Andy Feng/iStock Editorial via Getty Images

Elevator Pitch

My Hold rating for NIO Inc. (NYSE:NIO) stays unchanged. I wrote about NIO’s five-year outlook in my prior article for the company published on April 7, 2022. My latest article focuses on NIO’s share price recovery that began in the second half of May, and the sustainability of the company’s positive stock price momentum going forward.

NIO’s shares rose since the middle of May 2022, driven by positive expectations about May 2022 vehicle deliveries data and Q1 2022 financial results. The company’s vehicle deliveries in the previous month grew strongly, but its Q1 2022 vehicle gross margin was a disappointment. Taking into account the expected vehicle gross margin contraction for Q2 2022 and the stock’s valuations as compared to peers, I am of the view that NIO’s shares will be range-bound in the short term and not continue going up. This supports my Hold investment rating for NIO’s shares.

Why Has NIO Stock Risen Recently?

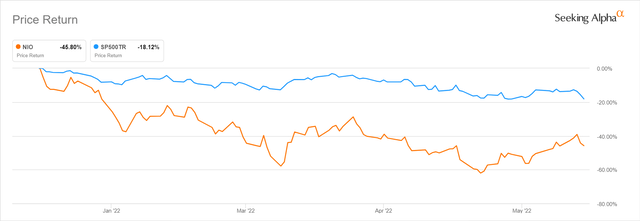

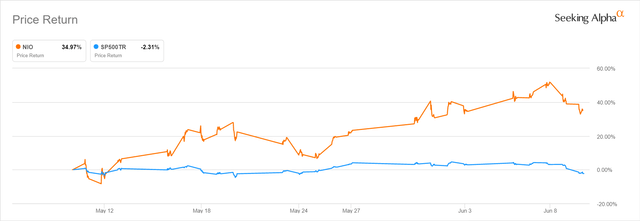

NIO’s shares have performed poorly in 2022 thus far, but it has seen a strong recovery in its stock price since mid-May as per the charts below. Year-to-date, the company’s share price fell by -45.8% as compared to a -18.1% correction for the S&P 500. But things have started to turn around in the past month, with NIO’s shares rising by +35.0% in contrast with the S&P’s 500’s -2.3% decline during the same period.

NIO’s 2022 Year-to-date Stock Price Performance

NIO’s Share Price Performance In The Past One Month

NIO’s stock has risen recently, or more specifically since the middle of May. I think this is mainly attributable to the market’s positive expectations about the company’s May 2022 vehicle deliveries data and first-quarter earnings which were released on June 1, 2022 and June 9, 2022. In other words, investors thought that NIO’s vehicle deliveries for May and Q1 results will surpass expectations, and they started buying NIO’s shares in the second half of the previous month.

In the next section of the article, I determine if NIO has managed to live up to investors’ expectations.

NIO Stock Key Metrics

On June 1, 2022, NIO released the company’s vehicle deliveries data for May 2022, and the metrics were decent.

Despite headwinds like supply chain disruptions and the COVID-19 lockdown in Shanghai (key manufacturing base for the company), NIO still achieved a reasonable amount of vehicle deliveries at 7,024 units in May 2022. This was equivalent to a MoM (Month-on-Month) growth of +38% and a YoY increase of +5%.

Notably, the ET7, which NIO refers to as its “flagship premium smart electric sedan”, saw deliveries jump by +146% MoM from 693 units in April 2022 to 1,707 units in May 2022. In my earlier April 7, 2022 article for NIO, I noted that the company “has plans in place to launch three new models (ET7, ET5 and ES7) in 2022”, so the strong delivery numbers for the first new model launched, ET7, are encouraging.

Prior to the May 2022 vehicle deliveries data announcement, NIO’s shares have already went up by +37% from $12.71 as of May 11, 2022 to $17.39 as of May 31, 2022. NIO’s stock price rose by another +17% to close at $20.38 as of June 8, 2022, after investors’ bullish expectations about the company were validated by its May 2022 operating data release.

NIO subsequently announced the company’s financial results for the first quarter of 2021 on June 9, 2022 before trading hours, and another important set of metrics was disclosed. As part of the Q1 results announcement, NIO guided for Q2 2022 vehicle deliveries in the 23,000-25,000 units range. This implies that NIO expects to deliver between 10,900 and 12,900 units in June 2022, which translates into a robust MoM growth of +55%-84%. Furthermore, NIO stressed at its Q1 2022 earnings briefing on June 9, 2022 that “we are confident of ramping up of our deliveries at a much faster pace in the second half of this year.”

In a nutshell, NIO’s vehicle deliveries and revenue for full-year FY 2022 are likely to exceed market expectations, based on the company’s May 2022 operating data and its management guidance for Q2 2022 and fiscal 2022.

However, NIO’s shares decreased by -8% from $20.38 as of June 8 to $18.82 as of June 9, and declined by an additional -4% to finish at $18.14 at the end of the June 10 trading day. This puts the sustainability of NIO’s recent share price rise in the spotlight, an issue which I discuss in the subsequent section.

Can NIO Stock Continue To Go Up?

In my view, NIO’s stock price will remain range-bound in the near term, rather than keep going up.

I think NIO’s post-results share price correction is mainly due to the company’s weaker-than-expected profitability. NIO’s vehicle gross margin contracted by -280 basis points QoQ and -310 basis points YoY to 18.1% in the recent quarter. This was also -100 basis points lower than the market’s consensus Q1 2022 vehicle gross margin projection of 19.1% as per S&P Capital IQ data. At the company’s first-quarter investor briefing, the company attributed the decrease in vehicle gross margin to “the rising cost of batteries from materials and chips.”

NIO also acknowledged at the recent quarterly earnings briefing that “the vehicle gross margin of the second quarter is going to be lower compared with that of the first quarter” as a result of “the battery cost impact.” In other words, an improvement in vehicle gross margin for NIO, a key re-rating catalyst for the stock, will only happen in the third quarter of 2022 at the earliest.

Separately, a peer valuation comparison also suggests that NIO’s positive share price momentum should be halted, as I explain in the next section.

Is NIO Overvalued Now?

I see NIO’s shares as fairly valued now.

Peer Valuation Comparison For NIO

| Stock | Consensus Forward Next Twelve Months’ Enterprise Value-to-Revenue Multiple | Q1 2022 Vehicle Gross Margin Expansion/(Contraction) On A QoQ (Quarter-on-Quarter) Basis |

| NIO | 2.58 | -2.8 percentage points |

| XPeng Inc. (XPEV) | 2.68 | -0.5 percentage points |

| Li Auto Inc. (LI) | 2.79 | +0.1 percentage points |

Source: S&P Capital IQ

As highlighted in the peer comparison chart above, NIO’s forward Enterprise Value-to-Revenue multiple is largely aligned with that of its peers. However, NIO’s Q1 2022 vehicle gross margin performance was the worst in the peer group.

Separately, it is noteworthy that NIO and its peers are all trading at undemanding low single-digit Enterprise Value-to-Revenue multiples on an absolute basis. But the current market environment doesn’t favor loss-making companies, and NIO is only expected to turn profitable in fiscal 2024 as per S&P Capital IQ.

In my opinion, NIO is fairly valued, rather than overvalued, after considering both the positive and negative factors as discussed above.

Is NIO Stock A Buy, Sell, or Hold?

I still view NIO stock as a Hold given the mixed outlook. The company’s vehicle deliveries for full-year 2022 could surprise on the upside, but it will take longer than expected for a recovery in the company’s vehicle gross margin.

Be the first to comment