We Are/DigitalVision via Getty Images

Mark Zuckerberg wants to play poker with you. He is wearing a Pikachu costume and sitting in a Swiss chalet at the top of Machu Picchu. You’re reluctant but he is willing to sweeten the pot.

Warning: the metaverse can trigger such fever dreams. From its inception in the 1992 cyberpunk classic Snow Crash – when a world of digital avatars was first conjured in the mind of one visionary writer – to its ultimate rather deafening crescendo during peak meme 2021 when six (!) thematic ETFs were eventually rolled out to take advantage of investor interest, the metaverse as a concept has been rather pliant. It has been many things to many people. It’s been workshopped and versioned; it’s even been multiplexed (Ready Player One).

Since the Nasdaq topped on November 19, 2021, however, the metaverse as a frothy investment motif has never been the same. Fount Metaverse ETF (MTVR) debuted two weeks prior to the top and is now down 44%. Roundhill Ball Metaverse ETF (METV) is down 49%. A few others that went public later in the spring – Global X’s Metaverse ETF (VR), the Fidelity Metaverse ETF (FMET), ProShares Metaverse ETF (VERS), and the Subversive Metaverse ETF (PUNK) to name a few – are all down an average of 38%.

Of course, the metaverse market is still projected to grow from $61.8 billion in 2022 to $426.9 billion by 2027. Other forecasts suggest it could surpass $1.5 trillion by 2029. These forecasts may look like hype, but so did Henry Blodget’s famous call on ecommerce and Amazon in 1998. Blodget’s call would of course later be vindicated, but not without going through a dotcom bust that left several future titans at fire sale prices (AMZN at 51 cents, anyone?).

In 2021 metaverse-related companies raised $10 billion, so we should soon be seeing the fruits of that proverbial labor. Ten months does not make for a maximum drawdown – at the very least 15 months does in my opinion–but the price carnage that has ensued thus far in 2022 offers an opportunity to re-appraise a now unfavored sector and parse out some of the more salient new developments, especially as these firms seek to aggressively monetize.

It is the time to take a more sober, brass-tacks approach to the metaverse -specifically what is it and which companies are best positioned.

What is the Metaverse?

In the beginning there was AR and VR. Whereas augmented reality (AR) was defined as an “informational overlay” upon a real-world task, virtual reality (VR) suggested an immersive experience, one in which the participant was fully ensconced in a digital construct.

Mainstream AR saw a still-born arrival when Google Glass was announced in 2012. That April Sergey Brin famously wore one to a Foundation Fighting Blindness event in San Francisco, but interest failed to ignite. (Oddly, the reason might reside in a swift social reaction to so-called “Glassholes” in San Francisco’s local bars and coffee shops.) Glass sales were ignominiously halted in early 2015.

VR has an earlier history. Back in the early 90s, innovators like VPL and Sega created impressive headsets and data gloves, but the needed computing power never got affordable. They were too early. The flat magazine-like layouts of Netscape 1.0 were sufficient for information retrieval and the world moved on. The VR promise was later glimpsed in the arrival of the Oculus in 2013, but poor content and headset-triggered nausea plagued mainstream adaption by gamers quite content with their onscreen Xbox fare.

Since 2018, most discussions of virtual reality are typically subsumed by another term: the metaverse. The moniker applies to a rather vast digital landscape now incorporating gaming, social networking, entertainment, shopping, certain aspects of business, and education. Essential to it: 1. the notion of a 3Dworld that is persistent, spatial, and engaging, and 2. the assumption that the user can deploy an “embodied” avatar that will readily interact with others in this world. Avatar creation is full of optionality, identity building, and accessorizing (i.e., Mark’s choice of a Pikachu costume.)

According to the SEC, in the twenty years from 2000 to 2020, the word “metaverse” appeared in regulatory filings 12 times. In 2021, the term appeared 260 times. However, in just the first six months of 2022, the word appeared more than 1,100 times! That’s what we call “peak meme.”

In many high-minded discussions, the metaverse is imagined as becoming a single, universal virtual world that – agnostic to hardware or monthly subscription plans – can be “dropped into” via VR or “accessed” via AR. There is a breathy, almost sacred air to the descriptions. Of course, capitalist investors typically prefer proprietary platforms with clear monetization strategies rather than “single and universal worlds.” And therein lies the rub.

On October 28, 2021, Facebook declared itself Meta Platforms (META). Sporting a blue infinity symbol as a logo, the effort implied an apotheosis of sorts – a determined effort by FB to rise above the rolling PR crises and establish its own platform, one that would be impervious to the privacy rejiggering of phone providers like Apple or Google. “We believe the metaverse will be the successor of the mobile internet,” Zuckerberg said in a now famous video. “We’ll be able to feel present – like we’re right there with people no matter how far apart we actually are.”

Meta logo from “Designing Our New Company brand: Meta” October 21, 2021 page (Meta Platform’s design website)

Zuckerberg’s enthusiasm was not requited by the market. Despite a decade of taking big bets and winning in social media, the market found Zuck’s approach to the metaverse naïve and too unfettered from profitability concerns. Even employees were confused. The stock topped out two weeks later and is now down more than 50% in 2022.

With a price to cash flow multiple of 11(!), Meta Platforms is easily the most undervalued big tech company on the market today. No other big tech name comes close. It has zero long term debt and a cash position of $40.5 billion. Yes, sluggish subscriber growth and TikTok are clear and present dangers to its crown jewels, but the “metaverse all-in” concerned investors. Though Meta is paying for its metaverse R&D in cash (unlike most other firms), the market doesn’t like tilting at windmills.

After the Crash: The Metaverse and Ad Monetization

Market drawdowns have a way of recalibrating expectations. They make you appreciate sustainable results and approachable objectives. They are a strong tonic to utopianism.

It was in the crucible of the dotcom bust that Google famously changed its high-minded, money-losing business model to include rival Goto.com’s paid search. After the heady days of 2021/early 22, tech investors are now looking at a future where more incremental wins will suffice, taking a harsher eye to high burn rates and long business runways.

Besides their top-line names, the metaverse ETFs all share a heavy weighting in a few well-known names – Meta, Roblox, Unity, Microsoft (MSFT), Apple (AAPL), Adobe (ADBE), Autodesk (ADSK), QUALCOMM (QCOM), & NVIDIA (NVDA). Lesser-known stocks include: Kopin (KOPN) – a micro display maker; Vuzix (VUZI) – for its AR glasses; Matterport (MTTR) for 3D walkthroughs; and WiMi (WIMI) – Chinese VR glasses.

For the sake of clarity, I will divide the names into two distinct wings:

- Gaming / Experience: Companies focused on the creation of games, social media, advertising, media, personal shopping, and the creator economy.

- Business Collaboration / Design & Hardware: The second wing is more b2b -the IP, 3D design & computing components, specialized hardware, decentralized fintech, and next generation user interfaces that provide the hardware or provide business collaboration solutions.

All the holdings are tech companies that have fallen hard since January. Very few are “pure plays” on the metaverse. Because the pandemic pulled forward business spending and the low interest rates pulled forward real estate spending, even firms more related to 3D design and construction like Autodesk, Matterport, or Windtunnel have tough comps. That makes forecasting 2023 revenues for any metaverse-related stocks tricky. Most of the smaller stocks are negative EBITDA. In addition to the economic cycle, the metaverse requires adoption, an elusive secular momentum.

Of the well-known names, Roblox (RBLX) and Unity (U) are the two gamers most connected to the metaverse and both have pivoted sharply to advertising this summer. In July, Unity merged with ironSource, an Israeli company bringing a decade of expertise in app monetization. On September 9, Roblox stated that in-game ads will be rolled out next year for all users 13 and older. The ads will be native to the platform, probably games themselves, and built by brands hoping to capture the teen demographic.

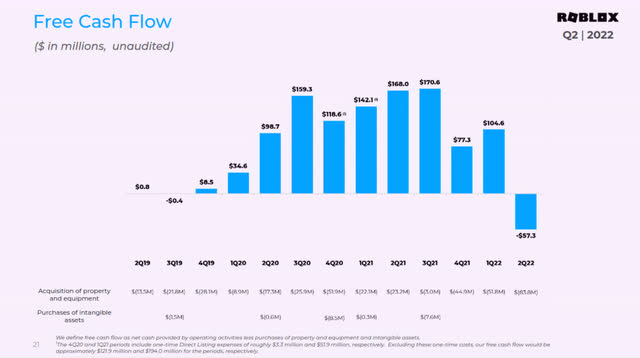

Roblox has clearly found religion. This money-losing stock has dropped from $134 in November to $39 a share Friday. It has missed estimates for the past three quarters. Free cash flow is at its lowest level in three years and turned negative in the most recent quarter. The strong dollar and the post-pandemic drop in gaming will continue to hurt Roblox short-term and the next two quarters could be ugly. Most recently, the markets punished the company for its “estimated average bookings per daily active user” being down 16% year over year. This is a falling knife.

Roblox Free Cash Flow (Roblox)

However, the demographics of Roblox are impressive. Last quarter, the company reported 52.2 million daily active users, up 21% year over year. Hours engaged: 11.3 billion, up 16% year over year, making for about 48 billion hours a year.

Advertisers should find the long hours spent on Roblox (by very young people not yet set in their purchase decisions) very attractive. Assuming 51% of its users are 13 or older, and one hour of engagement could be monetized with five ‘impressions’ (and the going rate impression value is 0.6 cents), then Roblox could eventually generate an extra $734 million in advertising revenues yearly -and that assumes the user base ceases to grow further.

This could make Roblox a highly profitable company within the next 3 to 5 years, especially as many analysts believe it daily users will easily double or even triple within that time frame, and brands will also directly pay for better positioning and development rights. Indeed, the click-through rate is statistically higher for retail and tech (the most likely segments to advertise to teens). A deep recession might even increase hours, with Roblox ads looping in the living room as families return to “staycations” en masse.

This is a pre-teen and teen demographic, but it is important to note that they are typically the young of the educated and affluent. Roblox is considered a “higher,” more educational form of digital entertainment by parents. As the philosopher Josef Pieper suggested 70 years ago: leisure has been, and always will be, the first foundation of any culture. The 59 million kids that choose the creator economy of Roblox are getting their very first taste of coding and business transactions, but in the heady context of genuine play and the “creative flow” that psychologists like Csikszentmihalyi so often eulogize.

In 15 years, these kids will likely be the next generation’s STEM innovators and managerial elite, with many of their skill sets and dispositions formed in the Roblox metaverse. I could even imagine a Tesla game that teaches children about EVs, a fun but educational “engineering how-to” that expands mindshare early and quietly primes future customers and/or employees.

Nevertheless, it will take several quarters to see if advertising can turbocharge Roblox’s bottom line as it did with Google twenty years ago. The stock it is still expensive. You have plenty of time before making a wager, but Roblox may be the closest we have to a metaverse pure play.

AR: Will 5G and Voice Activation Make It Different This Time?

Most metaverse stocks are down for a reason, but one “baby thrown out with the bathwater” that looks mispriced is Kopin (KOPN), a micro display component provider. It has a strong backlog with 50% of its business is defense sector orders. It is the sole supplier of the helmet micro displays for the F-35 Joint Strike Fighter Program (in production until 2030) and just received a new $4.8 million order from the program in May. The company is priced at $1.07 with only a $102 million market cap, despite having $18 million in cash, $28 million in working capital, and no debt.

It also supplies displays to RealWear, a private AR glass manufacturer that has seen big industrial orders from Ford for its voice-controlled AR glasses, and Moziware, another enterprise AR glass provider that sells into the Chinese market. Its new P80 Pancake lenses released in January 2022 provides for longer wear times and less eye fatigue.

RealWear HMT-1 (RealWear website)

The company is a niche supplier that has been hurt hard by the current chip supply chain bottleneck, but it has an extensive IP portfolio. Five years ago, Goertek – a Qualcomm XR partner, the maker of the Oculus Quest 2 and PlayStation VR2 – took a 10% equity stake in Kopin (7.6 million shares at $3.25 per share) and it didn’t sell even when Kopin shares were at $13.50 early last year.

At present AR glasses are slated to grow only 17% yearly until 2029, but the new lines of rugged, long-battery, voice-activated AR glasses are garnering interest in industry.

Of course, there is the risk that the headset revolution will stall out like it did in 1995 and 2013. What is different this time? 5G. No feedback stutter, a new threshold in resolution, and hands-free direction via excellent voice activation could coalesce to be the game changer. Qualcomm’s Snapdragon XR2 is an 8k VR system and the first one to be 5G enabled.

Another possible spark for mass adoption: Apple’s AR glasses –slated for release in 2024– which just might be hip enough to leap beyond the curse of Google Glass. No word if Kopin will be a supplier.

The Safer Bets

In the near term, the drawdown in metaverse-related stocks is likely to continue. The excesses are still unwinding. If you look to wager today, the safest bets on the sector are Microsoft and Nvidia. Both straddle the “experience” and “business” wings of the metaverse and lean into the space from secure positions to solve specific tasks. In January, when Microsoft bought Activision Blizzard, one of the world’s premier game developers, for $68.7 billion, CEO Satya Nadella admitted that the purchase a key part of its metaverse strategy:

“Our vision is for a river of entertainment where the content and commerce flow freely… Removing these barriers will only become more important as the digital and physical worlds come together and the metaverse platforms develop.”

Activision is the biggest acquisition in Microsoft’s 40-year history. Clearly this is a gaming play, but it will also cross-fertilize with the firm’s business side. Microsoft has vast entertainment properties (think Xbox), but its promising Mesh product could push Teams collaboration into a wider terrain, nudging Office into a type of metaverse dominance for those corporations or universities that, say, need to onboard or address thousands and do it economically. Mesh is a solution to certain travel expenses and even real estate costs (think those underused auditoriums).

Microsoft’s Mesh –speculative PR image from website (Microsoft)

The gamification of work is especially exciting to Gen Z. It has literally grown up on Animal: Crossing, Fortnite, Minecraft, and Roblox; massive multiplayer gaming is in its collective DNA. (Depending on the month, gaming ranks #1 or #2 as their favorite hobby).

Mesh will not move the Microsoft needle, but it could ensure Office dominance further into the century.

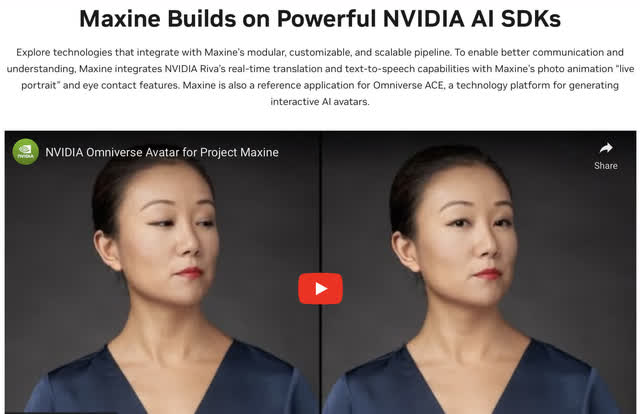

On August 9, Nvidia announced its Omniverse ACE, a suite of tools for building virtual assistants. Though Nvidia is experiencing a falloff in gaming and crypto mining demand, this Virtual Intelligent Assistant effort could result in the most salient b2b development in the metaverse.

The company’s confluence of proprietary computational power, AI, speech recognition, and natural language is potent. Placing all that “under the hood” of a photorealistic digital avatar operated with real-time graphics (see their Project Maxine avatar videos) could be transformational to the future of work. These types of avatars will ace the Turing Test and fundamentally cut the demand for many front-facing fast food and customer service workers. Persistent inflation or a recession might even accelerate the process as virtual assistants cost less in terms of onboarding, turn-over, healthcare and 401K matching.

Project Maxine –AI-enabled Intelligent Virtual Assistant (Nvidia)

Recall that in Stephenson’s Snow Crash, people not only interacted with other humans represented as avatars, but also with avatars that were pure data, presented as human-like digital constructs. This folds neatly into today’s trend in data-driven mass customization.

In 2019, McDonald’s bought AI company Dynamic Yield for $300 million in order to change its menus real-time based on the local weather conditions of its stores. These types of intelligent platforms for massive localization or personalization are extremely interesting to corporations, all of which strive for pitch-perfect brand delivery. Nvidia’s avatars would synch perfectly with this AI-driven phenomena, giving it a human face.

In contrast to Nvidia, Meta’s view of the metaverse remains too complacent to feel like a good business venture, too unencumbered by tangible tasks that need to be solved. With the price of food and gas climbing, whether consumers will pay big money for 5G “full immersion” and pricey avatars in their free time is debatable. But corporations might.

That’s why, though I am eagerly going with Mark to Machu Picchu later today, my bets – at this juncture -are with Microsoft and Nvidia.

Be the first to comment