Pgiam

Main Thesis & Background

The purpose of this article is to evaluate the Invesco KBW Bank ETF (NASDAQ:KBWB) as an investment option at its current market price. This is a sector-specific fund, with a focus on bank stocks exclusively. Importantly, it is heavily weighted towards the biggest banking names, and it is managed by Invesco. This is a fund I have owned for a while for banking exposure, but the truth is 2022 has not been kind to it:

YTD Performance (Seeking Alpha)

As I look ahead to 2023, I see this sell-off as a buying opportunity. There are certainly headwinds to this outlook – such as a global recession, an uptick in consumer and corporate delinquencies, and rapid inflation. But I see positives too that suggest a 25% drop is overdone on the downside. The banking sector has seen strong earnings reports and will continue to benefit as central banks raise interest rates. These factors suggest to me that positions in the fund remain warranted, and I will explain why in more detail below.

Valuations Are Finally Reasonable

Let us first point to why readers may want to buy anything right now – whether KBWB or otherwise. Clearly, this has been a rough year for equity bulls, although the past week has seen a nice relief rally. But the fact remains that stock indices are down for the year. These include the major averages and also sector indexes that funds like KBWB track. While losing money in the market is never fun, the upside to this is it often offers investors a chance to pick up stocks at a discounted price.

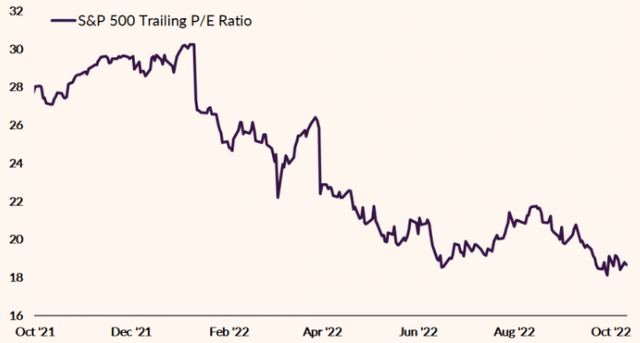

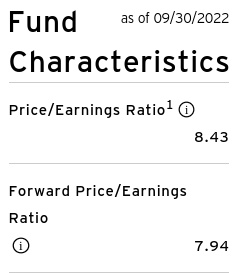

Obviously, a lower price looks like a discount compared to a higher one, but that is not the type of discount I am referring to. I am looking more at P/E ratios, since that suggests how “expensive” a stock/fund/sector is, beyond just the sticker price. With respect to both the broader market (as measured by the S&P 500) and the banking sector index (as measured by KBWB’s valuation), we see that share prices have been falling much faster than actual earnings. What this means is that investors can buy-in at lower valuations as a result:

S&P 500 P/E (Ally Bank) KBWB’s Valuation (Invesco)

To be clear, this is in no way mean that stocks are guaranteed to go up. A lower P/E doesn’t always translate to market gains, and a P/E can also go higher if earnings come up short. This would push up the valuation despite the share prices staying constant – not a good sign.

That said, KBWB does look pretty cheap here. The market as a whole has seen its valuation come in range of its historical average, and KBWB still offers investors a sharp discount to that broader equity market average. This makes me confident that buying in now offers opportunity. Given KBWB’s single-digit P/E, I’m extending that confidence to this particular fund.

Strong Balance Sheets Helps Credit Environment

My next thought concerns the broader corporate backdrop, not banking specifically. While this may sound counter-intuitive, it is just as critical because it offers loans and other services most often to non-banking companies. Therefore, the underlying health of banking financials depends in large part on how the rest of the market is performing. Simply, if borrowers are seeing revenue and profit growth and are managing their balance sheets well, then banks are likely to be paid back in full and on time. That is key to growing interest margins when rates are increasing. Charging more for loans is great, but not if those loans never get paid back!

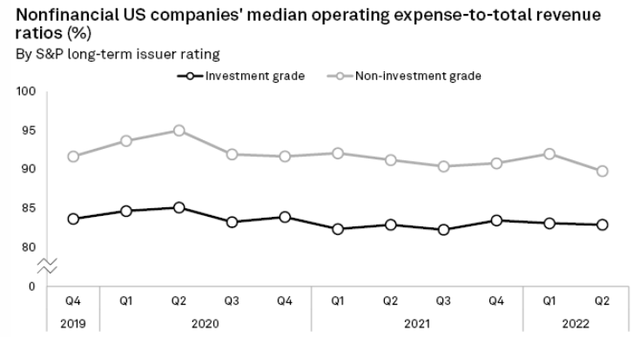

In this vein, I take comfort in broader metrics that show nonfinancial companies have improved their fiscal standing over 2022. While this has been a challenging environment, many large-cap companies have been able to pass on some costs to consumers, paid down debt, and refrained from taking on excessive new debt at the prevailing (higher) interest rates. The result of all this is that, on average, U.S. companies have seen their expensive to revenue ratios decline, which is a positive:

This is good news because it means that there has been improvement in managing expenses across the market. It makes it more likely these companies will stay current on their debt, corresponding to more stable revenues to banks and lenders. Overall, this tells me that U.S. banks are going to be able to profit off of the higher rate environment because their customers are in a position to fulfill their obligations.

Dividend Growth Remains Strong

Another factor I like about KBWB is the income story. In my last review in June, I noted how this ETF had registered strong dividend growth year-over-year and used that as a supporting factor for owning it. Fortunately, Q3 has brought a continuation of that trend, as KBWB delivered double-digit growth again:

| Q3 Distribution 2021 | Q3 Distribution 2022 | YOY Change |

| $.34/share | $.38/share | 11% |

Source: Invesco

This is a basic attribute but one that bears emphasizing. The fact is that KBWB’s current yield is reasonably attractive and the growth the dividend has delivered in 2022 so far tells me this underlying companies are performing well in the current climate. That is a bullish factor overall, and key for why I have a “buy” rating on this fund.

U.S. Banks Have Relative Advantage

I will now shift to why I like KBWB at the expense of foreign banking sectors or foreign funds that have a large amount of financials exposure. Personally, I saw a good bit of merit to diversifying outside U.S. borders throughout this year. At the moment though, I am beginning to rotate back in the U.S. markets at the expense of those non-U.S. positions. The logic is simple, U.S. markets are beaten down and I see value. I believe 2023 will be a recovery year and now is the time to buy quality, stable, large-cap domestic companies for long-term positioning. I had diversified and raised cash over the course of the year for exactly this purpose.

With this in mind, it is helpful to understand why I favor U.S. banks in particular. This is due to a number of reasons. One, I continue to suggest avoiding central and mainland Europe due to geo-political risks, and I wouldn’t touch the banking sector there under current circumstances. I also see the Fed’s more aggressive action compared to other global central banks as a catalyst for a stronger move in the domestic banking sector.

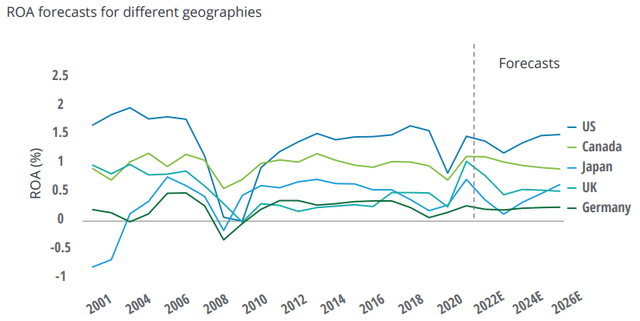

Finally, these trends are not going to be short-lived. The impact of a higher rate environment for longer and war in Europe is going to have an effect on earnings through next year and possibly beyond. This tells me the U.S. banking sector is going to see stronger returns going forward than its global peers, a view shared by analysts at the moment:

Return on Assets Forecasts For The Banking Sector (By Country) (Deloitte)

This shows me that even though the U.S. banking sector has its challenges, the rest of the world is in a tougher spot. This means in relative terms U.S. banks are predicted to come out ahead. In this challenging climate I don’t want to take on more risk than necessary, so global banks will remain an “avoid” for me at the expense of U.S. banks. That is a positive for KBWB.

Bottom-line

Banking stocks have been hammered along with the rest of the market in 2022. I last recommended the sector in June and it had a nice rally in the short-term, but overall market pressures continue to get the better of it. Looking ahead, it is likely this same backdrop could be challenging for KBWB. But I also see reasons for optimism. The fund is cheaply priced, the dividend growth is strong, and U.S. banks have a brighter outlook than their foreign peers.

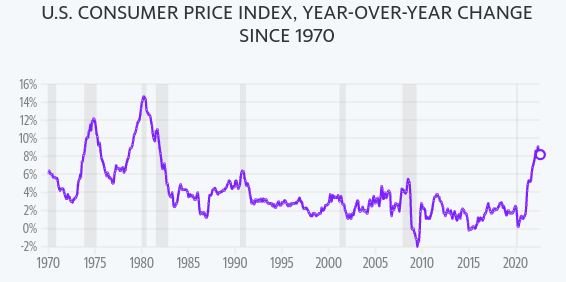

In truth, most of the market has been rallying recently on signals inflation may have “peaked” and the Fed will be less aggressive in 2023 than once thought. While that may be true, let us remember that inflation is still high. “Decelerating” or “peaking” at 8% is not exactly good news:

CPI (Yahoo News)

My takeaway is this means the inflation/rising rates story is set to remain in the headlines in Q4 and early 2023. The banking sector remains as reasonable a way to play this backdrop as any. Therefore, I am keeping my “buy” rating on KBWB in place, and suggest readers give the fund some consideration at this time.

Be the first to comment