Sundry Photography

Summary

I recommend a Buy rating on Coupa Software Incorporated (NASDAQ:COUP). It has a combination of factors that make it attractive, such as: a strong value proposition, strong network effect, and scale advantage. More importantly, the stock’s current low price makes it a good place for investors to get in, since it will give them a high IRR of 17% over the long term, thanks to continuous share capture in a large total addressable market (“TAM”) and margin expansion.

Company overview

COUP provides Business Spend Management [BSM] solutions. It’s a cloud-based business service management platform that facilitates connectivity between companies and their suppliers all over the world, allowing for better oversight and management of financial resources, supply chain efficiency, and cash flow. Providing the transactional engine for managing a company’s business spend, COUP’s BSM platform is comprised primarily of procurement, invoicing, expense management, and payment solutions. In addition to basic features, the platform offers advanced features and solutions for power users to help businesses with the technical and strategic parts of BSM such as contract management.

TAM is significant

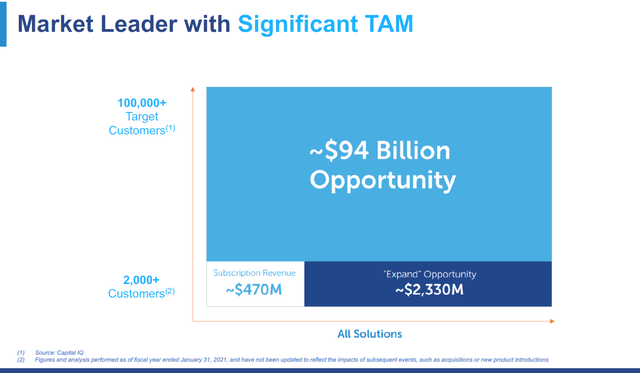

COUP operates in a very large TAM with a total annual revenue opportunity of $94 billion, implying that COUP can continue to grow for a very long time before reaching maturity, given that its revenue as of FY22 was only $725 million.

While there are many motivating factors for implementing BSM, I believe one of the most important is the potential for financial savings. Businesses are under increasing pressure to find ways to increase operational efficiencies, decrease costs, and boost profits and cash flow as a result of the current economic climate, intense competition, and the global regulatory environment. Consequently, spending management has evolved into a critical component of strategic planning for businesses in order to facilitate the realization of cost savings that boost operating profit and free up capital for further investment. There are two categories of spending for commercial enterprises: direct and indirect. Direct spending refers to items that are directly used in the production of the company’s products, while indirect spending describes categories of goods and services that support the company’s business processes and are consumed by internal stakeholders.

Inefficient processes or point applications used by different departments can make it more challenging to manage indirect spending on goods and services, which in turn can lead to a lack of full spending visibility and wasteful employee behavior. Organizations need a tool to streamline their overall spending across all departments and employees, not just the procurement team. The bottleneck to dealing with business expenditures is managers’ inability to conduct credible analyses due to incomplete visibility into the organization’s spending. According to a 2018 COUP study, more than 60% of CFOs lack full visibility into organizational transactions.

As a result, I believe there is a significant market for COUP’s offering, which is not a patchwork of separate solutions and facilitates real-time spend analysis. To enable real-time analysis on spend data, businesses need a solution that integrates data from several sources and payments seamlessly, and provides a single source of data so employees can make informed purchasing decisions. The proliferation of fragmented point applications addressing specific areas of spend management on the market today has resulted in increased complexity for businesses and their employees, who frequently need to access multiple systems or review electronic and paper files before making informed purchases. Since financial transactions are not collected and stored in a centralized database, it is difficult to examine spending patterns and check for compliance with internal policies. Processes that aren’t well thought out and don’t work well together lead to mistakes, unhappy workers, and bad decisions about how to use resources.

Strong network effect from large supplier network and data set

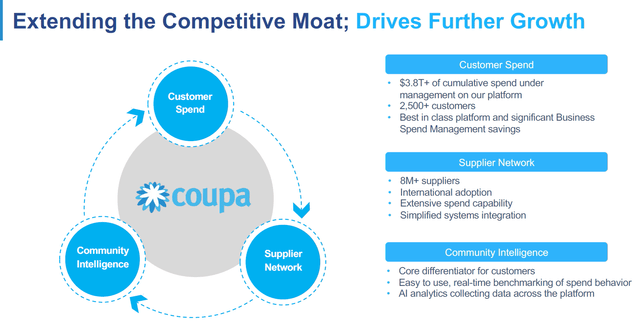

COUP can be thought of as a business that serves as a network for both buyers and sellers. Suppliers are looking to expand their clientele base, while businesses are hoping to cut costs and improve their relationships with all of their suppliers. Scale is an important factor. As more companies join COUP’s network, the total amount of money being managed increases. The more money we can manage, the more suppliers will want to work with us, and the more businesses will want to buy the products and services we offer, creating a powerful network effect. Spend under management also increases as a higher percentage of businesses and workers join COUP’s network. The end result is greater customer savings and an increase in COUP’s ability to bring in new customers.

COUP manages over $3.8 million in spend for over 2,500 customers and 8 million suppliers as of July 2022. COUP’s extensive data and knowledge base allow it to produce valuable Community Intelligence, which is then disseminated to the COUP user base as a whole. In order to better serve COUP’s clientele, Community Intelligence analyzes structured data gathered from a large number of businesses spend transactions conducted on the COUP platform using artificial intelligence. The platform makes recommendations to customers based on community-wide best practices for optimizing spending decisions, raising operational efficiency, and decreasing risk.

I believe the community intelligence solution is difficult to replicate due to the large amount of data required. More importantly, it is great for businesses because it helps them save money, and it should aid COUP’s GTM initiatives by letting them better tailor their sales pitch to win over prospects, which will be especially useful as the company grows into the mid-market.

Strong GTM strategy

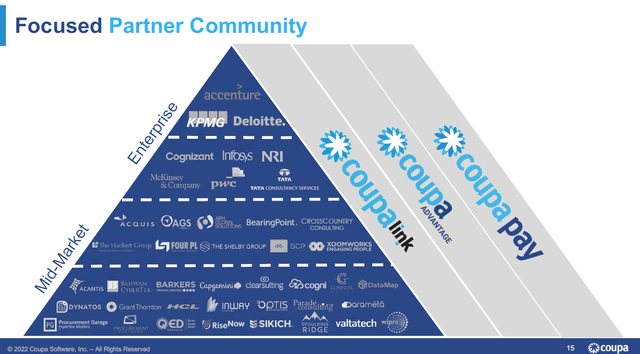

COUP’s go-to-market [GTM] strategy consists of both direct sales time and strategic partnerships. Inside sales and field sales representatives make up the global direct sales team, which is segmented by region, account size, and use case. COUP’s direct sales team structure makes a lot of sense, given that the product being sold is an enterprise solution and the target audience consists of c-suite executives who need a knowledgeable sales representative to manage the client relationship. I am optimistic about COUP’s growth and scalability because of its partnership strategy, which mitigates the inefficiency that comes with having a direct sales team. Some of COUP’s partners are advisory and referral firms; others are implementation firms like Deloitte, Accenture, and PwC; still others are resellers like IBM; and still others are technology providers like Dell Boomi. I think it’s important to note that COUP carefully chooses its partners because they have established relationships with the most senior executives at major corporations.

When COUP shifts its focus to the mid-market, it will require a GTM strategy that enables the company to rapidly and efficiently target customers from a wide variety of industries, increasing the significance of partnerships. Since the number of potential mid-market companies is much higher than at the enterprise level, it would be foolish to employ a direct sales strategy. Thus, a partnership approach is appropriate given the need for scalability and expanded distribution channels.

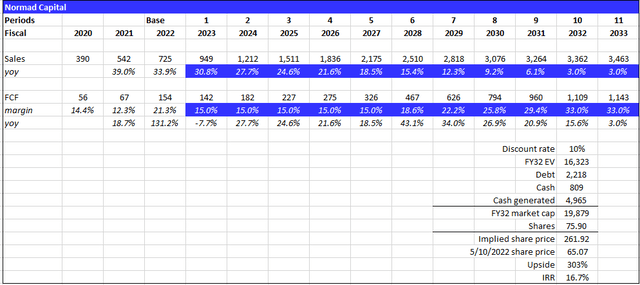

Valuation

At the current stock price of $65.07 and 75.9 million shares, the market cap is ~$4.9 billion. I believe the current market price presents a decent entry point for investors to enjoy a high IRR of 17% IRR. Based on my 10-year discounted cash flow (“DCF”) model, I believe COUP will make $3.3 billion in sales and $1.1 billion in free cash flow (“FCF”) in FY32. This will be driven by declining sales growth from its current 30+% to a terminal growth rate of 3%, and a long-term FCF margin of 33%, giving it a market cap of $18 billion and a stock price of $243 in FY31.

Assumptions:

- Sales: growth to decline from the current 30+% to a long-term growth rate of 3% over 10 years. I believe growth should definitely slow as COUP represents a larger piece of the pie and the law of large numbers kicks in. Also, as COUP finishes signing the low-hanging fruit, it should be relatively harder to get more customers at the same speed.

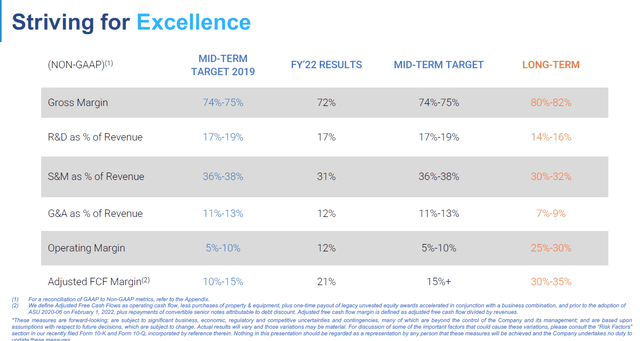

- FCF: to follow management’s mid-and long-term guidance of 15+% and 33% to 35%, respectively. I have high confidence that FCF margin will expand eventually as the business will have fewer CAPEX requirements and profit margin should increase as COUP tones down on sales and marketing.

- Valuation: I derived my terminal value of $16 billion in FY32 by assuming a terminal growth of 3% and a discount rate of 10%. The reason for 3% is that I believe COUP should continue to grow a low-single digits and increase prices at the same level as inflation (2%).

Normad Capital COUP Sep 22 Investor Day

Risk

Competition

The industry in which COUP operates is both saturated with competition and highly fragmented. COUP faces stiff competition from a plethora of established and up-and-coming companies, some of which offer niche products for specific industries. Concerns about pricing pressure are warranted by the intense competition in procurement and expense management, two of the most competitive markets. Since it’s not too hard to come up with a solution that works, COUP should face a lot of competition in the final market, which should stay active for the foreseeable future.

Product might not work in industries that rely less on digital solutions

The COUP solution focuses on processes that are easily digitalized, such as digital invoices. However, the solution is less effective when processes are not followed, such as purchasing a basket of oranges from a roadside stall that does not provide receipts. This may reduce the TAM that management anticipates.

Recession

A recession is clearly bad for COUP, because a critical component of COUP growth is company spending, which companies tend to do less of during a recession. A recession also causes sales cycles to get longer because companies want to put off big CAPEX investments. It also causes companies to go out of business, which hurts retention rates.

Conclusion

COUP’s solution has, I believe, a very important and direct value proposition to customers – cost savings – which all companies seek to address. Hence, the TAM is huge. As COUP continues to grow on both sides of its network, the resulting scale advantage will continue to compound, further enhancing COUP’s value proposition as it can help companies save more money. While the broader software sector has been beaten down recently due to rising interest rates, the current valuation is a good entry point with a high long-term IRR of 17%.

Be the first to comment