Galeanu Mihai/iStock via Getty Images

EnLink Midstream, LLC (NYSE:ENLC) (“EnLink”) closed 2021 at $6.89/share, and as of this writing has recovered to the $10+ area, a 48% gain in 2022, despite the greater market swoon. Back in February, in EnLink Midstream Outpaces The Market to Start the Year, we discussed the extensive hedging loses that weighed on earnings in 2021 and showed how EnLink’s variable pay flexes with the rise and fall in commodity prices. The take-away was that hedging losses would decline in 2022 and earnings would rise accordingly. We also built a simple model to show how the availability of ENLC units in the market drives the share price higher and lower.

Recent buying from both major institutions and EnLink itself has continued to drive EnLink’s unit price higher, although the recent market weakness will blunt some of the gains. In this article, we’ll look at recent updates to guidance and projects and review their capex spend over the years to gage the return on all that spending.

Guidance and projects

For those who follow energy markets, the unfolding events in the space have been nothing short of stunning. From natural gas prices in the $8-9/MMbtu range, to WTI and Brent oil prices trading at $120/bbl, to the slew of LNG long-term binding agreements that have recently been announced, the global recovery in the oil and gas markets from the depths of COVID has been remarkable.

With that recovery, has come increased activity – more drilling, more M&A and greater profits. In May, EnLink revised their net EBITDA guidance from $1150MM at the midpoint, to $1220MM at the midpoint. The majority of the rise is due to increased activity and the rise in prices for natural gas, oil and natural gas liquids. Growth Capex, net to EnLink, also increased from $245MM at the midpoint to $295MM at the midpoint. Free cash flow after distribution increased from $315MM at the midpoint to $345MM at the midpoint.

Carbon Capture Business

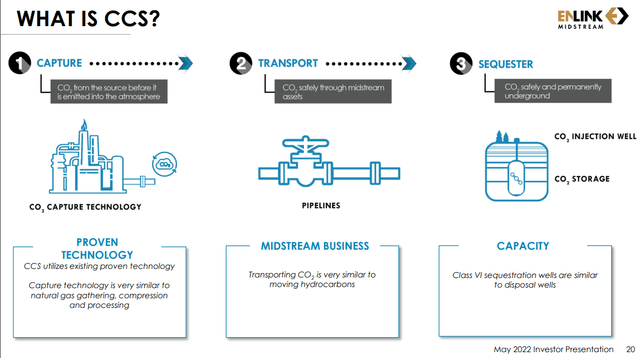

EnLink has announced a series of partnerships in the carbon capture space both in Louisiana and the Barnett. We covered the topic of carbon capture in Carbon Capture Attracting Investment and EnLink provided extensive coverage of their CCS plans in their Q1 2022 quarterly report, so we won’t go into too much detail here except to highlight their recent partnerships. EnLink has yet to provide returns on these projects because they are still laying the foundation for the business, but they have outlined a plan to target Louisiana’s industrial zones which are heavy emitters of CO2.

Back in November of 2014, EnLink purchased 3 systems from Chevron (CVX) for $235MM: the Sabine system and the Bridgeline systems (which they still own today) and the Chandeleur system (which they subsequently sold). The Bridgeline System, along with their exiting LIG system, provide redundancy in the pipeline servicing end-users in Louisiana, especially in the industrial corridors. The carbon capture business allows them to re-purpose that pipe from natural gas to CO2. Here’s a quick summary of the projects announced to date:

- Letter of intent with OXY (OXY) Low Carbon Ventures: EnLink plans to use both existing and new pipelines to move CO2 from customer sites along the Mississippi Corridor to a planned sequestration site in Livingston Parish run by OLCV.

- Partnership with Talos: Similar to the Oxy partnership, EnLink would provide the pipes and Talos Energy (TALO) would provide the sequestration sites, this time in 4 locations in southern Louisiana.

- BKV Corporation: BKV is now the largest E&P operating in the Barnett Shale basin with their recent purchase of Exxon’s (NYSE:XOM) assets in the Barnett. BKV purchased roughly 4,000 producing wells from Devon Energy (NYSE:DVN) in late 2020, primarily in Wise, Denton and Tarrant counties. The new CCS project would use EnLink’s Bridgeport facility to capture CO2 (which is produced along with natural gas) and pipe it to BKV’s nearby injection well. Normally, produced CO2 is vented to the atmosphere.

- Honeywell and EnLink Collaborate to Deliver Carbon Capture Solution: While the Talos and OXY partnerships provide sequestration, Honeywell (HON) provides customer site carbon capture solutions, especially in the production of hydrogen. Honeywell has a broad range of carbon capture solutions which they will use to target customers in the Mississippi corridor, from New Orleans to Baton Rouge, starting with a facility they own and operate in the area.

CCS, an overview (EnLink Investor Presentation)

The CCS space is critical not only for EnLink and the emitters, but for the midstream, E&Ps and global energy complexes. The world is becoming increasing intolerant of greenhouse gases and CCS allows natural gas a pathway to exist in a low-carbon future. When you think about the CCS space for EnLink, it is a gathering and transportation solution run in reverse. Instead of gathering and transporting hydrocarbons from wells and delivering them to end-users, they are gathering CO2 from end-users and delivering it back to sequestration wells. The bonus is that unlike natural gas and oil wells, the CO2 stream doesn’t decline over time. If the plant and the existing federal 45Q tax rebates remain in place, the molecules will keep flowing, and that makes it a relatively lower capex endeavor.

We can envision a rapidly evolving world where the midstream gathering and processing company of the future provides turn-key solutions, delivering hydrocarbons to run our industrial complexes and providing CCS solutions on the backend. The CCS business gives EnLink a competitive advantage over other companies who only provide part of the solution, both on the E&P side of the business with companies like BKV and on the end-user side in Louisiana. In a low-carbon future, the midstream companies that solve these challenges will increasingly garner the business.

EnLink earned $455MM in revenue from their gathering and transportation segment in 2021, a significant portion of their revenue across all segments of the business. That pie should grow once EnLink’s Carbon Solutions takes off, but it will take several years to realize it. For now, we’re going to put a pin in the economics until EnLink can provide greater visibility.

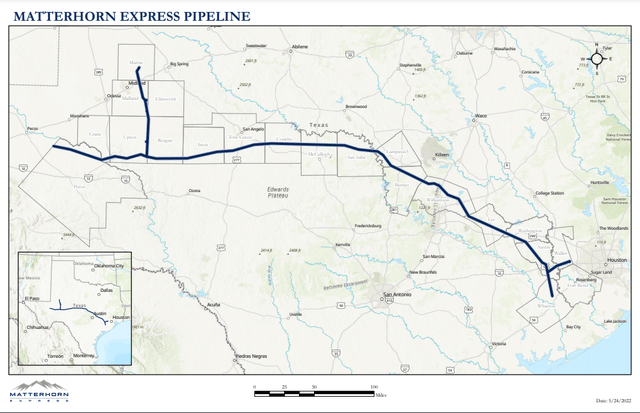

Matterhorn Express Pipeline

The headlines made this project sound like EnLink had a much larger role to play but in truth, they are only a small investor in the project. The Matterhorn Express Pipeline is a proposed 42” pipeline that will run from Midland Basin to demand centers in Katy, TX and will be in service in the 2nd half of 2024. It spans 490 miles and will transport up to 2.5 Bcf/d. That’s a major take-away pipe, and if we compare it to similar projects that were developed recently (for example, Kinder Morgan’s Gulf Coast Express pipeline costs $1.75 billion), it will cost somewhere between $1.75 to $2 billion dollars, perhaps more in this inflationary environment. Of that, EnLink will invest $100MM in the project ($70MM invested in 2022 and $30MM in 2023), a relatively small portion.

Matterhorn Pipeline Map (Whitewater Midstream)

This is a partnership between Whitewater Midstream, EnLink, Devon Energy and MPLX. Most likely, EnLink will receive between 5-6x adjusted EBITDA on the project. Again, judging by similar projects, the throughput will start at 2.0 Bcf/d, and with additional long-term agreements and installed compression, could be expanded up to 2.5 Bcf/d. The recent FID on the project will aid the Permian with take-away constraints looming for the region.

EnLink’s primary shareholder, Global Infrastructure Partners, had also invested $325MM in senior secured bullet notes back in June 2020 in another Permian pipeline project called the Whister Pipeline which runs from the Waha hub to Agua Dulce in southern TX. That project was spearheaded by a joint venture between Whitewater, MPLX (25%), West Texas Gas and Stonepeak Infrastructure (25%). The operator of that pipeline is MPLX. Whitewater Midstream will operate Matterhorn.

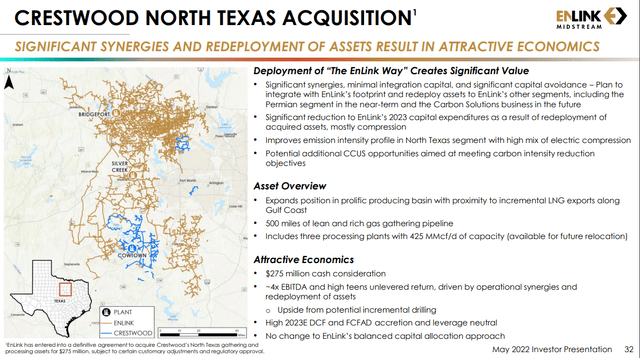

Crestwood North Texas Asset

EnLink’s Combined Barnett Footprint (EnLink’s Investor Presentation)

EnLink has agreed to acquire Crestwood Equity Partners’ (CEQP) Barnett Shale midstream assets for $275MM. The exact economics of this deal are a bit hard to come by in part because Crestwood doesn’t provide EBITDA numbers specifically for the Barnett asset. They lump their Barnett numbers in with their Delaware and Marcellas figures. However, there are some clues to the deal. EnLink would get the gathering system (see blue sections), 3 processing plants with a total capacity of 425MMcf/d (only 1 is operational at this time), and 140,000 dedicated acres. The average 2021 gathering volumes were 218 MMcf/d and 214 MMcf/d in Q1 2022, and the processing volumes averaged 76 MMcf/d in 2021 and declined to 71 MMcf/d in Q1 2022. EnLink plans to shut down the last remaining processing plant and shift the processing volumes over to their Silver Creek and Bridgeport facilities.

EnLink claims the deal will garner a 4x net EBTIDA multiple once they’ve redeployed the surplus compression equipment and 3 processing plants to other areas of the business including their CCS business. Some of the equipment may be sold to help pay for the deal. The midstream volumes for the assets have been in decline for over a decade due to a lack of drilling in the southern Barnett region. A peek at the current drilling permits in Somervell, Hood and Johnson counties shows absolutely no activity. Sage Natural Resources drilled a few wells in Tarrant county on the small Arlington Lake dry gas system in 2021 and Diversified Energy which currently owns the bulk of the well connects in Somervell, also contributed a few new connections in 2021. This kept the gas volumes roughly flat for that year.

Typically, a declining asset like Crestwood’s Barnett system would be valued at 3x net EBITDA so the price paid is a bit rich. The contracts have a mix of both fixed fees and percent-of-index fees so they are doing better with the NGL composite priced at over $1/gallon and natural gas in the $8-9/MMbtu range. If EnLink moves the processing plants to the Midland basin over the next couple of years and reuses the compression equipment, they would offset $150MM to $160MM in capex costs versus a new build.

We’ll get a better understanding of the cash flow in the coming quarters. A 4x cash flow says the assets will generate roughly $30MM per year in EBITDA. EnLink’s guidance for the Barnett position rose by $15MM at the midpoint in their recent investor presentations which dovetails with this assessment given that they will realize about 6 months of production.

Adding up all the growth Capex and the pending projects in 2022, EnLink will spend $650MM in 2022: $275MM on the Barnett system, $70MM deployed for Matterhorn, $80MM to move the Oklahoma Thunderbird plant, $215MM in well connects and other growth projects and $10MM to finish paying for the Amarillo Rattler acquisition in the Midland basin. They haven’t spent this level of capex since 2019 and it’s nice to see them get active again.

Capex Spend & Returns Over the Years

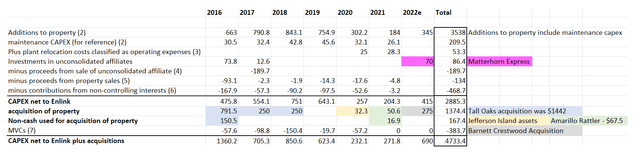

What is the capital deployed over the years? For those that follow the company, numbers get presented all the time, so it is hard to keep track. Fortunately, annual reports keep tabs of all that, and we can compile the data:

EnLink’s CAPEX spend 2016-2022 (Author with data from EnLink’s Annual Reports)

This is a busy chart, so let’s unpack a few things:

- Amounts are all in millions of dollars.

- Additions to property include both growth and maintenance CAPEX, and we will include both in our final calculation. We’ve included the maintenance capex for reference only.

- We will add plant relocation costs that were classified as operating expenses.

- In 2017, they closed the sale of their interest in HEP for $190MM in cash. This offsets CAPEX spent so we will subtract this.

- Property sales reduce CAPEX expense and, in many cases, it reduces EBITDA, so we will subtract these sums. For example, in 2016, they sold the NTX pipeline system in the Barnett for $84.6MM which reduced their CAPEX spend and reduced their EBITDA.

- Some of the CAPEX is contributed by unconsolidated affiliates like NGP who owns 50% of EnLink’s Delaware system. These sums also need to be subtracted.

- We also need to subtract payments for shortfalls in minimum volume commitments. When an E&P signs an agreement with a midstream company, obligating them to produce a certain volume of hydrocarbons, and they don’t follow through (I’m looking at you Devon Energy!), they must pay contractual penalties called shortfall payments for minimum volume commitments. Since 2016, EnLink has collected $409MM in this category. The best way to think of these payments is offsets to CAPEX because EnLink has built processing plants and compression stations to account for the extra volume that never materializes. It then costs additional CAPEX to move those assets to another basin. Because of this, we reduce the CAPEX amount by these shortfall payments, and we also remove these payments from EBITDA.

That was a lot to unpack! What’s left is a clear picture of the net capital spent from 2016 through 2022, which is $4.7 billion or an average of $676MM per year including maintenance CAPEX.

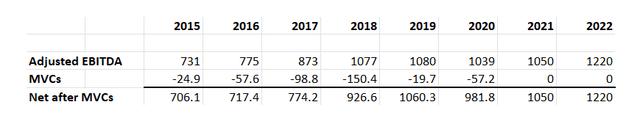

That’s the numerator and here’s the denominator. EnLink grew adjusted EBITDA net of MVCs by $514MM. This is a 9.1x return inclusive of the declines in the Barnett which dropped roughly $115MM in adjusted EBITDA net of MVCs and Oklahoma which lost $77MM in adjusted EBITDA net of MVCs from its peak in 2019.

EnLink’s adjusted EBITDA 2015-2022 (Author with data from EnLink’s annual reports)

If we back out these declines, remove the maintenance CAPEX and remove the Tall Oak acquisition which will take years to fully rationalize, we can see that new projects and small acquisitions from 2016-2022 have a 5-6x multiple depending on the commodity price environment. This is consistent with the estimated returns that EnLink has quoted (typically 5-7x). The quoted project returns don’t include the heavier declines in some of the basins.

Conclusion

EnLink has resumed their capex spend and returned to levels last seen in 2019. This spending level, along with increased producer activity and higher commodity price levels, will boost their EBITDA levels significantly. On the last earnings call, they stated that Oklahoma will see a significant boost in producer activity in 2023 (most likely from Devon Energy) which will reverse the previous decline in that basin. The decline in the Barnett has also leveled off thanks to re-fractionation activity from BKV and new wells being drilled in that basin. If we combine this with the supersized growth we are seeing in their Permian position, we will see adjusted EBITDA lift to the $1350MM area in 2023. EnLink is back in growth mode.

Be the first to comment