alphaspirit/iStock via Getty Images

The investment thesis

Shares of Louis Vuitton Moët Hennessy or, in short, LVMH (OTCPK:LVMHF) have performed very well this year, outperforming the S&P 500 index (SPY) by a wide margin. While the broad economy experiences some serious headwinds, LVMH is still posting excellent results with nearly 20% organic revenue growth over the first nine months of FY2022. This is not an exception. LVMH has a long history of posting great financial results during economic expansion and showing resilience during economic downturns, resulting in a steadily growing dividend.

In this article, I will use financial data to show you why LVMH does great in any market environment and why growth-oriented dividend investors should keep a close eye on the stock price.

LVMH in short

Before I show you the numbers, it’s first important to understand what the company does. LVMH is a world-leading luxury holding company with 78 distinguished ‘maisons’ rooted in six different sector:

- Wines & Spirit: 26 maisons specialized in champagnes, wines, and spirits, such as Moët & Chandon, Dom Pérignon, Hennessy, Ardbeg, and Belvedere.

- Fashion & Leather Goods: 14 maisons of well-known brands which design clothing and accessories, such as Louis Vuitton, Loewe, Givenchy, and Kenzo.

- Perfumes & Cosmetics: 15 maisons leading the perfumes, make-up, and skincare markets, such as Christian Dior parfums, Acqua di Parma, and Fenty Beauty.

- Watches & Jewelry: 8 maisons of iconic jewelry and watch designers, such as Tiffany & Co., Bulgari, Tag Heuer, and Hublot.

- Selective Retailing: 5 maisons aiming to offer customers unique shopping experiences, such as Sephora, DFS, and Le Bon Marché Rive Gauche department store in Paris.

- Other Activities: 10 maisons in a variety of sectors, such as media brand Le Parisien, luxury hotel developer Cheval Blanc, and high-end yacht builder Royal Van Lent.

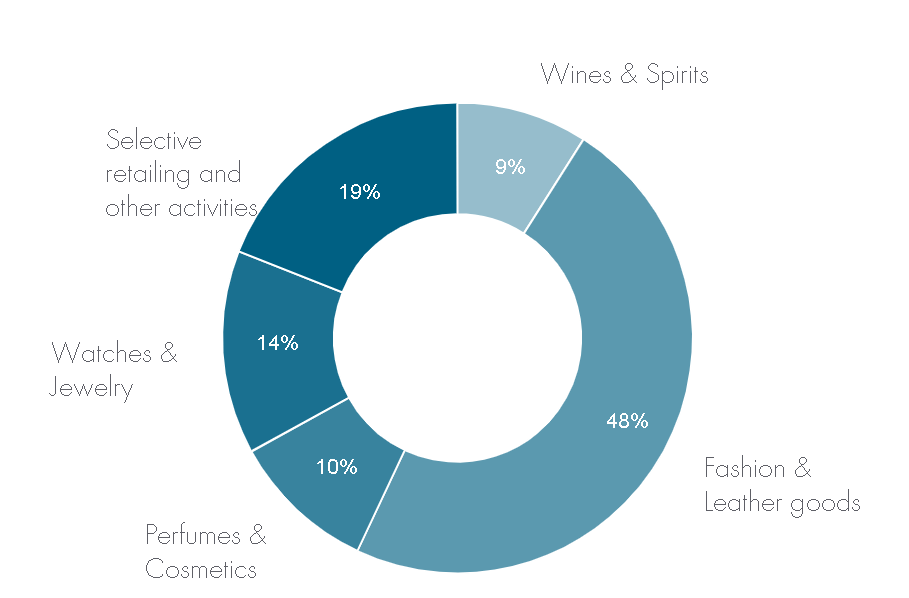

As shown in the following figure, Fashion & Leather Goods is by far the largest business segment. Over FY2021, it accounted for nearly half of total company revenue. The other half of total revenue is nicely distributed over the other five segments.

Revenue by business group (LVMH Investor Relations)

You may notice that every maison is a major player in a specific luxury niche. The strong market share and brand recognition of individual brands give LVMH a lot of pricing power among its business groups. The company has a combination of heritage brands (Louis Vuitton since 1854; Moët & Chandon since 1743; Tiffany & Co. since 1837) and younger brands (Belvedere since 1993; Fenty Beauty since 2017; Kenzo since 1970). I think that this diversification of exclusive brands is the reason that LVMH is less vulnerable to fashion cycles. Besides, it protects the company from being overly exposed to a single brand.

Another interesting aspect about LVMH is that it controls the entire supply chain of products. The complete control over production, distribution, pricing, and branding enables the company to avoid discounts on products, thus maintaining consistency in brand image, product quality, and profitability. Besides, LVMH is able to correct any operational mistakes in the product chain faster compared to peers. LVMH even owns a variety of vineyards that deliver grapes for the Wines & Spirits segment.

LVMH has an amazing track record

Revenue growth

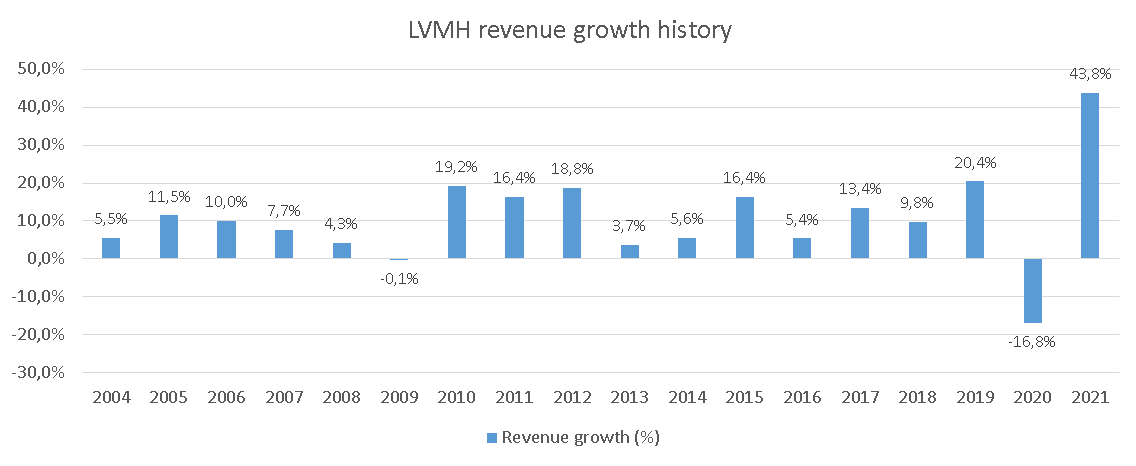

Now it is time to show some numbers. The following graph shows net revenue growth for every fiscal year since 2004. There have been only two years with negative net revenue growth: 2009 and 2020. In 2009 net revenue declined with only 0.1%. I think this is pretty good considering consumption expenditure was hit significantly by the Global Financial Crisis in many countries across the world.

The decrease in revenue of 16.8% in 2020 can be largely explained by COVID-related restrictions. The health crisis shut down global travel and led to retail store closures. But, the company posted a stunning 43.8% increase in revenue in 2021 as restrictions were gradually lifted (organic growth was 36% – total revenue grew considerably faster driven by the Tiffany & Co. acquisition). With this jump, revenue did not only make up for the 2020 decline, but exceeded revenue over FY2019 by a wide margin. Revenue growth between FY2021 and FY2019 was 19.6% (14% organically).

Year-over-year revenue growth history (LVMH annual reports FY2004-FY2021)

Apart from those two years, LVMH has built an amazing track record of growing total revenue, driven by organic revenue growth and accumulating new brands. Net revenue has grown from 12.0 billion EUR over FY2003 to 64.2 billion EUR over FY2021 – that’s a 9.8% CAGR!

Operating margins

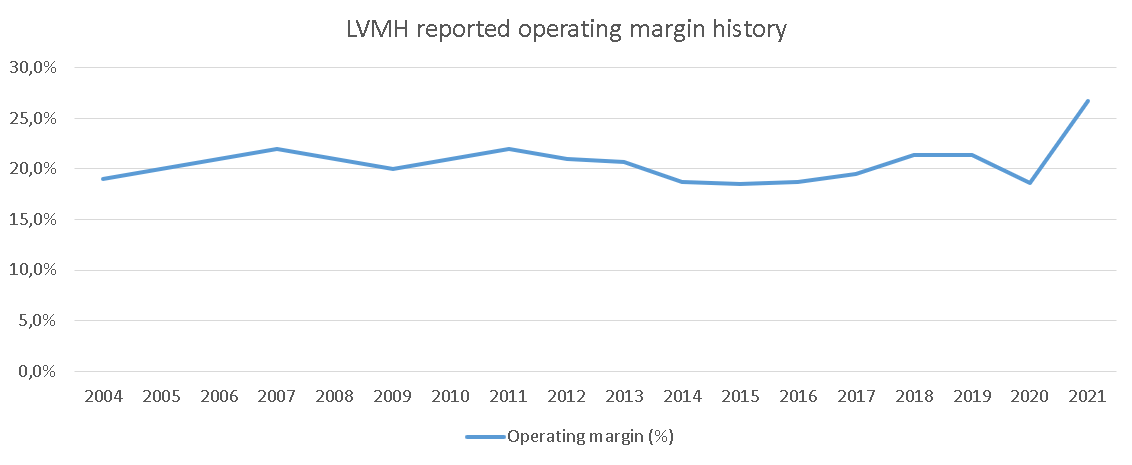

We can also take a look at the company’s operating margins over the years. The operating margin has been nicely trending around 20.0% for almost all of the considered fiscal years. After a slight dip in FY2020, margins skyrocketed in FY2021 as revenue grew significantly faster than cost of sales and SG&A expenses.

Operating margin history (LVMH annual reports FY2004-FY2021)

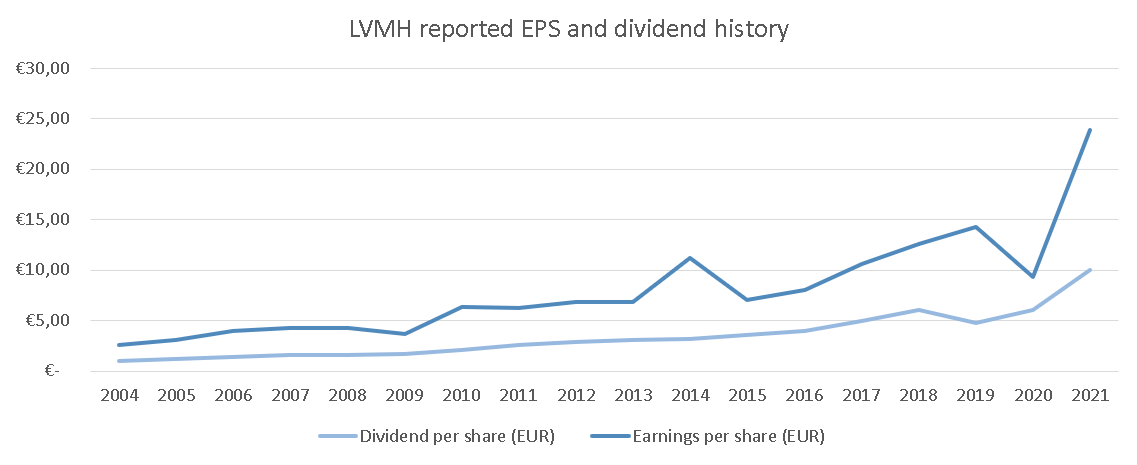

EPS and dividend growth

The near double-digit top-line growth and strong margins have resulted in excellent growth for earnings per share and dividends (see figure below). Earnings per share have grown from 2.53 EUR in FY2004 to 23.89 EUR in FY2021 (representing a 14.1% CAGR) and dividend per share has grown from 0.95 EUR to 10.00 EUR over the same period (representing a 14.9% CAGR). Also note that the dividend has been raised nearly every year. The only two years that the dividend did not grow were 2008 (dividend remained flat at 1.60 EUR) and 2020 (the dividend decreased from 6.00 EUR to 4.80 EUR). Luckily, the latter has been offset by the huge dividend increase in 2021.

Despite the enormous jump in earnings and dividend per share for 2021, growth will not stop in the foreseeable future. Data from Marketscreener currently predicts that EPS will grow with a 12.9% CAGR through FY2024, and the dividend will probably grow at the same pace.

EPS and dividend history (LVMH annual reports FY2004-FY2021)

Excellent performance in FY2022 so far

So LVMH has performed very well in the past. The thing is that past performance does not guarantee future returns. As you might have noticed, 2022 has been a tough year for financial markets. Financial news pages have been flooded with articles about inflation, interest rate hikes, and the question whether or not we are in a recession.

It is true that companies are facing headwinds and the economic outlook remains uncertain, causing analysts to dampen their outlook for future earnings. Year-over-year earnings growth for the S&P 500 companies in Q3 2022 was 4.1% and analysts predict a 0.4% decline in Q4.

There are however some companies in the world that are still doing great. One of them is LVMH.

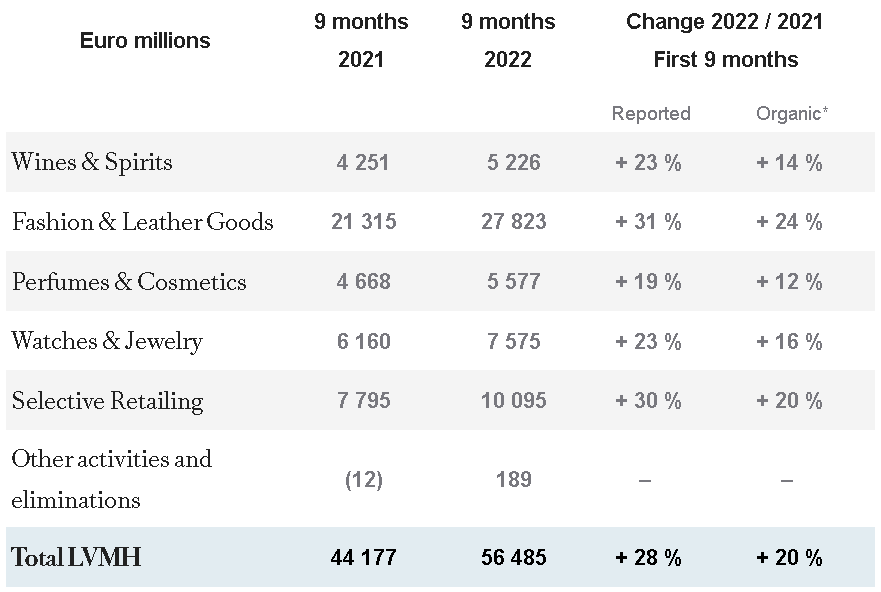

Over the first nine months of 2022, the company posted 27.8% total revenue growth compared to the same period in 2021 (see figure below). Organic revenue growth came in at 20%. Growth has not been slowing in the most recent quarter. Over Q3 of 2022, organic growth was still 19%, in line with the trend of the first half year. The largest business segment, Fashion & Leather Goods, showed the best performance with 31% net revenue growth (24% organic revenue growth).

9M results for FY2022 per business group (LVMH Investor Relations)

Fun fact: the operating margin has continued to grow after the huge leap in FY2021. In the first half of 2022, the company reported an operating margin of 27.9%. I think the second half of 2022 will show a slight margin decrease, but analyst still expect that the operating margin of FY2022 will be higher compared to FY2021.

Based on the Q3 outlook, the company remains confident that the current growth will continue in Q4. Management will be selective with investments and control costs as well as possible to maintain profitability.

Based on numbers, it seems that LVMH is not experiencing a recession (yet)…

Valuation

Even if a global recession hits and negatively affects LVMH’s financial results, I strongly believe that the company will continue its track record in the future. With that, LVMH is a great stock to own for growth-oriented dividend investors.

But, is the stock a buy now?…

That question will be answered with a Discounted Cash Flow (or DCF) analysis, a widely applied method to calculate the intrinsic value of a company. Free cash flows will be projected until FY2031 – a nine-year period. It is very hard to predict the exact future growth rate, so in the following I will determine a bandwidth for the free cash flow growth rate.

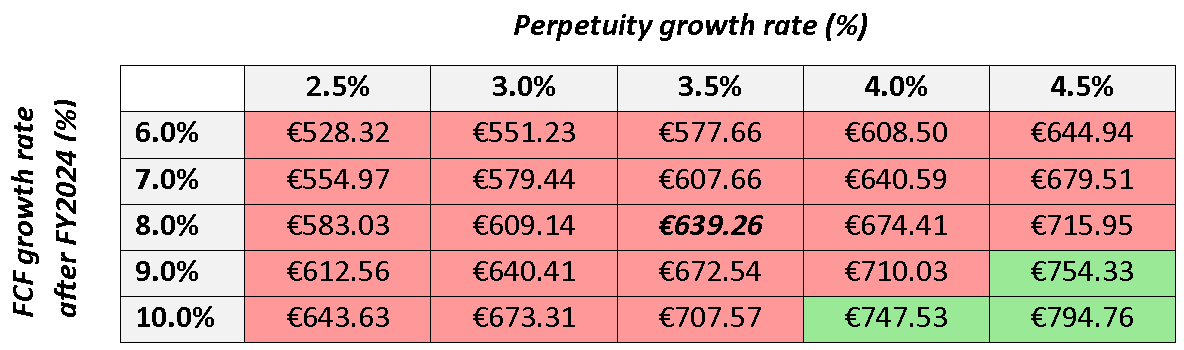

Over FY2021, operating free cash flow came in at 13.5 billion EUR. Analysts currently predict free cash flow to be 17.2 billion EUR in FY2024 – that implies a 8.4% CAGR. Moreover, I have shown that long-term revenue growth has been 9.8% and margins have slightly expanded over the past two decades. I think that it is most realistic that growth will decelerate as the business is growing bigger and bigger. Assuming margins will keep expanding at a slow pace, 8.0% will be a fair mid-point growth rate for free cash flow after FY2024.

With this is mind, I will take a 6.0%-10.0% CAGR free cash flow bandwidth between FY2024 and FY2031 for the DCF analysis. The perpetuity growth rate is typically between historical inflation (2-3%) and historical GDP growth rate (4-5%). Therefore, I assume a 2.5%-4.5% range for the perpetuity growth rate.

|

Input |

Value |

|

First year of projections |

2022 |

|

Personal Required rate of Return |

10.0% |

|

Number of shares outstanding |

0.501 billion |

|

Free cash flow for fiscal year 2024 (last year with analyst predictions) |

17.2 billion EUR |

|

Free cash flow growth rate after FY2024 |

6.0% / 7.0% / 8.0%/ 9.0% / 10.0% |

|

Growth rate in perpetuity |

2.5% / 3.0% / 3.5% / 4.0% / 4.5% |

The intrinsic values from the DCF analysis are presented for every growth rate combination in the table below. At the mid-point growth rates, I arrive at a target price of 639.26 EUR per share. This is roughly 11% below the current share price. It seems that this year’s earnings already have been priced into the stock. For a 10.0% return on investment, I advise investors to wait for the mid-600s before considering to add LVMH shares.

DCF analysis for different growth rates (Author)

Risks to consider

So far, this has been quite a positive piece about LVMH, and rightly so. But, there are multiple factors that could negatively affect the growth of the business and thus the dividend. If the company cannot manage to grow free cash flow with a 8.0% CAGR in the coming decade, the target price will obviously decrease accordingly. Therefore, I will address a few risks that could influence the investment case for LVMH.

- Consumer spending could decrease: Global inflation seems to cool off but remains at elevated levels. With an economic slowdown on the horizon, this might impact consumer spending at some point. This is not the case yet, as consumer spending in October 2022 in the U.S. actually increased from the prior month. Even if an economic downturn happens, history has shown that LVMH is able to deal with such events pretty well.

- High exposure to Asia: Nearly 40% of total revenue was generated in Asia during the first half of FY2022. China has been struggling with a slowing economy and the uncertainty around COVID restrictions remains. But some other Asian countries are also dealing with a broad economic slowdown. The exposure to Asia might add some additional risks to the investment case for LVMH. On the other hand, the Asian middle class is expected to boom in the coming decade. LVMH could be an interesting play to benefit from this trend.

- Brand desirability could decline: Fashion & Leather Goods accounts for nearly 50% of total revenue and Louis Vuitton is responsible for a big chunk of that. For LVMH, it is highly important to constantly maintain and enhance brand desirability. The company has a long history of successfully maintaining the exclusivity value of its brands. But if desirability for Louis Vuitton or another brand declines, this could significantly impact future financial results. Currently, there are no signs of a slowdown as the company posted excellent result in recent quarters. Moreover, LVMH is continuously expanding its portfolio to mitigate this risk.

Final thoughts

LVMH has a long history of creating high-quality products in major sectors of the luxury market. It has that sweet combination of heritage brands and young (emerging) brands, each having a unique character and strong market position. Because the company has complete control over the entire product chain – from manufacturing to marketing – I think the ‘maisons’ will maintain and enhance their exclusivity value. Therefore, LVMH will continue to build its track record and deliver great shareholder returns through dividends and capital gains.

Looking at the shorter term, LVMH is posting very solid earnings, also in the current economic environment. I am confident that this will continue in the foreseeable future. Long-term growth may slow down as the company is growing bigger and bigger every year. But, high-single digit growth is very well possible. With this assumption, the stock will be attractive in the mid-600s (EUR) for investors demanding a 10.0% return on investment. I therefore rate LVMH a hold for now, but growth-oriented dividend investors should keep a close eye on the stock to take advantage of a short-term fall in stock price.

Be the first to comment