B4LLS

Investment thesis

GigaCloud Technology (NASDAQ:GCT) is a high growing Chinese company, which experienced a significant sell-off as a consequence of its too lofty valuation back in 2021. I believe the company is surrounded by high uncertainty as we can’t know how Chinese regulation and relationships between the US and China will play out despite US regulators gained access to Chinese companies’s audits. Nonetheless, despite being a high growing business, GigaCloud is cash flow positive with a good handling of the company’s working capital.

Overview

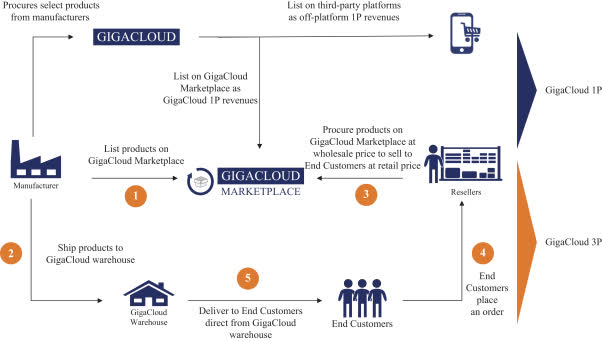

GigaCloud Technology is a leading provider of end to end B2B e-commerce solutions that facilitate transactions in the GigaCloud Marketplace. The GigaCloud Marketplace is a global marketplace that enables manufacturers, who are typically sellers in the marketplace, to transact with online resellers, who are typically buyers in the marketplace, without borders. The platform allows manufacturers to deliver their products around the world and gives online resellers access to a large and growing catalog of products at wholesale prices, supported by industry–leading global fulfilment capabilities.

I believe that the main benefit of GigaCloud Technology’s platform is that it allows manufacturers and online resellers to have access to the company’s bundle of discovery, logistics and payments services. I think this makes it easier for manufacturers to “transact without borders“, while allowing online resellers to access a large and growing catalog of products at wholesale prices. The platform also provides integrated e-commerce solutions to support international distribution. I believe these solutions help online resellers to offer products and services comparable to those offered by large e-commerce platforms.

The company supports its logistic service thanks to its fulfilment network through which the company operates 21 warehouses with 4 million square feet of storage capacity across the US, Europe and Asia, while also leveraging extensive trucking and shipping networks at cheaper rates than legacy companies like Fedex and UPS. I’m comfortable with saying that this gives the company a significant scale as it is demonstrated by the GlobalCloud ability to reach approximately 90% of its customers at an average of 3 days.

Business segments

GigaCloud 3P

GigaCloud 3P provides users with an easy way to find products, compare prices, make payments, track orders, and manage returns. The company has built an extensive marketplace where both parties can come together for business purposes. The main revenue stream of GigaCloud Technology comes from its commission fees which are charged when a buyer and seller enter into a transaction on their Marketplace. These commissions range between 1% and 5%, depending on the size of the transaction value.

Furthermore, they also charge warehousing fees if goods need to be stored in their warehouses as well as last–mile delivery services or fulfillment fees for other freight services such as ocean transportation deliveries. Overall it seems like GigaCloud Technology offers quite competitive rates while providing seamless digital experiences throughout all steps of customer journeys – from product search through purchase completion – for both buyers and sellers alike; thus making them attractive enough for customers who wish to engage via this technology platform over others available out there today such as eBay or Amazon’s own marketplaces.

GigaCloud Technology GigaCloud Technology

GigaCloud 1P

With GigaCloud‘s 1P (1st party) platform, businesses can further enhance their marketplace experience by selling their own inventory. GigaCloud 1P offers a significant opportunity for businesses to increase their sales velocity, gain proprietary data insights into their customers, and create more products for buyers. By selling their own inventory through GigaCloud 1P, businesses can generate revenue from product sales and strengthen their customer relationships.

Off-Platform E-commerce

This off-platform e-commerce business provides top quality goods directly from producers, which then are sold directly to third-party businesses such as Rakuten, Amazon, Walmart and Wayfair. This segment also offers valuable opportunity to strengthen relationships with sellers and have access to proprietary data.

GigaCloud Technology

Financials

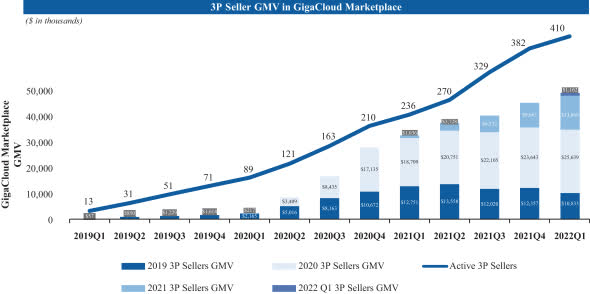

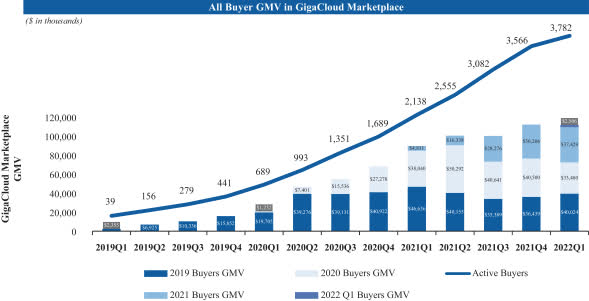

The company experienced massive growth in 2020, which was reflected in every of the company’s KPI followed by a sharp decrease in the following year. This significant slow down was caused primarily by a surge in the demand for online goods, which was limited by supply chain constraints such as as factory closures and shipping delays.

| KPI | 2019 | 2020 | Growth YoY | 2021 | Growth YoY |

| Gross merchandise volume (GMV) | $35.46 | $190.5 | 437% | $414.2 | 117% |

| Active 3P sellers | 71 | 210 | 196% | 382 | 82% |

| Active buyers | 441 | 1689 | 283% | 3566 | 111% |

| Spend per active buyer | $80.42 | $112.77 | 40% | $116.15 | 3% |

Only GMV figures are in million

The slowdown in the company’s KPI metrics was reflected both in the GigaCloud’s top and bottom lines.

| 2019 | 2020 | 2021 | |

| Revenue | $122.29 | $275.4 | $414.2 |

| Gross margin | 18.1% | 27.2% | 21.6% |

| Operating margin | 4% | 16% | 9.5% |

| Net margin | 2.3% | 13.6% | 7% |

Despite the current macroeconomic conditions, as of Q3 2022, the company experienced a 23.4% growth in revenues, which was fueled primarily by a significant jump in both GigaCloud 3P (46% growth) and 1P segments (30.5%) offsetting the revenue decrease in the off-platform e-commerce segment. Overall, I think the company is continuing its shift from a low margin business segment like the off-platform to a more profitable margin structure like GigaCloud 3P and 1P. In the third quarter of 2022, the company managed to decrease general and administrative expenses by 19% (reduction of stock-based compensation), which resulted in operating profits increasing by 432% YoY.

| Metric | 2019 | 2020 | 2021 | Q1 2022 | Q2 2022 | Q3 2022 |

|

GigaCloud 3P % of total revenue |

12.4% | 21.8% | 23.7% | 27.8% | 26.4% | 31.6% |

| GigaCloud 1P % of total revenue | 34.5% | 44.3% | 45.5% | 48.2% | 48.9% | 45.4% |

| Off-platform % of total revenue | 53.1% | 33.9% | 30.8% | 24% | 24.7% | 22.8% |

With regards to the company’s balance sheet, I believe it is pristine conditions since it has about $2 million of debt which are well covered by $117.7 million of cash and restricted cash. Moreover, I think the company is allocating well its capital since it has reported a return on invested capital of 43.6% in 2020 and 27.7% in 2021. The reduction in the company’s ROIC was due to an increase in general and administrative expenses as GigaCloud enhanced its workforce and warehouses network. As it is stated in the company’s balance sheet, its operating expenses as a percentage of revenue are already decreasing and this should help the company to boost its ROIC going forward.

Risks

As we enter into 2023, I expect GigaCloud to suffer from a severe recession, which could have significant negative impacts on customer demand with consumers reducing their overall spending. Moreover, while the company conducts the majority of its operations in the US, GigaCloud’s financial statements are audited by a Chinese auditor, which can exercise significant negative consequences to GigaCloud’s business.

Conclusion

Based on the current macroeconomic environment with Fed hiking aggressively interest rates, I believe GigaCloud is trading at fairly cheap valuation considering the high double digit growth in its main KPIs and the robust ROIC. Moreover, I think the company is rigorously managing its inventory, which directly influences the company’s revenue base (23.4% growth YoY) and cash flows (52.3% growth YoY in the first 9 months of 2022). I expect the company to continue increasing its inventory management capabilities in the future as it continue to leverage its AI technology. Based on the previous considerations, I assign a buy rating to the company’s stock.

Be the first to comment