da-kuk/E+ via Getty Images

The iShares Core Growth Allocation ETF (NYSEARCA:AOR) is an exchange-traded fund designed as a “simple way to build a diversified core portfolio focused on growth using one low-cost fund”. The expense ratio is reported as being 0.15% on a net basis through November 30, 2026, although the gross reported expense ratio is 0.20%. That is not cheap for a long-term holding, but not wholly unsatisfactory. AOR has attracted a reasonable amount of assets, with assets under management of $1.87 billion as of June 17, 2022.

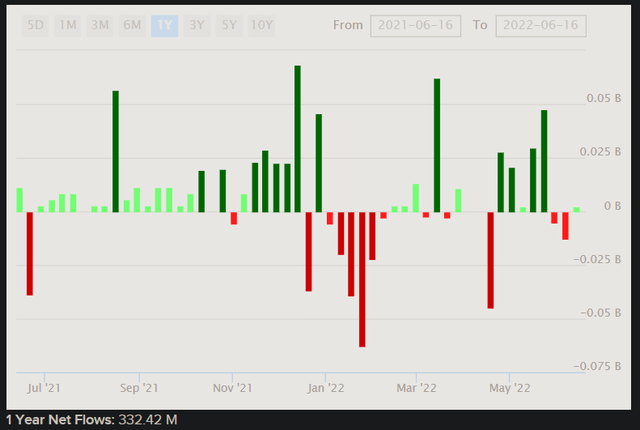

That follows positive net fund flows of $332 million over the past year, as illustrated below.

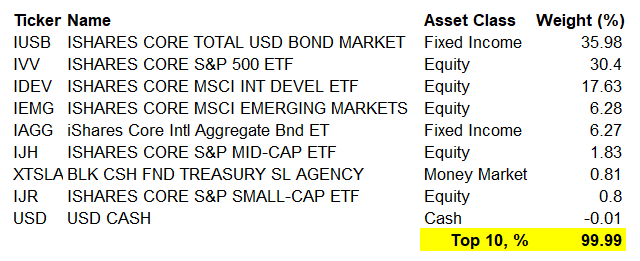

AOR is essentially a “fund of funds”; it has only seven reported holdings as of June 16, 2022. This includes a 36% allocation to U.S. bonds (which includes treasuries as well as higher-yielding investment grade corporate bonds), a 30% allocation to U.S. equities (a fund that tracks the S&P 500 U.S. equity index), some allocation to international developed market equities (18%), emerging market equities (6%), international fixed income (6%), and a handful of other minor holdings (including mid- and small-cap U.S. stocks).

Data from iShares.com

So, in essence, you have a fund that has a 43% allocation to bonds and bond-like instruments, and a 57% allocation to global equities (but that total allocation including an over-weight U.S. equities position).

This makes AOR somewhat difficult to value. It is not easy to guess at future interest rates. However, the 57% allocation to equities can be valued in accord with general rules. Morningstar estimate three- to five-year earnings growth on the equity allocation as being 13.00% for AOR. The forward price/earnings ratio is estimated at 14.77x, with a price/book ratio of 2.14x. That implies a forward return on equity of 14.49%, which is reasonable, and a forward earnings yield of 6.77%, which is also decent, although the lower average price/earnings ratio will have been helped by international equity exposure (some countries abroad have higher risk-free rates which drag down valuations of riskier assets like stocks).

In a sense you can value AOR as a normal equity portfolio, while treating the bond allocation as a way to, at least in theory, depress the volatility of the fund (reduce the beta, and therefore the equity risk premium that one might demand).

On the equity portion, assuming a steadily declining return on equity from around 14.49% in year one to 12% in a terminal year six, with a roughly a third of earnings distributed as dividends, and keeping the forward earnings multiple the same, the implied IRR is 10-12%. In a more optimistic scenario (actually, just going by Morningstar’s growth estimate, which is more optimistic), you could see an IRR north of 13%, although this is perhaps an unrealistic assumption as it would require several more years of uninterrupted, low-volatility earnings growth. Finally, by my calculations, if we saw a drop in earnings in a global recessionary outcome, the IRR might drop to 7-8% on the portfolio (which includes a 10% dip in earnings over the next year ahead).

The range of outcomes suggests the IRR on the equity portion of AOR is going to be reasonable, however that is the headline IRR. By my calculations, the risk-free rate on a geographically-weighted basis is circa 3% for AOR’s equity portfolio allocations. That lends to an equity risk premium of something like 8% in my base case, and 4.5% in my recessionary scenario. The equity funds that AOR invests also have historical betas (relative volatility rates) in line with averages (broader U.S. equity indices; i.e., close to 1.00x). So, I would not necessarily want to scale the equity risk premium upward, especially given AOR investors are going to be diversified across the globe.

On the basis of a 10% IRR, the equity portion looks safe on a valuation basis, and therefore on a long-term basis. Even in a recession, the valuation of AOR’s total equity portfolio allocation does not look stretched. More recently, AOR has suffered in line with broader markets not just because of its equity allocation but also its bond allocation; equity and bond prices have been positively correlated due to inflationary pressures lending to higher long-term bond yields (so-called “risk-free rates”). But assuming global bonds are fairly priced, you would need to mark down the forward IRR of 10% on the equity allocation by the extent of AOR’s non-equity weighting (43%), and then add in the anticipated fixed income percentage. Assuming a balanced risk-free rate of 3%, you might guess at a weighted IRR of about 7% for AOR shares.

Of course, if interest rates keep climbing, bond prices will fall, just as equity valuations will likely follow. So, AOR is unlikely to protect one against the most proximate concern, which is elevated inflation. However, if inflationary pressures do subside, long-term yields will likely fall, and that should support both equity and bond prices.

AOR, just like many other funds out there at the moment, is implicitly a “short-inflation” bet. I would not count on AOR providing much lower volatility than broader funds at the moment. On a valuation basis, I think AOR is priced satisfactorily, but as I can see no particular reason to hold AOR over other funds at the moment given that the underlying forward IRR is probably not going to be “high”, I would recommend being neutral and building one’s own portfolio oneself, without the assistance of a “fund of funds” structure.

Be the first to comment