hapabapa

Thesis

Leading cybersecurity company Fortinet, Inc. (NASDAQ:FTNT) has been a solid investment for investors over the past ten years, with a 10Y total return CAGR of 26.7%. Notably, the stock has been a massive winner for investors who grabbed it early in the 2020 COVID bottom, with gains that reached over 430% through its December 2021 highs.

We managed to get on board in September 2020 and rode it toward its December 2021 highs, but we have since pared most of our positions in early 2022. We postulate that Fortinet’s underlying thesis remains intact. But, with a slowing growth cadence moving ahead, we are not convinced its valuations are sustainable at the levels in early 2022.

FTNT has also been battered in the tech bear market, as the market sent it falling by more than 36% through its recent lows. Hence, we believe investors could be considering buying the dips in FTNT to ride on the next uptrend when the market recovers.

However, we urge investors to be cautious, as we don’t think the digestion in FTNT is near completion. Therefore, adding at the current levels could lead to market underperformance moving ahead, despite its robust growth drivers.

As such, we rate FTNT as a Hold for now and urge investors to wait on the sidelines.

Fortinet’s Growth Could Peak in 2022

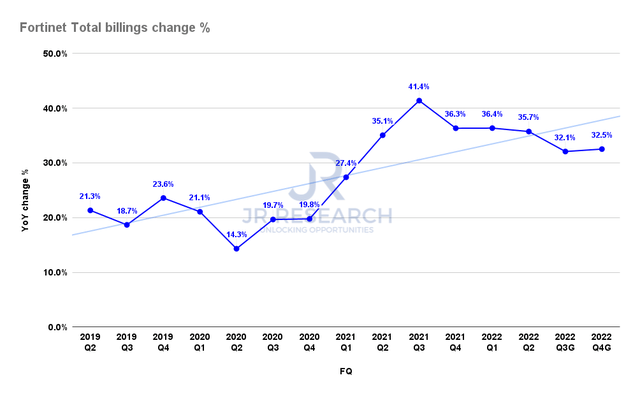

Fortinet Billings change % (Company filings)

As seen above, Fortinet has leveraged an enlarged TAM in its network security leadership by tapping robust growth drivers in the broader cybersecurity space, including in the cloud. Hence, it has been growing faster than the estimates of its TAM expansion (10% CAGR), suggesting that Fortinet has been gaining share against its peers.

However, its billings growth has likely peaked in Q3’21, which is also consistent with FTNT’s December 2021 highs. Furthermore, management’s FY22 billings guidance suggests that growth in H2’22 is expected to slow further, down to 32.1% in FQ3 and 32.5% in FQ4. Hence, even management’s guidance indicates that investors need to expect growth normalization moving forward.

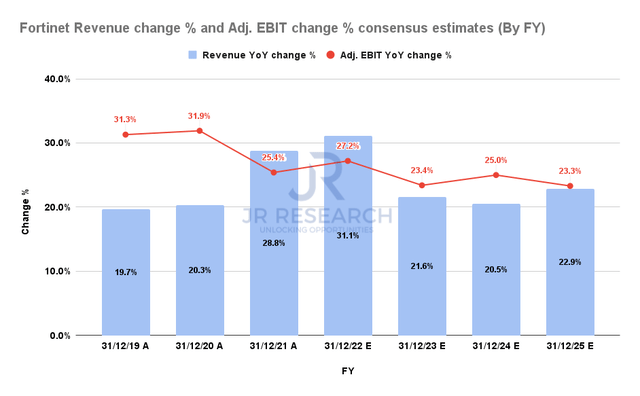

Fortinet Revenue change % and Adjusted EBIT change % consensus estimates (By FY) (S&P Cap IQ)

As seen above, even the bullish consensus estimates indicate that Fortinet’s growth could have peaked in FY22 before moderating further through FY25.

We believe the estimates are credible, given the guidance in its billings growth. Also, management telegraphed an FY25 model of $8B in revenue. Therefore, investors need to be wary about projecting higher growth estimates than what management has suggested.

Notwithstanding, bullish investors could argue that cybersecurity solutions are non-cyclical and should be impacted less significantly by the looming economic recession.

However, we urge investors to be more cautious in making that assumption. Instead, we encourage investors to pay close attention to whether the company expects enterprise spending to moderate further, impacting its near-term growth momentum.

FTNT Is Not Undervalued

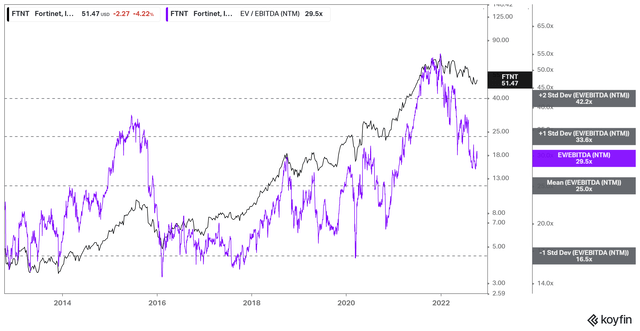

FTNT NTM EBITDA multiples valuation trend (koyfin)

FTNT has fallen markedly from the overvaluation zones in December 2021 as the market justifiably digested its rapid surge from March 2020.

However, we postulate that FTNT seems far from being considered undervalued, even as we move closer to a global recession. Therefore, coupled with potentially peak growth in FY22, we urge investors to be cautious about adding FTNT at the current levels.

Accordingly, we consider FTNT’s valuation as well-balanced at best.

Is FTNT Stock A Buy, Sell, Or Hold?

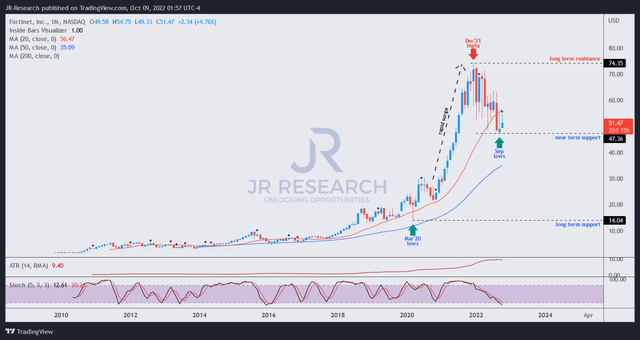

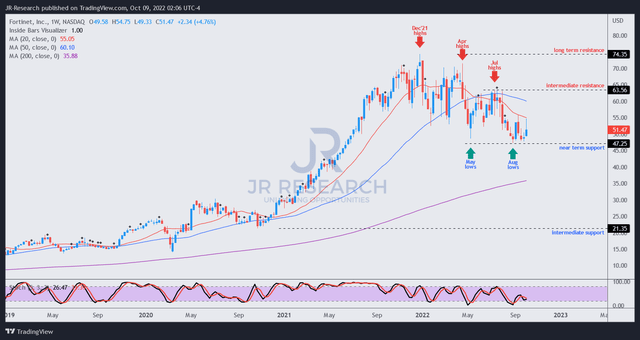

FTNT price chart (monthly) (TradingView)

FTNT’s long-term chart also indicates that investors need to be cautious about considering adding more positions at the current levels.

We assess that its rapid surge from March 2020 is still being digested by the market, with the distribution phase still in action through September 2022 from its December 2021 highs.

We assess that the distribution phase could find a sustained consolidation phase in the gap between its near-term and long-term support. However, it’s still too early to determine where the likely zone could be.

However, we will be watching whether FTNT can sustain its long-term uptrend above its 50-month moving average (blue line). Losing that support level could spell more pain toward its long-term support.

FTNT price chart (weekly) (TradingView)

Poring through FTNT’s medium-term chart corroborates our view that the digestion is ongoing, as it had already lost its medium-term bullish bias.

Therefore, we urge investors to be patient. We have yet to glean any capitulation price action that could suggest investors have been forced to flee in a panic, de-risking the entry levels for less aggressive buy zones.

We rate FTNT as a Hold for now.

Be the first to comment