Author’s Note: This article was published on iREIT on Alpha back on the 8th of June of 2022 – the thesis has not changed.

Philiphotographer

Dear readers,

So, let me start again by making things clear that I’m talking about Fresenius (OTCPK:FSNUF) (OTCPK:FSNUY) here – not Fresenius Medical Care (FMS). This distinction is important to me because I view the non-volatile parent company far more appealing than the more volatile company that’s natively listed on the US stock market, for reasons that will become apparent fairly quickly once we look at the recent results here.

Fresenius has had a pretty terrible YTD so far – despite strategic reinvestments and sticking to low valuations, I’m down slightly more than 16% here, with plenty of investors asking whether I’m still buying the company or what I’m doing with my stake here.

Let me show you what I think.

Fresenius – an update

In some of my basic articles, I go through very clearly just what Fresenius is, and why you should consider the company fundamentally appealing. I also go through exactly what makes the FMS symbol different from the FSNUY symbol, and how these should be considered as investments.

These are things that need to be understood if you’re interested in investing in the business – because investing in FSNUY is very different from investing in FMS.

Fresenius, if looking at the basic company, has a number of different branches – and if you’re just looking at the FMS symbol, meaning the Medical Care company, has one appealing branch that’s US-specific.

If we focus on the Medical Care branch (The FMS symbol), the company is a fully-integrated dialysis service provider with lifetime patient relationship expectations. The company has been significantly expanding its offerings by including home dialysis services, and its market position makes it possible for FMS to essentially set industry standards in cooperation with local authorities and the US government, its biggest market by far. This is also the reason why things haven’t been going all that well. Because of the labor issues, wage inflation, mortality, market pressures, and other factors, the FMS ticker, or the medical care branch, if looking at FSNUY, is under a tremendous crunch which is still impacting the share price not only of FMS but of FSNUY as well.

Fresenius (FSNUY), meanwhile, has several appealing businesses that have nothing to do at all with FMS.

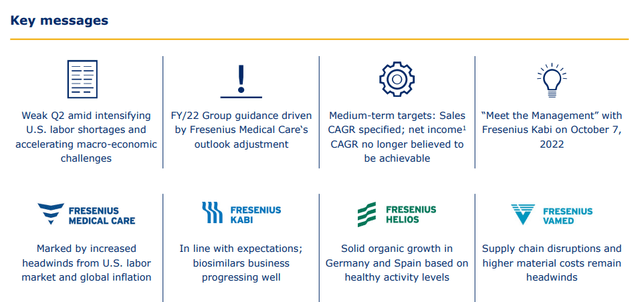

Now, granted – 2Q22 was weaker for FSNUY as well. But much of that was the impact from weak US labor shortages and accelerating macro challenges. These are things that no company can control, and the impact of increased medical care headwinds and global inflation can only be slightly met by the company’s actions.

The 2022 company outlook is in part driven by the medical care segment and its negative outlook. This is the entire reason the company is currently down. Understand this:

- Fresenius is down mostly because of the Medical Care Wing.

- Fresenius has other segments, namely Kabi, Helios, and Vamed, that are all working well, reporting either in-line results, solid organic growth with healthy activity, or the like. But these are currently not enough to drive the company upward in the face of the Medical Care headwinds.

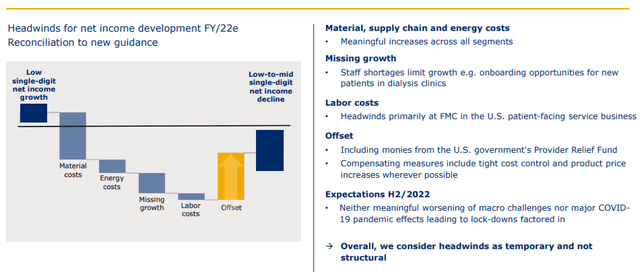

So, because of that, the previously expected 2022E earnings growth is now turned into a low-to-mid-single digit net income decline. This is due to a mix of material, energy costs, missing growth, labor costs, and not offset by many of the company’s positives.

Meanwhile, on a segment-specific basis and ex-Medical Care, results were impressive.

Kabi managed a solid 2Q22 with a 2% sales growth, defending its market share. The biosimilar business is working well, the company’s Ivenix M&A is now closed, and the company is about to deliver on mAbxience.

Helios delivered excellent admissions in exceedingly COVID-19-free Europe, especially Germany, where people are returning to hospitals for elective treatment. Spain was never really down and continues to climb. The segment reported growth of 5% in sales, as well as a 1% pre-tax earnings growth, ahead of schedule given the difficulties the company is currently facing.

And then we have Vamed, which saw sales increase but a drop in EBIT due to macro challenges. This drop clouds the backlog a bit because Vamed actually has an all-time-high order backlog.

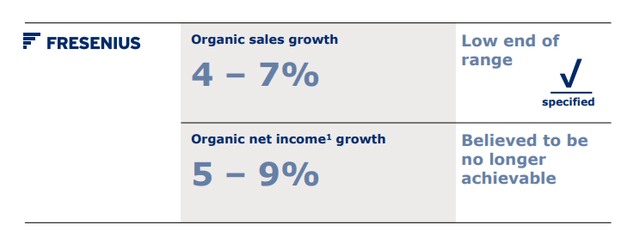

The outlook for the non-medical care segment is, therefore, mostly positive for the full year. The new outlook calls for Fresenius sales to increase – low- to mid-single digit or so for the year, but the company is expected to make less money from its sales, translating into a decline in the net income. The company believes its 2020-2023 targets to be no longer achievable for net income growth, but does believe it can manage sales growth increases as per the forecasts.

And of course, as I often say, sales increases without corresponding earnings increases really aren’t worth that much. We want both sales and income growth if this is to matter in the longer term.

So, Medical care and macro are the two culprits responsible for Fresenius declining in the manner which we’re currently seeing – the other segments are mostly performing as expected.

So what is Fresenius doing about it?

Well, Fresenius is limited in what it can do. The company makes it clear that labor shortages, wage inflation, supply chain costs, and deterioration of macro are impacting their organization, in particular, FMS across the board, but as to what it can do, no single company can change the nature of macro. Beyond cost savings and efficiency measures, which are already in place, the best thing Fresenius can do, is ride this wave out.

It’s not as though the company is in any fundamental danger. I mean, the debt increased by around 5% on a constant currency basis, with a net debt/EBITDA of 3.72X – but this ratio is neither worrying nor threatening to the company’s credit rating.

FMS is the world’s largest provider of services and products for patients with renal diseases, and as of 2022 2Q is treating close to 350,000 patients at 4,163 dialysis clinics.

These are non-optional forms of treatment that while impacted, are not going away. However, at the same time, it’s clear that without the upside from FMS growth, the company isn’t going to be able to deliver on its targets. At most, we can hope for flat results and sales growth, with perhaps flat sales in 2023E, and making its other segments more relevant to the mix through increasing M&As and market share increases – all of which is ongoing, but a slow process.

No investor likes to hear a hard truth, such as that this company likely isn’t going to recover or hit its positive targets in the next years – but these are the facts.

I do not see these headwinds disappearing anytime soon. At best, I expect the company to be able to deliver flat YoY results in earnings for 2023, to 2021 year, while sales are likely to increase slightly, meaning overall margins across the board are actually going down.

However, it would be completely wrong to say that the company is staying inactive, or that its measures are not bearing fruit. Too often I see investors saying one version of that they believe the company isn’t addressing these issues. This simply isn’t true.

Now obviously, we are working hard to accelerate the implementation of measures to offset the various headwinds for example, through very tight cost control, phasing of projects and product price increases, albeit limited in scope and magnitude. And with that, we have been able to broadly offset negative effects, particularly at Kabi.

The company also does not believe this is in any way a “new norm”, but that these headwinds will disappear or lessen over time, allowing the company to return to its growth plan.

Because I agree with this assessment, this means that the company, in my view, is only in a temporary slump, but remains fundamentally attractive.

The definition here means that we’re looking at an “undervalued business”.

Let me clarify this.

Fresenius Valuation

If we establish that the company’s headwinds are of a temporary and not of a permanent nature, then the question we need to ask ourselves is the following.

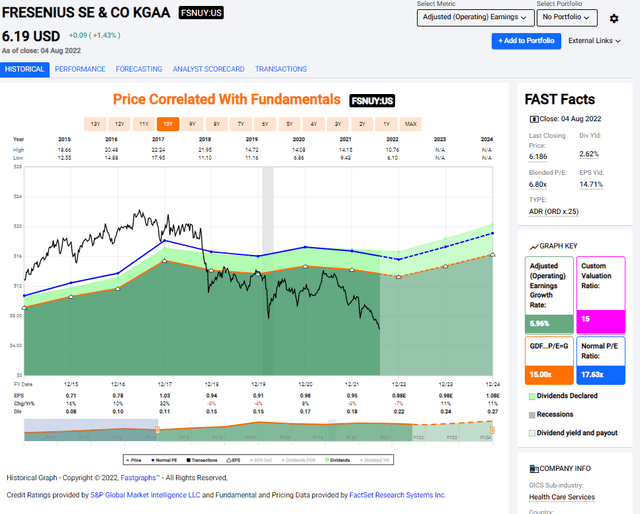

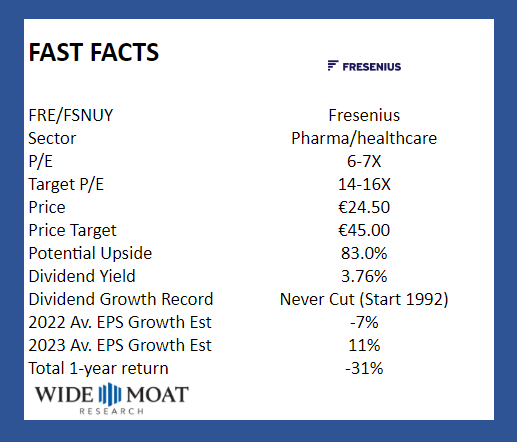

Does a potential transitory 6-7% drop in Net income and adjusted EPS justify a valuation decline from a 15-17.5x P/E down to a 6.8x P/E?

Fresenius valuation (F.A.S.T. Graphs)

Now, obviously, I’m going to say “no”. I don’t think that an investment-graded company with expertise in these many fields can even be considered to be seriously impacted in the long term by something like a 7% EPS decline, even if this negative trend continues longer than is currently expected.

The realistic downside to Fresenius is that the company’s downturn might take longer than expected to correct itself – but this also assumes a very long pathway to recovery, which I’m uncertain will be as long as it’s feared. Even in the case of a recession, small or large, we’re still talking about necessary services in every single one of the company’s segments. That is why despite everything, this company’s earnings, unlike its share price and valuation, can be said to be relatively stable and not that volatile.

The fact is Fresenius is now cheaper than during COVID-19.

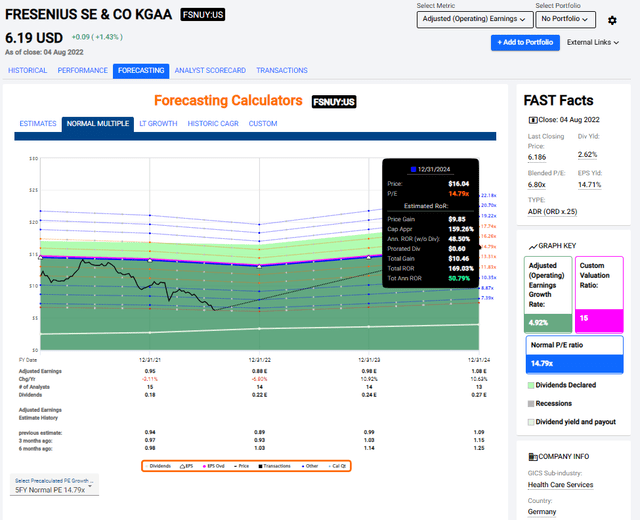

The upside, if we’re even talking about a slight recovery here and a conservative discounted P/E of around 14-15x to the usual 17-18x, is more than an annualized rate of return of 50%.

Fresenius upside (F.A.S.T. Graphs)

Or, as you can see a full reversal potential of 170% or close thereto in less than 3 years. It might be hard to remember that the company actually used to trade at a native share price of over €60/share, and now trades at around a third of that – but in the case of normalization, the potential for earnings growth here is nothing short of massive.

Few people like listening to a contrarian or value investor when they’re in the red. Me, that’s where I’m comfortable. I like investing in quality companies where I have a very high conviction that what I am buying is essentially “cheap quality” because the market is being irrational.

I have a high conviction this is the case with Fresenius.

One of the company’s business segments is heavily impacted by trends that the company has very little or no control over. That is the issue with Fresenius (beyond some of the fundamental risks I mention in my initial article).

Fresenius is always a question of what you want to be investing in. Do you want the Medical Care wing, which is only for Dialysis and associated businesses?

Or do you want the full investment, which includes the above-mentioned Kabi, Helios, and Vamed as well as the FMS business? For me, this has always been an easy one to answer – and I go for native ticker FRE, with the ADR’s FSNUF and FSNUY.

DCF valuation for FSNUY takes into consideration a long-term sales growth of no more than 1.5-2% per year, which I’ve cut to 0.5-1.5% as of this article, as well as expense increases at the same level. For NAV, I apply market-accurate 10-16X EBIT multiples to the various segments. Unlike with FMS, it doesn’t matter through which lens you view FSNUY.

If you look at FSNUY instead of FMS, you’ll see that the valuation, in any case, is better for the former than the latter. P/E upside is over 45%, and on a NAV basis, the upside is close to 100%, even when I value Vamed at a very conservative 9.5X EBIT, and with the FMS wing as low-valued as it currently is.

For the native FSNUY ticker FRE, the upside based on S&P Global analyst averages is more than 70%, based on a current average of €41.5/share, with 8 out of 16 analysts either considering the company a “BUY” or “Outperform”. While we might quibble back and forth on the specific impairments, growth rates, multiples, and other details, I believe the gist of this difference is accurate.

FSNUY is far more conservative than FMS due to the company’s appealing diversification. FSNUY provides you with more growth vectors than does FMS, and you also get to own FMS as part of the deal. That is why my preference is for the bigger parent, rather than the smaller, albeit US-based business.

The basic issue with both tickers remains the same – we’re waiting for normalization, and as things look now, this normalization may be a long way off.

But I believe that FRE offers a better avenue for you as an investor to wait for that normalization, given the substantially better diversification of the company’s top and bottom line.

For those reasons, I rate FRE/FSNUY higher than I do FMS, and why my main investment, around 2.5% currently, is in FRE. I’m aiming to increase this.

I hope this has been a clarifying update for you – but feel free to ask questions and I will do my best to respond to them.

Here are my targets for Fresenius.

Fresenius targets (FRE IR)

Be the first to comment