guenterguni/iStock via Getty Images

Chord Energy Corporation (NASDAQ:CHRD) is a Williston focused company with a market capitalization of almost $5.5 billion. The company was formed by the merger of Whiting Petroleum and Oasis Petroleum both of which went bankrupt in 2020 and emerged later that year as victims of the COVID-19 induced oil price collapse.

The new company, with its renewed financial strength, has the ability to drive substantial shareholder returns.

Overview

Chord Energy has an impressive portfolio of assets that will support continued production.

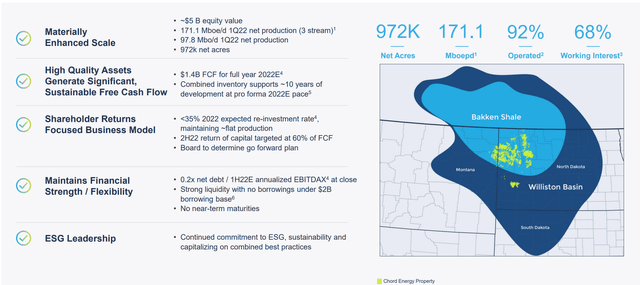

Chord Energy Investor Presentation

The company has 972 thousand net acres that are 92% operated but with only a 68% working interest. The company’s assets are substantial in Williston Basin and Bakken Shale, and are clumped together which means lower production costs and easier operations along with the ability to drill longer and more substantial laterals.

The company’s inventory supports 10 years of development at its 2022 pace. The company expects <35% reinvestment rate to maintain full production. Lastly, the impact of bankruptcies was substantial, the company has a 0.2x net debt / EBITDAX at close and strong liquidity. All of this is a combined platform that will support significant shareholder returns.

Assets

Chord Energy has unique integrated assets.

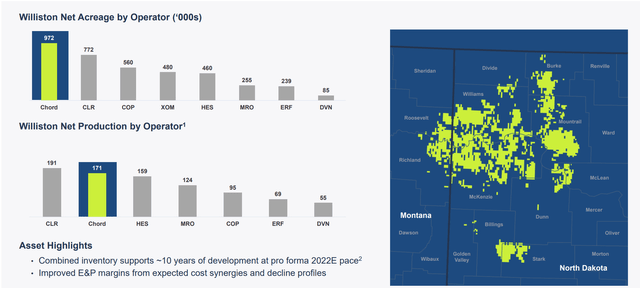

Chord Energy Investor Presentation

The company is a Williston focused company and has substantial assets. The company’s tightly integrated assets and single-basin focus along with strong production make it a strong acquisition target for a company looking to expand its assets in the region. For example, Continental Resources (NYSE:CLR) could synergize strongly with its assets.

The company’s asset integration means minimal midstream costs with its midstream affiliate recently acquired by Crestwood. It also means the ability to drill longer laterals keep its development costs low. The company has 171 thousand barrels / day in production and ~10 years of inventory, although we’d like to see it maintain that number.

Shareholder Return Potential

The company has the ability to return massive shareholder yields at a variety of prices.

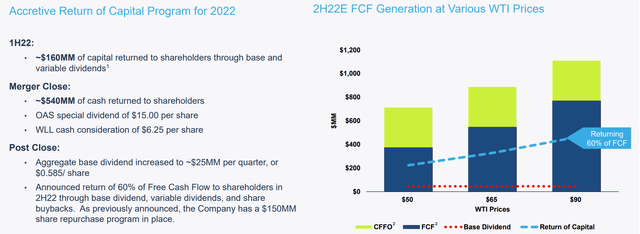

Chord Energy Investor Presentation

The company returned $160 million of capital to shareholders in 1H 2022, partially due to substantial special dividends. That resulted in $540 million in cash returned to shareholders at merger close. The company’s new dividend is $100 million / year or ~2% a year, and the company’s new target is 60% as a FCF yield.

The company announced a $150 million share repurchase program and we’d like to see that grow substantially given the company’s cash flow. At $90 WTI, or ~8% below current prices, the company’s FCF is almost $800 million meaning an annualized 30% FCF yield. The company will be returning ~20% of that to shareholders based on its targets.

The company has a mere $450 million in debt that it can comfortably afford with low interest rates. We don’t see a need for the company to invest paydown, so we’d like to see it invest in repurchases, dividends, and growth. Those varieties of focuses will all help the company generate substantial shareholder returns.

Even at $50 WTI the company can generate close to double-digit returns.

Thesis Risk

The largest risk to the company is oil prices. The company’s two components went bankrupt in early-2020 on the basis of oil prices going negative. Its financial profile is now substantially stronger, however, there’s still a substantial risk of lower prices. If prices go below $50, the company will struggle to generate double-digit shareholder returns.

Conclusion

Chord Energy has now integrated Oasis Petroleum and Whiting Petroleum to make one of the largest and strongest Williston Basin focused companies. The company is generating roughly 170 thousand barrels / day in production with a 10-year reserve life and minimal capital required to maintain production for shareholders.

The company, at $90 WTI, well below current prices, can generate a 30% shareholder yield. We expect the company to be able to continue those shareholder yields making it a valuable long-term investment. We recommend investing at this time. Let us know your thoughts in the comments below.

Be the first to comment