400tmax

Investment Thesis

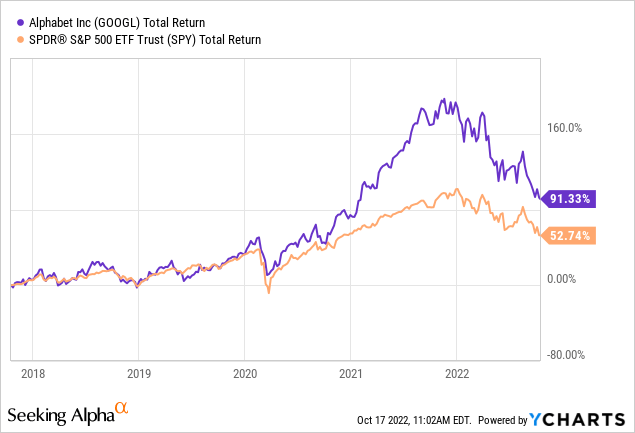

Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL), the parent company of Google, has been a stellar investment over the past five years. Shares have returned 91%, and they have been a part of the big tech FAANG names that have driven the S&P 500 to recent highs.

The company divides itself up into two core Google-related segments: Google Services and Google Cloud, with a further segment for Other Bets.

The products and platforms at the heart of Google Services include ads, Android, Chrome, hardware, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube. These are all services that we come into contact with every day; I’m currently using Google Chrome and Google Search to do a lot of the research for this article. The hardware products also offered by Google include the Pixel smartphones, Fitbit, Chromecast, and the Google Nest Cams and Doorbell.

Google Cloud is the company’s cloud platform and a challenger to the likes of Amazon’s (AMZN) AWS and Microsoft’s (MSFT) Azure. It also offers Google Workspace, which generates revenues from cloud-based collaboration tools for enterprises such as Gmail, Docs, Drive, Calendar, and Meet.

The final offering from Alphabet is the Other Bets section, which is essentially venture capital. It invests in emerging businesses at various stages of development with a goal for them to become thriving, successful companies in the medium to long term. The most well-known of these Other Bets is probably Waymo, an autonomous driving start-up.

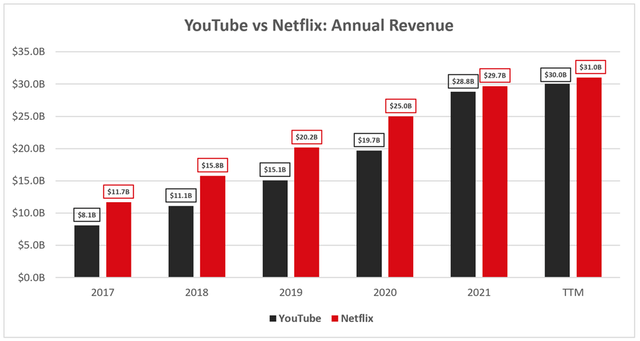

For Google investors, there are a multitude of reasons to invest in the company: Google Search has a global market share of 85%, YouTube has grown rapidly and may soon bring in more money than Netflix (NFLX), and Google Cloud could become a cash-printing behemoth if AWS is anything to go by.

Alphabet / Netflix / Excel

Combine all this with a net cash position of $141 billion, and the Other Bets segment that continues to search for opportunities with substantial upsides, and Alphabet feels like one of the best-looking investments for the upcoming decade.

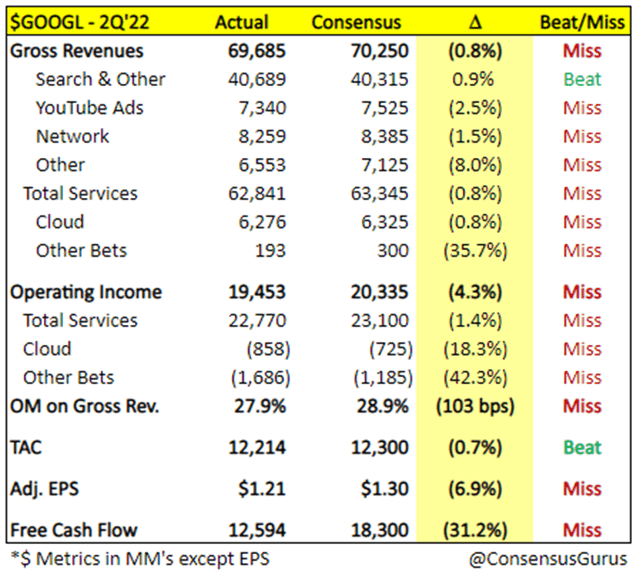

Yet the company’s Q2’22 results were fairly disappointing, missing analysts’ estimates on the top and bottom line for the second quarter in a row. Whilst Search revenue managed to come in ahead of expectations, everything else performed relatively poorly – especially YouTube.

Consensus Gurus

This goes some way to explaining why shares of this pretty incredible business are down by ~30% in the last year. Investors are now looking ahead to Q3 results for some positives, hoping to see some signs of light at the end of a tough tunnel; but are they hoping for too much? Let’s take a look.

Latest Expectations

Alphabet is set to report its Q3’22 earnings on Tuesday, October 25, and there are several key items that investors should keep their eyes on.

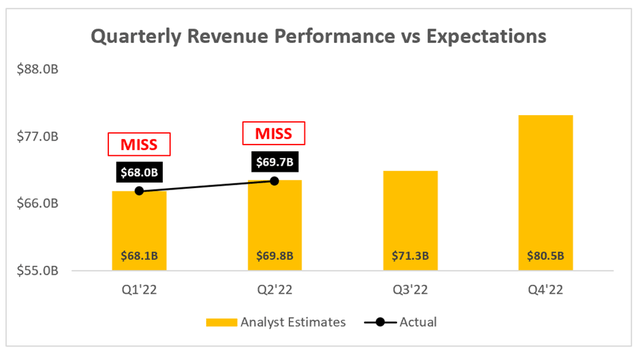

Starting with headline numbers, and analysts are expecting Q3’22 revenue of $71.34B, representing YoY growth of 9.6%.

Alphabet has seen single digit YoY revenue growth in only one quarter over the past six years- Q2’20, when advertising took a massive hit due to the impact of the pandemic. This highlights just how substantial a slowdown analysts are expecting, and given Google’s sub-par performance so far this year, I don’t blame them.

Investing.com / Alphabet / Excel

As we can see, Google missed analysts’ revenue estimates in both Q1 and Q2 this year. On the plus side, both misses were small, and not terrible when you consider the number of headwinds faced by Google in 2022, from a soaring dollar to difficult YoY comps.

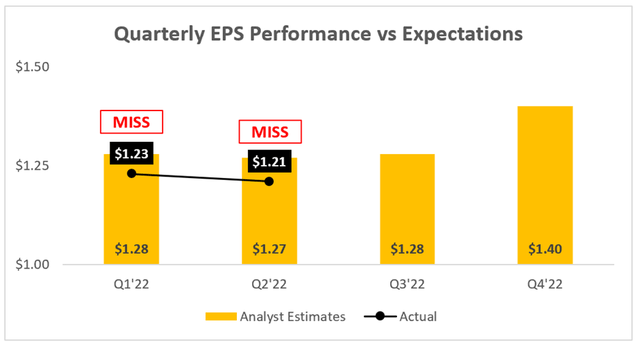

Moving onto the bottom line, and analysts are expecting Alphabet to achieve an EPS of $1.28 in Q3, which would be an improvement from both Q1 and Q2 this year – again, both previously missed analyst expectations, but it’s not as bad as it looks in my view.

Investing.com / Alphabet / Excel

Alphabet likes to make equity investments in several businesses, which is no surprise given its entire Other Bets segment revolves around investing and incubating smaller companies. The problem is that (unrealised) profits and losses on equity investments impact the net income; and, as we have seen, high growth, disruptive technology companies have seen their shares battered in 2022.

To put this into perspective, Alphabet’s ‘Other income’ was a positive $2.624B in Q2’21 compared to negative -$439M in the latest quarter, and this has driven Google’s EPS downward. In short, it’s not related to the business operations themselves, and that is a positive.

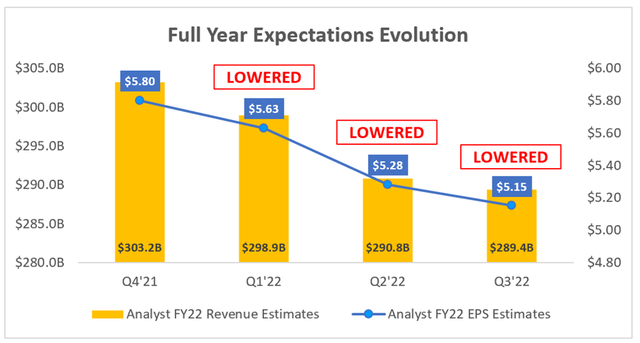

A quick look at the evolution of analysts’ full year estimates for 2022 paints a picture that resembles Alphabet’s share price – the numbers are falling.

Seeking Alpha / Excel

The latest expectations according to Seeking Alpha are $289.4B for Google’s FY22 revenues, representing YoY growth of 12.3%. Whilst this is a clear slowdown from Google’s FY21 revenue growth rate of 41.2%, investors should not lose sight of the bigger picture. We are moving from a booming, stimulated economy in 2021 to an inflation-ridden economy with a looming recession and low consumer sentiment in 2022. Given that Alphabet makes the majority of its income from advertising, it was always going to struggle to maintain a high growth rate going into this current year.

In fact, perhaps it’s worth diving into everything that is putting Alphabet under pressure, as this behemoth of a business tries to navigate the choppy waters of 2022.

A Business Facing Multiple Headwinds

Since Alphabet has such a huge reach, investors cannot ignore the macroeconomic environment within which it operates; a macroeconomic environment that has rapidly deteriorated over the first half of 2022, with little short-term signs of improvement.

This goes some way to explaining why Google’s advertising business has seen a substantial slowdown. Advertisements are the easiest thing for a business to cut when it’s trying to reduce costs during economic downturns, and so Google is certainly going to be hurt by a recession. YouTube in particular has suffered, growing only 4.8% YoY in Q2, but it did come up against an extremely strong Q2’21 in which YouTube Ads saw revenue grow by a staggering 83.7% YoY.

By comparison, the advertising growth of ‘Google Search and Other’ saw YoY growth in Q2’22 of 13.5%, which is fairly respectable given all the difficulties surrounding both Google and the economy. CFO Ruth Porat had the following to say about these growth rates on Alphabet’s Q2’22 earnings call:

Starting with our Google Services segment. Total Google Services revenues were $62.8 billion, up 10%. Google Search and other advertising revenues of $40.7 billion in the quarter were up 14%, driven by both, travel and retail. YouTube advertising revenues of $7.3 billion were up 5%. The modest year-on-year growth rate primarily reflects lapping the uniquely strong performance in the second quarter of 2021. Network advertising revenues of $8.3 billion were up 9%, driven by AdSense. The quarter-on-quarter deceleration in both YouTube and network advertising revenues primarily reflects pullbacks in spend by some advertisers.

As mentioned, it is unsurprising to see the pullback in spend by advertisers given the economic backdrop. Let’s also not forget that Google is a global business, and a strong US Dollar is going to be yet another headwind for the company, as Porat highlighted:

In terms of foreign exchange, our second quarter results reflect the U.S. dollar strengthened versus last year from a significant tailwind last year to a 3.7 percentage-point headwind in 2Q. Looking to the third quarter, based on strengthening of the U.S. dollar quarter-to-date, we expect an even larger headwind from foreign exchange.

Clearly there are a lot of reasons to be pessimistic about Alphabet’s upcoming earnings report, but the question is this – how much of that pessimism is already reflected in the current share price? And could the current valuation appear to be an attractive opportunity for long-term investors willing to ride out this storm?

Valuation: Is The Negativity All Priced In?

As with all growing, innovative companies, valuation is tough. I believe that my approach will give me an idea about whether Alphabet is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

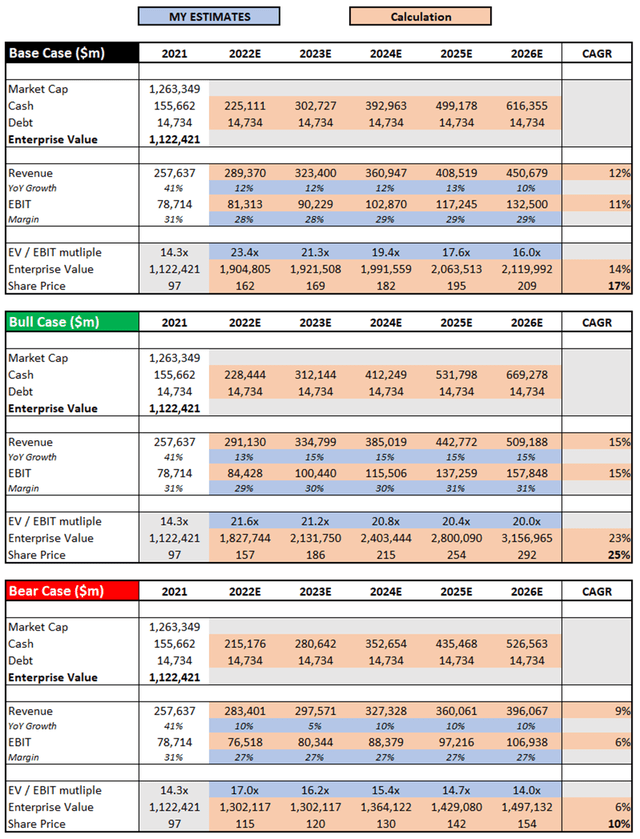

Alphabet / Seeking Alpha / Excel

Alphabet is a particularly difficult business to value, purely because of the number of different revenue and profit drivers within its ecosystem. As such, I have used analysts’ estimates to guide my base case scenario, combined with my understanding of the business.

In terms of the bull case scenario, I assume that Alphabet will obtain a very achievable revenue CAGR of 15% through to 2026. I feel that there is potential for revenue to achieve an even greater CAGR if one of the Other Bets pays off, or if Google Cloud continues its impressive momentum for the foreseeable future, or if the advertising revenue recovers quicker than expected. I have assumed that the increased revenue enables Alphabet to improve margins slightly with scale, and I’ve used an appropriate EV/EBIT multiple given the opportunities for revenue growth and margin expansion from 2026 onwards.

My bear case scenario effectively assumes the opposite; mainly that Alphabet’s main advertising business gets really bogged down over the next year or so due to the recessionary pressures. There are also potential regulatory challenges faced by Alphabet due to its dominance in Search, and whilst the company has always mitigated these risks, they remain nonetheless.

Put all that together, and I can see Alphabet shares achieving a CAGR through to 2026 of 10%, 17%, and 25% in my respective bear, base, and bull case scenario.

Bottom Line

Given that I still see Alphabet’s shares achieving a 10% CAGR through to 2026 in my bear case scenario, you’ll understand why I conclude that a lot of negativity is baked into the current share price. There are still a whole host of headwinds facing this company, but I do not believe many of them to be thesis-busting.

Alphabet handled the difficult economic environment well in Q2, and whilst I expect Q3 to look like a poor result on paper, I think that the market is already expecting poor results.

Conversely, any small signs of hope could result in rewards for shareholders, and I’ll be especially keen to see if there’s any signs of revenue recovery in Q3 for advertising. I’ll also be looking at Google Cloud to see if its growth rates remain in excess of 30%, whilst also seeing how its growth compares to Amazon’s AWS.

All things considered, I am more than happy to reiterate my previous ‘Buy’ rating on Alphabet shares; it is a high quality business going through a difficult, macro-induced period, but the current share price is too attractive for me to ignore.

Be the first to comment