lechatnoir

Introduction

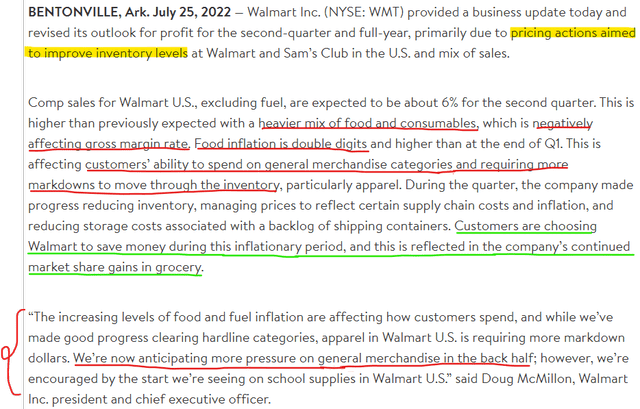

On 25th July 2022, Walmart (NYSE:WMT) provided an unusual interim business update, where the company cut its Q2 FY2023 and full-year profit guidance whilst raising its net sales outlook.

Walmart Investor Relations

Walmart Investor Relations

After Q1 FY2023 ER in May, Walmart’s inventory problem became evident, and looking at this update; the company is still in adjustment mode. Unfortunately, food and gas inflation is causing a shift in consumer spending patterns, making it harder for Walmart to re-adjust inventory without huge markdowns.

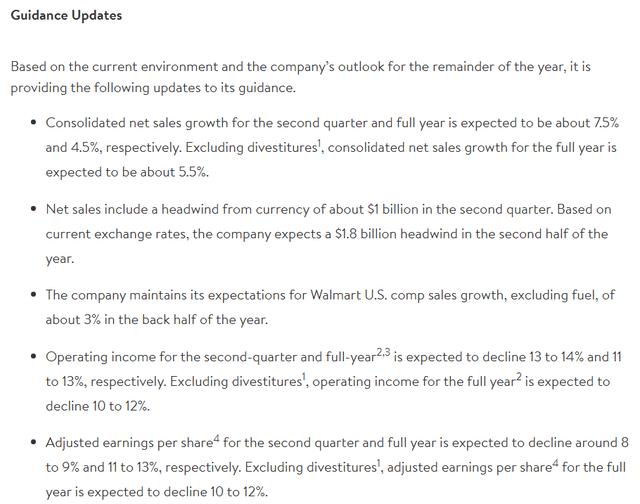

Costco (NASDAQ:COST) is a vastly different business from Walmart due to its varied consumer and product mix; however, it is still exposed to the economy. In a recent news report on CNBC, Jefferies suggested that Costco is well-positioned for the ongoing shift in consumer spending patterns. In comparison to Walmart, Costco is probably faring better due to the lower margin and higher turnover nature of its business. However, this may change as we move deeper into an economic downturn.

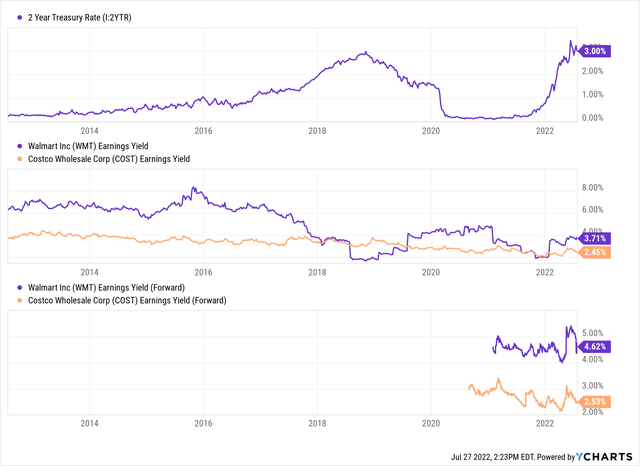

YCharts

Both Walmart and Costco are broadly viewed as defensive stocks due to their massive retail footprint and history of long-term sales and profitability growth. The typical recession/stagflation playbook favors defensive stocks, and so Walmart and Costco should be of particular interest to investors in the current macroeconomic conditions.

In today’s note, we will run through Walmart and Costco’s financials to gauge the strength of these businesses and then consider their valuations to find the better buy among these dividend aristocrats.

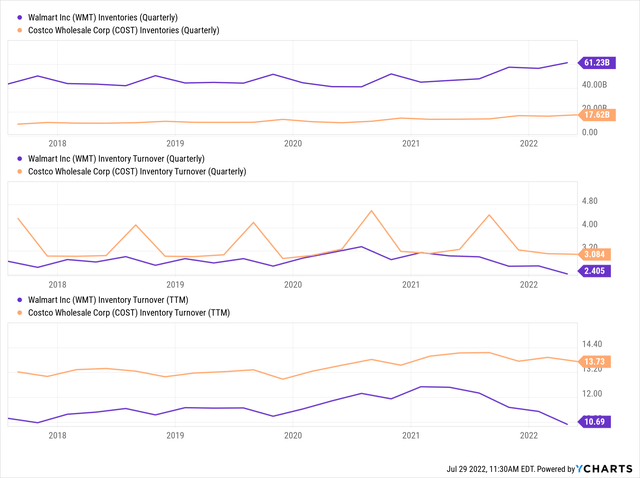

Walmart And Costco: By The Numbers

As you may know, Walmart is the world’s largest retailer with TTM sales of $576B (and 10,500+ stores). On the other hand, Costco runs 830+ (member-only) warehouses and records sales of ~$217B. While Walmart commands higher gross and operating margins compared to Costco, its net profit margin is more volatile and currently trending lower than Costco.

YCharts

As you may have observed, Walmart and Costco operate at a massive scale, but both have razor-thin profit margins. The retail sector is highly competitive and crowded by multiple big box retailers. Further, the rise of e-commerce over the years has led to a shrinkage in TAM. While Walmart and Costco have embraced e-commerce in recent years, there’s a lot of room for improvement for these retail titans’ e-commerce businesses.

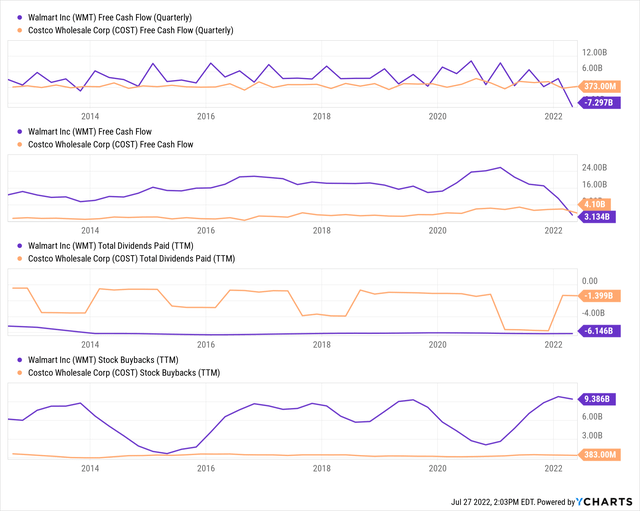

Fortunately, Walmart and Costco’s core retail operations are resilient across different market conditions (well, at least, they have been for the past few decades). Over the years, Walmart and Costco have delivered single-digit CAGR sales growth and steadily expanding free cash flows. Both of them have also instituted capital return programs that include dividends and stock buybacks. As you can see below, Walmart’s capital return program is far better in reliability and size; however, Costco’s balance sheet is superior.

YCharts

YCharts

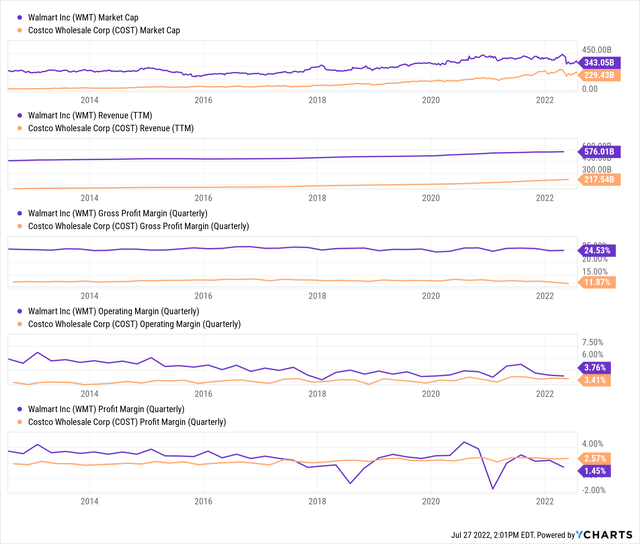

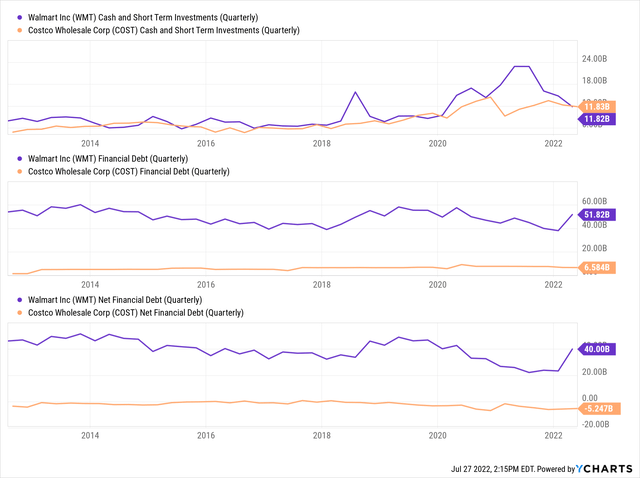

While both Walmart and Costco have ~$12B in cash and short-term investments, Walmart’s financial debt of ~$52B leaves it with a negative net cash position, whereas Costco has a positive net cash position of ~$5.25B. Clearly, Costco has a stronger liquidity profile as compared to Walmart.

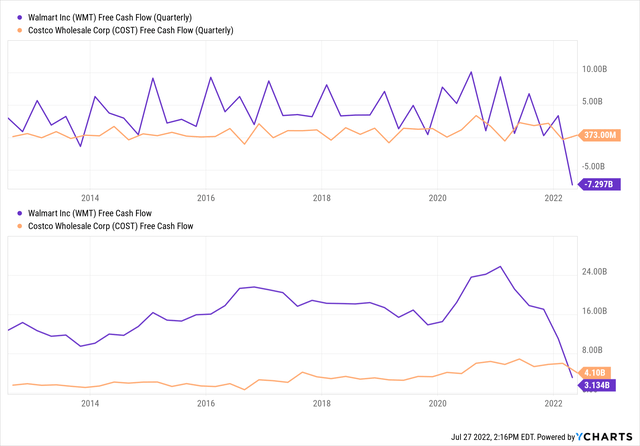

Raging hot inflation, waning consumer demand, and supply chain issues are causing massive business disruption at retail companies like Walmart and Target (TGT). As a result of these challenging macroeconomic conditions, Walmart has been forced into marking down inventories and taking a severe hit to free cash flows. On the other hand, Costco is not showing similar inventory issues, but that could be due to its product and consumer mix.

YCharts

That said, Walmart and Costco have been seeing a contraction in their free cash flows over the last twelve months or so. Despite inflation being a tailwind for sales growth, Walmart and Costco’s pricing power has failed to offset the rising input and operating costs. I believe Costco is faring better than Walmart as a business at this point in time; however, this is reflected in the valuations (and then some).

Walmart Vs. Costco: Which Stock Is The Better Buy?

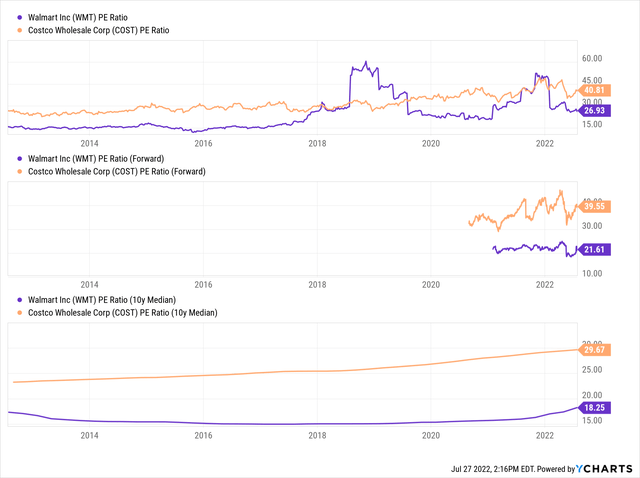

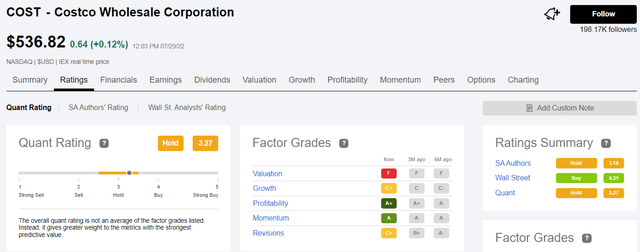

Despite some correction in their stocks during 2022, both Walmart and Costco continue to trade at elevated PE multiples of ~27x and ~40x, respectively. These multiples are well above the historical PE multiples commanded by these businesses over the years.

YCharts

While current valuations of Walmart and Costco would make sense in a ZIRP environment, we are no longer operating in such an environment. With inflation still running hot, the FED must adopt a restrictive monetary policy, and we are still only at neutral (after the FED funds rate was hiked by 75 bps to 2.5% last week). We haven’t even seen the full force of quantitative tightening (FED’s bond sales) on the credit and equity markets.

YCharts

Considering the risk-free rate of ~3%, Costco’s earnings yield of 2.5% is not enough to warrant a long position. While one could make a case for a long position in Walmart based on its earnings yield of 3.7%, the business is heavily indebted ($40B net debt), and it is struggling with inventory issues that are causing a massive cash burn at the retail giant. This may be just a temporary blip at Walmart, but management’s capabilities are under serious doubt after two disappointing quarters on the trot.

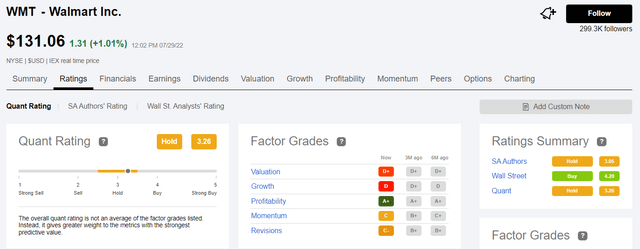

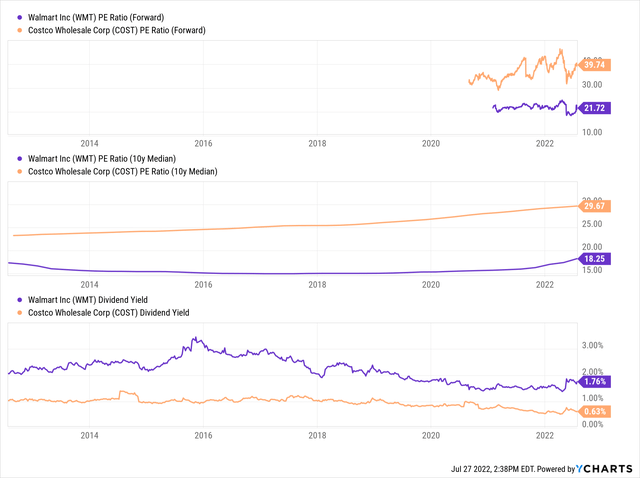

Furthermore, both Walmart and Costco are rated as “Hold” by Seeking Alpha’s Quant Rating system with a near identical score of 3.26/5. As you can see in the images below, Costco has better factor grades for Growth (“C+”), Momentum (“A”), and Revisions (earnings) (“C+”) compared to Walmart; however, the Valuation grade of “F” firmly renders it a hold (not a buy).

SA Quant Rating

SA Quant Rating

Considering business fundamentals and valuations, I wouldn’t buy Walmart or Costco. However, if I had to pick one, I would go with Walmart.

Why Walmart?

Over the last year or so, Walmart and Costco have traded up to multiples far above their long-term median multiples as investors rushed to defensive stocks to protect their portfolios against inflation. While both Costco and Walmart seem to have entered a technical correction in 2022, neither has completed a mean reversion. As inflation wreaks havoc in the economy, corporate earnings could come under significant pressure, and Walmart has already seen declining profit margins. Today, Walmart trades at a PE ratio of ~26x, whereas Costco is trading at a PE of ~40x. The downside to 10-yr median PE for Walmart and Costco is roughly 10% and 25%, respectively. Hence, I see a lower medium-term downside risk for Walmart as compared to Costco.

YCharts

In addition to lower downside risk, Walmart offers a larger dividend compared to Costco, as evidenced by the dividend yields. Also, I see Walmart faring better in a deeper downturn than Costco (as consumers can’t afford to buy items in bulk later in the downturn). As I said before, I wouldn’t buy either of them at elevated trading multiples. Still, if I must pick one between Walmart and Costco, I would go with Walmart due to its lower starting valuation and larger dividend.

Concluding Thoughts

The price an investor pays for a business determines the returns he/she/they get. Currently, Walmart and Costco are trading at elevated multiples as investors seek defensive stocks in a challenging macroeconomic environment. Personally, I think that inflation will subside over the coming months as monetary policy becomes more restrictive. As a forward-looking investor, I think that the time to be in defensive stocks is gone, and paying ~40x earnings for Costco or ~26x earnings for Walmart is akin to locking in several years of underperformance. Ideally, I wouldn’t touch either of them at these elevated multiples; however, if I must choose one, it would be Walmart.

If getting exposure to the retail sector to protect against inflation is the goal, I would instead go for Amazon (AMZN) – a stock that I have covered extensively over the last twelve months. If you’re interested in learning more about my investment thesis for Amazon, refer to my coverage on Seeking Alpha.

Key Takeaway: I rate both Walmart and Costco – “Neutral” (Avoid) at current levels.

Housekeeping Note: I’ll soon launch a Marketplace service on Seeking Alpha focused on generating long-term outperformance through financial engineering. For a short period post-launch, “The Quantamental Investor” will be offered at a heavily discounted legacy price. Stay tuned for more updates!

Be the first to comment