EUR/USD, DAX, FTSE Talking Points:

- EUR/USD reacts to probable sanctions and a more hawkish Fed

- FTSE 100 breaks above huge resistance. Can bullish momentum prevail?

- DAX40 takes strain but bulls aren’t ready to surrender just yet.

DAX 40 reacts to potential sanctions and hawkish Fed

The global equity market has experienced an impressive rally since the beginning of the Covid-19 pandemic as low interest rates and an influx of fiscal stimulus supported the demand for riskier assets.

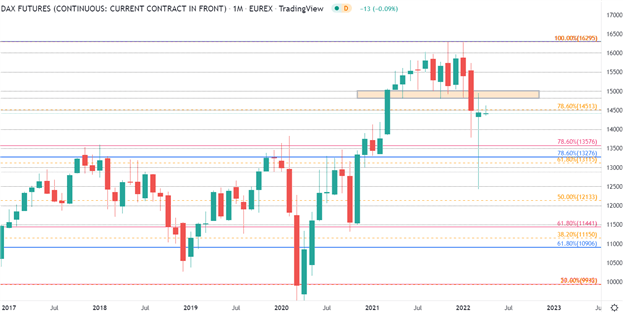

After reaching a fresh all-time high in November last year (at 16,295), rising inflation and increased probability of more aggressive quantitative tightening prohibited DAX 40 bulls from driving prices to yet another all-time high in January, allowing bears to gain temporarily control over price action.

With the invasion of Ukraine exacerbating these concerns, the German Index briefly entered into bear territory (declining by 20% since its peak) before rebounding swiftly.

Since then, failure to rise above the key psychological level of 15,000 (prior support turned resistance) has placed additional pressure on European equity indices which are currently perceived to be more vulnerable to developments in the conflict and to shifts in investor’s appetite for risk.

DAX Daily Chart

Chart prepared by Tammy Da Costa using TradingView

From a technical standpoint, support and resistance levels are visible on the monthly chart which provides a clearer perspective of the longer-term trend. After a steep rally from the 2020 low, DAX prices rose to a record high (16,295) before finding support above 15,000. After breaking through this level in February, bearish momentum gained traction before sliding to a historic zone of both support a resistance at 12,425.

With a long wicked doji developing on the monthly chart, the uptrend currently remains intact with the 14,000 – 15,000 range holding firm.

DAX 40 Monthly Chart

Chart prepared by Tammy Da Costa using TradingView

FTSE bulls rise above 7,600

As discussed in yesterday’s article, the UK FSE 100 has finally reclaimed the critical 7,600 mark and continues to rise back towards the February 22 high at 7,630. On the four-hour chart below, lackluster momentum resulted in the formation of several doji’s before buyers were able to hold firm above 7,500.

As 7,630 and 7,688 remain in sight, a break above both these levels could see a potential retest of the July 2018 high at 7,782.

UK 100 (FTSE) 4Hr Chart

Chart prepared by Tammy Da Costa using TradingView

EUR/USD faces intensifying pressure

As proposed sanctions and a more hawkish Fed continue to weigh on the Euro, EUR/USD continues to slide towards the March low, holding as support at 1.085.

With Fed officials suggesting that they could start reducing the balance sheet as early as May, proposed sanctions and an optimistic ISM report have placed further pressure on EUR/USD which remains well-below the 50-day MA (moving average).

As long as the 1.100 mark holds as resistance, the 1.085 remains key with a break below bringing the April 2020 low into play at 1.0756.

EUR/USD Daily Chart

Chart prepared by Tammy Da Costa using TradingView

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

Be the first to comment