Chris Hondros

A lot has happened since my last article on UBS Group (NYSE:UBS). The bank is the largest and the most reliable in Switzerland but the recent financial and geopolitical events made many investors question if they still should hold Swiss banks’ shares. It is often a good strategy to buy when everyone is selling. And yet the stock of UBS has been holding up relatively well. But let me explain this in some more detail.

Swiss monetary system

The Swiss monetary system seems to be relatively stable these days. Many banks, however, are facing capital outflows and investors are quite skeptical these days. Quite recently the Swiss National Bank (SNB) has reported losses on its holdings. The SNB is a listed company and its shares are listed on the SIX, the Swiss stock exchange. The year 2022 has been problematic for many kinds of investors, Swiss banks and even the SNB included. Many of the banks’ assets as well as these of their clients have substantially plunged in value.

Another interesting point about the Swiss banks – it is also true of many other countries nowadays -, is that their clients’ money outflows have risen substantially. It is not just the fact many analysts and market players are predicting a prolonged recession is upon us. Much of this negative attitude towards the banks is probably due to the sanctions against Russia. As we all know, the EU, the US, and all the G7 countries imposed sanctions against Russia. The first package was agreed upon in February this year. Although the Swiss government initially wanted to abstain, it eventually joined the other countries in taking measures against Russia.

Switzerland and the other countries decided to take measures against Russian citizens, primarily the ones on the sanctions list, including government officials. The measures also included freezing the bank accounts. This made some investors question how neutral the status of Switzerland really is. Most of the country’s well-being is due to its banks and being a safe haven for investors’ financial assets. Traditionally Switzerland has been abstaining from any wars and political conflicts. But the current situation is extraordinary for this country. That made some investors question their well-being. These investors also include some Chinese clients since the tensions between China and the West, especially the US, are also escalating. This is mostly due to Taiwan. So, some clients might also worry the Swiss government could also sanction Chinese citizens. All that is quite worrying.

But UBS is holding up relatively well in spite of that.

UBS and its recent earnings

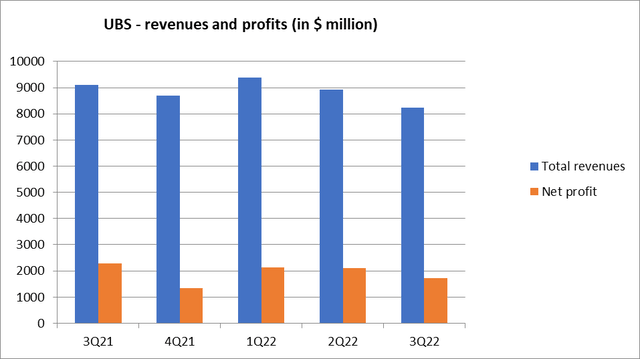

We can safely say that the recent third-quarter earnings and revenues were somewhat worse in 3Q22 than they had been in 2Q22 and also in 3Q21. And yet profit-wise the recently reported earnings were better than they had been for 4Q2021.

| 3Q21 | 4Q21 | 1Q22 | 2Q22 | 3Q22 | |

| Total revenues | 9115 | 8705 | 9382 | 8917 | 8236 |

| Net profit | 2279 | 1348 | 2136 | 2108 | 1733 |

Source: Prepared by the author based on UBS data

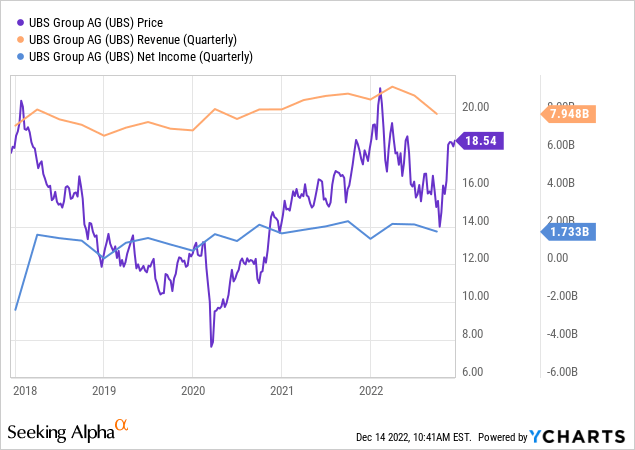

As you can see from the diagram below, the revenues have not been falling rapidly. Instead, they have been staying relatively stable. This is true of both the several last quarters and the quarterly results in the last several years.

Source: Prepared by the author based on UBS data

The graph above generated by Y-Charts shows the bank’s quarterly revenues and net profits over the period of 5 years. As you can see from the graph, the quarterly net profits have in fact been rising, whilst the revenues have shown very slow growth. That trend has not changed in the past several quarters in spite of capital outflows and the likelihood of a recession.

Valuation

We can see there was a plunge in the value of UBS shares. They did not perform particularly well recently. But compared to the whole banking sector, that correction was not dramatic, indeed.

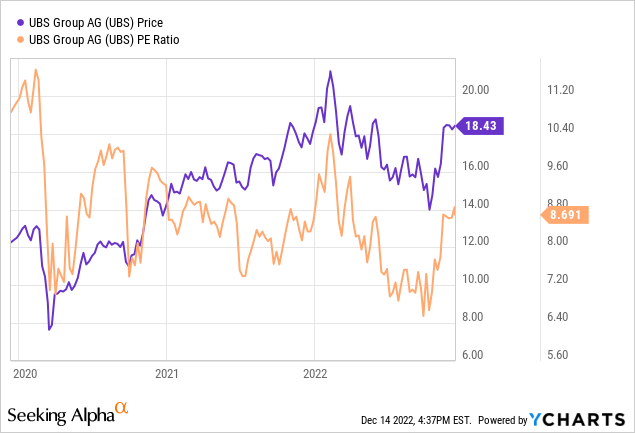

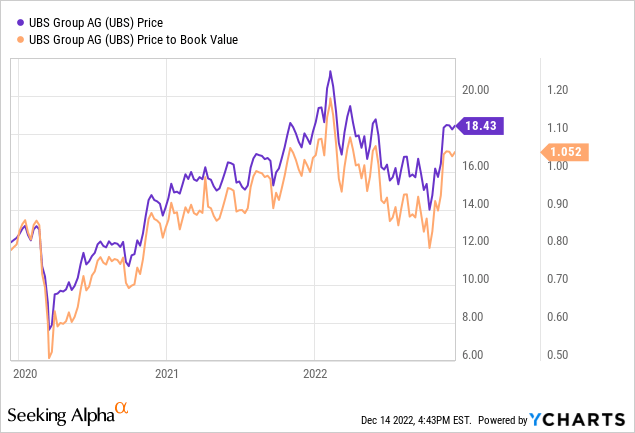

If we see the classical valuation ratios, namely the P/B (price-to-book ratio) and the P/E (price-to-earnings ratio), we will see UBS shares are not particularly expensive but not very cheap either.

The P/E of around 8.7 is below the local high of 10.4, recorded at the beginning of 2022. But still, we cannot say the stock is too undervalued.

The same is true of the bank’s P/B. It is off its high of 1.2 and currently lingering at 1.05. It is not expensive at all but not very cheap for UBS.

I would not risk giving a stock price target for a year for UBS Group. Yet, the bank’s stock price collapse similar to that of 2020 may only happen if there is a very serious recession, not my base-case scenario. However, if a moderate recession happens, I would expect the bank’s earnings to be almost unchanged, the P/E ratio to be no less than 6, and the stock price to total no less than USD 12. If such a recession eventually happens, it will be a great time for investors to increase their positions in UBS.

Although there is plenty of political and macroeconomic uncertainty right now, the bank’s earnings and revenues are still in pretty good shape. That is why I am quite optimistic about UBS shares and its fundamental indicators.

Risks

A recession could be upon us. The UK financial system, most importantly the bond market, was on the brink of a collapse this autumn. So, the Bank of England had to intervene in order to save it. The central banks are hiking the interest rates due to multi-decade high inflation. High-interest rates on their own are good for banks when they do not provoke recessions. But eventually, hawkish central banks make their economies contract.

In addition to that, as I have mentioned before, if the geopolitical situation gets worse, there may be even more capital outflows. There is also a risk the relations between the US and China get tenser. This is particularly true in the case of Taiwan.

All these risks may eventually affect UBS and its earnings. However, UBS at the moment is in a good shape and is almost unaffected just yet. So, I do not think these macroeconomic and geopolitical risks would substantially affect UBS thanks to its leading positions.

Conclusion

UBS has been performing quite well, given the current situation we are in. Its earnings have not suffered too much, whilst the bank’s shares have been reflecting the bank’s relatively strong performance. The bank is one of my favorite picks in Switzerland. However, there are plenty of risks for the global financial system, including that of a global recession. The shares of UBS are fairly valued. I would suggest buying them after the next substantial correction.

Be the first to comment