Zoran Orcik/iStock via Getty Images

Introduction

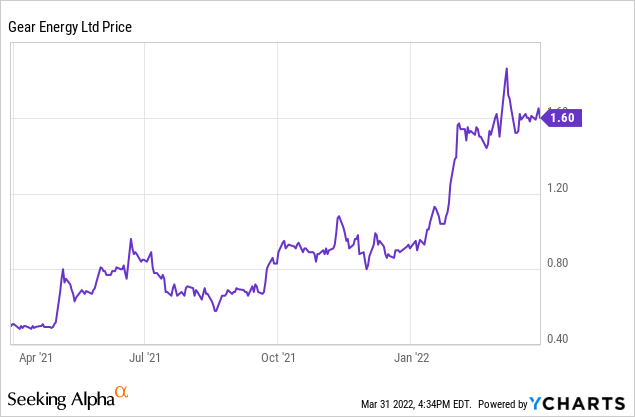

In a recent article on Gear Energy (OTCQX:GENGF) published in January, I ran the numbers to see what we could expect in 2022 from a free cash flow perspective. According to the official guidance of the company, Gear Energy was slated to report a 16% free cash flow yield using an oil price of US$75/barrel. We’re now just two months later but Gear Energy’s share price is up by about 50%. As the oil price isn’t anywhere near the $75/barrel I used in my previous article, perhaps I should update my expectations.

Gear Energy has currently 260M shares outstanding, for a total market capitalization of around C$420M. The company’s Canadian listing is much more liquid than the US listing and I would strongly recommend to trade in the company’s securities using its TSX listing where it’s trading with GXE as its ticker symbol. The average daily volume is almost 2.7 million shares in Canada.

2022 should be a banner year for Gear Energy thanks to the strong oil price

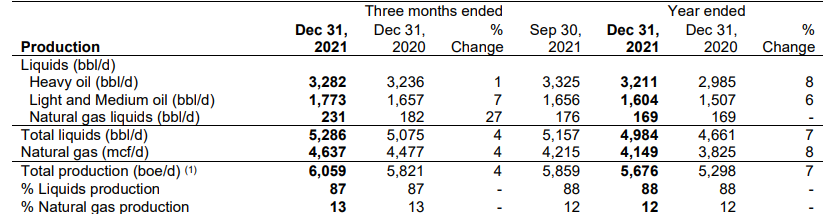

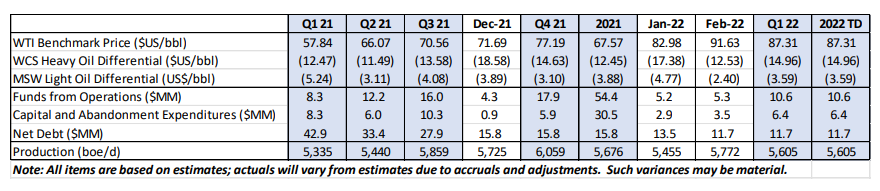

As Gear Energy provides monthly updates on the production rate, cash flow result and capital expenditures, the final results for FY 2021 didn’t contain any major surprises. The average production rate in the final quarter of 2021 came in at 6,059 barrels of oil-equivalent per day. The fourth quarter started off with strong production rates exceeding 6,200 barrels of oil-equivalent per day, but due to the cold weather in December, production was scaled back to just 5,725 boe/day, resulting in a lower than expected quarterly production rate.

Gear Energy Investor Relations

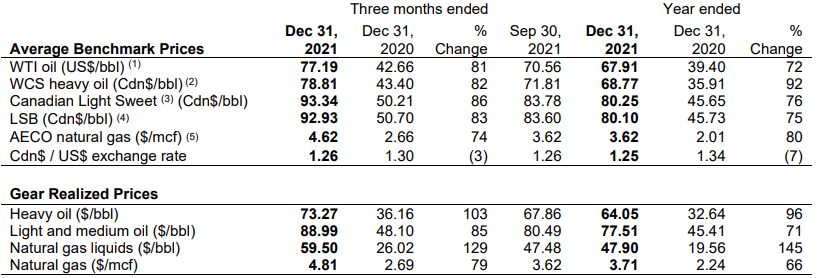

That was a small setback but didn’t have a noticeable impact on the company’s financial results as the higher oil price more than fully compensated for the lower-than-expected production rate. The average heavy oil price was just under C$79/barrel which compares favorably to the C$71.81/barrel in Q3 and the full-year average of less than C$70M.

Gear Energy Investor Relations

This resulted in a quarterly operating cash flow of C$17.4M and as Gear Energy spent just C$4.9M on capital expenditures, the company’s underlying free cash flow was approximately C$12.5M in the final quarter of the year. Looking at the full-year results, the operating cash flow was just under C$52M with just under C$29M in capex for a total free cash flow of around C$23M. The combination of the strong free cash flow and the conversion of some convertible debenture into common shares reduced the net debt from almost C$53M as of the end of 2020 to just under C$16M at the end of December.

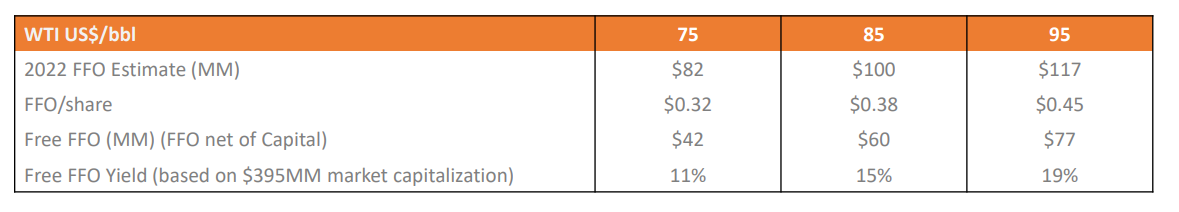

The company is sticking with its guidance for 2022. At US$75 WTI, Gear Energy is expected to generate about C$82M in FFO resulting in a free cash flow result of C$42M after deducting the planned C$40M in capital expenditures. As the sensitivity analysis below shows, at $85 WTI, the anticipated free cash flow is approximately C$60M which would be around C$0.23 per share.

Gear Energy Investor Relations

The monthly updates indicate all is well in the Canadian oil patch

As the oil price has been pretty high in the first quarter, we can expect Gear Energy to handsomely beat the lower end of the guidance. Gear is one of the very few companies providing monthly updates on the production and cash flows. The March update obviously isn’t out yet, but the January and February updates provide some good insight on how the company is doing. With an average oil price of around $87 WTI in the first two months of the year, the oil price is most definitely cooperating but the production still hasn’t reached the 6,000 boe/day that was anticipated to be the average for the entire year.

Gear Energy Investor Relations

The lower production rate resulted in a rather disappointing C$10.6M in operating cash flow and C$4.2M in free cash flow after deducting the C$6.4M in capital expenditures. That being said, the company also has held back about 10,000 barrels of oil that it hadn’t sold yet. The inventory build-up started in January, and the company confirmed in its February update it was planning on selling the excess oil in March. As the oil price exceeded $100/barrel for most of the time in March, we can expect those 10,000 barrels to add at least C$1M in additional revenue in the first quarter of 2022.

Investment thesis

While I certainly appreciate Gear’s focus on continuously reducing the net debt on the balance sheet, the stock currently isn’t cheap enough to buy more. While the current oil price of around $100/barrel is encouraging, the futures market seems to be pointing to a lower longer-term oil price and a barrel of oil for delivery in May next year is trading for just around $85. So while the current high oil price will provide a nice tailwind for Gear Energy, we should use a lower long-term oil price.

At $85 WTI, Gear Energy is currently trading at 7 times the anticipated free cash flow. And that’s not materially cheaper than larger companies so I’m not inclined to go long at this moment. I missed the jump but I’m glad the share price moved up by approximately 55% since the previous article was published in January as the opportunity was correctly identified but unfortunately I lacked the cash to act on it.

Be the first to comment