RHJ

Investment Thesis

Cameco (NYSE:CCJ) reported 12.9% of adjusted net earnings margins. Not only is this a massive improvement from Q1, but it’s a truly impressive improvement from the same period a year ago, which was marked by negative double digits in adjusted earnings margin.

That’s not to say that the sky is rosy and the outlook is sizzling strong. However, we are talking about a business that is now in a markedly different position from last year and there are reasons to conclude that Cameco’s prospects could substantially improve going forward.

I believe that paying 6x this year’s revenues is a very fair multiple for this investment. Here’s why:

Revenue Growth Rates Likely to Remain Elevated, But Cameco Fails to Revise Its Outlook Upwards

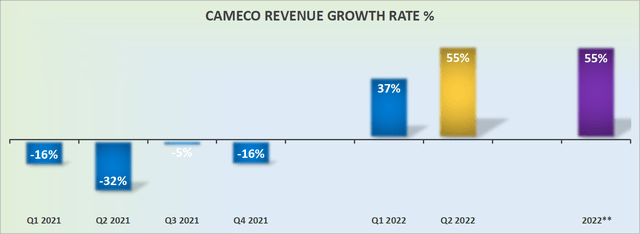

Cameco reported Q2 2022 revenue growth rates of 55%. This was a mightily impressive result, which saw its revenue growth rates accelerate from Q1.

Needless to say that Cameco had a very easy comparable with the same period last year, that if Cameco didn’t deliver impressive results, something seriously wrong would have taken place in the quarter.

That being said, Cameco didn’t feel confident in its recently found momentum to revise its full-year outlook upwards.

And this immediately begs the question, given all the positive dynamics taking place, why didn’t Cameco increase its full-year revenue guidance?

Near-Term Prospects, More of the Same? Or This Time It’s Different?

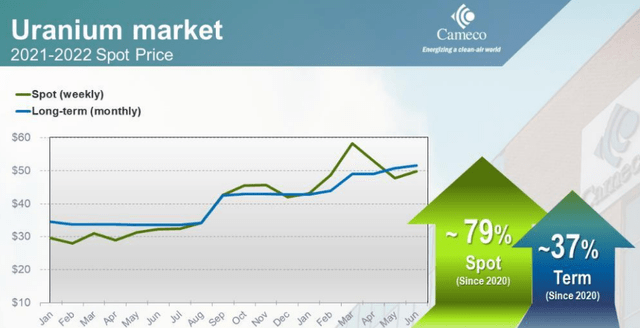

Anyone coming to Cameco is likely to know the bull case already. Nevertheless, if anyone reading this has missed the background, Cameco has neatly summarized the situation as such:

This geopolitical uncertainty has led many governments and utilities to re-examine supply chains and procurement strategies that are reliant on nuclear fuel supplies coming out of Russia.

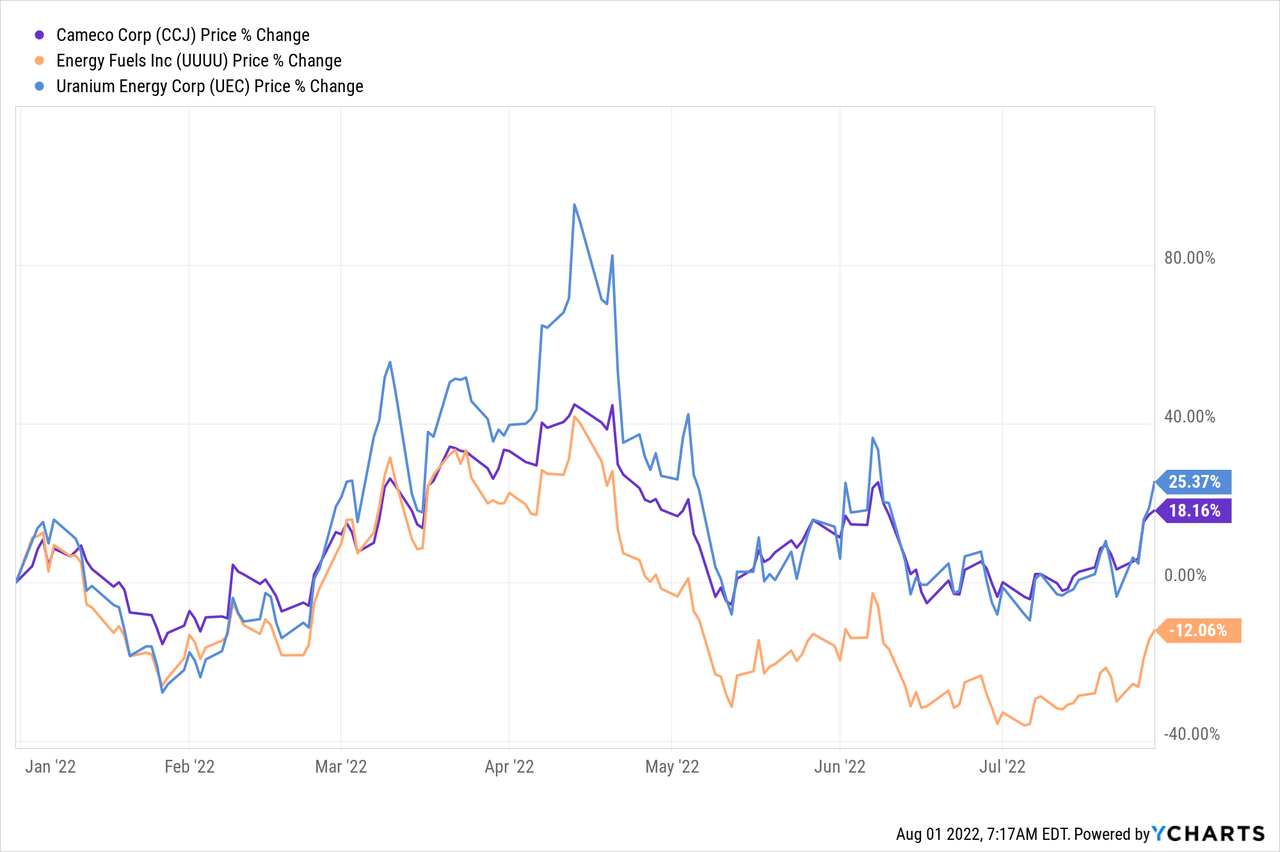

This is the situation facing uranium companies right now, and is the same as it has been for several months. However, despite positive fundamentals, where supply to North America has been severally restricted, for uranium shareholders, despite this compelling backdrop, investors have not seen Cameco or its peers return to recent highs.

As you can see above, many uranium stocks had a pop a few months ago, but have since given back much of their gains. The question is why?

Was it something particular about uranium companies? Or was it that investors en masse turned their backs on commodity companies? I believe it was the latter.

Commodity investors have become so accustomed to losing capital by investing in commodities, that investors didn’t have any faith in a potential commodity bull market, least of all, uranium – what some would argue is a second-tier energy source.

Others would passionately argue that uranium is by far the cleanest and greenest energy source per volume, particularly when it comes to its disposal.

Then, further complicating matters, as you can see above, the uranium spot market has been volatile, which has translated itself into the equities tied to uranium prospects being even more volatile, with cycles of fear and greed building on themselves.

And to add even more complexity to this puzzle, during Cameco’s earnings call, Cameco stated:

Suffices to say we are seeing governments and companies turn to nuclear with an appetite that I’m not sure I have ever seen in my four decades in this business. Therefore, it is easy to conclude that the demand outlook is durable and very bright. (Emphasis added)

So there are a lot of crosswinds, and it’s difficult to get a firm sense of the pervasive winning force.

As it stands right now, the unavoidable fact is this, even though uranium should be seeing a huge spike in pricing, Cameco had to downwards revise its anticipated uranium average realized price to $56.60 per pound from $58.60 per pound in Q1.

This is not a substantial downgrade, but at the same time, this appears to be contrary to this running narrative.

On the other hand, was this already priced in?

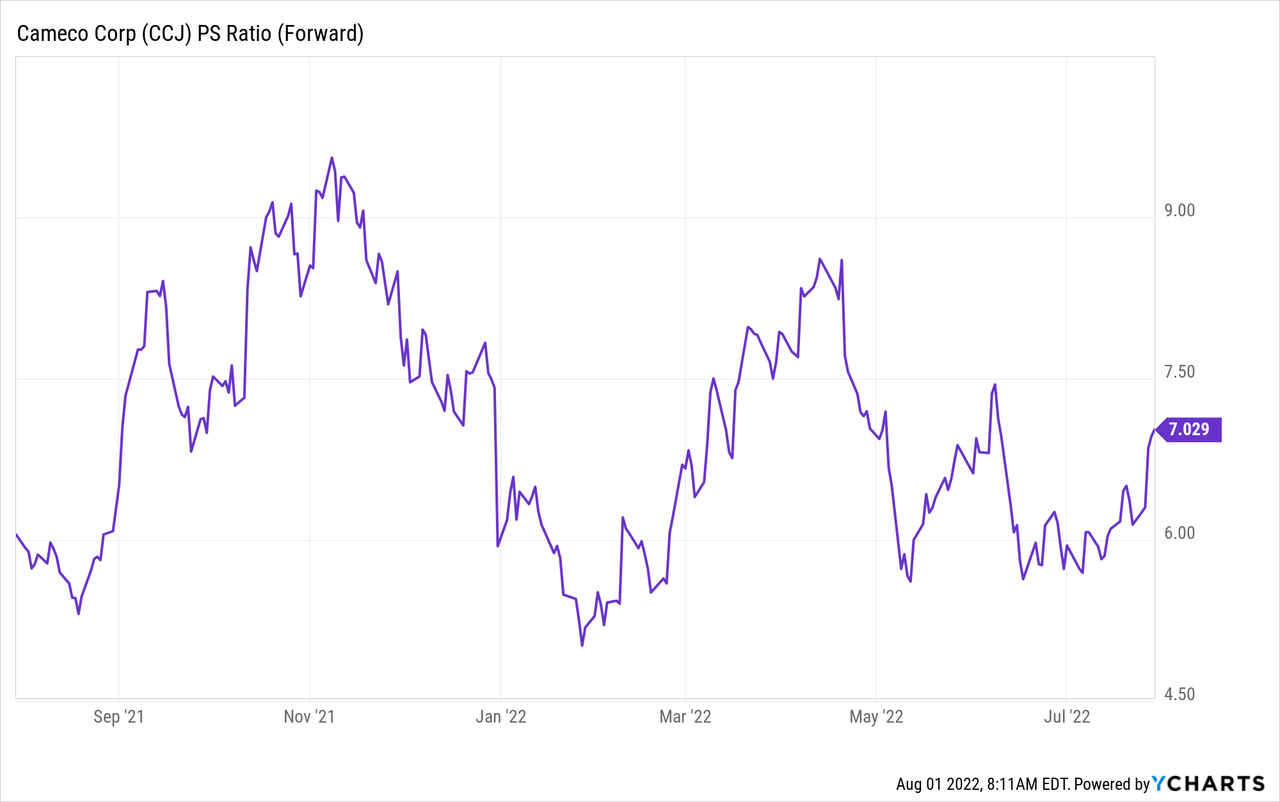

CCJ Stock Valuation – Priced at 6x Sales

I believe that investors had already been pricing in since April a reduction in the price of uranium in the spot market.

Simply put, there’s all the negativity and investor apathy already priced in, but very little hope.

We just saw Cameco reporting 12.9% in adjusted net earnings margin. This is the highest adjusted net earnings margin over the past several years.

So again, I ask, could this time really be different?

The Bottom Line

When all is said and done, this is the negative risk factor, uranium prices are volatile and Cameco had to downwards revise its uranium average realized price to $56.60.

On the other side of the equation, I believe that it’s an unavoidable fact that we are coming out of a prolonged uranium bear market that lasted 10 years, and that there will be the occasional pull back in pricing along the way.

For now, there’s disbelief that Cameco could soon start gushing sustainable cash flows. Nevertheless, we just saw Cameco positively report Q2 results that for many investors would have seemed impossible only a few months back.

Consequently, I believe that Cameco could have what it takes to delight investors. And that paying 6x this year’s revenues is not an exaggerated multiple, particularly for a company that’s now reporting solid double digits of adjusted earnings margins. I rate the stock a buy.

Be the first to comment