Justin Sullivan

Introduction: Musk Fumbles, Tesla Tumbles

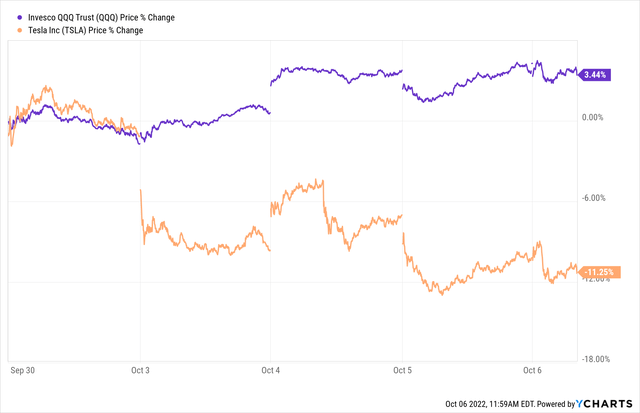

Tesla, Inc. (NASDAQ:TSLA) shares are tanking in the aftermath of its AI Day 2.0 event, as it seems that the announcements around the “Optimus” humanoid bot have failed to appease investors. Furthermore, the negative impact of Tesla’s Q3 delivery miss and Elon’s decision to complete his Twitter (TWTR) buyout for the originally agreed-upon price of $44B ($54.20 per share) are hurting the stock.

While I think Musk putting an end to the Twitter drama removes an overhang from Tesla’s stock, Elon may need to sell more of his Tesla holdings to raise cash for the Twitter acquisition in the coming weeks. And Musk’s selling (or traders frontrunning his fresh sales) could have been driving Tesla’s underperformance relative to the Nasdaq-100 (QQQ) over the last few days. In my mind, Elon is overpaying for Twitter by ~2-2.5x (fair value: low $20s), and Tesla’s shareholders are the ones paying for his fumble.

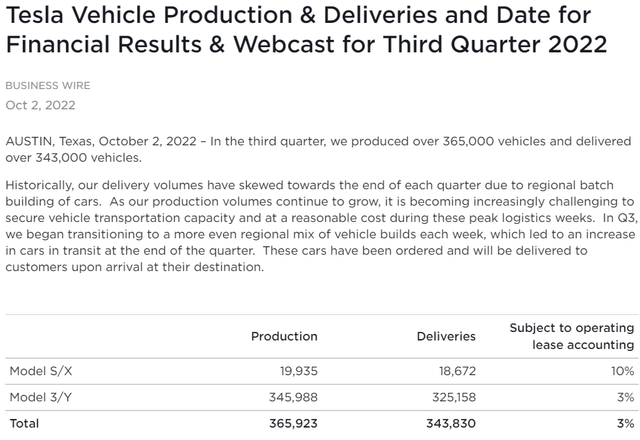

Another potential driver of this rapid move lower in Tesla’s stock is the Q3 miss on deliveries. Last week, Tesla released its production and delivery data for Q3 2022, which saw the company make new records.

Despite Tesla hitting new records for Production and Deliveries, the Deliveries count of 343.8K missed Wall Street [FactSet] estimates of 371K. An eyebrow-raising miss of ~7% is more than enough to stoke investor concerns around demand in a poor macroeconomic environment. In the press release, Tesla’s management blamed the delivery miss on logistical issues, which means demand is not the problem here (not yet, anyway).

Now, for long-term investors, the Twitter drama and Q3 Deliveries miss are nothing but short-term noise. The silver lining here is that Tesla’s stock is catching up to its fair value, presenting long-term investors with a reasonable entry point. We discussed Tesla’s valuation back in June, along with its business fundamentals. In this note, I’ll share an updated valuation for Tesla and then review its technical chart and quantitative factor data.

Silver Lining: TSLA Is Closing In On Fair Value

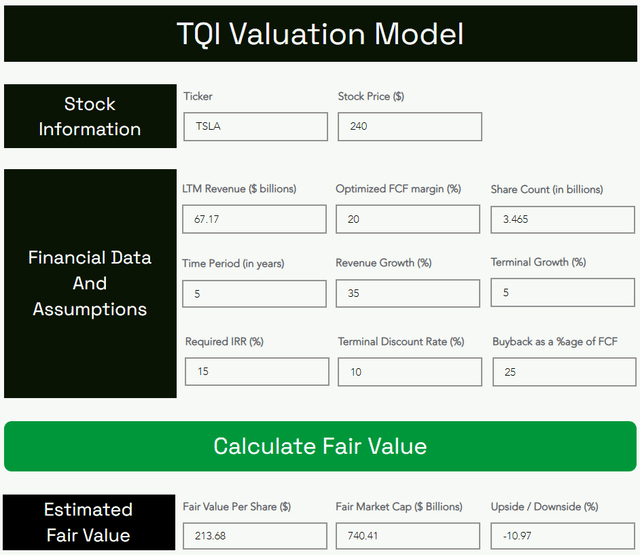

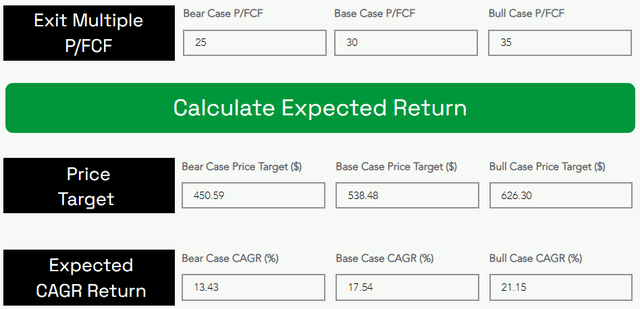

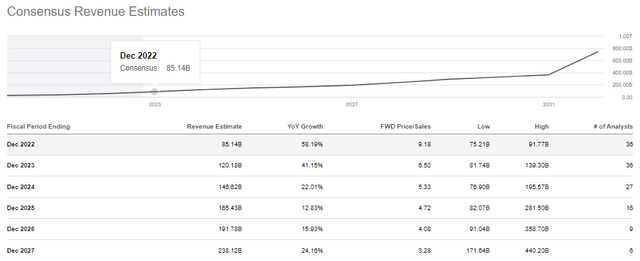

Tesla is a unique company with no real comparables in the market, and so we must value it on an absolute basis. To do so, we will utilize TQI’s Valuation model. According to Elon, Tesla could grow its EV volumes by 50% per annum for years to come; however, achieving this lofty goal would require perfect execution and no external hiccups. Looking at Tesla’s Berlin & Texas Gigafactory progress, it is fair to assume that scaling up production is not as straightforward as it seems on paper. For 2022, Tesla is expected to produce 1.4M vehicles (495K in Q4, ~40K units per week). And in 2023, Tesla’s production estimate stands at 2.1M, which would reflect ~50% y/y growth.

Beyond 2023, Tesla’s revenue growth rates are expected to slow down drastically, but I think these projections are too low considering EV penetration levels, Tesla’s aggressive expansion plans, and the immense potential of new business lines. While I don’t think Tesla will maintain 50% CAGR growth for the next five years, I do see rapid growth for the company.

Further, Tesla is delivering robust (and improving) profit margins and generating tons of free cash flow. Here’s my valuation for Tesla:

TQI Valuation Model (Author) TQI Valuation Model (Author)

According to my analysis, Tesla’s intrinsic value is ~$214 per share, i.e., it is still overvalued by ~12%. Over the next decade, Tesla’s stock price could increase at a CAGR rate of 17.54%, which fails to beat my investment hurdle rate of 20% for high-growth stocks. Hence, I wouldn’t buy more Tesla at its current levels. That said, we own a 2% position in Tesla within TQI’s Moonshot Growth portfolio at my marketplace service, and we are patiently waiting for a decline to the low-200s to add more and mid-100s to take our position to 4%.

Why wait for those levels? The answer lies in the technical chart.

An Ominous Technical Setup

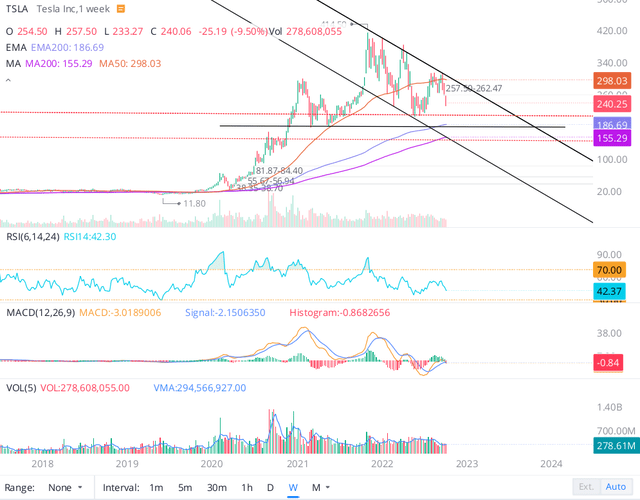

As of writing, Tesla is trading at ~$240 and trying to form a base at this level after a rapid decline; however, the stock remains stuck in a falling wedge pattern. From a technical perspective, Tesla is looking nailed on to retest its 2022 lows of ~$209 (a level last seen in May), which is very close to my fair value estimate for the company.

If Tesla fails to hold onto the psychological support level of $200, we could see a swift ride down to the $175 to $150 range. In the past, I have discussed the idea of a reverse gamma squeeze in Tesla, and such a move could come to fruition in the event of a deep economic recession hurting consumer demand for Tesla’s products amid rising competition in the EV market (yes, competition is coming in the form of traditional automakers and other EV startups).

On the flip side, if Tesla can break out of the falling wedge pattern, we could see a run up to new all-time highs ($400+) in 2023. While it is hard to see such a move in the foreseeable future due to the rising probability of a recession, the market is unpredictable, and Tesla is one of the strongest earnings growth stories in the market.

If I were to make a directional bet, it would be to the downside, and here’s my reasoning for this somewhat bearish stance on Tesla.

Growth Slowdown Could Drive Trading Multiples Lower

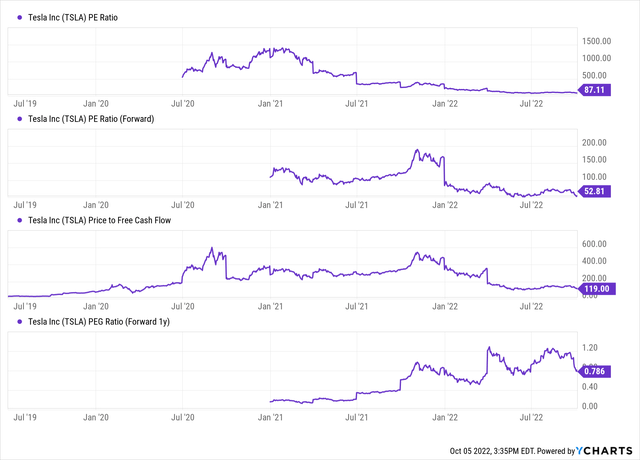

After an 18+ month stagnation in the stock, I no longer view Tesla as ridiculously overvalued as I have in the past. However, Tesla’s trading multiples (Price-to-Earnings ratio: 87x, Forward Price-to-Earnings ratio: 52x, and Price-to-FCF ratio: 119x) are still quite elevated.

Now, Tesla’s leadership position in the rapidly-growing EV market (combined with the potential of autonomous driving, energy storage, insurance, humanoid bot, and other potential revenue streams) warrants a premium valuation. However, a rapidly changing macroeconomic landscape can take a toll on Tesla’s trading multiples.

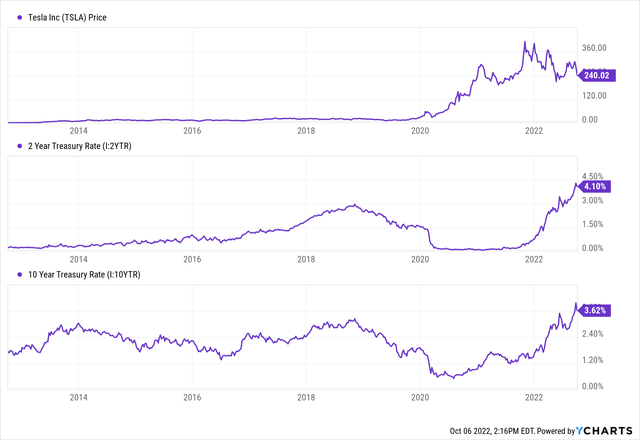

The last ten to fifteen years could be looked at as an era of free money (due to extremely loose monetary policy), and Tesla’s stock went on a wild run after FED implemented a ZIRP environment at the onset of the COVID-19 pandemic. As interest rates go up, asset prices have been moderating across the board. And Tesla is not immune to this valuation reset. As financial conditions tighten further (liquidity evaporates), Tesla’s stock could reset lower (like so many other growth names already have). This is why I maintain a cautious outlook for Tesla’s stock in the near to medium term.

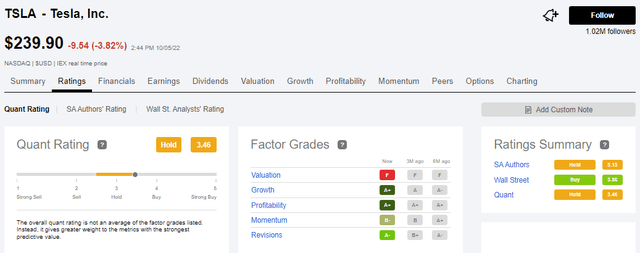

My fellow SA authors and Seeking Alpha’s Quant Rating system seem to be in agreement with my analysis, as Tesla is rated a consensus “Hold.” While Wall Street analysts have a “Buy” rating on Tesla, I think this rating will follow the price lower in due time.

Final Thoughts

Tesla’s stock is rapidly approaching its fair value, and given current market conditions, it may very well overshoot to the downside. Patience is key to building wealth in the stock market, and Tesla’s technical and quantitative factor grade data is more than compelling evidence to deter investors from deploying fresh capital in this counter at current levels. For those looking to invest in Tesla for the long term, the low-200s seem like a reasonable (and very feasible) entry point.

Key Takeaway: I rate Tesla ‘Hold’ at $240 per share.

As always, thank you for reading, and happy investing. Please feel free to share any questions, concerns, or thoughts in the comments section below.

Be the first to comment