M/I Homes Issuer Default Rating at BB confirming its “outlook stable” but with a greater level of risk than the top investment grade.

Factor Grades (seekingalpha.com/symbol/MHO)

Its last earnings report on July 27, ’22 for Q2 reported an EPS of $4.79. It beat estimates by a hefty $1.01. Revenue for the quarter was +8.2% Y/Y. The average house price rose 16%. M/I delivered 6% fewer in Q2 ’22 than last year.

New contracts fell -20%, but the company reported a backlog of over 5K units; that is a 9% increase in backlog sales to make a Q2 record. Shares were then selling for +$46 and steadily slipped. The stock is -36.75% for the last 12 months after opening 2022 at over $60 per share. We expect the Q3 earnings report on October 26.

S A forecasts 2022 revenue at $4.06B up from $3.75B in FY ’21. We forecast the EPS for Q3 ’22 will be over $4 compared to last year’s Q3 of $3.03, but lower than Q2. The current price-to-earnings ratio is 2.33x; the average among similar companies in the industry is 3.7x.

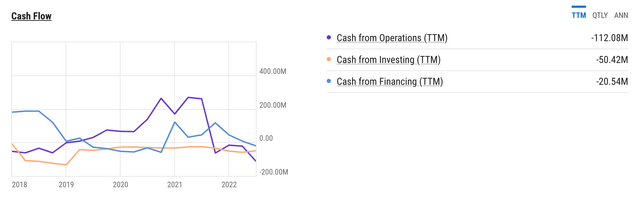

Risk

Short interest is at a modest 3.42% despite the company debt topping $943M, cash at under $200M, and $566M in liabilities at the end of Q2. EBIT grew 24% in the last year and the market cap of $1.12B. Free cash flow is a disappointing 21% of EBIT. M/I Homes has a worse cash-to-debt ratio than 70% of peers but collects more in interest than it pays with a better record than 90% of other homebuilders.

M/I Homes Cash Flow (ycharts.com/companies/MHO)

Together, these conditions raise investment risks about shareholder dilution if cash tightens at M/I Homes, especially considering macroeconomic conditions. If economic conditions improve and sales pick up, we expect the average price target to top $55 over the next 6 to 12 months. The shares can potentially hit $65 over the next three years. Management will have to keep growing earnings close to the 41% annual historical rate.

Hedge funds cut their holdings by over 25K shares last quarter after steadily increasing them. In Q3 ’21, 17 funds held MHO shares. 24 funds have shares in M/I Homes. Insiders en masse sold in early FY ’21 but there have not been significant sales reported since then. 95% of the stock is owned by institutions and the rest is split between insiders and the public. This situation adds to our risk concerns; it breaks our rule of the more stockholders the better. In this tumultuous market, we take institutional ownership as a positive sign. Add to our concerns the MHO Beta is 1.38, meaning the stock is more volatile than the market.

Closing the Door

In the end, M/I Homes Inc is profitable with growth potential. There are headwinds, several downsides, and risks but no egregious threats to the share price. We believe negatives are mostly factored into the lower share price. The nearly 40% debt-to-equity ratio is down from 96.7% over 5 years. But their cash situation does not let them pay a dividend, and, in this environment, investors are seeking some regular return. The CEO is paid an above average of +$7M. He holds the majority of insider shares (2.09%).

Consumers are going to have to be able to afford M/I’s average home price that nears $500K. The future for M/I Homes investors lies mostly in Mark Twain’s declaration that, “It isn’t the sum you get, it’s how much you can buy with it, that’s the important thing.”

Be the first to comment