J-Elgaard

“Great losses are great lessons.”― Amit Kalantri

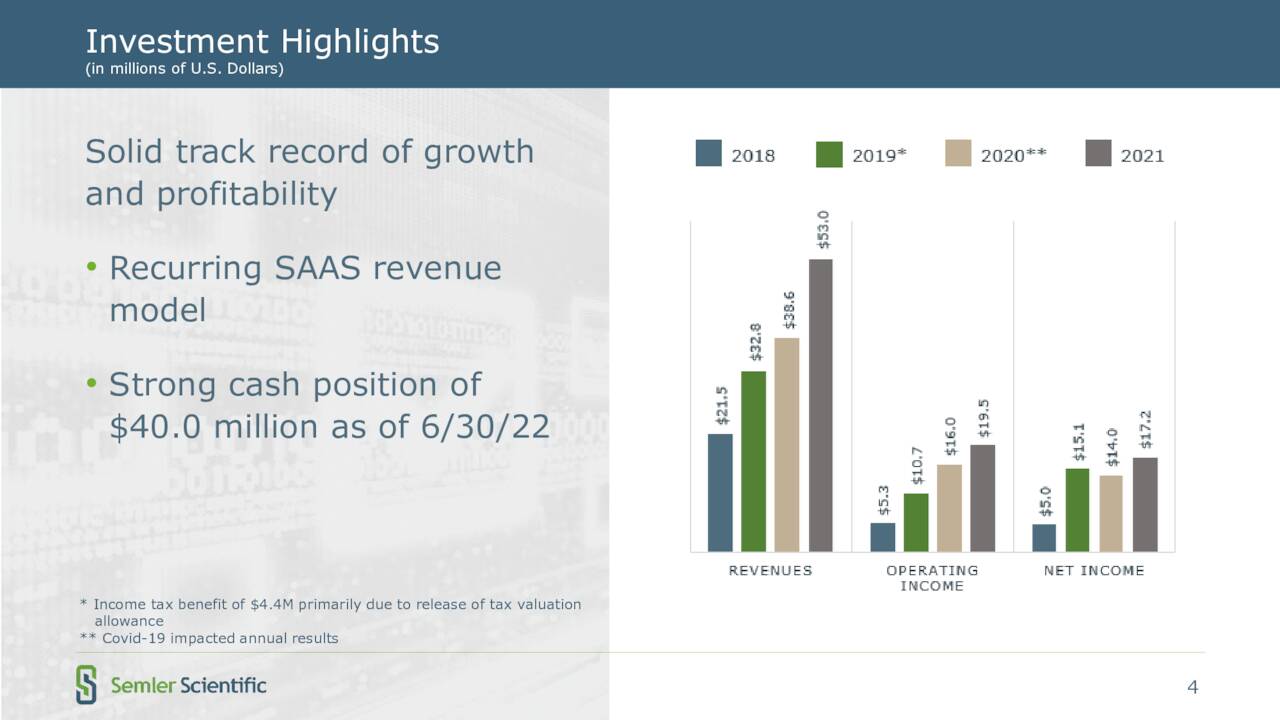

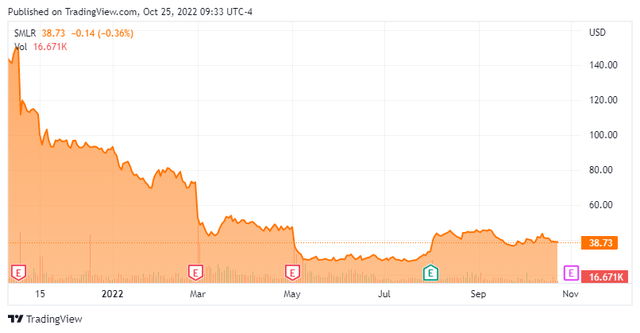

Today, we take our first look at medical device maker Semler Scientific (NASDAQ:SMLR). The stock is down by some 75% over the past year. The equity has suffered as the fizz has gone out of growth names here in 2022 as interest rates have spiked higher. The shares also have been hit as growth has slowed and operating expenses have risen. Has SMLR fallen enough yet to be in the ‘buy zone‘? An analysis follows below.

Company Overview:

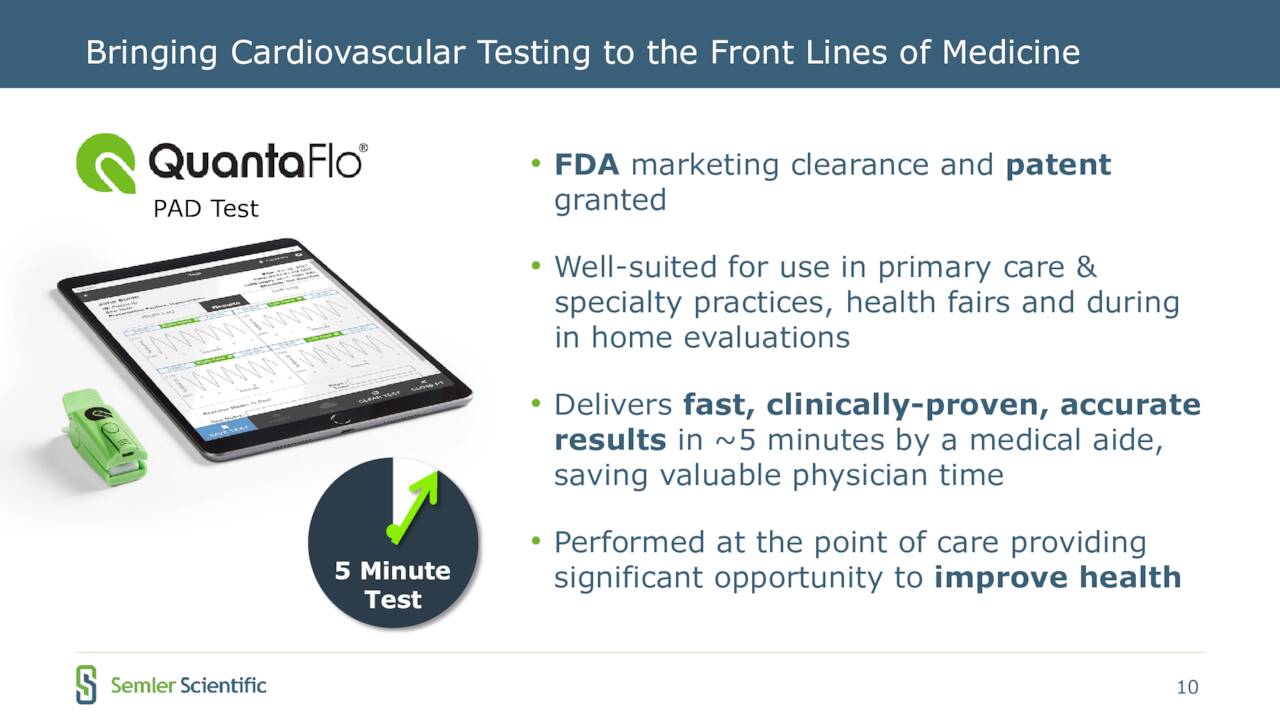

Semler Scientific is based in Santa Clara, California. The company provides technology solutions to improve the clinical effectiveness and efficiency of healthcare provider. Semler’s primary product is called QuantaFlo. This consists of a four-minute in-office blood flow test that enables healthcare providers to use blood flow measurements as part of their examinations of a patient’s vascular condition.

August Company Presentation

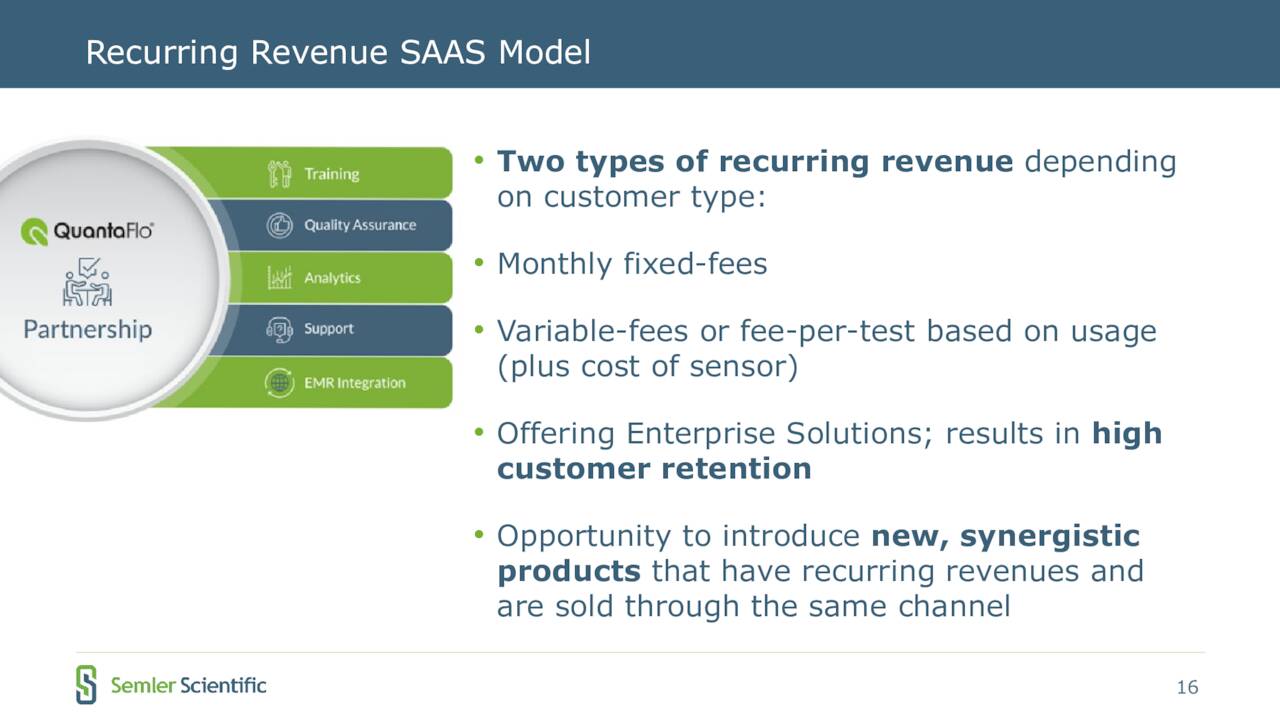

This product is designed to measure arterial blood flow in the body’s extremities to help detect peripheral arterial disease or PAD which is also associated with other afflictions such as diabetes and renal failure. The company’s revenue model consists of both fixed and variable fees. This razor and razor blade model means providers don’t have to pay for the entire purchase price of the system up front. The stock currently trades around $39.00 a share and sports an approximate $265 million.

August Company Presentation

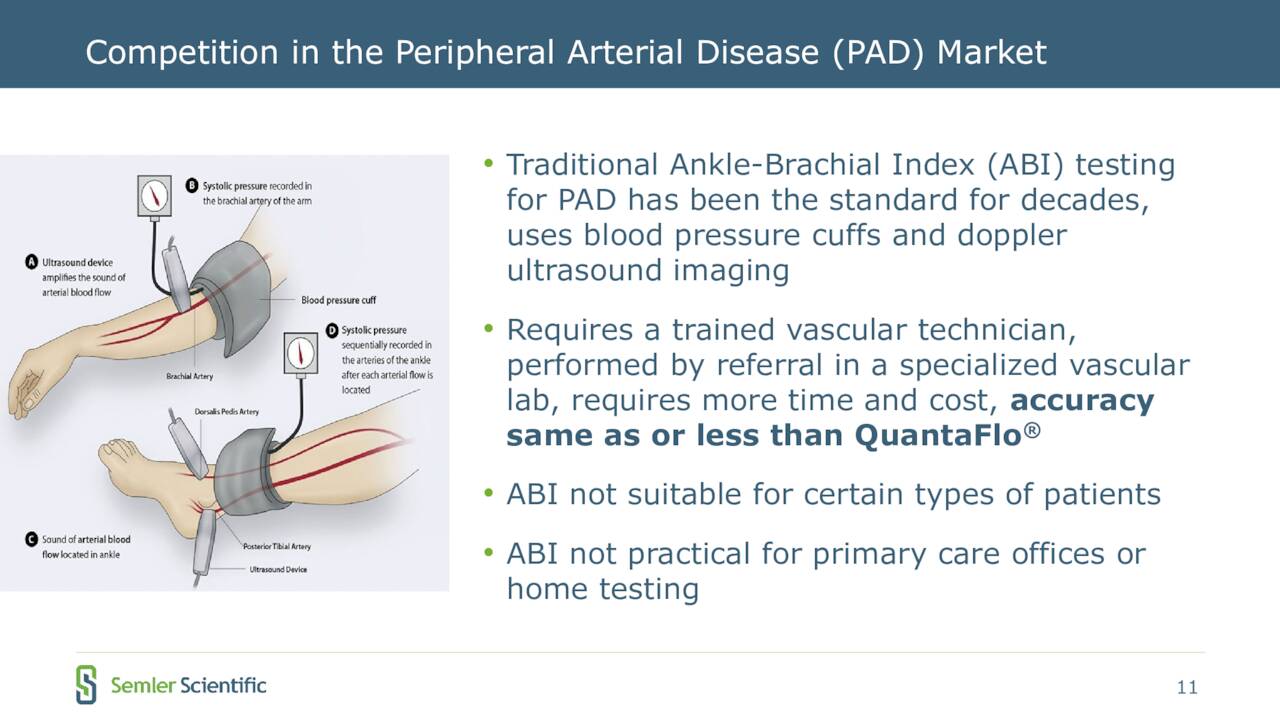

QuantaFlo has several advantages to existing PAD test. QuantaFlo is faster, cheaper and does not have to be performed in a specialized setting and should continue to benefit from the growth in the preventive care segment.

August Company Presentation

Second Quarter Results:

On August 2nd, Semler Scientific posted its second quarter numbers. The company had a GAAP profit of 51 cents a share, roughly a dime a share above expectations. Revenues rose just less than four percent on a year-over-year basis to just under $15 million which was largely in line with the consensus. Fixed fee software license revenues came in at $8.5 million, up 12% from the same period a year ago. Variable fee software license revenues came in at $6 million, down $500,000 from the same period a year ago.

August Company Presentation

Notably, total operating expenses were $9.6 million for the second quarter, a $1.8 million increase from 2Q2021. It should be noted that total operating expenses also increased 41% in the first quarter of this year compared to the same period a year ago. Overall net income was $4.1 million in the second quarter, down $2.6 million from the same quarter in 2021.

August Company Presentation

Management provided FY2022 sales guidance of $58 million to $60 million with targeted operating expenses of $42.5 million to $44 million for the fiscal year. As can be seen above, management expects sales growth to accelerate in the second half of 2022.

Analyst Commentary & Balance Sheet:

Only two analyst firms have chimed in around Semler Scientific so far in 2022. On March 1st, Lake Street maintained its Buy rating on SMLR. However, the analyst there slashed his price target from $175 all the way down to $100 a share. On August 3rd, the day after second quarter earnings were posted, B. Riley Financial reissued its own Buy with a $60 price target.

Less than one percent of the outstanding float in the shares is currently held short. The CEO sold approximately $1 million worth of shares in January and February of this year via myriad trades. Those have been the only insider transactions in the stock so far in 2022, however.

The company ended the second quarter with $40 million of cash and marketable securities on its balance sheet against no long-term debt. The company repurchased $2.8 million worth of its own stock during the quarter, at an average price of $28.75 a share. The company has $17 million left on its current stock repurchase program as of the end of the first half of 2022.

Verdict:

Only two analyst firms have projections on SMLR currently. One analyst sees $1.18 a share in profits in FY2022, the other sees $1.58 in EPS. Both project sales will move up some 10% to $58 million. Their sales estimates for FY2023 are approximately $64 million and $78 million, respectfully. It should be noted that Semler made just over two bucks a share in profit in FY2021.

The company is currently rolling out the product extension of QuantaFlo for use as an aid in diagnosing another cardiovascular disease to its existing client base which hopefully will boost growth in the quarters ahead. It is also important to note that the company’s two largest customers and their affiliates currently make up approximately 70% of Semler’s overall sales.

August Company Presentation

There some positives to Semler’s story. The company is profitable and has a pristine balance sheet. No shareholder dilution, therefore, is on the horizon. The company is also using its cash flow to buy back existing shares. The company has also delivered solid growth over the years.

That said, revenue growth of 10% this fiscal year is down significantly from prior years. Earnings will also declined substantially this fiscal year compared to FY2021. Even with the stock falling by roughly three quarters over the past year, the shares are still priced at over 25 times the midpoint of analyst earnings projections for FY2022 and roughly 4.5 times revenues. Valuations are a bit cheaper if you equate for the net cash on Semler’s balance sheet.

That said, I don’t think SMLR is quite cheap enough to be in the buy zone yet given the current market environment. Closer to the $30 level and I may pick up a small ‘watch item‘ holding in SMLR, however.

“He who profits by villainy, has perpetrated it.”― Iain Pears

Be the first to comment