courtneyk

The uptrend of Western Alliance Bancorporation’s (NYSE:WAL) earnings will continue through the end of 2023 mostly on the back of strong top-line growth. On the other hand, the ongoing reduction of mortgage banking income will restrict earnings growth. Overall, I’m expecting Western Alliance Bancorporation to report earnings of $9.79 per share for 2022, up 13% year-over-year. For 2023, I’m expecting earnings to grow by 12% to $10.93 per share. Compared to my last report on the company, I’ve reduced my earnings estimates for both 2022 and 2023 because I’ve slashed my estimates for mortgage banking income. Next year’s target price suggests a high upside from the current market price. Therefore, I’m maintaining a buy rating on Western Alliance Bancorporation.

Management’s Strategy Shift Likely to Slow Down Loan Growth, Boost the Margin

Western Alliance Bancorporation’s loan portfolio surged by a remarkable 7.4% in the third quarter of 2022, or 30% annualized. Going forward, the management intends to “surgically reduce” loan growth through increased pricing and tighter credit criteria, as mentioned in the conference call.

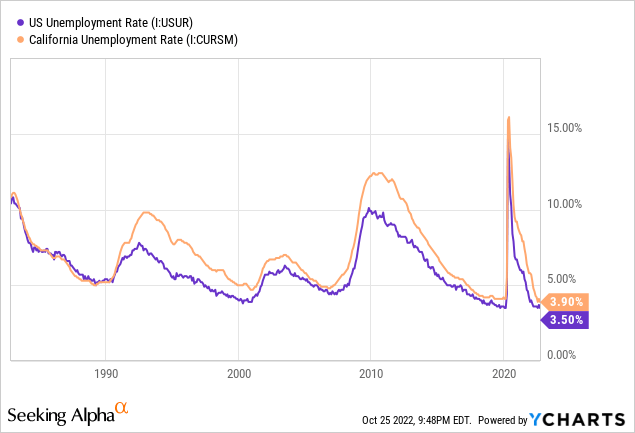

Despite the change in strategy, the loan growth will likely remain at a decent level. The management is targeting double-digit loan growth, or in other words, $1.5 billion per quarter, as mentioned in the conference call. Economic factors will likely keep loan growth high. Western Alliance Bancorporation is a nationwide lender with around 36.8% of loans based in California, as mentioned in the earnings presentation. Therefore, both the U.S. and Californian unemployment rates are appropriate gauges of credit demand. As shown below, the unemployment rates are near multi-decade lows.

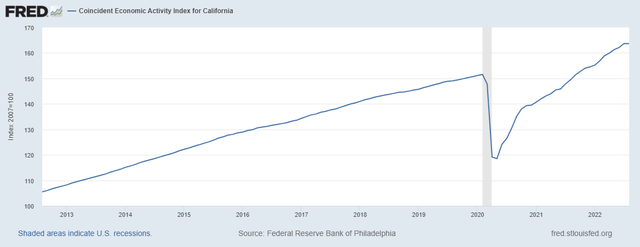

Additionally, California’s coincident index shows that the state’s economic activity is rapidly improving, as shown below. The economic activity also bodes well for loan growth.

The Federal Reserve Bank of Philadelphia

Considering these factors, I’m expecting the loan portfolio to grow by 3% in the last quarter of 2022, and 3.5% in every quarter of 2023. This means I’m expecting a full-year loan growth of 38% for 2022 and 15% for 2023. In my last report on Western Alliance Bancorporation, I estimated a loan growth rate of 17% for 2023. I’ve reduced my estimate mainly because the management has shifted its strategy.

For the same reason, I have also decided to change my margin estimates. As mentioned above, the management is looking to give preference to pricing over volume; therefore, new loan additions are likely to boost the margin in the coming quarters.

Moreover, the ongoing up-rate cycle will benefit the margin. Western Alliance Bancorporation has a large balance of non-interest-bearing deposits, which makes the average deposit cost quite sticky. Non-interest-bearing deposits made up a hefty 44.8% of total deposits at the end of September 2022. These deposits will ensure that interest expenses remain low even as interest rates rise.

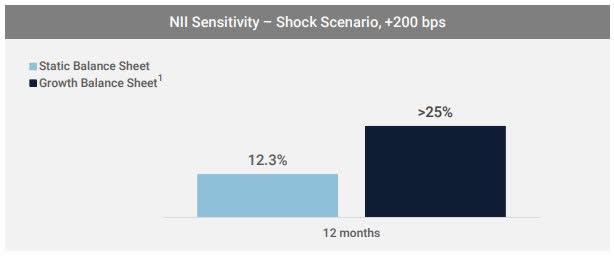

The results of the management’s interest-rate sensitivity analysis given in the presentation show that a 200-basis points hike in interest rates could boost the net interest income by 12.3% over twelve months.

3Q 2022 Earnings Presentation

Considering these factors, I’m expecting the margin to grow by 30 basis points in the last quarter of 2022, and a further 30 basis points in 2023. Based on my margin and loan growth estimates, I’m expecting the net interest income to increase by 45% year-over-year in 2022 and 20% year-over-year in 2023.

Reducing the Non-Interest Income Estimate

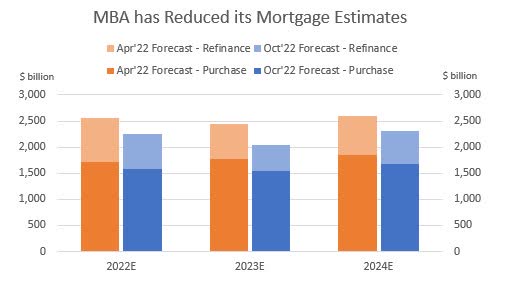

The rise in interest rates led to significant attrition of mortgage banking income during the third quarter of 2022. As a result, the non-interest income plunged by 35% sequentially during the quarter, which negatively surprised me. As the ongoing up-rate cycle has been more extreme than previously anticipated, its negative impact on mortgage demand has also been higher than expected. The bottom of the mortgage income trend now seems to be lower than my previous expectations. The Mortgage Bankers Association has also materially reduced its forecast so far this year.

Mortgage Bankers Association

Overall, I’m expecting the non-interest income to dip by 21% year-over-year in 2022 and 29% year-over-year in 2023. Compared to my last report on the company, I’ve significantly slashed my non-interest income estimates for both years mostly because mortgage banking income has performed much worse than I previously anticipated.

Expecting Earnings to Grow by 13%

The anticipated loan growth and margin expansion will drive earnings this year. On the other hand, a sharp fall in mortgage banking income will restrict earnings growth. Meanwhile, I’m expecting the provisioning for expected loan losses to be in line with the historical average.

Overall, I’m expecting Western Alliance Bancorporation to report earnings of $9.79 per share for 2022, up 13% year-over-year. For 2023, I’m expecting the company to report earnings of $10.93 per share, up 12% year-over-year. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Income Statement | ||||||||||

| Net interest income | 916 | 1,040 | 1,167 | 1,549 | 2,238 | 2,682 | ||||

| Provision for loan losses | 23 | 19 | 124 | (21) | 95 | 100 | ||||

| Non-interest income | 43 | 65 | 71 | 404 | 319 | 225 | ||||

| Non-interest expense | 426 | 483 | 492 | 851 | 1,129 | 1,318 | ||||

| Net income – Common Sh. | 436 | 499 | 507 | 896 | 1,057 | 1,179 | ||||

| EPS – Diluted ($) | 4.14 | 4.84 | 5.04 | 8.67 | 9.79 | 10.93 | ||||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

In my last report on Western Alliance Bancorporation, I estimated earnings of $10.00 per share for 2022 and $11.74 per share for 2023. I’ve reduced my earnings estimates mostly because I’ve slashed my non-interest income estimates.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Further Attrition of Equity Book Value is Likely

Most balance sheet items will likely grow in line with loans through the end of 2023. However, the growth of equity book value will likely trail loan growth. This is because the market value of the large available-for-sale securities portfolio will fall as interest rates rise, leading to unrealized losses. These losses will skip the income statement and flow directly into the equity account through other comprehensive income.

The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Financial Position | ||||||||||

| Net Loans | 17,558 | 20,934 | 26,774 | 38,823 | 53,454 | 61,340 | ||||

| Growth of Net Loans | 17.4% | 19.2% | 27.9% | 45.0% | 37.7% | 14.8% | ||||

| Other Earning Assets | 4,087 | 4,307 | 8,009 | 13,526 | 11,023 | 11,815 | ||||

| Deposits | 19,177 | 22,796 | 31,931 | 47,612 | 57,674 | 66,182 | ||||

| Borrowings and Sub-Debt | 874 | 410 | 554 | 2,414 | 7,210 | 7,282 | ||||

| Common equity | 2,614 | 3,017 | 3,414 | 4,668 | 4,839 | 5,559 | ||||

| Book Value Per Share ($) | 24.8 | 29.3 | 34.0 | 44.7 | 44.8 | 51.5 | ||||

| Tangible BVPS ($) | 22.0 | 26.4 | 31.0 | 38.6 | 38.5 | 45.2 | ||||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

High Price Upside Justifies a Buy Call

Based on the earnings outlook, I’m expecting Western Alliance to increase its dividend by $0.02 per share to $0.38 per share in the third quarter of 2023. The earnings and dividend estimates suggest a payout ratio of 13.5% for 2023, which is close to the 2019-2021 average of 15%. Based on my dividend estimate, the company is offering a forward dividend yield of 2.2%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Western Alliance Bancorporation. The stock has traded at an average P/TB ratio of 1.88 in the past, as shown below.

| FY19 | FY20 | FY21 | Average | |||

| T. Book Value per Share ($) | 26.4 | 31.0 | 38.6 | |||

| Average Market Price ($) | 46.2 | 41.7 | 98.1 | |||

| Historical P/TB | 1.75x | 1.34x | 2.54x | 1.88x | ||

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $45.2 gives a target price of $85.0 for the end of 2023. This price target implies a 29% upside from the October 25 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.68x | 1.78x | 1.88x | 1.98x | 2.08x |

| TBVPS – Dec 2023 ($) | 45.2 | 45.2 | 45.2 | 45.2 | 45.2 |

| Target Price ($) | 75.9 | 80.4 | 85.0 | 89.5 | 94.0 |

| Market Price ($) | 65.9 | 65.9 | 65.9 | 65.9 | 65.9 |

| Upside/(Downside) | 15.3% | 22.2% | 29.0% | 35.9% | 42.7% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 9.7x in the past, as shown below.

| FY19 | FY20 | FY21 | Average | |||

| Earnings per Share ($) | 4.84 | 5.04 | 8.67 | |||

| Average Market Price ($) | 46.2 | 41.7 | 98.1 | |||

| Historical P/E | 9.6x | 8.3x | 11.3x | 9.7x | ||

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $10.93 gives a target price of $106.1 for the end of 2023. This price target implies a 61% upside from the October 25 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 7.7x | 8.7x | 9.7x | 10.7x | 11.7x |

| EPS 2023 ($) | 10.93 | 10.93 | 10.93 | 10.93 | 10.93 |

| Target Price ($) | 84.3 | 95.2 | 106.1 | 117.0 | 128.0 |

| Market Price ($) | 65.9 | 65.9 | 65.9 | 65.9 | 65.9 |

| Upside/(Downside) | 27.9% | 44.5% | 61.1% | 77.7% | 94.3% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $95.5, which implies a 45% upside from the current market price. Adding the forward dividend yield gives a total expected return of 47%. Hence, I’m maintaining a buy rating on Western Alliance Bancorporation.

Be the first to comment