These REITs won’t be your superman. Take the gains and reallocate. You don’t want these 3 at today’s prices.

Gil Vicente Xaxas/iStock Editorial via Getty Images

Get ready for charts, images, and tables because they are better than words. The ratings and outlooks we highlight here come after Scott Kennedy’s weekly updates in the REIT Forum. Your continued feedback is greatly appreciated, so please leave a comment with suggestions.

July was an exceptionally exciting month for mortgage REITs. We saw enormous gains throughout the sector. We’re predicting a handful of mortgage REITs to see increases in book value from 6/30/2022 through 7/31/2022. However, as the earnings reports come out you should still expect to mostly see losses for Q2 2022.

So, what’s happening lately?

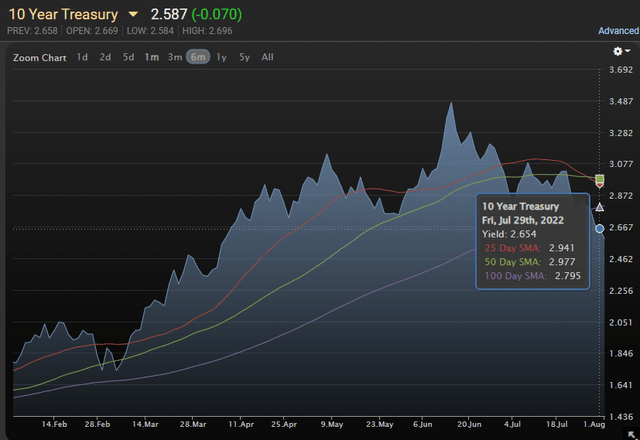

The 10-year Treasury dipped below the 25-day, 50-day, and 100-day moving averages:

MBSLive

That’s pretty exciting. As negative economic news comes in, the 10-year Treasury yield began to sink. With fear of rates rising to nearly infinity, investors began to buy stock again. That helped to push price-to-book ratios. It also creates an interesting scenario for the housing market. Generally, a weakening of the economy would be bad for housing, but a reduction in mortgage rates would be positive for home values. The biggest threat to home values recently was the difficulty for buyers trying to qualify for a mortgage.

As Treasury rates and mortgage rates declined, fear about home values declined significantly. We previously argued that several of these REITs were getting much too cheap. The market suddenly agreed, and prices roared higher. For the agency mortgage REITs, we’re seeing a tightening of spreads between agency MBS and Treasury rates that should help to lift book values.

The result is a mix of ratings. Some weeks ago, we had a huge volume of strong buy ratings. Today we have fewer, but there is still a huge disparity in the risk/reward between mortgage REITs.

Big Rallies

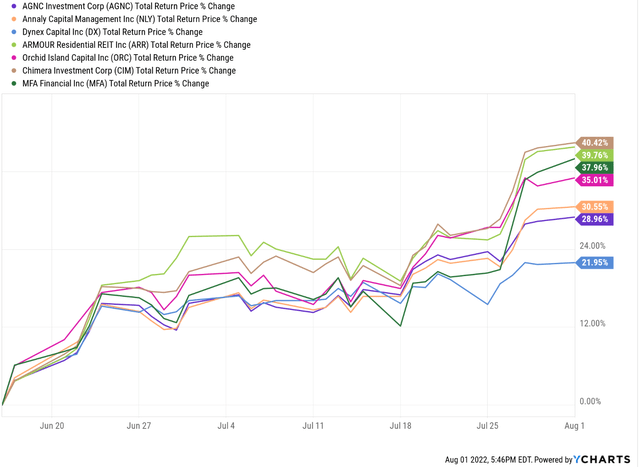

A bunch of mortgage REITs put together huge rallies since June 16th, 2022:

YCharts

That’s not even including the biggest gainers. To put it simply, investors who insisted on waiting on the sidelines missed out dramatically. The environment for mortgage REITs improved and the prices roared higher. We bought NRZ four times that day. The following day, we published: 11% to 18% Dividend Yields, 5 Picks at Huge Discounts.

Regarding NRZ, we wrote:

NRZ has been absolutely wrecked over the last week and we believe the market is precisely wrong about NRZ. We’re backing up that view with a significant investment. We bought another 3,358 shares today. That’s worth about $27,703 at today’s closing price of $8.25 (6/16/2022, when this is prepared rather than 6/17/2022 when it will likely be published). If we’re wrong, this article certainly wouldn’t be enough to cover my losses. Are we wrong? Probably not. It hasn’t happened often. Well, it hasn’t happened often in stock analysis. I’m wrong about other things all the time. Fortunately, I don’t need to be a jack of all trades to succeed.

Do you like analysts who post ratings but don’t have the conviction to buy something they just called out as a strong buy? Me neither. That purchase brings our total up to 7,930 shares of NRZ.

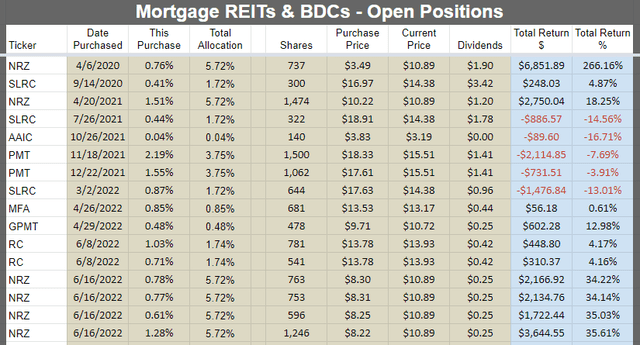

We reduced our position following a large rally, so our total is “only” 5,569 shares of NRZ currently.

These are our current mortgage REIT and BDC positions:

The REIT Forum

Note: These are common share positions only. The preferred shares are a different chart.

Judging from the four purchases of NRZ, you can probably guess what our favorite pick was for that day.

On that article, a reader asked if I had checked interest rate data yet for that day. We do our BV estimates once per week, so something could still have changed abruptly. This was my answer:

I last checked them last night. Before that, I checked on them earlier that day and each day during the week. I don’t need to check daily, but it’s an area of interest and my usual source for interest rate data is also the primary source for MBS pricing.

This is why I can be confident in saying it was a rough week, but I can also eyeball the potential damage. Some mREITs will be hurt worse than others but generally we are looking at low single digits to high single digits (severely over leveraged) for book value hits in the sector between Friday of last week and Thursday evening.

To be clear, we were buying in the middle of June and prices were plunging. It was a period where many investors in the sector were downright scared. That’s a great time to buy.

Focusing On Negatives

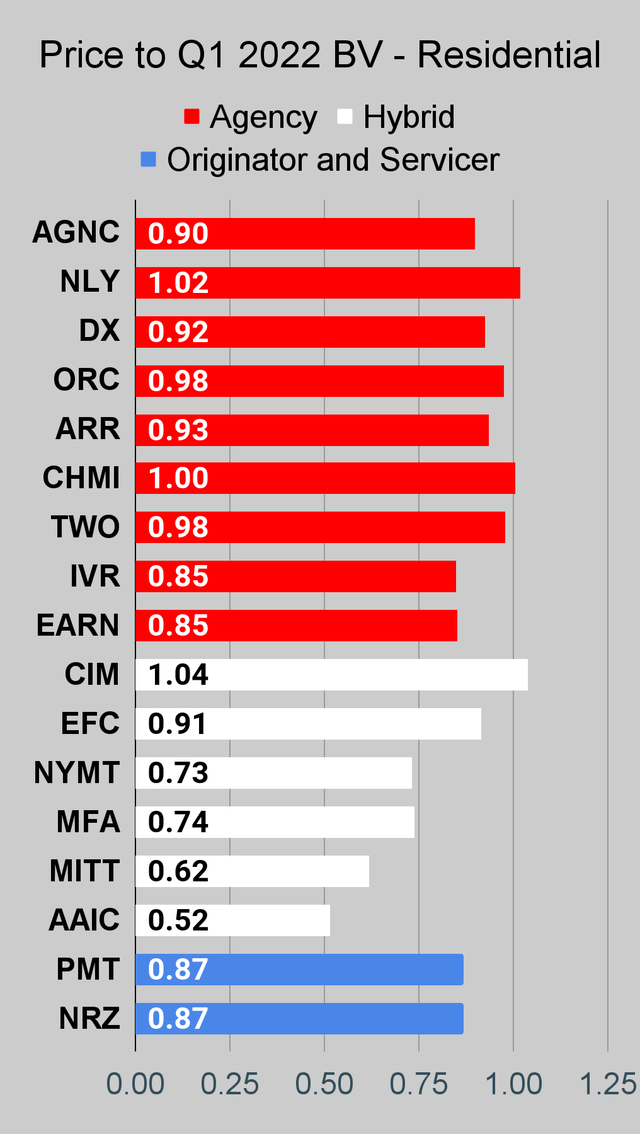

Sometimes we focus on bringing out the bullish ratings, but following the big rally, I think it would be better to mention a few places where investors should look to pocket their gains. Each of these mortgage REITs is trading at a premium to our projection of current book value. We won’t cover every mortgage REIT carrying too much price, but we have a few.

Annaly Capital Management

The massive mortgage REIT is back to nearly $7.00. Bad deal. Seriously bad deal. I think there’s a high chance Annaly Capital Management (NLY) initiates a secondary offering to take advantage of the high price-to-book ratio. Wider spreads are great for investing because the mortgage REIT can lock in a better deal. Spreads have tightened some, but a mortgage REIT can still put capital to work very reasonably.

If NLY issues new capital, they can use it to buy mortgages offering a higher yield. That sounds nice. To maintain similar leverage, they would still need to take on additional debt, which carries higher rates today. Overall, it’s positive, but investors shouldn’t get excited. The stock usually slumps at least a bit when they announce an offering.

How can you tell if the price is high enough? Shares trade at a premium to book value. If the price-to-book is above 1.05 or so, an offering shouldn’t be surprising. We estimated a ratio closer to 1.09, which makes it a very easy decision.

Edit: While I was finishing up this article, a new story came out on Seeking Alpha indicating NLY announced they will offer 100 million shares. That should take it down a bit.

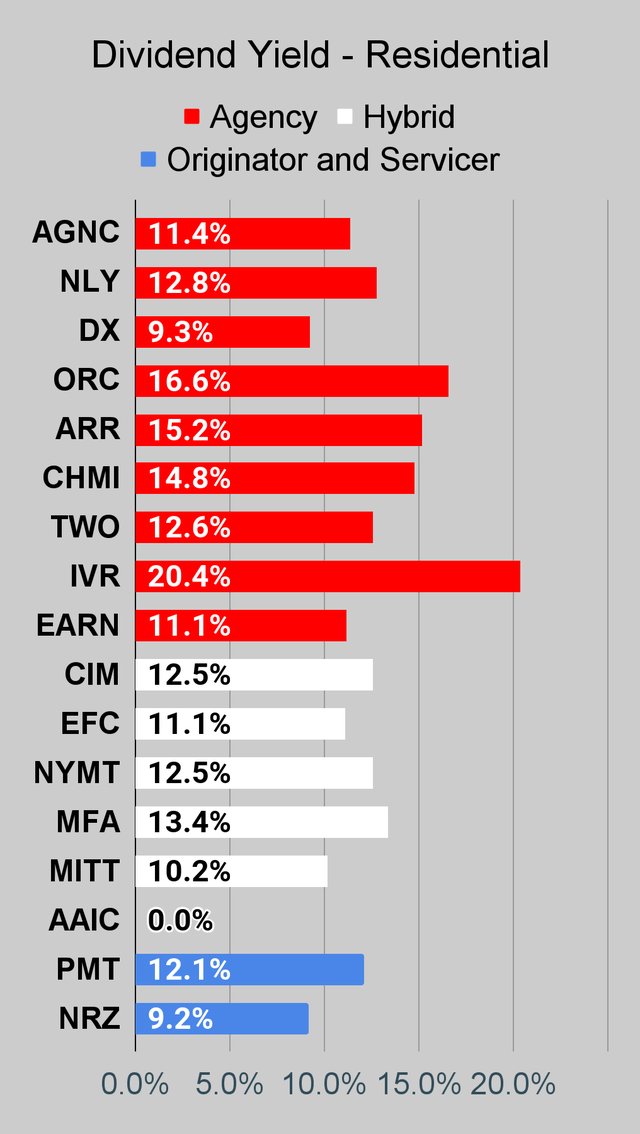

ARMOUR Residential REIT and Orchid Island Capital

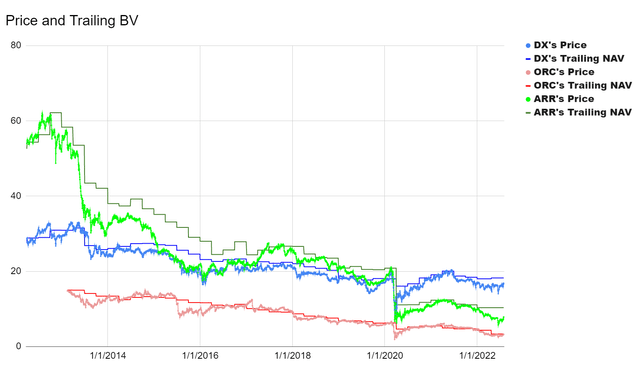

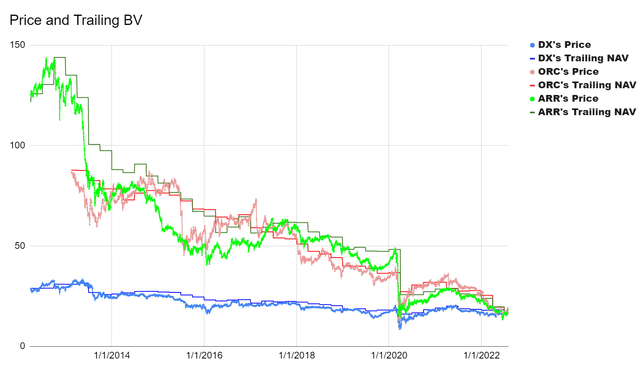

ARMOUR Residential REIT (ARR) and Orchid Island Capital (ORC) are two smaller mortgage REITs are also trading at premiums (using our estimates for current book value). They don’t have an outstanding record, in my opinion, of generating strong total economic returns (change in book value per share + dividends). Their projected premiums are a bit smaller than NLY, but still high enough that it wouldn’t be at all surprising if they took the opportunity to issue new shares. Some investors really like these REITs because of the monthly dividend and the high dividend yield. They could still get a monthly dividend with Dynex Capital (DX). The yield is lower, but DX did a vastly superior job of protecting value for shareholders.

Maybe you’re thinking ARR and ORC generate more earnings, so they are better? No, that’s not how it works. Try to explain the huge gap in book value performance. Any mortgage REIT could ramp up core earnings on book value by taking on extra leverage. The real test of a mortgage REIT is their ability to pay out a reasonable dividend while protecting book value. The rally feels a bit suspect to me because we’re seeing weaker mortgage REITs get bid higher rather than stronger ones. When NLY, ORC, and ARR all have higher price-to-book ratios than DX, that’s not a sign of an efficient market. It feels like some investors are getting really excited about yield and don’t know what they are buying.

The following chart uses the latest quarter-ending book values:

The REIT Forum

You may notice that today, DX has a higher share price and book value. However, the shares start at materially different values. We could modify this using percentage terms, but we can also normalize it by using more than 1 share for ARR and ORC. If we use 5.85 shares of ORC and 2.3158 shares of ARR with 1 share of DX, it results in a nearly identical ending book value:

The REIT Forum

Investors in ARR and ORC got more dividends along the way, but not enough to offset the capital losses. Hopefully, you’ll also notice that the share price rarely moves dramatically away from book value. If it gets well over book value, that’s an opportunity to issue new shares. If it gets well below book value, that’s an opportunity to repurchase shares (something many executives find less exciting). Of course, a mortgage REIT could also just issue shares at a discount to book value. That wouldn’t be awesome, but it is technically possible and has been done.

In summary, prices on NLY, ARR, and ORC are too optimistic. Investors in those shares would have a much better risk/reward profile if they were in DX instead. So why don’t they change? Well, some of them are still focused on the earnings, yelling about how they get to have a big dividend, and throwing a party as their portfolio suffers.

Someone may think rallying by 30% or even 40% isn’t impressive when shares are still so much cheaper than they once were. The problem is that those higher prices of prior years were based on much higher book values. The facts changed and investors who refuse to consider new facts are facing a huge handicap.

Wonder why you need an analyst when the stock just rallied 40%? Because sometimes the role of a good analyst is to encourage you to pocket the gain and reallocate while the prices are right for it.

Something Interesting

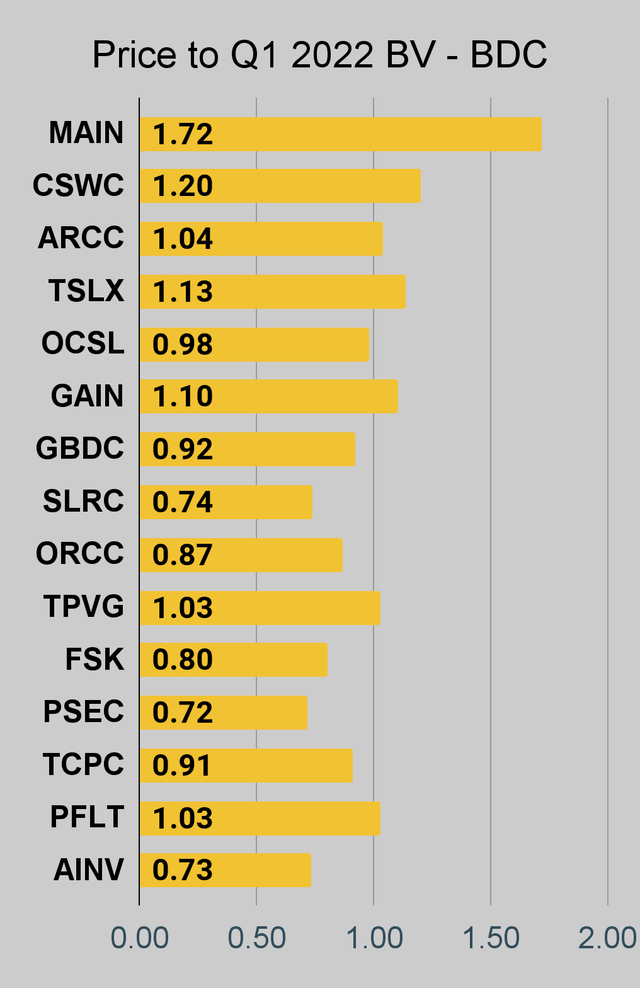

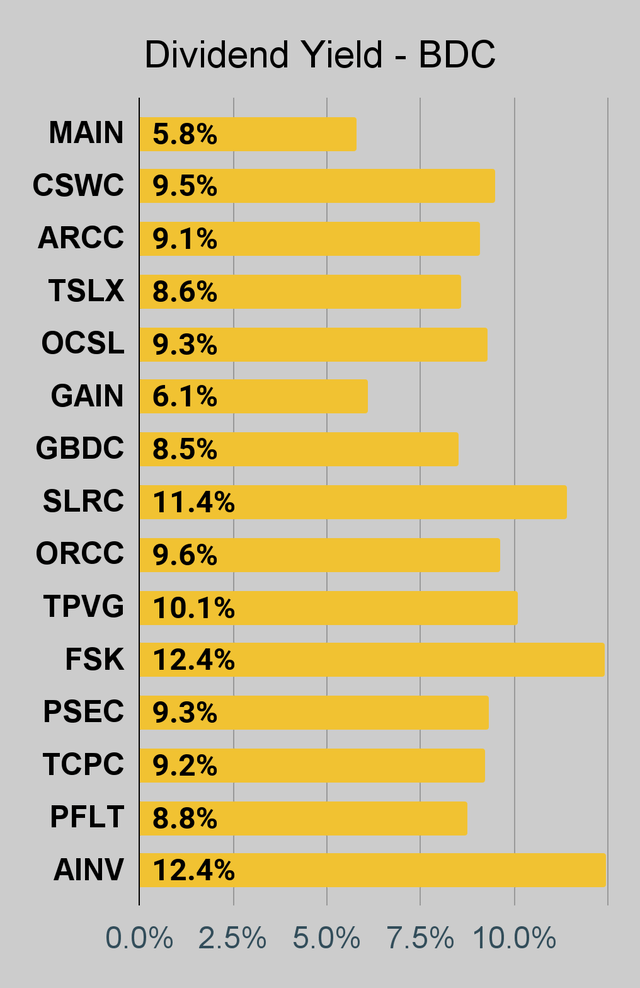

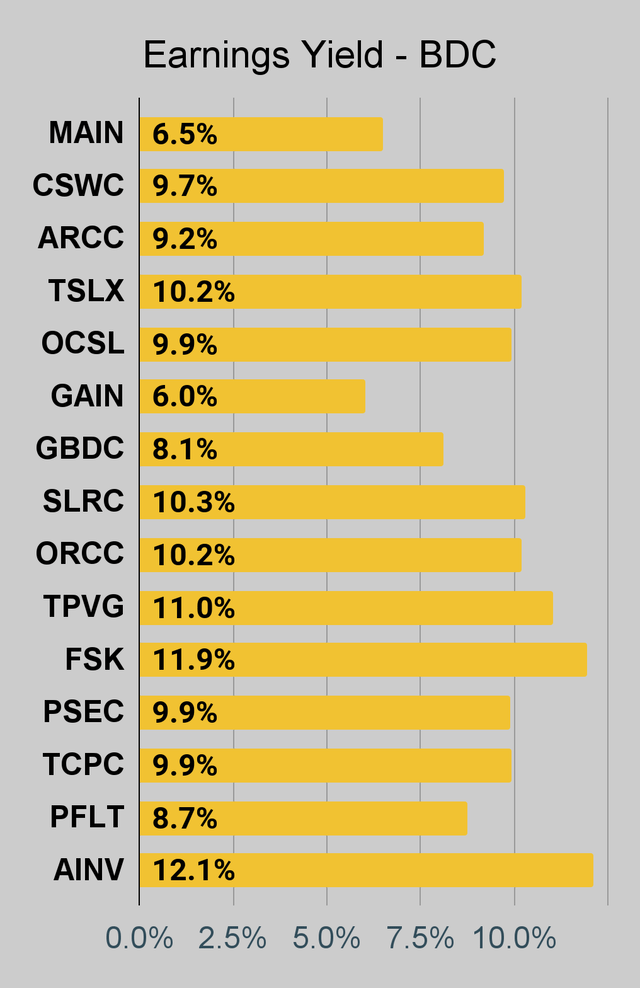

You might think BDCs would’ve rallied dramatically as well. However, there are still a handful trading at discounts to book value. There is still some respectable value in the BDCs and bunch of value in the preferred shares. There are handful of bargains left in the mortgage REIT common shares as well, but vastly fewer following the huge rally.

The rest of the charts in this article may be self-explanatory to some investors. However, if you’d like to know more about them, you’re encouraged to see our notes for the series.

Stock Table

We will close out the rest of the article with the tables and charts we provide for readers to help them track the sector for both common shares and preferred shares.

We’re including a quick table for the common shares that will be shown in our tables:

Let the images begin!

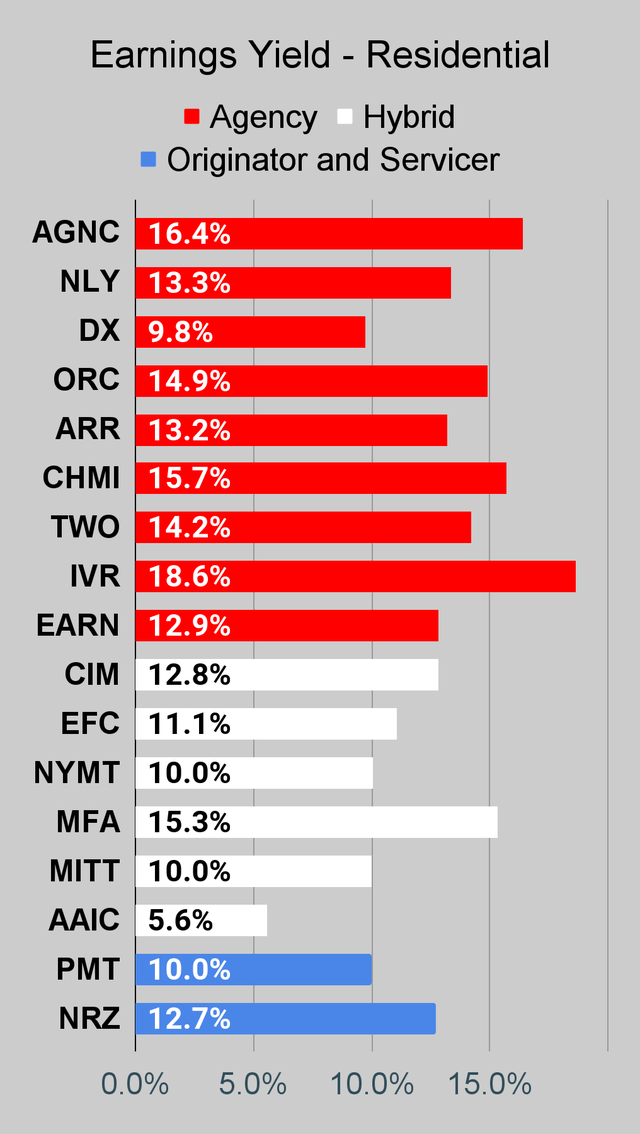

Residential Mortgage REIT Charts

Note: The chart for our public articles uses the book value per share from the latest earnings release. Current estimated book value per share is used in reaching our targets and trading decisions. It is available in our service, but those estimates are not included in the charts below.

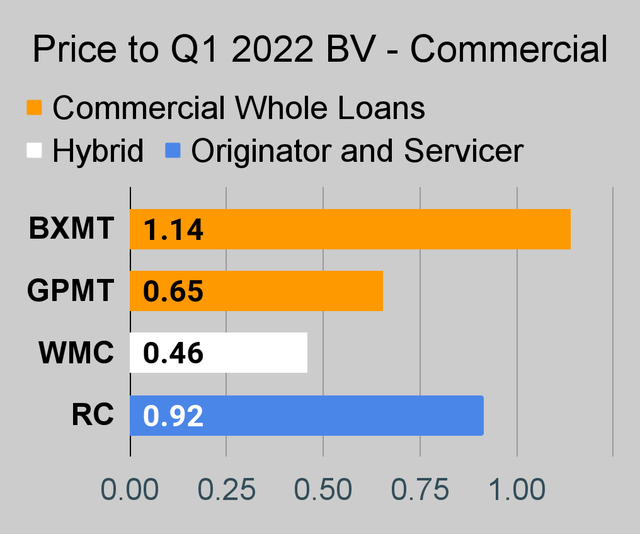

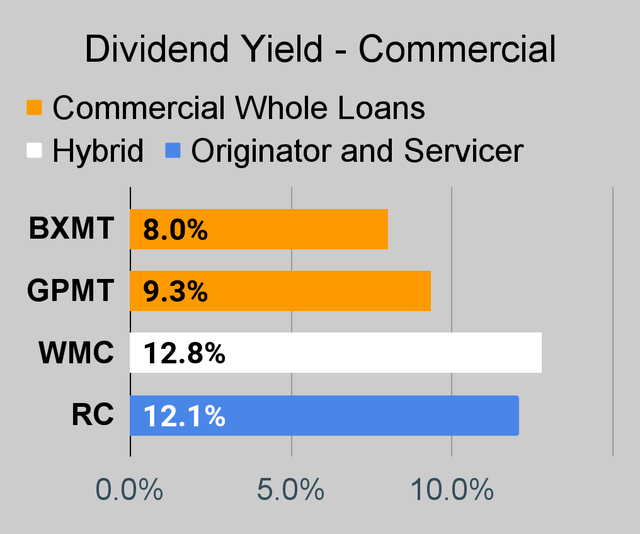

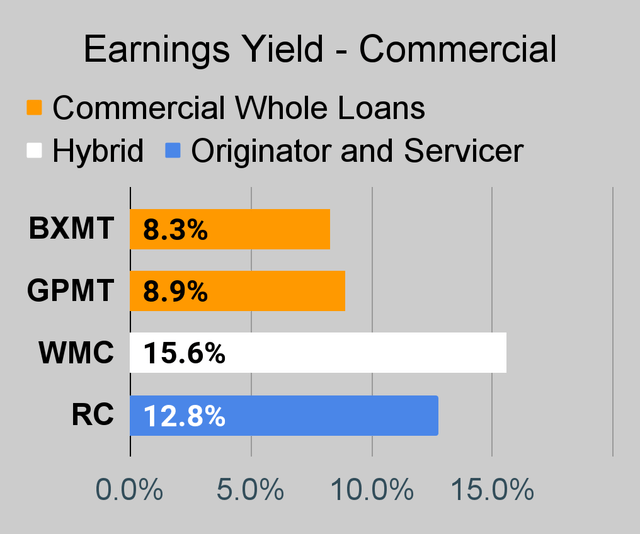

Commercial Mortgage REIT Charts

BDC Charts

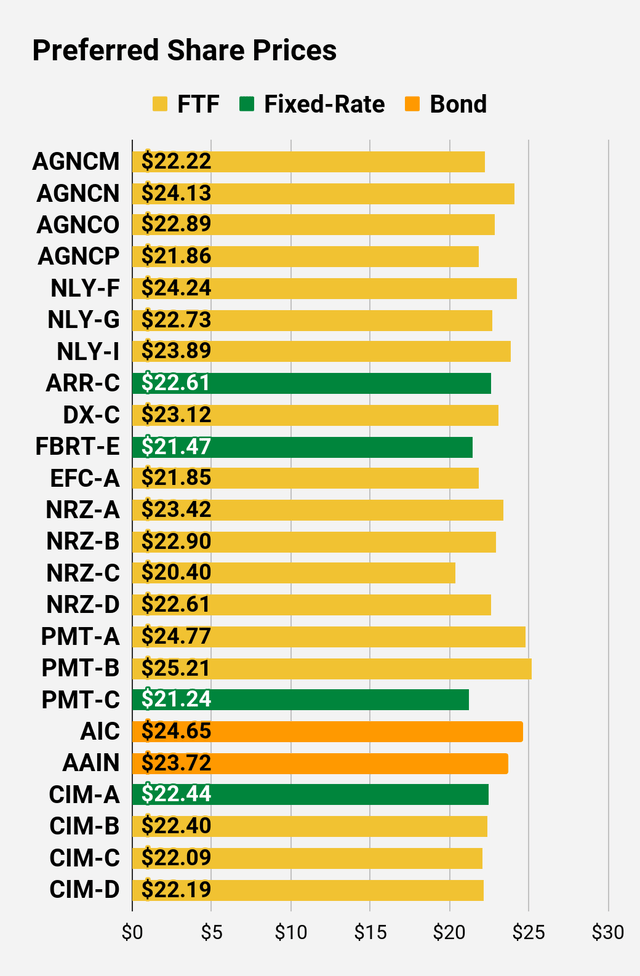

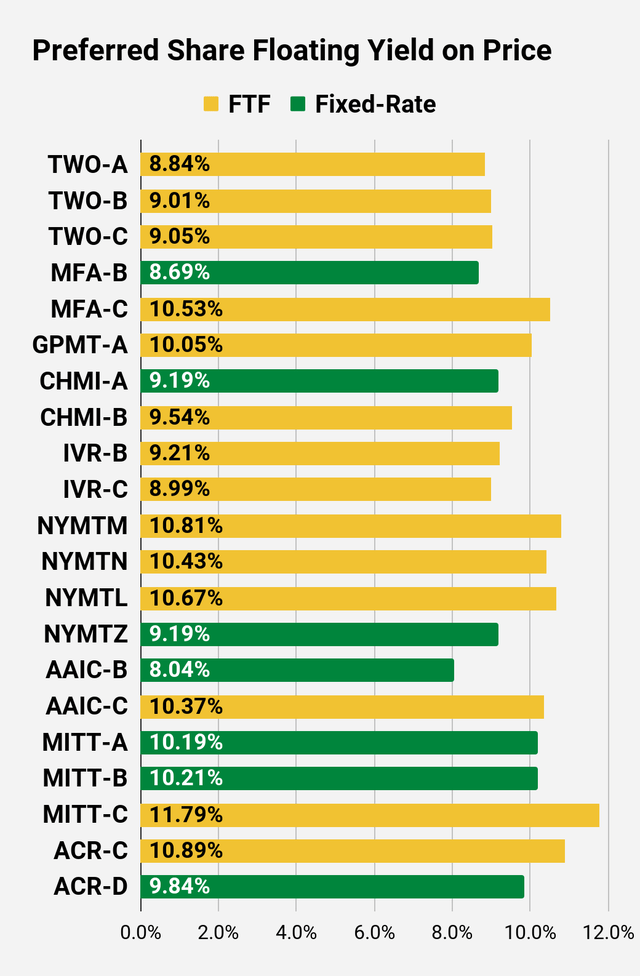

Preferred Share Charts

Preferred Share Data

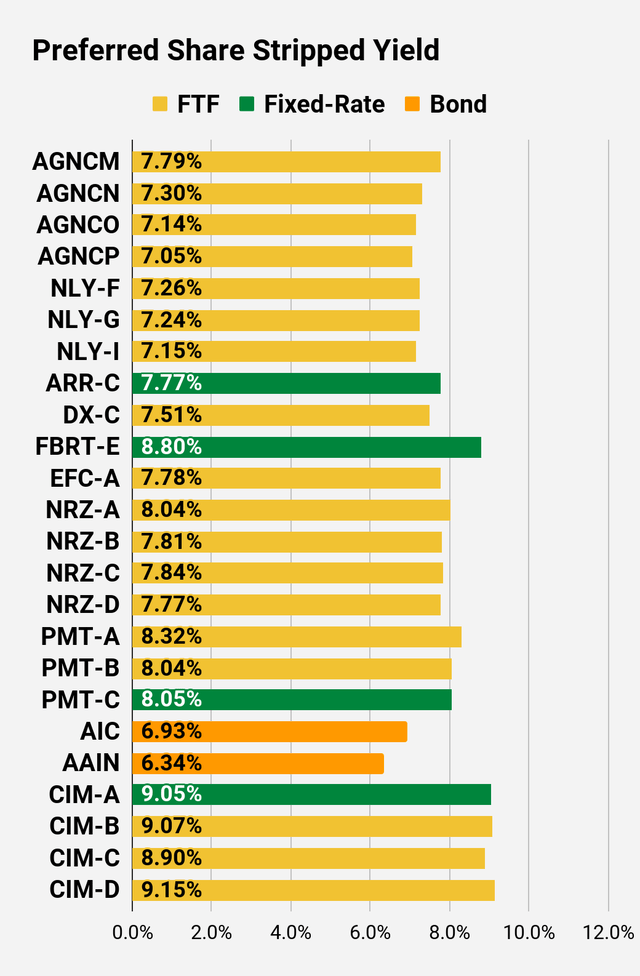

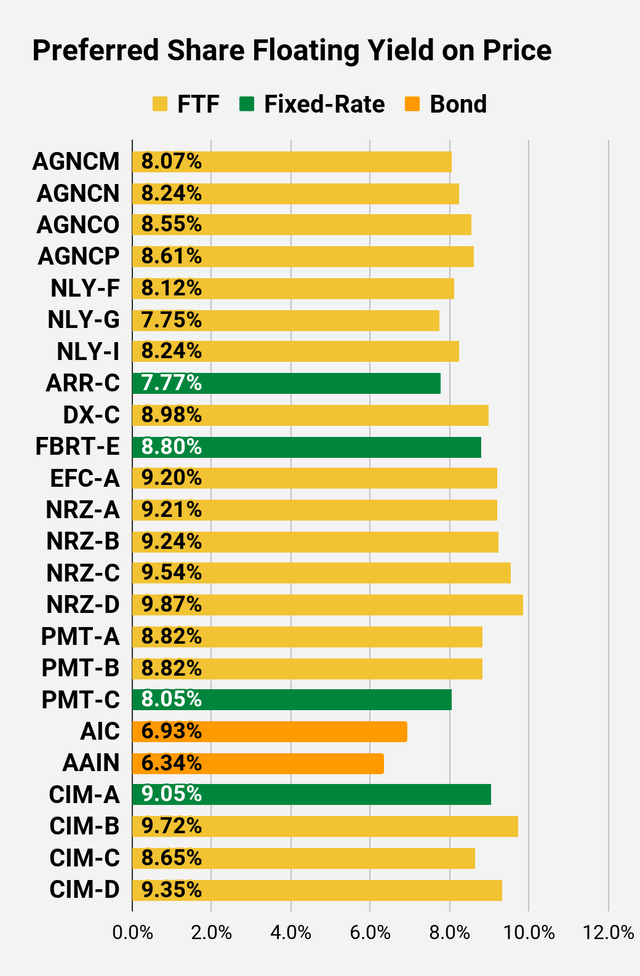

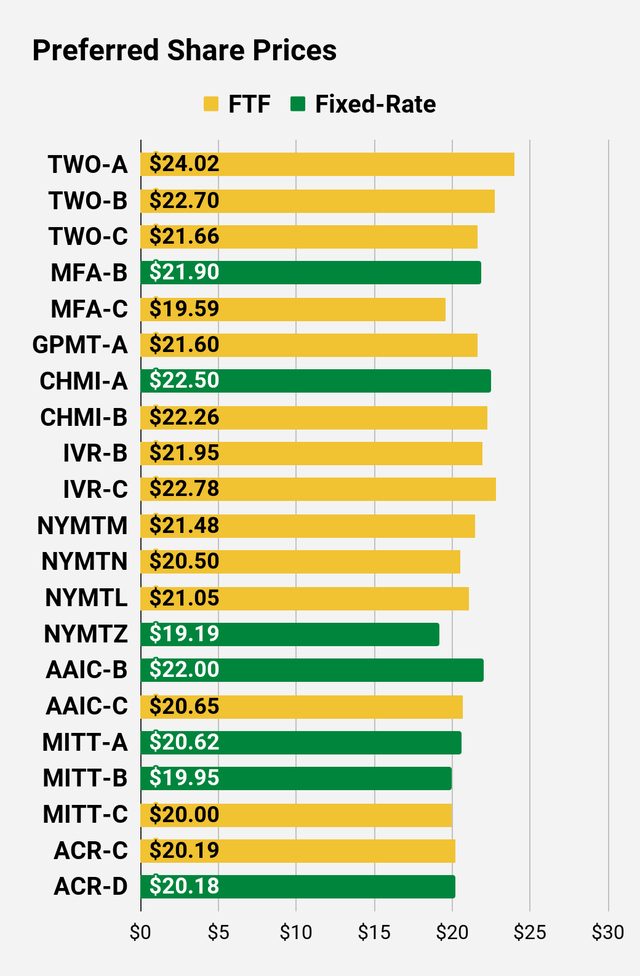

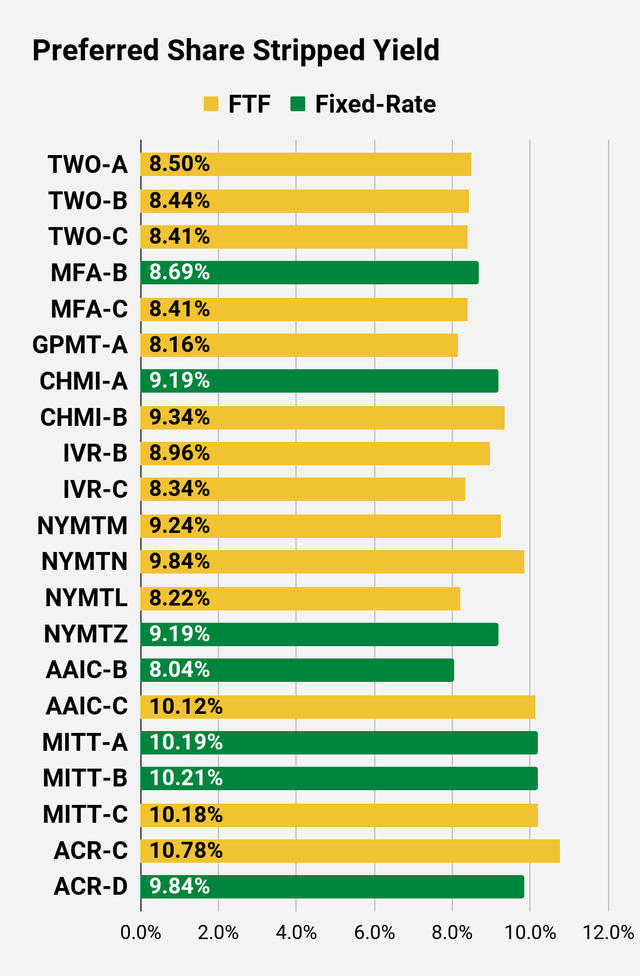

Beyond the charts, we’re also providing our readers with access to several other metrics for the preferred shares.

After testing out a series on preferred shares, we decided to try merging it into the series on common shares. After all, we are still talking about positions in mortgage REITs. We don’t have any desire to cover preferred shares without cumulative dividends, so any preferred shares you see in our column will have cumulative dividends. You can verify that by using Quantum Online. We’ve included the links in the table below.

To better organize the table, we needed to abbreviate column names as follows:

- Price = Recent Share Price – Shown in Charts

- BoF = Bond or FTF (Fixed-to-Floating)

- S-Yield = Stripped Yield – Shown in Charts

- Coupon = Initial Fixed-Rate Coupon

- FYoP = Floating Yield on Price – Shown in Charts

- NCD = Next Call Date (the soonest shares could be called)

- Note: For all FTF issues, the floating rate would start on NCD.

- WCC = Worst Cash to Call (lowest net cash return possible from a call)

- QO Link = Link to Quantum Online Page

Second Batch:

Strategy

Our goal is to maximize total returns. We achieve those most effectively by including “trading” strategies. We regularly trade positions in the mortgage REIT common shares and BDCs because:

- Prices are inefficient.

- Long-term, share prices generally revolve around book value.

- Short-term, price-to-book ratios can deviate materially.

- Book value isn’t the only step in analysis, but it is the cornerstone.

We also allocate to preferred shares and equity REITs. We encourage buy-and-hold investors to consider using more preferred shares and equity REITs.

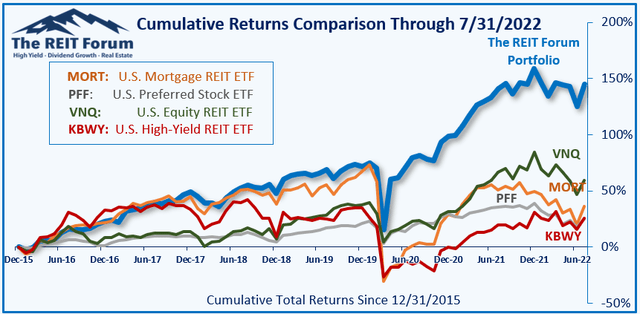

Performance

We compare our performance against 4 ETFs that investors might use for exposure to our sectors:

The REIT Forum

The 4 ETFs we use for comparison are:

|

Ticker |

Exposure |

|

One of the largest mortgage REIT ETFs |

|

|

One of the largest preferred share ETFs |

|

|

Largest equity REIT ETF |

|

|

The high-yield equity REIT ETF. Yes, it has been dreadful. |

When investors think it isn’t possible to earn solid returns in preferred shares or mortgage REITs, we politely disagree. The sector has plenty of opportunities, but investors still need to be wary of the risks. We can’t simply reach for yield and hope for the best. When it comes to common shares, we need to be even more vigilant to protect our principal by regularly watching prices and updating estimates for book value and price targets.

Ratings:

- Bearish on NLY / ARR / ORC

Be the first to comment