arlutz73/iStock Editorial via Getty Images

Although I don’t eat as much of it now, because these mentally sluggish doctors haven’t yet figured out a way to allow me to live a healthy life fueled entirely by candy, I still like to write about confectionery. Writing about it is the closest I can get given that I can’t eat as much of this as I did when I was 14, for now at least. For that reason, I’m interested in starting to write about The Hershey Company (NYSE:HSY), not least because I have a multi decade history of being absolutely addicted to their products. In this piece I want to work out whether or not it makes sense to buy the stock at current prices. I’m going to review their financial history, paying particular attention to the dividend. I’m also going to look at the valuation. If you subject yourself to my stuff regularly, you know that I see a strong inverse relationship between price paid and subsequent returns.

We’re here for a good time, not a long time, so I’ll come right to the point in this, my “thesis statement” paragraph. I offer this up for those who are interested in gleaning the gist of my thoughts but might (justifiably) find my writing style “a bit much.” In case you missed the title, and flew past the bullet points above, I’ll repeat myself here. I think this is a wonderful company, with a very sustainable dividend. I don’t mind the dual class share structure at all, as the common shareholders receive 10% more than the Class Bs anyway. The payout ratio is quite low, which suggests the dividend can continue to grow, which will obviously be supportive of price. The problem, in my estimation, is the fact that the shares are very overpriced. I make the point more fully below, but the fact is that we only make money in stocks when we spot the discrepancy between expectations embedded in the current price and subsequent returns. The problem is that the expectations about dividend growth and so on are already priced in, suggesting suboptimal returns for longs from current levels. Additionally, as my regulars know, I like to write deep in the money puts on overpriced, high quality stocks like this one, but the problem is that the premia on offer for out of the money puts is so thin at the moment as to not make the exercise worth it. There you have my thoughts in a nutshell. If you accept the risk of various eye rolls, and industrial grade bragging from here, that’s on you.

Financial Snapshot

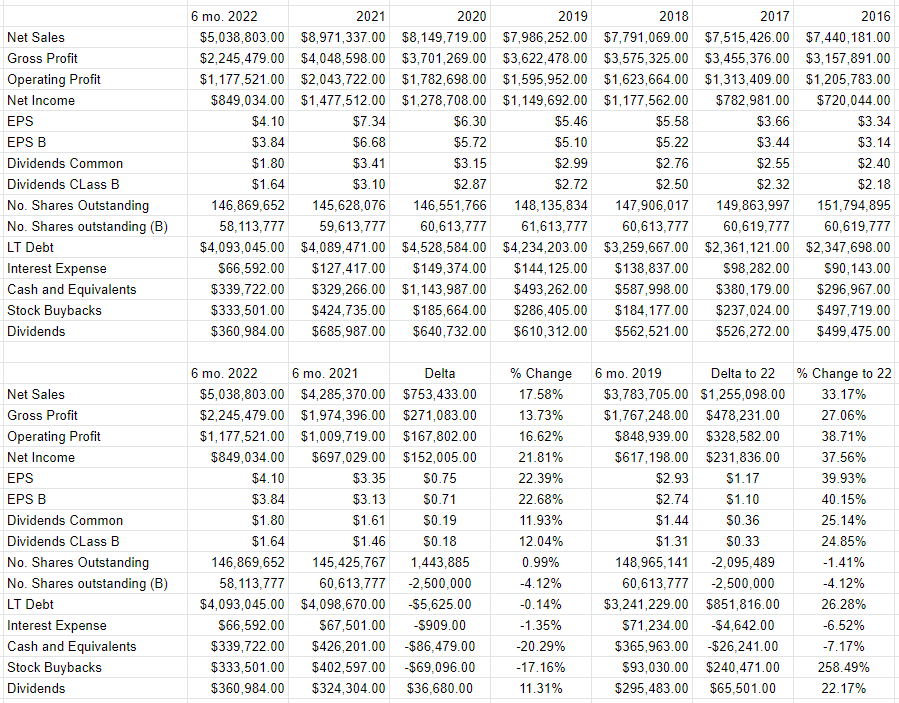

The long run financial performance has been generally quite good in my estimation. I’ll start with the worst aspects of the financials here, because I’m in the mood to lead with the bad news. The company has taken on a great deal of debt over the past several years, growing long term debt at a CAGR of ~9.7% over the past six years, which has caused interest expenses to grow at a compounded annual rate of ~6%. At the same time, the capital structure has deteriorated to the point where cash has gone from representing about 15% of long term debt to only about 8%. The company is more highly levered now, and that presents risk in my view. Acquisitions obviously come at a cost.

That’s the bad news done, though. Since 2016, the company has managed to grow the top line at a CAGR of about 3.2%, while growing net income at a CAGR of over 12.5%. It’s always a positive when earnings growth trounces revenue growth. At the same time, management has rewarded shareholders for this performance by growing the dividend at a CAGR of just over 6%. In my view the most important question is whether or not the dividend can grow, so I’m going to focus more deeply on that question below.

Before getting into that specific question, I should point out that the most recent half year results have been extraordinarily good in my estimation. Specifically, relative to 2021, revenue and net income are up by 17.6% and 21.8% respectively. Additionally, the level of indebtedness actually declined a little bit, down by $5.6 million. In case you’re worried that I’m making a comparison to an “easy” year, fret no longer. The past two quarters have been much better also than the most recent pre-pandemic period. Revenue and net income were both materially higher than the first six months of 2019, up 33% and 37.6% respectively. In summary, the company is a financial powerhouse. It’s now a matter of working out how well covered the dividend is.

Dividend Sustainability

Now it’s interesting (to me at least) that the company has managed to grow nicely over the past several years. I’m as interested in financial history as the next finance nerd, but investors are particularly interested in a company’s financial future for obvious reasons. In particular, people may be interested to learn about the level of dividend sustainability for two reasons. First, the cash flows received from dividends are a significant portion of total returns. They’re far less volatile than the price of the stock, for instance. Second, the dividend is obviously supportive of stock price. So, readers may be curious about what goes on with the dividend. If you guys have an itch, I’m absolutely committed to scratching it, so I want to spend some time writing about the dividend.

When it comes to tracking the sustainability of a given dividend, I take off my “accruals” hat and put on my “cash flow” hat, because I think cash flow is more relevant to the question of dividend sustainability. In particular, I want to compare the size and timing of future cash obligations to the current and likely future sources of cash.

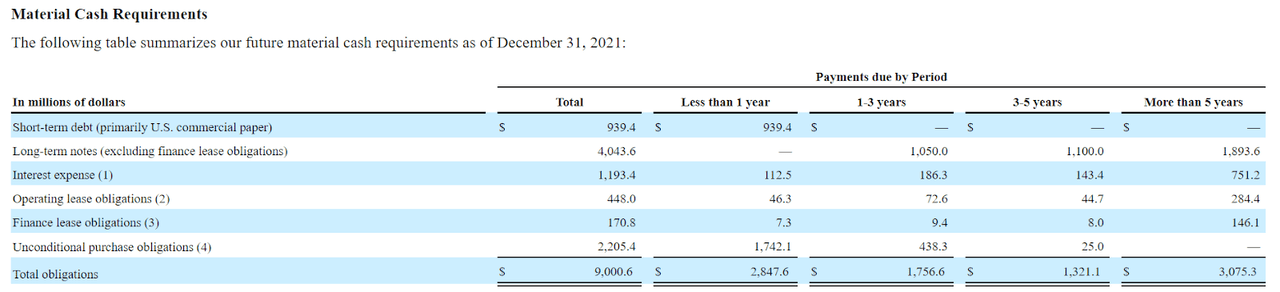

Let’s start with the obligations. I’ve plucked the following from page 36 of the most recent 10-K for your enjoyment and edification. It is a table of the size and timing of various cash obligations over the next several years. I’m forced to make a simplifying assumption by taking the average obligation over a span of a few years. For instance, I’m assuming that the $1.756 billion that the company has to come up with over the 1-3 year periods will average out to about $878 million annually. It’s a simplifying assumption, but not an egregious one in my view.

Hershey Company obligations (Hershey 2021 10-K)

Against these obligations the company has about $340 million in cash and equivalents at the moment. Additionally, they’ve generated an average of $1.848 billion in cash from operations over the past three years, while spending an average of $1.178 billion in investing activities. Note that the CFI average has been goosed by $1.6 billion of acquisition expenses in 2021, as the company acquired Dot’s Pretzels, Pretzels Inc., and Lily’s Sweets. Stripping out these non-recurring acquisitions, average cash for investing purposes was about $645 million.

I also think its relevant that the company has a pretty conservative culture. The fact that they only pay out about 43% of net income in dividends suggests to me that the company throws its nickels around like manhole covers. All of the above suggests to me that the dividend is very well covered, and for that reason, I’m very comfortable buying the shares at the right price.

Hershey Company Financial History (Hershey Company investor relations)

The Hershey Company’s Stock

If you subject yourself to my stuff regularly for some reason, you know that I think the stock is distinct from the business in many ways. If you’re new here, I’ll let you know now: I think a stock is very different from the underlying business. Also, the stock is often a very poor proxy for the business that it supposedly represents. A business buys a number of inputs like cocoa, sugar, and the like, adds value to them, and then sells the results at a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for the company, beliefs about the upcoming Halloween season and the like. Given stock volatility, it seems that the crowd changes its views about the company relatively frequently, which is what drives the share price up and down. Added to that is the volatility induced by the crowd’s views about “the market” in general. “Stocks” become more or less attractive, and the shares of a given company get taken along for the ride. Although it’s tedious to see your favourite investment get buffeted because of all of this, the tedium presents us with an opportunity. This brings us to the big point I want to make in this article. If you’ve been skimming this article to this point, it’s time to stop and read this part carefully. Here goes. The only way to consistently make money in stocks is to spot the discrepancies between the current assumptions embedded in price and subsequent returns. So, if our approach involves investing based on something we read in The Journal, we’re going to do badly over time. This is because by the time the information hits our screens, it’s been priced into the stock price. If we want to make money, we need to spot discrepancies. In particular, if we want to go long a stock, we should only ever do so when the crowd is feeling pessimistic. That’s my point in a nutshell. You can get back to skimming now.

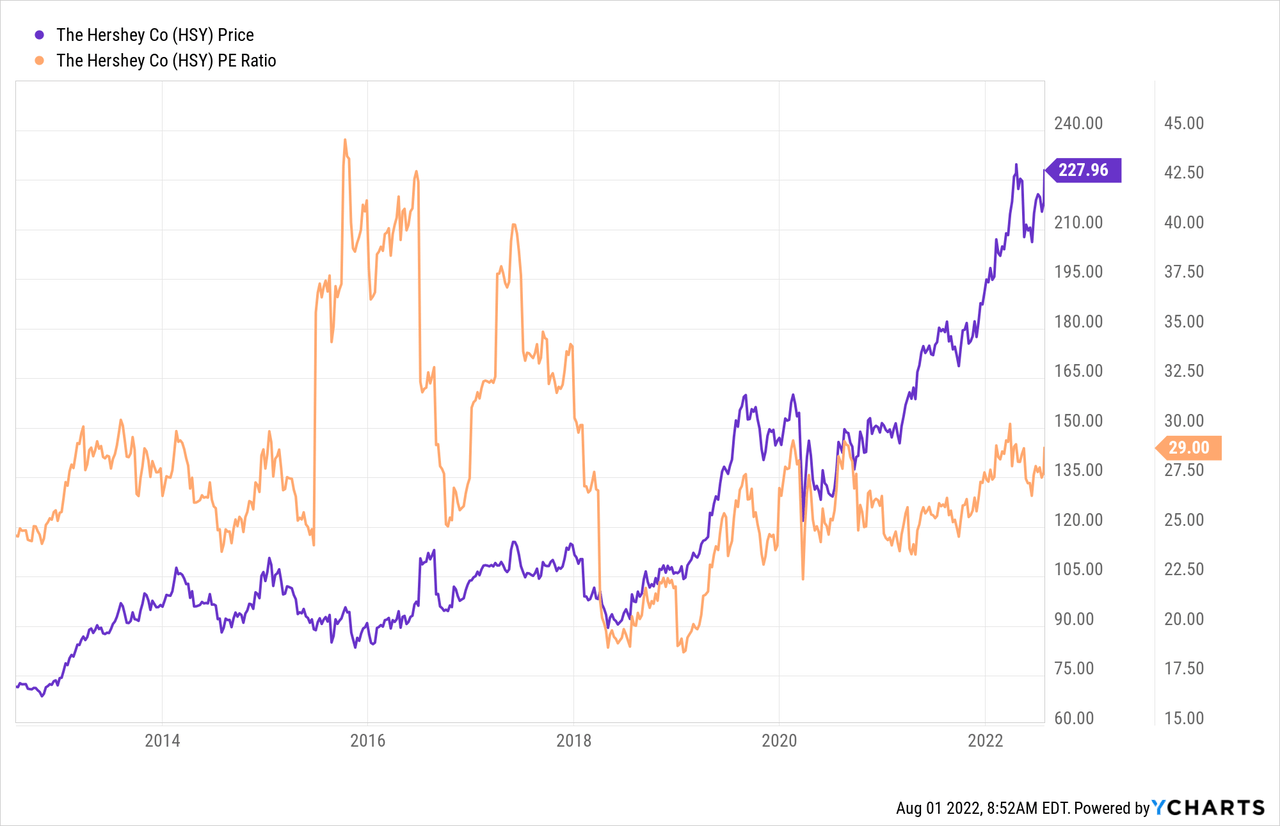

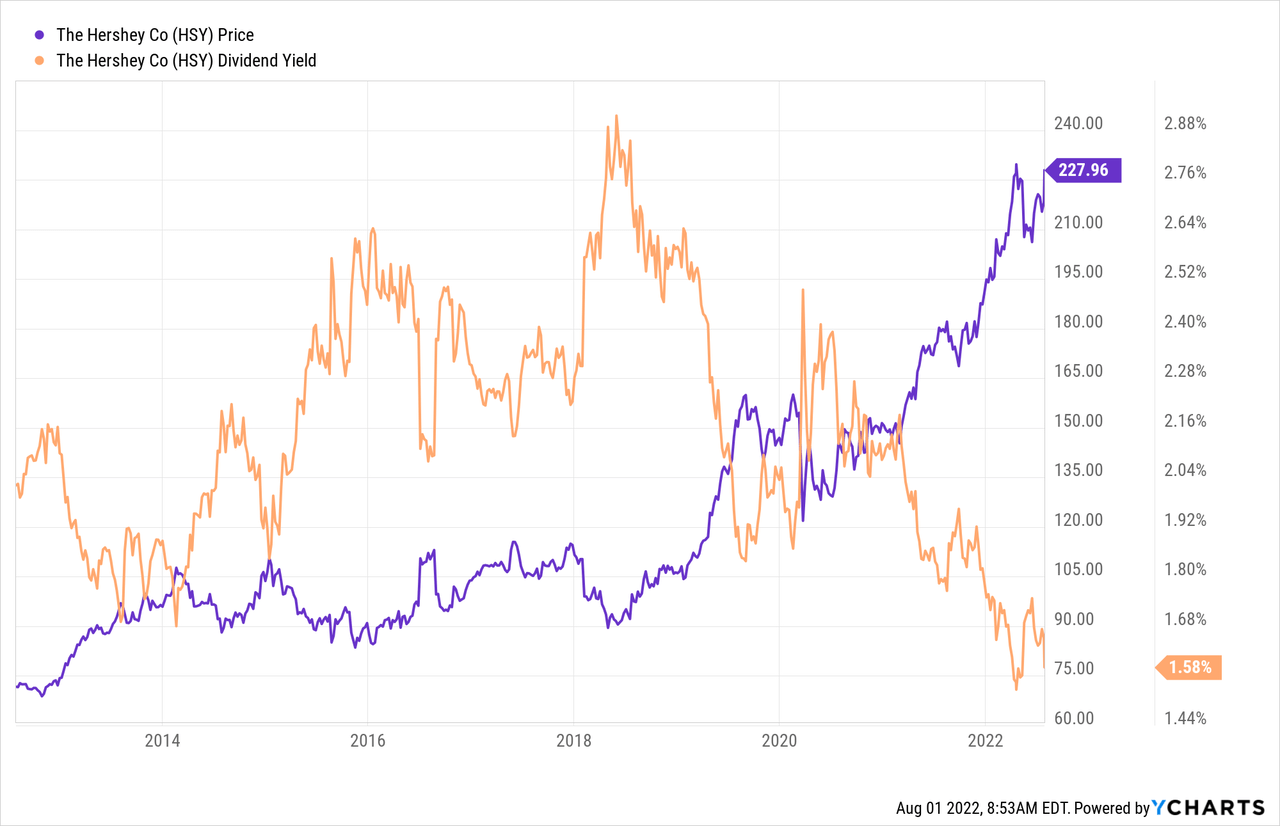

It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name. As my regulars know, I measure the relative cheapness of a stock in a few ways ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. Once again, cheaper wins. I want to see a company trading at a discount to both the overall market, and the company’s own history. On that score, I’d suggest that things don’t look particularly compelling here, per the following:

Source: YCharts

While the shares are trading near highs not seen since 2018, the dividend yield is actually very near a decade low. Written another way, investors are paying more and getting less. That’s not a spectacular combination in my view.

Source: YCharts

While the dividend is certainly sustainable, and the financial performance here is impressive, the shares are too richly priced in my view. For that reason, I can’t recommend buying at current levels.

Options As Alternative

My regulars know that when I consider a very high quality company such as this one to be overpriced, I like to write deep out of the money put options, because these represent a lower risk “win-win” trade for me. If the shares fall in price, I’ll have the opportunity to buy a great company at a great price. If the shares remain elevated in price, I’ll collect premia. The problem in this case is that the premia on offer for reasonable strike prices is very thin, suggesting that there’s not much point on a risk adjusted basis. For instance, the January 2023 put with a strike of $180 last traded hands at only $3.37. Note that $180 is not a “cheap” price but merely an “average” price for this stock. So, in my view there are no viable options trades here.

Conclusion

There’s obviously much to like about this company. The company is growing on the back of some great acquisitions, and the dividend is very well covered. The problem is that the great company is only half the equation, because even a great company can be a terrible investment at the wrong price, because there’s a very strong negative relationship between price paid and subsequent returns. So, I can’t recommend buying this stock at the current price. I’ll certainly put it on my radar, but I would suggest that investors look elsewhere for returns at the moment. I think “price” and “value” can remain distinct for a long time, perhaps years, and I think investors should avoid this stock until price falls to more closely align with value.

Be the first to comment