sefa ozel

With the Federal Reserve Bank struggling to control rampant inflation by hiking rates, a recession is becoming more and more likely, and already, we’re seeing signs that perhaps the US is already in a recession.

For investors, now is the time to be considering how to best set up your portfolio in readiness for a recession and look for firms well insulated to a downturn.

To do so, we’ll utilize the benefit of hindsight and consider advice from the 2008 Great Recession, assessing the Top 100 US Firms and score firms based on their recession preparedness.

Ranking Recession Readiness is a series of articles I’m authoring based on academic research along with advice from business leaders who took their firms through the Great Recession of 2008, to help investors identify which top 100 US firms are positioned to strive through a downturn, and which firms will stumble.

Today’s article takes a look at NVIDIA (NASDAQ:NVDA), a tech manufacturing powerhouse that has enjoyed a very solid run in the past few years and become an investment darling. So let’s break down NVDA into pieces, examining how well put together the firm is and how prepared the firm’s balance sheet is heading into a recession.

A full breakdown of the methodology and explanation behind the calculations is available in my introductory article, Ranking Recession Readiness: Is Google Prepared For The Recession?

(Data & prices correct as of pre-market 13th July, 2022)

(The Top 100 US Firms referred to can be found on this Seeking Alpha screener)

Want to skip the articles and dive right into the data? You can download my data and calculations here and see how the Top 100 US Firms compare on Recession Preparedness

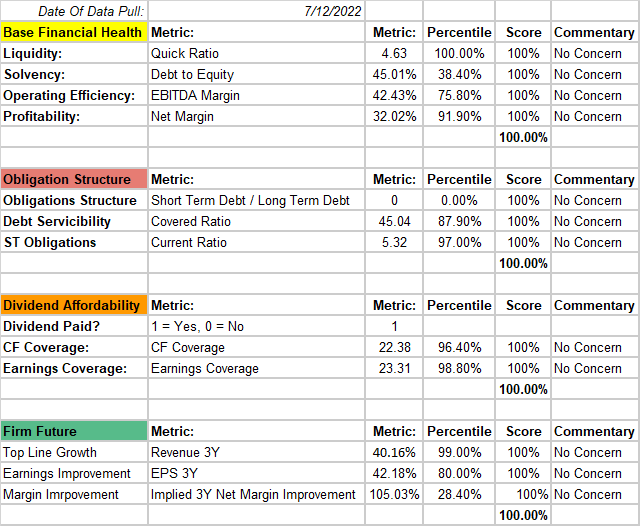

NVIDIA Corporation’s Base Financial Health

We’ll start by looking at NVDA’s overall financial health as it stands in the current operating environment relative to the Top 100 US Firms, in order to get a sense of how healthy the firm is going into a recession.

Author

NVDA’s base financial health has all round perfect scores, with the best quick-ratio in the entire peer group, a very modest level of debt on the balance sheet, along with strong operating and net profits.

Its obligation structure is also market-leading, with perfect scores across debt serviceability and current liabilities coverage, with no short term debts to worry about.

Dividends paid by NVDA are extremely well covered by cash flows and profit, implying room to grow dividends to increase shareholder value if the firm chose to.

Lastly, the firm’s financial future outlook is exceptional, with some of the highest top line and bottom line improvements in the market.

Author

So NVDA gets perfect marks across its current overall financial health.

So next, we need to assess the balance sheet in its preparedness to weather the storm of a recession.

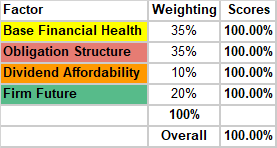

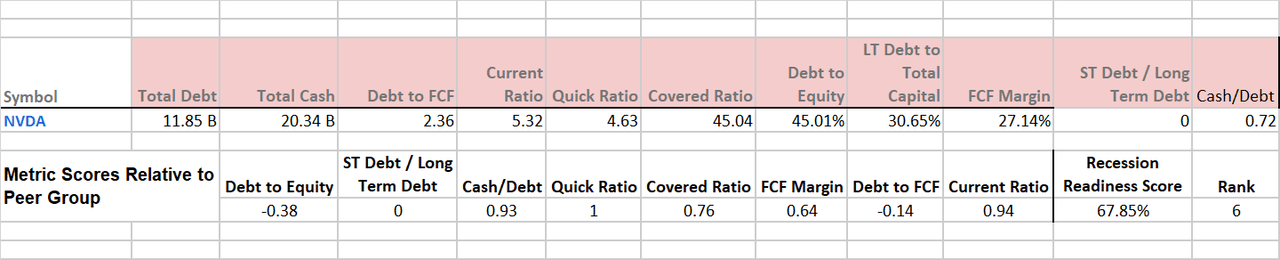

Assessing NVIDIA Corporation’s Recession Preparedness

Reviewing the advice from 2008 Great Recession business leaders, the first two major themes of advice were to minimize debt before a recession strikes, and build a cash stockpile.

Looking at NVDA’s balance sheet metrics, we see a strong cash to debt ratio, solid free cashflow to debt, and very modest debt to equity and debt to capital ratios.

So next, we score these metrics relative to the Top 100 US Firms peer group, and apply weights to these scores.

Author

Overall, NVDA earns a very attractive 67.85% recession readiness score, making it the 6th best prepared firm to face a recession out of the top 100 firms.

The only improvements to be made here would be a minimization of debt in order to further improve the firm’s balance sheet, but overall these are very strong numbers relative to the peer group.

But a quantitative analysis is not the whole narrative for NVDA, so let’s look at a more qualitative analysis of the firm in order to get a more comprehensive view.

A Deeper Dive Into NVIDIA Corporation’s Recession Readiness

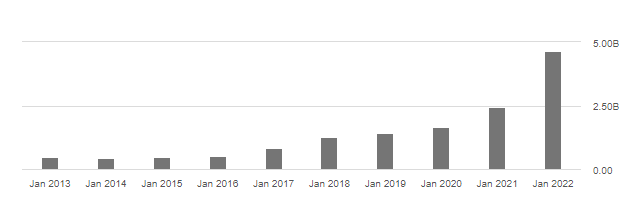

Reviewing the major advice themes from business leaders of the 2008 Great Recession, the next point to address was minimising a firm’s exposure to customer financials by minimising total receivables.

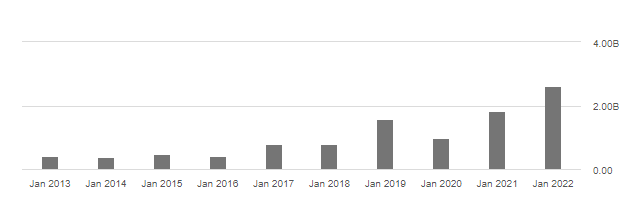

NVDA is a profitable, growing firm, and as such we have no surprise when seeing total receivables growing over time.

Total receivables $5.438B, 20.46% of total current assets, 12.02% of total assets (Seeking Alpha)

While receivables at 12% of total assets is not the largest ratio I’ve come across in this Ranking Recession Readiness series, it is still reasonably significant as this could be an area of equity drain for the firm in the event of a recession, should the firm’s customers be unable to service their creditors.

This does not cause me any great concerns at this level though, but it is certainly something investors would need to be aware of.

The next theme of advice from 2008 suggested firms should reduce levels of inventory due to the costs of warehousing and holding unsold inventory during a period where sales are slower.

Inventory $3.163B, 10.69% of total current assets, 6.99% of total assets (Seeking Alpha)

NVDA’s inventory levels are quite reasonable, so there should not be too much concern here for investors.

The following advice theme from the Great Recession was around being mercenary with cutting costs and reducing overheads, but avoiding layoffs where possible. The logic here was that the firm will need skilled and experienced staff coming out of a recession in order for it to recover and return to normal operations. Layoffs would mean that post-recession a firm will need to engage in expensive and time consuming recruitment and training, making recovery more expensive and slower.

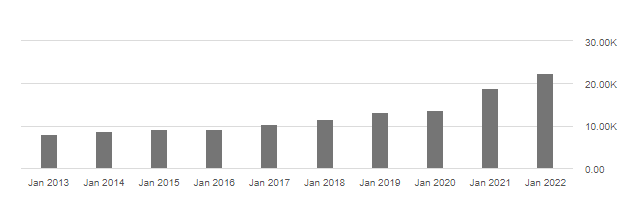

It’s difficult to predict exactly how the firm’s management team might react exactly to a recession and if they would consider layoffs, but we can look at its employee count relative to revenue and profitability to get a gauge of whether layoffs might be on the cards in order to maintain healthy financial success.

Total employees 22,473, $1,314,510 revenue per employee, $420,860 profit per employee (Seeking Alpha)

NVDA is extremely efficient with its staffing relative to its revenue and profit, with an exceptional $1.3m in revenue per employee, and $420k in profit per head, it’s unlikely that the firm would need to consider significant layoffs in order to maintain profitability.

The final theme of advice for firms from the Great Recession was to consider CAPEX investment while the opportunity cost of capital is lower during a recession.

We can’t predict ahead of time if a firm will or won’t invest during a downturn, but given how NVDA is well resourced and prepared to ride out a significant recession, there appears to be no reason for the firm not to consider investing in CAPEX to improve efficiency or output.

Closing Remarks

I have not created any kind of pricing mechanism for firms based on their recession readiness score, however I can provide a buy, hold or sell recommendation for a firm on how it might appeal to investors as a safe investment ahead of a recessionary environment.

NVIDIA earns a Strong Buy recommendation for its preparedness heading into a recession, on both quantitative measures and qualitative narrative. The areas of risk for the firm include a large accounts receivables balance, which exposes the firm to its customer’s financials, along with its level of debt (while the debt is well covered and serviced, it stills presents a non-zero risk).

If you have any questions or would like to see any particular Top 100 US Firms assessed for their recession readiness, please leave a comment and let me know (I always do my best to monitor and respond to genuine comments!).

Be the first to comment