brightstars/E+ via Getty Images

Speculative case

Snap (NYSE:SNAP) is down more than 80% percent from its all-time highs. This trend has been mirrored by all growth stocks to an extent, but not all growth stocks are born equal. Although top line growth is a key indicator for growth names, when speculating on a growth name one has to consider two key points:

- Survivability

- Vision for the future and its execution

Snap checks both of these boxes, and if an investor is willing to look past the current market commentary about the stock, the reward to risk ratio looks highly attractive.

The good, bad and ugly

The Good

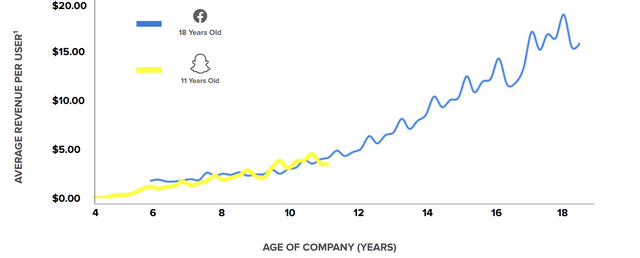

Snap has been able to show exploding topline growth with its revenue growing 10 times since its IPO in 2017 ($404M → $4.5B) and the average revenue growth rate for the last three years alone being 52%. Even with the slowing economy, the first two quarters of 2022 showed significant growth in QOQ revenues (38% and 13%). Average revenue per user has also been steadily improving and comparable to Facebook at the same age.

Average Revenue Per User (Company Website)

But how does it matter if even with all this growth the company is not able to turn a profit? (SNAP has not achieved a profit for any year of its existence.) Although this is a typical trajectory for a growth stock and they can still eventually become behemoths, there are also companies that have bit the dust following the same trajectory. The key differentiator here is survivability. How are the revenues being utilized? Does the company have enough cash to survive during lean times and survive long enough to be able to fully execute its vision? (Present situation being the case in point.)

Looking at the income statement for 2021, gross profit ratio has been continuously improving and stands at 58% which bodes well for the company. 38% percent of the revenues goes towards R&D expenses which is only the company reinvesting in itself for future growth. A troubling metric could be the high SG&A spend relative to revenues which stands at 37%. From the latest investor update, there are clear signs that the company is reining in its spending by reducing its headcount by 20%, lowering marketing spend, reducing real estate investments, infrastructure costs and fixed content costs to further drive profitability and reprioritizing investments in areas not directly connected to the main priorities.

In terms of cash, the company is sitting on approximately $4.9B, which fully covers all outstanding debt with no debt maturing before 2025. As long as the top line grows even at modest rates and the company has an eye on its cash burn, there is no question of the survivability of this company for the next couple of years.

What can one expect in the near term?

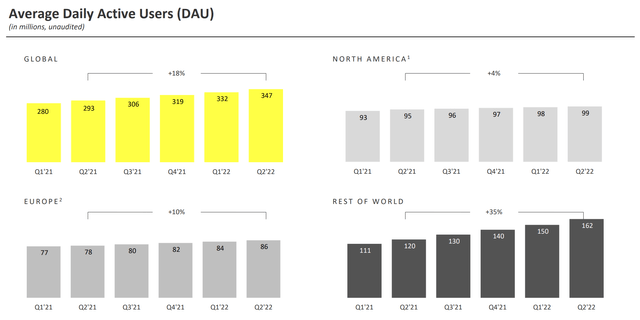

Snap has seen its daily active users double since its IPO and it currently stands at 347 million. This has been possible due to the expansion of the app outside of its core North American market and the company continuously improving their core product offering.

Daily Active Users (Company Website)

Currently, the company has 25% penetration in North America followed by 15% penetration in Europe and 6% penetration for rest of the world. Clearly, there is further room to grow in terms of total addressable market. While there is no public information on the future pipeline of products from the company, there is clear evidence of monetization attempts from its releases –

- Snapchat+: A premium subscription service in limited countries that offers users access to a collection of exclusive, experimental, and pre-release features in the messaging app at $3.99 a month. The service reached more than a million users within a month of its launch and is expected to reach 4 million users by end of the year with its launch in more countries and additional features being exclusive to the service.

- Spotlight: Snap’s answer to short form video content which has seen steady adoption. YoY, total time spent watching Spotlight content increased 59% and monthly active users grew 46% to reach more than 270 million in Q2. Ads placed on Spotlight will drive further monetization on the platform.

-

Snap Map: A location sharing feature with additional layers providing location based information/places (places could be restaurants, events etc.) on an interactive map. Location based information can ultimately be turned to location-based advertising with highlighted promoted places to further drive engagement and revenue from its users.

Snap’s vision of the future and its execution

We have had multiple eras of innovation with personal devices with post-2010 being the age of smartphones. When it comes to the next wave of innovation for personal devices, there are three schools of thought – Virtual Reality, Mixed reality and Augmented reality

Arguments could be made as to why one will trump the other and currently no company is making the case that all can flourish. While both Mixed Reality and Augmented Reality aim to serve as a complement to your current physical environment, Virtual Reality completely aims to take you to a virtual environment. Among the publicly listed companies with established products in each space; Mixed reality is primarily tackled by Microsoft’s HoloLens, Meta’s Oculus is completely in the VR space and Snap’s Spectacles is fully in the Augmented Reality space.

Speaking to Snap’s vision for the future from an AR standpoint, right from its first launch of lenses back in 2015, users have engaged with AR lenses 6B+ times per day on an average. Snap has been able to continuously be in the limelight for the next viral Augmented Reality feature for the past several years (Dancing Hotdog, Baby face, Crying lens, Shook lens etc.) and a big part of the reason is because they have open sourced the software and the process of creating lenses. Lens Studio, the desktop application from Snap to build Augmented Reality experiences has been used by over 250K+ people and over 2.5M+ lenses have been created by the community. Learning from its experience of launching and using AR, Snap has continuously found new practical uses for Augmented Reality –

- Utility Lenses – Scanning real world objects, ASL Alphabet learning

- Entertainment Lenses – Building AR for art, museums and cultural experiences

- Shopping – Shop, browse and virtually trying on products

- Games – Virtual games set in real world environments

- Education – Augmented Reality setups to aid learning

When it comes to AR hardware, company admits that the full technological leap is 5 – 10 years away. Currently, the 4th generation of Spectacles has been released only to creators as a development kit to begin experimenting and building AR experiences for the device. This strategy will serve the company well as it’s not a commercial launch and therefore not have to deal with any bad public reviews on the shortcomings of the device. At the same time this will enable the company to learn from its creators and eventually release a product that can be consumed by the public.

The bad and ugly (competitors and risk)

The next few years could be crucial for Snap and there are factors that would prevent it from achieving its Revenue growth and Profitability.

Competition from Incumbent: Snap’s arch nemesis Meta (META) has been biting at its heels ever since its inception. After its plan to buy Snap failed, Meta has been taking every opportunity to beat Snap at its own game by copying its best features and has been successful more than once! It is only through continuous innovation Snap has been able to survive but this may not last long. Meta is a deep-pocketed rival with its own vision of the future. Meta’s family of apps have a much larger user base and any missteps from Snap would quickly close any existing gap between the two companies.

Competition from Upstart: The popularity of TikTok has been a surprise for all existing social media companies. While it has existed only half the time as Snap, its user base already exceeds Snap by a wide margin. Since TikTok and Snap are mainly targeting the same demographics, competition for the ad dollars among the two companies is intense. TikTok’s short form video content is so popular that the format has been copied and implemented by most companies operating in the communication/media space and have not been nearly as successful. The good news is that Spotlight, as pointed before has also seen steady adoption, but this still has a long way to go before it can catch up to TikTok.

Threats to its vision: Although Snap is currently a leader in AR space it could start attracting serious competition from deep pocketed rivals in the same space. Apple and Google are rumored to have AR glasses in the pipeline and may see a release in the next few years. There are also some startups (Ex: Magic Leap) that have made an entry into Augmented Reality space. These products currently lack the depth and the community provided by Snap but this may change. It could also be that Augmented Reality does not take off as intended and the next growth in personal devices could be entirely restricted to Mixed Reality/Virtual Reality which could prove detrimental to Snap as it has its sights set only on AR.

Valuation

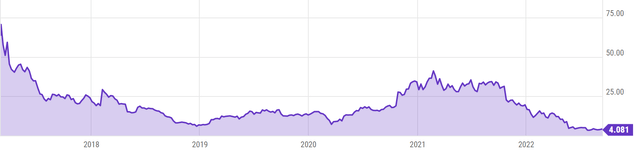

It is no secret that growth stocks have seen astronomical valuation in the last two years. The last six months have seen a reset in the valuation for all growth names including Snap. Also, for a company such as SNAP most valuation metrics won’t work as it is yet to turn a consistent profit. In light of this, let us use Price-to-Sales ratio as this can be used for companies without a positive net income.

Price-to-Sales Ratio (Y Charts)

From the chart above it is quite evident that at the current PS ratio of 4, Snap has never been valued lower in its entire history. Also comparing the current multiple with a broader group of some technology names, this ratio comes in at the lower end. For illustration, selected some names for the table below –

| Company | P/S Ratio |

| Snap Inc. | 4 |

| Tencent Holdings Ltd. | 4.3 |

| Pinterest Inc. | 6 |

| Meta Platforms Inc. | 3.5 |

| Twitter Inc. | 6.3 |

| Roblox Corp | 11.8 |

During Q1 earnings, Snap provided YoY growth guidance at 20 – 25% and failed to provide any guidance during Q2 earnings which makes it hard for calculating forward multiples for 2022. However, from an internal memo it was revealed that Snap has a target to achieve $6B annual revenues in 2023. At its current price, Forward PS for 2023 would come out to be 3.6 which brings our forward PS for 2022 to be likely between 4.15 and 3.6 which presents itself to be quite favorable in the growth category.

How should you invest in this?

Snap would be a perfect example of a candidate that would go into a barbell portfolio. For such a portfolio, you would have extremely safe investments on one end and extremely risky ones on the other end. The safe investments would carry no risk even in the face of extreme market drawdowns (Ex: US Treasury bonds). The aggressive side of the barbell while it has the full risk of losing your entire investment, it also has unlimited upside. The aggressive side also has its risk distributed between “N” such entities (where “N” is the number of investments an investor is comfortable with)

In this situation, I would be comfortable investing 1% of my portfolio into taking a long position with SNAP and expecting for this to payout well over the long term.

Be the first to comment