MarkGillow/E+ via Getty Images

Rocky Mountain Chocolate Factory (NASDAQ:RMCF) is a franchisor of chocolate stores and ice-cream stores in the US.

For a more detailed understanding of the company’s business and structure, please refer to my initial coverage of the company in January, and the follow-up article in June for FY22.

My hold rating for RMCF has not changed. I believe the company is entrenched in proxy fights among shareholders, and is not solving its most pressing issues. Operations and profitability continue deteriorating.

With most of the company’s historic management already retired, the new management has a clean slate. However, the situation is uncertain, therefore not justifying the company’s current valuation.

Note: Unless otherwise stated, all information has been obtained from RMCF’s filings with the SEC.

Previous situation

In previous articles on the company, I commented that RMCF had an interesting business that needed some improvements. Particularly worrying were the consistent fall in franchised stores, a relatively old-looking store design, and lack of alternative sources of growth (like white-label, direct to customer, etc.).

That is, the secular trend of the business was one of decrease. In order to bring growth, the company needed a new strategy. Without that strategy, the company’s shares are not attractively priced.

Unfortunately, the company seemed more concentrated on proxy fights among shareholders. These fights not only cost millions to RMCF directly, but also indirectly. Management and the Board have to dedicate time and effort to the proxy issues; potential franchisees might feel deterred from doing business because of the heightened uncertainty, etc.

Proxy fights are not over and are more costly

In my latest article, I suggested waiting for the August 2022 shareholder meeting before investing in RMCF. In my opinion, the meeting was an opportunity to find a resolution to the shareholder conflict sagging RMCF. The possible positive outcomes were if either one of the two sides (the Board or the activist group) gained a sufficient hold on the company or they reached an agreement.

Unfortunately, none of them materialized. Not only did RMCF spend millions in a proxy contest that did not solve any contested issue, but the company is now facing a new contest next year.

Specifically, by July 2022, the activist group (AB Value Management and Bradley Radoff), had proposed two opposition candidates to the Board, plus four candidates from the Board. The activist group contested two of the Board’s candidates, one of them being RMCF’s current Chairman.

From the start, therefore, the proxy contest was kind of unnecessary. If the activist group proposed only two candidates, why not solve it outside of a contest?

During the following month, and heading towards the meeting, scheduled for the end of August, more than 26 proxy materials were filed with the SEC. Not being a shareholder, I had the benefit of ignoring them until I reviewed them for this article, but how much investor time has been wasted with this? Attention requirements are definitely a cost the investor should consider.

On August 13th, a few weeks before the meeting, a ray of hope appeared. An agreement was announced, where the company would expand its board to 7 directors, including one of the activist’s candidates.

Sadly, only three days later the agreement was already breached. The activist group announced that its candidate was not willing to serve on the board and that therefore it had been left out of candidates.

The proxy contest therefore did not even include two options, only the Board’s proposal was considered. A complete waste of money. In September, the activist group confirmed the cancellation of the cooperation agreement with the Board.

The company replied by initiating litigation against the activists, claiming compensation for all the proxy related expenses, and claiming that the activists had misrepresented information.

Finally, and closing the circle, one of the activists announced its intention to make a complete Board proposal next year, therefore guaranteeing a new expensive proxy contest.

At least $2 million were spent on the contest, without considering all the bad press generated, managerial time wasted and loss of reputational business. Most importantly, the conflict is not solved, meaning next year will be the same.

A new management group

Coincidental with the proxy contests, most of RMCF’s historical management group started retiring. In the last year the company’s former Chairman, CEO, CFO and Sales VP all resigned. Most of them had been serving the company for 20+ years. Although the reasons behind their resignation might include the proxy contests, it is also true that these managers had already reached retirement age.

Therefore, a new managerial group was chosen, including CEO, CFO and Sales VP. The group is said to have been chosen by the company’s new CEO, a shareholder with 9% of the company’s stock, at the center of the fight with the activist groups.

It is still too soon to judge the new management group, as they have only recently assumed their new positions. It will be interesting to follow their strategic decisions, particularly in terms of initiatives to complement or improve the decaying franchise business.

In fact, the company announced in the second quarter that it would have a growth plan prepared by the end of this year.

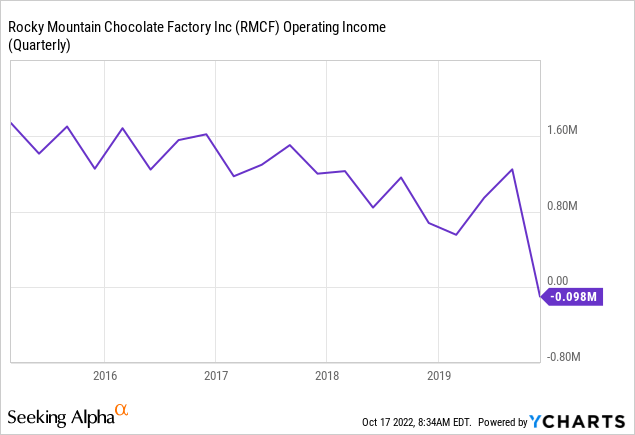

The business keeps deteriorating

RMCF had problems before the proxy contests. These problems were long-term deficiencies of the business model like lack of store redesign, fall in franchisee numbers and lack of alternative growth avenues.

Not only has the company not addressed these issues efficiently yet, but the macroeconomic situation has deteriorated. This has caused RMCF’s profits to decline, in the same way as many other US businesses.

In particular, the 10-Q report for 2Q22 shows declining revenue, at a rate of 2% YoY, which implies a real fall of 10% considering inflation. Cost inflation on the other hand, has not been terrible. Most costs have been kept at the same level, which again means they fell in real terms.

Unfortunately, the non-recurring proxy costs, added to severance payments to its retiring managers, added a significant burden to SG&A costs. This category, which represented $2.7 million in costs in 1H21, jumped to $5.7 million in 1H22. All of the increase was generated by the contests ($2.1 million) and severance ($900 thousand). If those extraordinary costs were not included, RMCF would have generated a pre-tax profit of $700 thousand for the first half of the year.

However, not all deterioration was generated by non-recurring costs. Even after accounting for extraordinary expenses, the second quarter of 2022 would not have generated any profits. That means the business is losing margins because of real operational issues.

Of course, the second half of the year should show higher revenues, given that it includes fall and winter, the holidays, and Saint Valentine’s. However, a review from previous years does not reveal a tremendous seasonality effect.

Conclusions

RMCF’s business keeps deteriorating, now at a faster pace given the macroeconomic headwinds. Management’s time and efforts were diverted towards a completely useless and expensive proxy contest.

The new managerial team task is not to deal with shareholder battles, but rather to find solutions to long-term problems: store design, franchisee count, and alternative growth models.

Even adding back proxy expenses, RMCF does not justify its current market cap. But with already two years of proxy contests, and a new one already announced for next year, it seems optimistic to eliminate those expenses yet.

With the situation as is, RMCF is definitely not a stock that interests me right now. It may become one in the future if management shows strategic initiative towards solving the real business problems sagging the company’s profits.

Be the first to comment