pixelfit

Signature Bank (NASDAQ:SBNY) navigates the stormy market with ease and prudence. Revenue growth and margins remain adequate and stable. Prudent portfolio diversification and efficient asset management are its strongholds. Moreover, cash and investments remain high and help maintain excellent liquidity. Indeed, SBNY has a solid positioning with reasonable investor returns. It covers dividend payments that increase along with yields.

Meanwhile, the stock price still appears divorced from the solid fundamentals. But the decline opens a perfect entry point for investors. Estimates using different metrics show a higher target price.

Company Performance

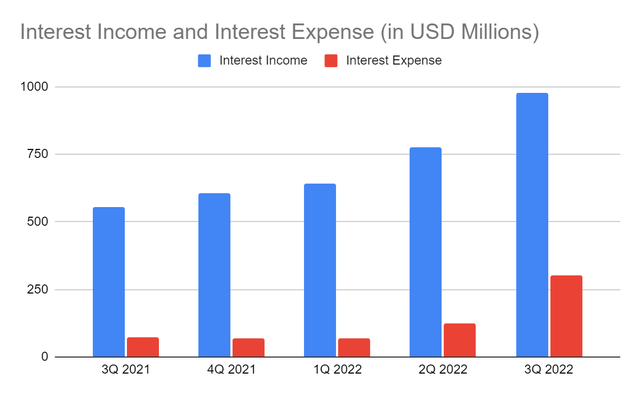

It is typical for a bank to become more exposed to macroeconomic headwinds. It may experience hammered growth, matched with high-flying expenses. Deposit outflows may become unmanageable without prudent asset management. Yet, Signature Bank is an exception. It uses the current situation to its advantage. The core revenue components of SBNY are interests, commissions, and other fees. The interest segment of the bank demonstrates an impressive performance. The most recent interest income amounted to $976.35 million, a 76% year-over-year growth. Various attributes contributed to the robust growth. I will focus on the three.

Interest Income And Interest Expense (MarketWatch)

First, SBNY maintains efficient loan and deposit management. These two accounts serve as the lifeblood of the business. Along with the interest rate hikes is sustained loan growth. But what mainly drove it was the ideal quality of loans. Note that most of SBNY’s loans are rate-sensitive. Moreover, 58% of loans come from the commercial and industrial segments. The commercial segment also comprises a substantial portion of real estate loans. If we combine them, they hold 72% of loans. Hence, loans are sustainable and secure even when the US economy steers into reversal.

Second, SBNY maintains prudent investment portfolio diversification and management. We can see it in the bank deposit and investment yields. Often, investment securities do not go along with inflation and interest rate hikes. Even so, SBNY managed to derive higher yields due to the nature of its investment securities. Most of these are government-backed securities and treasuries. In essence, these securities are more inflation-linked. This attribute allows them to cushion inflationary headwinds and lower valuation. Also, cash due from banks earns more interest despite the decrease in value. It proved effective since it helped sustain loan growth and cover deposit outflows. That way, SBNY can sustain growth with adequate reserves during these volatile times. Overall, SBNY’s portfolio is interest-sensitive and well-diversified.

Third, SBNY focuses its resources on aspects it can control and improve. Over the years, it has been enhancing customer relationships and competitive advantages. With adequate resources, SBNY has a flexible lending platform to serve clients better. Digitalization is also one of its current priorities to increase efficiency. It is integral to execute cost-reduction methods. So, it had over 1,000 new client relationships that quarter. It is no wonder commissions and fees had a noticeable increase.

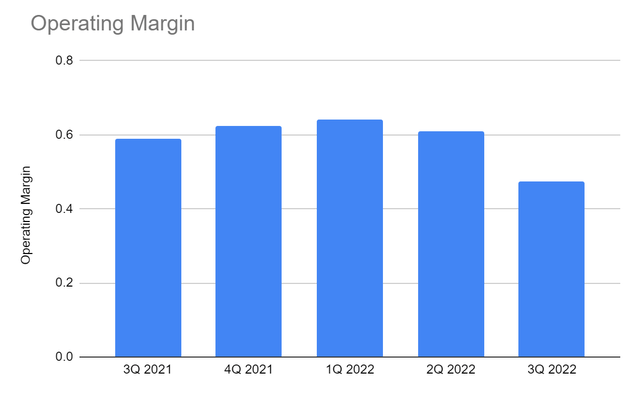

Likewise, interest and non-interest expenses skyrocketed. Only 64% of deposits are interest-bearing, but interest rate hikes have accelerated. Labor-related and technology-related expenses increased by 26% and 16%, respectively. In turn, the operating margin decreased to 47%. Despite this, SBNY shows stable growth with efficiency as it remains viable. It is well-positioned against inflation, interest, and mortgage rate hikes.

Operating Margin (MarketWatch)

Market Risks, Opportunities, And Core Competencies

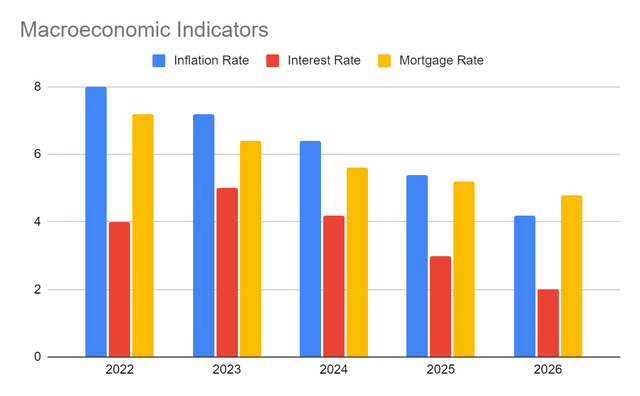

We have already felt the impact of macroeconomic headwinds. Signature Bank must be more careful. Although it has benefited from rate hikes, loan defaults may affect the performance. Even if most of the loans are collateralized, the fair value may not equate to the principal amount. SBNY must also watch for the potential residential property market crash. It may force the company to increase credit loss provisions to preserve liquidity. In turn, it may hamper growth and decrease income. Despite this, we can see that the bank is well-positioned against rate hikes. It sees more potential when the economy bounces back.

Macroeconomic Indicators (Barron’s, Forbes, And Author Estimation)

Despite this, unemployment remains way lower than during the Great Recession. So borrowers can pay loans to the bank. A looming recession may have mixed results for SBNY. Interest rates may continue to increase, but increments may slow down. In the following years, the economy may become stable. Lower interest rates may mean lower yields, but default risks may decrease. Overall, SBNY has improved efficiency and prudence in earning asset management. It takes advantage of its interest-sensitive Balance Sheet to stabilize income and margins. Hence, it must handle loans and investments better when the US recession strikes.

Meanwhile, SBNY may have potential opportunities as the market becomes more manageable. New York has the third largest economy in the US, with over $2 trillion in GDP. Employment in this developed state may remain manageable. There may also be an improvement in purchasing and borrowing power. The increased focus on digitalization is another driver as cashless transactions rise. Meanwhile, SBNY’s decreased exposure to the cryptocurrency market can have mixed results. Last month, it partnered with Coinbase, one of the prominent crypto spot exchanges. Yet, it decided to diversify away a portion of its assets from the market.

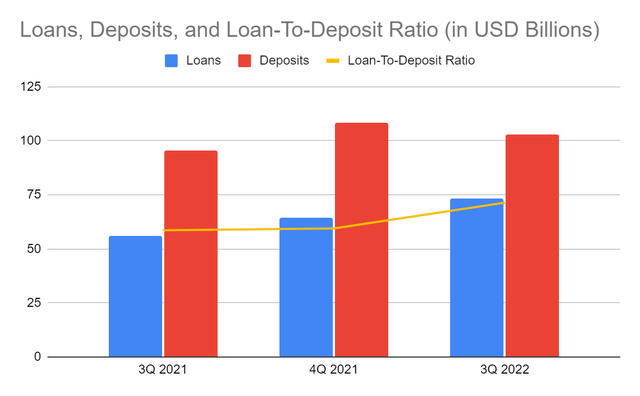

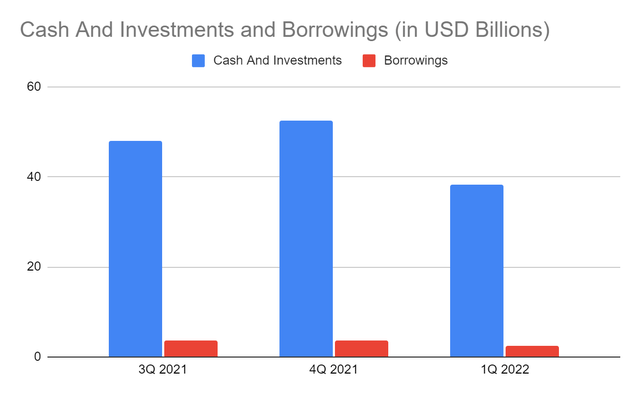

Thankfully, SBNY remains durable with its solid positioning against a potential recession. It maintains a stellar Balance Sheet composed of interest-sensitive assets. Loans flourish with relative stability and impeccable yields. With $73.4 in loans, the value rose by over 20%. Non-accrual loans are 0.24% of the total loans, which is still reasonable. Also, the loan-to-deposit ratio of 73% remains reasonably low. Deposits decreased but using cash could finance loan growth and maintain liquidity. It still has high reserves even during loan defaults. It is flexible in increasing loans further if deemed viable. Moreover, it still has $11 billion in cash, or 9.8% of the total assets. The cut portion funded loan growth and covered deposit outflows which proved helpful. Investments remain stable and secure. The combined amount of cash and investments comprise 33% of the total assets. They can cover all borrowings and other liabilities aside from deposits. We can verify it with the cash flow statement, given the stable cash inflows. The FCF/Sales Ratio of SBNY remains high at 62%. Indeed, it has a high capacity to turn operating revenues into cash. In turn, it can cover borrowings and dividends. Likewise, ROAA and ROAE remain impressive at 1.14% and 16.95%. These are high and ideal since SBNY is considered a huge bank.

Loans, Deposits, And Loan-To-Deposit Ratio (MarketWatch)

Cash And Investments And Borrowings (MarketWatch)

Stock Price Assessment

The stock price of Signature Bank has been in a continued downtrend for almost a year. It does even indicate an incoming stock reversal. At $118.56, it has already been cut by 62% from the starting price. Despite the pessimistic market outlook, it offers an entry point for investors. Its price-earnings multiple of 5.8x shows potential undervaluation. By multiplying it by NASDAQ estimates of $21.33, the target price will be $123.74. My estimation is lower at $21, leading to a target price of $121.8. Either way, the undervaluation is evident in both estimates. The BV multiple of 0.96x is way lower than the 1.4x average before. If we multiply the current BVPS of 110.96, the target price will be $168.98. After averaging the derived value of both metrics, the stock price should be $148.84. It shows a 25% increase in the stock price.

Meanwhile, dividends make SBNY an enticing stock. Payouts have been consistent since 2018, with a yield of 1.88%. It is way higher than the S&P 400 and NASDAQ composite average of 1.21% and 1.24%. Indeed, SBNY is a relatively valuable and generous stock. To assess the stock price better, we will use the DCF Model.

FCFF $280,000,000

Cash $11,400,000,000

Borrowings $2,400,000,000

Perpetual Growth Rate 4.8%

WACC 9.2%

Common Shares Outstanding 62,928,000

Stock Price $118.56

Derived Value $195.20

The derived value adheres to the two price metrics. There may be a 64% upside in the next 12-18 months. Investors may also take this opportunity to make a position.

Bottomline

Signature Bank maintains an impeccable performance amidst inflationary headwinds. Revenues are growing with stable margins, showing efficient asset management. Also, its stellar Balance Sheet has excellent loan growth quality. The company is very liquid, with a diverse and conservative portfolio. Indeed, it is flexible and secure even in a recession.

With sound fundamentals and well-covered dividends, it has a low price. Price estimates and valuation show a solid upside potential for the stock price. Hence, investors must take this ideal entry point to make a position. The recommendation is that Signature Bank is a strong buy.

Be the first to comment