MicroStockHub

Preferred equities have faced a challenging year in 2022 as higher interest rates and slower economic growth cause most to depreciate considerably. Many preferred equity funds, such as the levered Virtus InfraCap US Preferred Stock ETF (NYSEARCA:PFFA), were popular in 2021 as many investors sought high-yield investments to offset ultra-low interest rates. However, since interest rates rose rapidly this year, such funds delivered significant losses.

I warned about the potential for PFFA to suffer significant losses in 2021 in “PFFA: Leverage, Preferred Stocks, And Rising Rates Do Not Mix.” PFFA was around its cycle peak then and has lost 25.5% of its value since, or 17% after dividends. I reiterated the negative outlook over the summer in “PFFA: 9% Yield Is Not High Enough Given Growing Credit Risks“, with the fund falling ~15.5% since. Overall, PFFA faces two key issues; the rise in interest rates and the increase in credit risk factors. With the economy slowing, it is generally likely that the Federal Reserve’s longer-term interest-rate outlook will decline or stagnate, so higher interest rates no longer bode a considerable risk to PFFA – unless inflation reaccelerates. That said, as evidence of an economic slowdown mounts, PFFA may suffer permanent losses as credit risks grow.

In general, credit risk is a more significant risk factor for preferred equities than interest rates, particularly when leverage and option selling are used. Most analysts seem to focus on PFFA’s high yield and dividend coverage but not the weak dividend coverage of many of its constituent holdings. In my opinion, PFFA’s high yield clouds the logic of many analysts covering the fund – who do not look toward its considerable immediate and long-term risks, as seen in its losses this year. Quite frankly, 2023 may be an even worse year for the fund if the US economy enters a more significant recession. With interest rates likely peaking, the fund benefits from an end to its major 2022 risk factor.

Looking Beyond Front-Page Metrics

Investors clamor for high yields, often at the expense of risk exposure. In my view, this is less logical today as, with higher interest rates, sovereign bonds and similar assets deliver much stronger yields with no credit risk compared to 2021. Still, after its latest round of depreciation, PFFA offers a 10.73% SEC yield at a 10.48% distribution rate – meaning its dividend is “fully covered” by the most surface-level standard.

Around 30% of PFFA’s assets are usually purchased with borrowed money. Most of the fund’s holdings have a 5-10% yield. Short-term borrowing rates are currently around 4% but will likely rise to 5% as the hiking-cycle ends, so much of PFFA’s holdings’ dividends are going to pay interest. Using leverage made more sense in 2021 when interest rates were near zero. Today, they increase volatility while only marginally increasing yield. Additionally, between its high management fee and other costs, PFFA’s total expense ratio is 1.21% which is abnormally high for a preferred share ETF. While it is actively managed, its returns have been no better than its peers and have been considerably worse this year due to its strategy.

PFFA is also relatively opaque regarding its net exposures compared to similar funds. Its manager does the bare minimum by publishing its holdings and a semi-annual update on its sector exposure. However, it does not offer the more-useful information found in most peers. As seen in iShares, This usually includes weekly updated credit quality exposure metrics, beta, historical volatility, and derivative exposure. Without these metrics, investors, analysts, and financial advisors can not correctly assess PFFA’s risk exposure and instead rely on backward-looking data. PFFA’s beta and standardized annual volatility are 1.7X and 33% based on outside calculations, meaning PFFA is expected to rise and fall around 1.7% for every 1% change in the S&P 500. At a surface level, PFFA is about twice as risky as the S&P 500, but that risk is generally skewed toward the downside.

Compared to the “benchmark” PFF, PFFA holds much more exposure to mortgage REITs (~32% of holdings) and energy MLPs (~22.2% of holdings). Both of these industries pay very high dividends (and high risk), with the mortgage REIT ETF (REM) paying an 11% yield and the energy MLP ETF (AMLP) paying an 8% yield. An additional ~32% of PFFA’s holdings are in financials; however, they are skewed toward smaller banks, which are often riskier than the larger ones.

Energy MLPs are historically volatile, given declines in energy demand, but I believe they’re safer today than in the past. On the other hand, many mortgage REITs have suffered extreme book-value declines this year as mortgage rates have risen. I cover numerous firms in PFFA’s book, including ARMOUR (ARR), AGNC (AGNC), and others – most of which face bankruptcy risk if the mortgage market’s strain continues to grow.

While those specific firms may be riskier than others within PFFA’s book, I believe it is fair to state that PFFA’s credit risk exposure is materially higher than PFF’s. That is not a “bad” strategy as, during a recovery, such assets have a considerably higher upside than most. Indeed, under (quite) bullish assumptions, I believe PFFA is positioned to deliver alpha over PFF or other peers. However, combined with its leverage and opaque options exposure, PFFA is liable to suffer permanent and significant losses during an economic recession.

The experience in 2020 is likely not a strong precedent for its risk. PFFA lost around two-thirds of its value during the spring crash as credit risks soared. However, it was “saved” by the Federal Reserve’s strategy of directly infusing trillions into the economy and purchasing “fallen angel” bonds. As the Federal Reserve has generally made clear, it does not intend to make a dovish pivot soon and likely can not, given the massive inflation created during the last round of QE. In the long run, inflation is bearish for PFFA since it causes long-term interest rates to rise. Even if PFFA is eventually saved by the “Fed put,” that would likely result in higher interest rates in the long run to PFFA’s detriment.

Recession Credit Risks Continue To Grow

The “benchmark” ETF PFF carries typical credit ratings around the BB to BBB range or right around the junk-bond cusp. PFFA’s holdings are considerably riskier, many of which may not be rated. Still, I estimate they would be closer to the CCC to BB range based on their yields at purchase and typical credit ratings within mortgage REITs, MLPs, and smaller banks. “Single B” is likely a reliable proxy for PFFA’s current credit exposure.

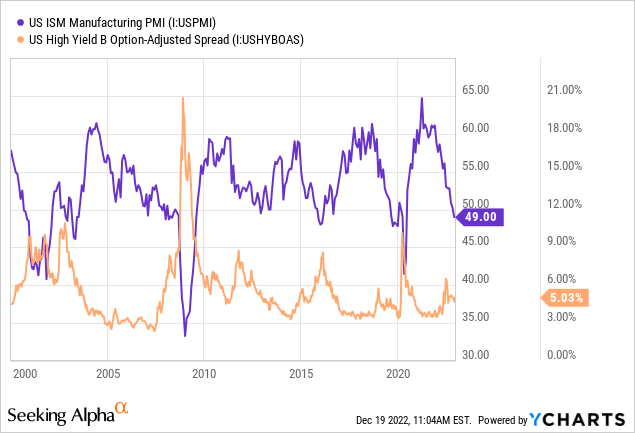

Interestingly, credit spreads have not risen substantially this year despite the moderate rise in recession risks. Comparing the “business growth” indicator, the manufacturing PMI, to the spread on “B-rated” corporate bonds (or their yield minus the equivalent Treasury rate), we can see the spread has only increased by a marginal ~1.5% this year. See Below:

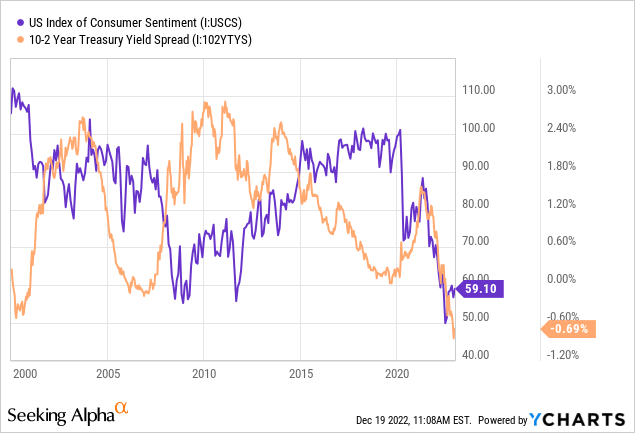

In 2000, 2008, 2013, 2015, and 2019, the manufacturing PMI was around as low as today, but the spread rose to about 9-12%. The 2019 trend is odd as spreads remained extremely low despite slowing economic growth but skyrocketed in 2020 due to the lockdowns. Of course, each slowdown is different, but notably, the spread has not risen as would be expected given the past business activity slowdown. This fact is particularly interesting given the additional leading recession indicators, which were not as strong in numerous previous PMI declines, such as consumer sentiment and the inverted yield curve:

In 2019, business activity and the yield curve (a proxy for bank lending returns) were low and signaled high recession risk, which was not priced into B-rated bonds until it was an immediate event in 2020. Of course, this point is obfuscated by the virus, lockdowns, and stimulus capacity, which were “one-off” factors. Consumer sentiment was also extremely strong in 2019, largely offsetting the business and banking slowdowns.

Today, all three of these indicators simultaneously point toward a bearish outcome, yet credit spreads have not increased proportionally. There are likely a few reasons for this. Firstly, base interest rates have risen dramatically, so riskier corporate bonds may not have been re-priced yet. Secondly, investors may assume the Federal Reserve will bail out markets in a recession, so markets are not pricing in this risk factor. In my view, the latter is likely the case, but as seen in the Federal Reserve’s speech last week, a shift in that view could lead to rapid declines for credit-risk assets such as PFFA.

The Bottom Line

Overall, I remain very bearish on PFFA and believe the fund will likely face more considerable losses in 2023 than in 2022. Further, I expect those losses to be more-permanent as some of PFFA’s holdings face material bankruptcy risk given a recession. Additionally, given concern regarding inflation and QE, it seems unwise to bet on PFFA benefiting from a Federal Reserve QE boost in a recessionary scenario.

The most bearish fact facing PFFA is that it has not declined this year due to a significant rise in credit risks. While “credit risks” have risen, they are not priced into most preferred equities and junk bonds. Instead, these fixed-income assets have declined almost entirely due to the rise in interest rates. In other words, PFFA has minimal upside potential, given a decline in recession risks. In fact, if recession risks decline, PFFA may continue to slide due to a higher long-term interest rate outlook. Thus, PFFA is stuck in a “lose-lose” scenario where either higher credit spreads or interest rates are likely to weigh on its value.

I would not bet against PFFA due to its high yield, but it seems to be a poor investment for 2023 with considerable downside risk compared to upside potential. Short-term Treasury or short-term corporate bonds appear to be far better risk-reward investments. While their yield is lower at 4-6%, their risk profile, both from recessions and interest rates, is far lower. For example, the short-term corporate bond ETF (VSCH) has a 5% yield, half of PFFA’s, but PFFA’s annualized volatility level is around 11X higher. Put simply, when interest rates are as high as they are, there is little to gain and much to lose by focusing on riskier levered bets like PFFA.

Be the first to comment