karandaev

The iShares Global Consumer Staples ETF (NYSEARCA:KXI) is yet another way to approach a consumer staples investment. This one is more global than the iShares U.S. Consumer Staples ETF (IYK) and we posit that this is not to the KXI’s merit. More US focus is good because there tends to be less private label competition and downtrading risk. With the multiples being the same, we think it’s a pass.

KXI Breakdown

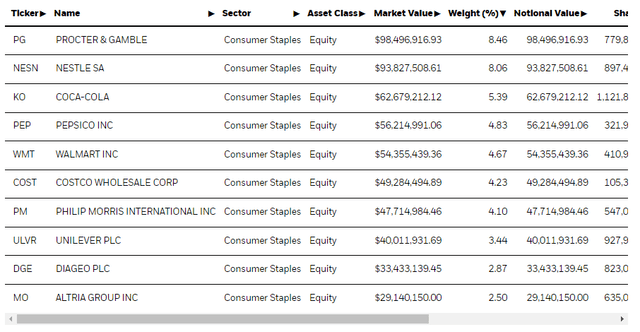

The big KXI holdings are shown below:

Procter & Gamble (PG) is at the head of the list. Then there’s Nestle (OTCPK:NSRGY) which is where some European listed stocks start making an entrance as opposed to the IYK. Then there’s Coca-Cola (KO) and PepsiCo (PEP) followed by Walmart (WMT), Costco (COST) and Philip Morris (PM).

Some of these stocks are in the IYK, and their situations have in general shown that consumer staples show resilience during periods of market uncertainty. PG is managing to grow its earnings thanks to pricing initiatives, although the input inflation is evident. Coke is having more trouble; while most pressure is coming from one-offs, some is clearly being driven by gross margin pressure and SG&A bloat to produce operating income declines. PepsiCo is coming out quite strong with its slightly more miscellaneous portfolio than Coke’s. PM has not seen any evidence of downtrading to discount competitor Imperial Brands (OTCQX:IMBBY). Walmart is staying strong thanks to price increases, but downtrading within the products that it offers has apparently been very visible.

Remarks

Nestle has managed to produce excellent growth with pricing completely offsetting inflation, but other European names have been seeing some downtrading. Companies like Unilever (UL) have decently sized discount portfolios for absorbing downtrading into their own businesses, but they are seeing some downtrading in their emerging markets especially and the EPS growth is more limited. Cosmetics brands‘ exposures are helpful, however, and these are less exposed to margin erosion thanks to growth powered secularly by a lot of emerging market exposures, although discount competition exists.

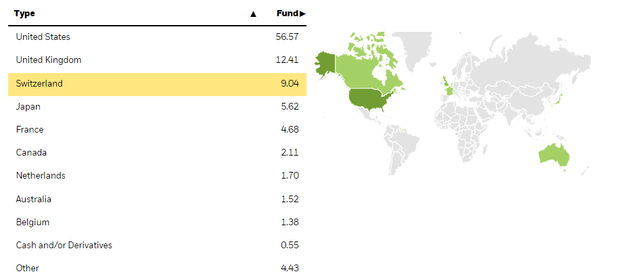

In general, European exposures, which really do add up for the KXI, are going to have more private label competition when the staples sell at supermarkets. This is something even the PG CFO acknowledges.

In Europe, private label shares are stronger. Private labels are reemerging in some of the markets. But for example, in the UK and France and Germany, we all have positive share reads in the most recent period. So we’re keeping a close eye on it.

Andre Schulten, CFO

The portfolio skews meaningfully to non-US allocations.

So while the occasional alcohol exposure or cosmetics exposure gives a boost to the earnings of the companies and offsets some of the earnings risks that investors need to absorb with the onsetting recession, the very substantial non-US exposures, on top of the EU markets within the US-listed stocks, do pose a structural problem.

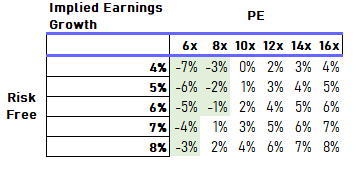

We already think that the IYK was too expensive considering the potential earnings at risk in a recession, but KXI trades at the same multiple despite structural issues being more pronounced.

Value Chart (VTS)

While we wouldn’t choose the IYK as an investment, we’d still choose it over KXI.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment