Scott Olson

Summary

Sports betting and stock trading share some very similar qualities, from risk management strategies and profit-taking techniques to the impact of expectations on the value of a trade. In fact, we would even go so far as to say that a sportsbook can be viewed, to a certain extent, as an exchange, with the main stipulations being that the house tips the odds (and liquidity, or so to speak) in their favor, instead of relying on market makers.

Having been outlawed at a federal level (except for Nevada) until recently, it’s been a long and controversial road from a regulatory standpoint for the Sports Betting industry. Approximately $4.76 billion was wagered on Super Bowl 52 in 2018, with an astounding 97% of that total having been wagered illegally. Shortly thereafter, the Supreme Court struck down the federal ban on sports betting, allowing states to establish their own rules and laws around the practice, and simultaneously clearing a path for a new multi-billion dollar industry to enter the fold.

DraftKings Inc. (NASDAQ:DKNG) was established in 2012 and quickly emerged into one of the largest daily fantasy sports (DFS) platforms, even becoming the official DFS service of the National Hockey League in 2015. Until the legalization of sports betting at a national level, their primary revenue streams came from their DFS and online casino businesses. However, the regulatory changes provided immense opportunity for expansion into a new industry, and sports betting now serves as their largest source of revenue.

The first domino to fall occurred when New Jersey officially legalized the practice, paving the way for DraftKings to emerge as the first online sportsbook outside of Nevada. This milestone represented a massive achievement over their competition in the industry and has cleared the road for them to become one of the most recognizable brands in sports to date.

Industry

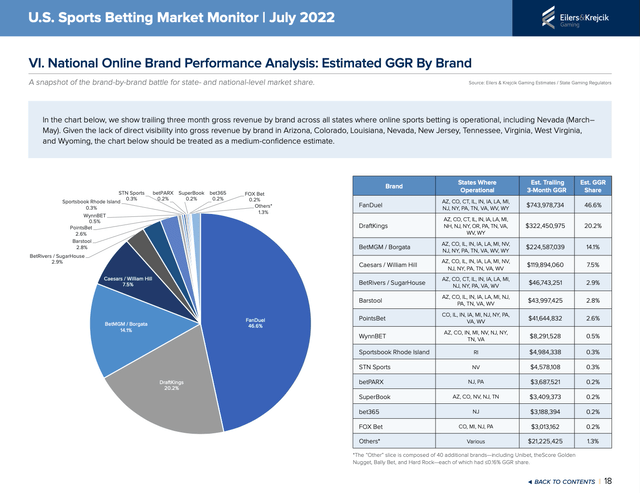

As it stands, there are two dominant players among iGaming and online gambling platforms: DraftKings and FanDuel. The latter is owned by Dublin-based Flutter Entertainment (OTCPK:PDYPY). Much like DraftKings, FanDuel originated as a DFS service, prior to integrating a sportsbook platform.

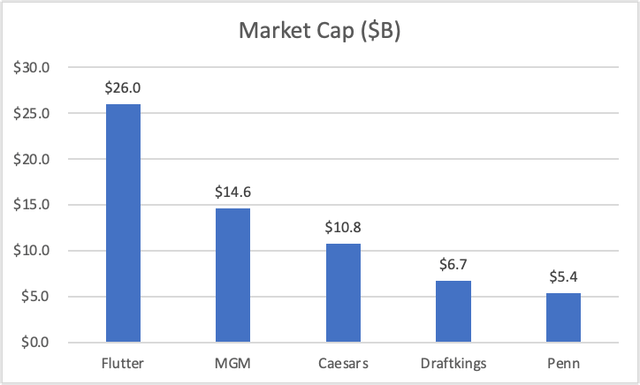

The market also features several other competitors with iGaming platforms, including MGM Resorts International (MGM), Caesars Entertainment (CZR), and PENN Entertainment (PENN). Each of these three owns and operates physical resorts and casinos, differentiating themselves from DraftKings and FanDuel. Below is a breakdown of market share among sports betting platforms:

Among those presented above, the only two platforms that originated as DFS platforms happen to be the exact two platforms that occupy the largest sports betting market shares: FanDuel and DraftKings. Why might this be the case? To put things simply, neither FanDuel nor DraftKings was forced to make major adaptations to their pre-existing product, as a sportsbook proved to fit in rather nicely with both companies’ DFS and casino platforms.

On the other hand, existing Las Vegas-based casinos and gambling operations such as Caesars and MGM were forced to invest significantly in improving their technological pallet in order to remain competitive. In order to adjust to the changing regulatory conditions, Caesar’s was forced to spend $4 billion in acquiring gambling firm William Hill to piggyback the development of their sports betting app on the back of William Hill’s Liberty platform. Even with the massive spend, Caesars Sportsbook was not able to launch until 2021, a full 3 years after the practice first became legal.

Being first was a huge achievement for DraftKings. As a result, they have the most recognizable brand among sportsbooks. Unfortunately for them, however, their competition is far too large to continue maintaining their market share without aggressive spending or financial backing.

Each of the five companies listed above operates one of the six largest sportsbooks by market share. As mentioned, Flutter owns FanDuel, while MGM, Caesars, and DraftKings run their own platforms and Penn Entertainment operates Barstool Sportsbook. Simply put: DraftKings may not have enough of a war chest to continue fending off increased competition, as their competitors possess more resources to allocate towards technological innovation, marketing, and legal disputes.

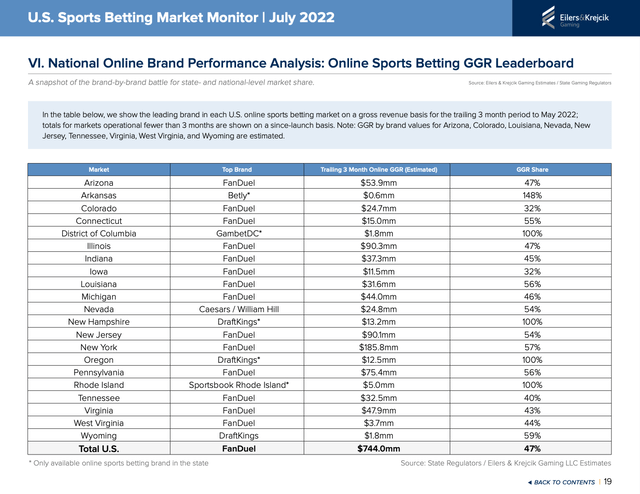

However, we can also look to gain a better understanding of how at-risk DraftKings is by analyzing how widespread the problems appear. Sportsbooks generally incur very low switching costs between platforms, so a user’s ability to seamlessly transfer from sportsbook to sportsbook or even utilize a combination of a few is very high. This means that the market as a whole can prove very susceptible to changing trends. But, if we can at least identify that DraftKings has strongholds in a few locations, we can potentially assign some of those markets a lower risk of losing market share from a brand loyalty standpoint. Below is a breakdown of the largest sportsbook operator by state:

FanDuel dominates market share in two-thirds of legal gambling states, suggesting that DraftKings simply may not have the firepower to compete with multiple gambling conglomerates. Even if the betting industry continues to rapidly grow in size, there lies the risk that DraftKings may not be a main beneficiary, if at all. For revenues to continue to grow, DraftKings must be able to either ward off competitors to protect their market share or grow their reach at a rate that outpaces any potential losses in overall market share.

Market Conditions

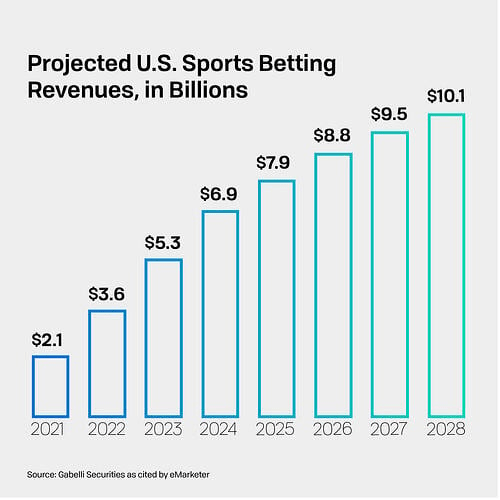

Given the recent regulatory changes, sports betting has been one of the fastest-growing industries over the past few years, having even eclipsed $100 billion in legal bets taken in 2022, a record breaking feat. Even still, over 40% of money wagered in the United States this year has been gambled illegally. Furthermore, online sports betting is only legal in 23 states at the moment (excluding Rhode Island, where residents must use the state-run sportsbook), with four more pending official legalization in early 2023. Those numbers alone indicate the vast possibilities for the sports betting market. Even more impressive, those numbers don’t include the country’s three largest states (California, Texas, and Florida) by population, which have yet to legalize the practice. When those states legalize sports betting, which likely will be in the next few years, the overall size of the market could grow at an exponential rate.

Gabelli Securities, through eMarketer

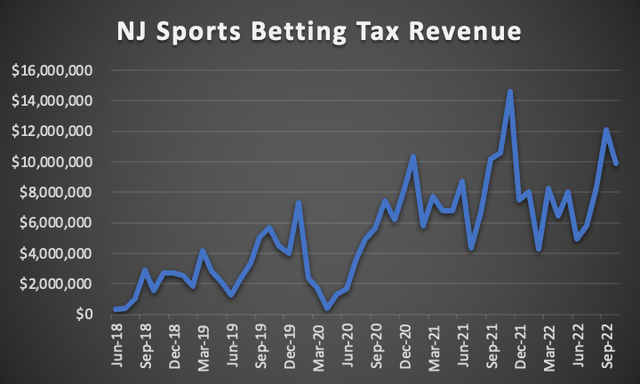

Naturally, with the regulatory changes causing such an industrial boom, governments will be looking for their piece of the pie mainly in the form of tax revenue. The chart below depicts the amount of revenue New Jersey has been able to receive since the legalization of sports betting within the state.

Tax increases have already begun to serve as a thorn in the sides of sportsbooks, and DraftKings is no different. It will be interesting to monitor the relationship between government tax collection agencies and online gambling platforms in the coming years, and whether companies will be able to sidestep tax payments as more states legalize and finalize tax plans. If things go the right way, or if ongoing lobbying attempts prove successful, certain tax plans may prove beneficial to the existing sportsbooks and serve as a possible economic moat. Otherwise, regulatory changes within legal states could pose a threat to either operators’ revenues or user bases, who may be dissuaded from betting for tax reasons.

Given that the underlying revenue streams are heavily reliant on the type of content available, online sports gambling is a very seasonal practice (hence the cycles in the graph above), with wager amounts generally peaking during football season. As we enter the prime winter months, expect online gambling revenues to spike towards early February and into March, as the Super Bowl and March Madness are consistently the two largest gambling events of the year.

Financial Analysis

DraftKings generates revenue from a few aspects of their business. Some secondary sources of revenue include licensing out their technology/data, apparel and merchandise, and advertising within their platform. However, the vast majority (93% in the first three quarters of 2022, up from 87% in 2020) of their revenue stems from their business’s online gaming platform, including their DFS, online casino, and sports betting features. Unfortunately, the exact division of revenue between the three primary features is not disclosed within any financial statements delivered by the organization, but based on the division of market share within the sports betting industry depicted above and DraftKings’s total reported revenue numbers, it can be inferred that around 70% of DraftKings’s revenue from their online gaming platforms is derived exclusively from their sportsbook.

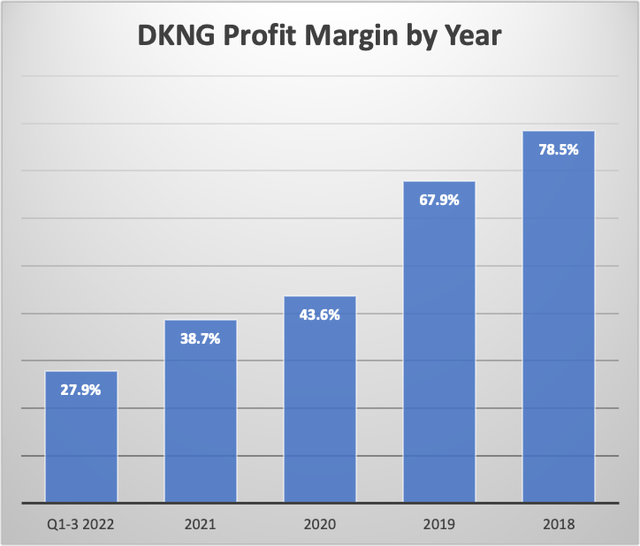

As more states legalize sports betting, DraftKings has continuously been able to build their cash input, increasing their revenue from 2019 to 2021 by over 300%. However, even though sports betting has provided a massive boon to DraftKings’s total revenue, their profit margins over time indicate a different story.

Company’s recent 10-K & 10-Q filings

For comparison, at the beginning of 2018, sports betting was not legal at a federal level (although, 3 states had legalized online sports betting by the end of the year). Currently, DraftKings operates their sportsbook in 21 states, a number that has been consistently increasing YOY. Difficulties with scaling their business have hampered their growth outlook, as both costs of revenue (+1431.1%) and sales and marketing expense (+474.2%) growth have outpaced revenue growth (+372.8%) from 2018 to 2021, a trend that appears to be continuing thus far in 2022.

Understanding the reasons for their increased costs of revenue is crucial. Are these one-time costs incurred as a result of adding new markets? Or are these costs fallout from expansion that will continue to occur? The first thing to note is that sportsbooks and casinos generally recognize revenue AFTER gambled winnings are paid out, meaning user winnings are not generally included in costs of revenue. So where do these costs come from? For DraftKings, their costs of revenue increased $457.9M (84.6%) in Q1-3 in 2022 as compared with the same period in 2021. Of that total increase, $253.5M (55.4% of the total COR increase) can be attributed to an increase in product taxes, while payment processing fees increased $63.0M (13.8%). For comparison, from 2020 to 2021 the same expense categories rose $203.4M and $73.1M, respectively. As these costs are variable in nature, DraftKings is unlikely to find improvements as revenue grows, implying that profit margins could continue to decrease for the foreseeable future. Should variable costs manage to overtake revenue, DraftKings could be in serious trouble.

As new states continually enter the market, DraftKings’s inability to properly scale their business will come to haunt their ability to compete with some more well-rounded competitors. For example, MGM’s profit margins actually rose from 47.7% in the first 3 quarters of 2021 to 49.7% over the same period of 2022, while still achieving 44% revenue growth. The reason other organizations, such as MGM are able to maintain a strong profit margin is due to the diversity of their revenue streams. Only around 43.9% of MGM’s $9.54B total revenue through the first three quarters of 2022 has been generated by their casino business (which includes online gaming) in its entirety. Their overall casino business has been able to generate 53.4% profit margins through the first 9 months of 2022, further illustrating the difference in profitability between physical and online casinos. This diversity of revenue allows them the freedom to incur lower profit margins within the online gaming industry, while offsetting their costs of revenue in that area with profits from some higher-margin aspects of their business. Marketing, technological, and administrative costs will all continue to grow with the business, so unless DraftKings can figure out how to properly scale while maintaining margins, achieving profitability in the near future may be a lost cause unless they are willing to surrender further market share to their competition.

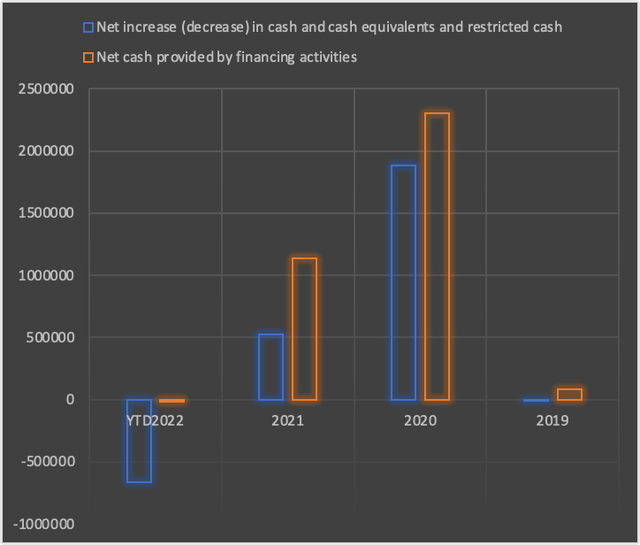

Another point of concern worth noting is DraftKings’s cash flow. While, in recent years, DraftKings has looked to increase their cash intake through financing (primarily through the issuance of convertible notes), the organization has looked to reduce their reliance on debt to sustain themselves.

Company’s recent 10-Q & 10-K filings

While less debt is never a bad thing in and of itself, losing ~$700M in overall cash balances could prove disastrous, especially in an industry that is experiencing record growth and with larger competitors. Based on their latest 10-Q filing, their current cash and cash equivalents have fallen to $1.38B, a 36% drop from their balance at the same point in 2021, and their current liabilities are $1.29B. Given the small discrepancy, future growth prospects could be hindered by the necessity to pay off current debts while simultaneously competing in a highly competitive market. This form of cash intake would not affect current liabilities either, making it odd that DraftKings would choose not to equip themselves with short-term resources with further expansion plans on the horizon. Additionally, the convertible notes that DraftKings has been using recently to raise cash have the countereffect of diluting shareholders.

What’s even more concerning is that those convertible issuances were primarily intended for the purpose of fueling further acquisitions and expansion. Since DraftKings has opted not to continue with issuing notes this year, there are implied doubts over their intended direction and concerns about growth prospects. Those who are looking to buy shares of DraftKings at the moment must rely on the assumption that they will figure out new methods of achieving growth without share dilution.

On the brighter side, one thing that DraftKings has often been criticized for is their high customer acquisition costs. However, they have actually been able to get away with spending less on the area than its two top competitors, MGM and FanDuel. As a result, they may, at the very least, have the ability to buy themselves some time from a market share standpoint. However, prospective shareholders should keep an eye on how that figure moves in the coming years with relation to changes in market share.

Valuation/Financial Metrics

DraftKings went public in early 2020, at the height of the coronavirus pandemic, via a merger with a special-purpose acquisition company (SPAC), proving to be one of the most successful SPAC IPOs to date. Within a year, DraftKings’s market capitalization more than quadrupled, hitting a historical high of $28.62B in March of 2021. However, 2022 has not been quite as friendly to shareholders.

After opening the year with an ~$11B valuation, share prices have steadily fallen from YTD highs of ~$24 earlier in the year, with a bit of a resurgence in the first half of August towards resistance levels of $21 prior to entering a downtrend that has moved the stock towards its current price of $12.63. All in all, DraftKings has lost around 80% of their market capitalization from their all-time high, and around 49% since the beginning of 2022.

DraftKings does not issue dividends which may make the stock unappealing to income investors. For value investors, DraftKings has higher price-to-book and price-to-sales ratios than MGM and CZR, as well as a higher price-to-cash ratio than MGM. As discussed, growth investors should be concerned over the issues with scaling the business.

The vast majority of financial metrics indicate a dire situation for DraftKings. Overall, the company possesses a -0.81 Altman Z-score. For comparison, a Z-score of less than 1.8 is generally regarded as the threshold of a severely distressed company. Their debt-to-EBITDA metric of -0.89 does not inspire any more confidence, and their 3-year EBITDA growth rate of -112.1 is worse than 98.8% of companies in their industry. They currently possess a -90.34% return on equity, further indicating its inability to convert equity into profits. All of these metrics cast doubt over the survival ability of DraftKings, and it is difficult to find a valuation metric that warrants a bullish position on the stock.

Strengths/Competitive Advantages

While the current state of DraftKings provides serious concern, there are a few aspects of the model that can provide some hope. For starters, the very nature of the sports betting industry provides a strong moat in the form of gaming licenses, which are not only very expensive, but take several months to obtain. This makes it very difficult for new players to enter the industry without proper backing.

Additionally, while organizations in other industries may be in direct competition for customers, the iGaming industry is not as zero-sum. Users aren’t necessarily forced to restrict themselves to one platform. In fact, users often gamble simultaneously on multiple platforms depending on many factors, such as promotions or offerings.

DraftKings does have some competitive advantages over its competitors. As mentioned earlier, the company has the strongest brand recognition within the industry. This important factor may allow the platform to continue spending less than competitors on customer acquisition costs, which would prove to be a huge relief to their already-negative net margins.

Finally, DraftKings is the only company in the space that is taking advantage of the increasing utility of cryptocurrency and blockchain technology. Having started as a DFS platform, the company has seemingly attempted to implement a new form of DFS, using Non-Fungible Tokens (NFTs) of NFL players as both tradable and usable aspects of fantasy line-ups. Having an in-house marketplace for users to buy, sell, and trade fantasy football players to use in line-ups will allow them to collect revenue and commissions along the way, hosting competitions for users to put those tokens to use. Timing of the initiative is unfortunate, as cryptocurrencies across the board have hemorrhaged value, with several going to zero. Additionally, the recent fallout from the FTX disaster has not helped to inspire confidence in the crypto market. However, in the event of a market reversal, DraftKings would find themselves well-positioned to take advantage of the market, with a brand-new product.

Risks

DraftKings needs to fix their apparent scalability problems. There is no possible way for the organization to keep up with larger competitors otherwise. Furthermore, while they have been able to get away with less spending towards customer acquisitions, DraftKings possesses fewer sources of natural lead-generation than their competitors. For companies such as MGM and Caesars, their physical resorts and casinos help them establish their brand, hosting thousands of potential sportsbook users within their walls on a weekly basis. Such a feature inherently sets DraftKings (and FanDuel) at a disadvantage.

The company may also face legal troubles in the future. While the company originated as a DFS platform, DFS has essentially operated in a legal gray area, with many considering the practice a form of gambling, and therefore subject to similar laws. Future regulations may restrict that area of their business. While DFS has not been the central aspect of their business model for many years now, the impact of pressure on one of the higher-margin aspects of their business would no doubt be felt.

Finally, technical errors within the platform may plague DraftKings if they aren’t careful. Unlike casino games where the house is usually guaranteed a profit, the results of a sports bet are reliant on the results of an external event, meaning the sportsbook must ensure that the line chosen for a given outcome attracts near-even wagers for either result. For example, if a book sets the line for the total amount of points scored in a game too low, that may cause an imbalance in the total number of bettors who take the over as compared to the under. In that event, should that point total be exceeded, revenues would be negatively impacted.

Other technical issues may include situations like hacks or bugs, which may affect revenues or user experiences. Even within the past month, DraftKings experienced a situation where $300k of user funds were stolen to hackers, causing the stock to tumble 10%. Obviously, such occurrences are rare, but may have an adverse effect on stockholders.

Possible Solutions

“You don’t seem to realize what business you’re in. You’re not in the burger business. You’re in the real estate business.” Those are the words that completely changed the direction of the McDonald’s business model, at least according to the movie The Founder. At the time, Ray Kroc was in the process of scaling the fast food burger concept, while facing difficulties in finding cash to grow the company. As a result, McDonald’s instead began renting out plots of land to franchisees, providing a steady upfront cash supply that allowed the business to continue buying land for franchises, while maintaining ownership of the property. The rest is history.

DraftKings finds themselves in a similar situation, struggling with both margins and scalability, both of which are absolutely necessary in a highly competitive and ever-growing industry. DraftKings seems to have misinterpreted the driving factors of their business model. For their bigger competitors, casinos are more of a driving factor for their customer base into their hotels and resorts, with the gambling simply serving as an added revenue stream. Thus far, DraftKings has been attempting to approach the industry from an opposite standpoint, instead opting to focus on deriving the majority of their revenue from their iGaming business. What they’ve failed to realize is that their biggest asset isn’t their sportsbook, but rather, their user base.

It is difficult to compare DraftKings to other offerings, such as MGM or Caesars, as they both have physical locations and real estate assets. Attempting to follow a similar path via building out a physical resort/casino would not only prove incredibly expensive, but would fail to provide a competitive advantage. Rather, DraftKings more closely resembles a technology company, with their software and a strong user base behind them. In fact, DraftKings finds themselves attracting more monthly visitors than FanDuel, having attracted 31.5% more visitors over the past 3 months despite being way behind in market share.

The solution? Attracting advertisers/sponsors. While the company already uses such a model on their DFS platform, which may help explain their improved profitability prior to including sports betting offerings, the sportsbook/casino platform offers no such solution. Sponsored pools/contests/competitions would provide a more steady supply of guaranteed cash and revenue, while simultaneously providing the opportunity to leverage their status as the most popular sportsbook around. Social media sites usually generate between $6-10 per 1000 impressions. With over 21M total website visits in October alone, DraftKings could in theory have generated $210,000 per sponsor over the same timeframe. While that total alone may not seem so relevant compared to the $500M in revenue they generated in Q3 alone, the platform offers a handful of pools, promotions and contests every day, providing multiple opportunities to attract sponsors. Not to mention, large events could provide an even greater opportunity to attract advertisers. This past Super Bowl generated $485M in ad revenue alone. Those ads don’t come cheap, so platforms such as DraftKings would be able to provide an alternative method of advertising for those companies.

Regardless of the direction the company chooses, it is apparent that the business model will need to be redesigned more creatively in order to diversify revenue streams.

Recommendation

At this point, it is very difficult to envision a scenario in which DraftKings is able to turn the state of their business around in the near future. The expenses have piled up, and despite increases in revenue, cash balances have tumbled, leaving the organization in a position where it may be forced to make some uncomfortable decisions in order to survive. Unfortunately, the influx of well-funded competitors may continue to cause headaches for DKNG stock owners, as a reduction of market share could cause some deep wounds within their financial statements. Should DraftKings find a way to add more margin-friendly aspects to their business model, we may revisit my bearish sentiments, but even in that case, there may just be too much strong competition for market share for me to completely change my tone. If you own DraftKings Inc. shares hoping for a reversal, it may be best to cut bait.

We would like to thank B. Peskin for his contribution to this piece.

Be the first to comment