sanfel

Investment Thesis

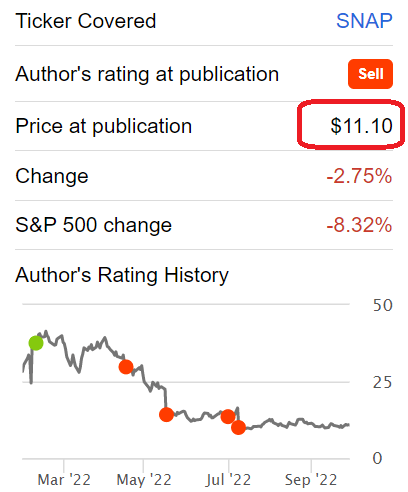

Snap (NYSE:SNAP) reports disappointing results. And, for my part, I remain bearish about its prospects.

Author’s work

In my most recent coverage of Snap, in July, I stated that even though its shares looked cheap, if we anchored to a higher price, I asserted that $11 was still too expensive.

Recall, this was a company that I was once upon a time bullish on, see above.

One positive from this report is that approximately 30% of Snap’s market cap today is made up of cash. However, that’s offset by $3.7 billion of debt, with one of its debt stacks maturing in May 2025.

There’s a lot to get through, so let’s get to it.

Snap’s Revenue Growth Rates Fizzle Out

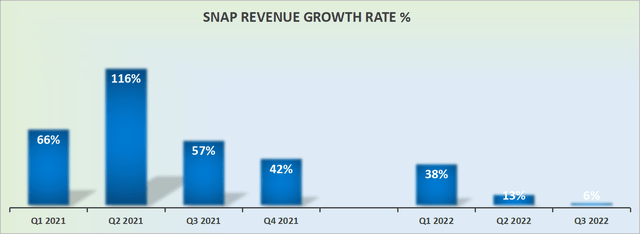

Anyone that has followed Snap for a while knows how last year Snap was guiding for long-term growth rates of 50%.

For the company that now cannot even eke out double digits growth rates, one thing is strikingly obvious, Snap is no longer a growth enterprise.

And companies that are clearly no longer growth enterprises, don’t get awarded a P/Sales multiple. They get priced off future earnings, future GAAP earnings.

Before discussing Snap’s valuation, I’ll discuss what was an extremely irksome outcome from Snap’s Q3 earnings report.

Capital Return Program, What Are You Doing?

Snap ended the quarter with $4.4 billion. This equates to approximately 30% of its market cap is now made up of cash. However, this is offset by $3.7 billion of debt, with $1 billion of its senior notes maturing in May 2025.

Snap’s 2025 senior notes carry an interest rate of 0.25%. It will be interesting to see what rate the new notes will get with interest rates today at 4%. Plus, investors have become highly skeptical of unprofitable companies.

Now consider this, Snap repurchased $500 million worth of stock during the quarter at $9.75. Without being ”captain hindsight”, even the most bullish investor should take pause and think if that’s really the best use of capital for an unprofitable company.

Let me provide a much better use of capital. Keep it on the balance sheet! Why? Because Snap has no visibility into its outlook.

Snap hasn’t had to navigate this type of environment before. And I believe that being so frivolous and insouciant with shareholders’ capital is naive, unwise, and imprudent.

SNAP Stock Valuation – A Sign of Things to Come

How does one value a mature company? How does one value a cyclical mature company?

Realistically, this is what Snap is, a slow-growth, cyclical stock. And nobody values these companies on a P/Sales multiple.

Typically, investors price these sorts of investments on a P/free cash flow. But everyone knows that the bulk of Snap’s costs, approximately 30% of its running costs, is management’s stock-based compensation.

And SBC is added back to Snap’s free cash flow line. So, by extension, investors start to appraise the company off of its GAAP earnings. And here the profitability turns grim.

With every quarter, Snap’s GAAP earnings are moving in the wrong direction. With these facts in mind, without being contentious, will anyone give credence to a company’s narrative of how they are striving to remain free cash flow positive?

The Bottom Line

When one invests in a company, one does so because one ultimately believes one of two things.

Firstly, the share price is trading cheaply and is undervalued. Or secondly, they believe in management’s vision.

And I believe that neither of these considerations makes sense in this case. In the first instance, I find it difficult to see what this company’s fair value could be. What I can see is that we are far from that point now.

Secondly, I have an issue with a management team that now believes is the best time to send $500 million out the door. Respectfully, that is either lazy or arrogant, to believe that this splurging of precious capital would help these Snap’s shares find a bottom.

Despite having no skin in the game here, I’m disappointed in Snap. A company that I used to have a lot of conviction in. I hope things improve for its shareholders.

Be the first to comment