Sundry Photography

We are bearish on Zoom Video Communications (NASDAQ:ZM). Zoom is one of the tech names that won big during the pandemic. Zoom’s business model perfectly met the needs of the work-from-home environment the pandemic demanded of businesses and enterprises. We are sell-rated on Zoom based on our belief that demand for its services will normalize as we leave the pandemic behind and as competition penetrates the market. We expect the company will face increased churn as the competition enters the video conferencing industry. We believe video conferencing alternatives by companies like Microsoft Teams (MSFT) and Google G suite (GOOG) (GOOGL), among others, are well-positioned to steal market share from Zoom.

While Zoom is relatively cheap, we believe the seemingly attractive valuation is due to the major downside risks. We expect Zoom stock to pull back further and recommend investors exit the stock.

No significant growth catalyst post-pandemic

We do not expect Zoom to grow meaningfully in the post-pandemic environment. Zoom operates in the video conferencing industry, expected to grow at a CAGR of 11.3% between 2022-2029. Zoom’s sales surged during the pandemic as enterprises, businesses and individuals flocked to video conferencing. Now, as businesses and individuals return to work and leave the pandemic behind, we worry that Zoom will be left behind too.

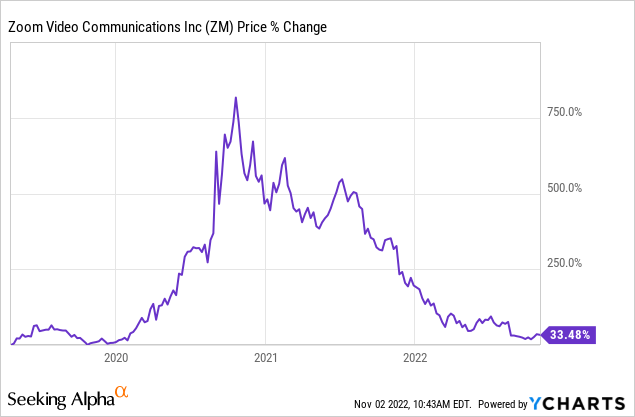

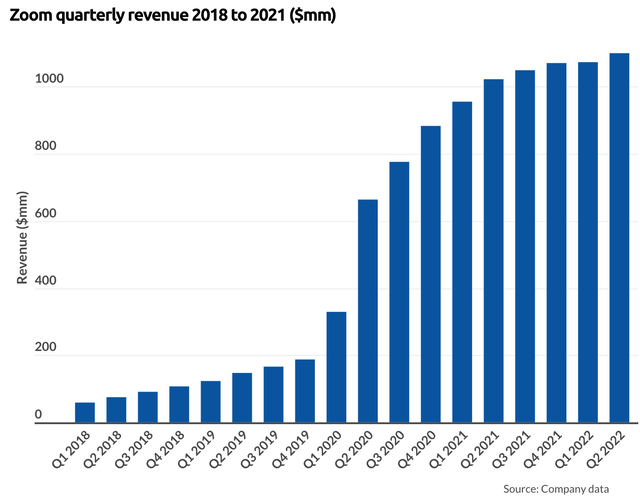

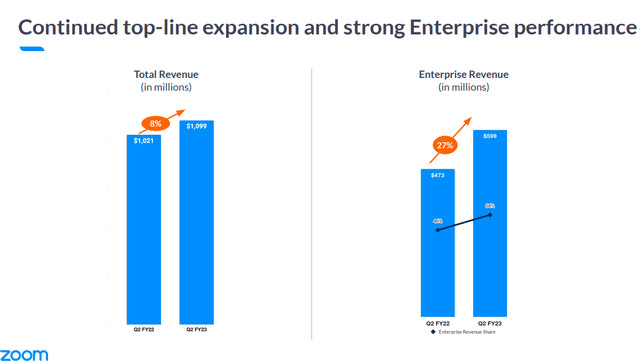

In its 2Q23 earnings report, the company missed revenue expectations with total revenue of $1.10B, missing consensus by $17.58M. Zoom shares fell around 16% the day after the company announced its 2Q23 earnings. In 2Q23, Zoom’s revenue grew 8% Y/Y slowing from 12% Y/Y growth in the prior quarter. Zoom’s earnings report surfaced concerns we already had for the company in the post-pandemic environment: there is no clear growth catalyst in sight. We believe demand for Zoom’s online video services will normalize as the work-from-home demand subsides. We expect Zoom’s revenue to slow down as it loses its pandemic catalyst.

The following graph outlines Zoom’s revenue slowdown.

Zoom’s guidance for 3Q23 and the entire FY2023 does not inspire much confidence. The company guided lower for 3Q23, with revenue forecast estimated to be between $1.095B and $1.1B compared to the consensus of $1.15B. Zoom’s consensus for its FY2023 revenue is $4.53B, while the company guided lower in the range of $4.385B to $4.395B.

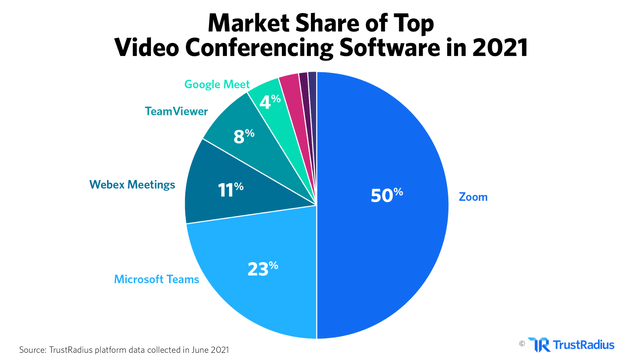

Competition is eating into Zoom’s market share

Slowing demand is not Zoom’s only challenge. The company is also suffering churn as alternative video conferencing services enter the market. Companies with a far larger, pre-existing ecosystem and client bases, such as Microsoft Teams, Google G Suite, and Cisco (CSCO), are actively making a name for themselves in the video conferencing industry. We also expect TeamViewer (OTCPK:TMVWF), BlueJeans by Verizon (VZ), and other minor players to dissect the market. We expect Zoom to struggle to retain its market share in the industry.

We believe Zoom’s market share will shrink over the coming quarters. The following graph shows the video conferencing market share in 2021.

The benefits of the work-from-home environment incited by the pandemic have not entirely washed out. We believe the pandemic created a trend of hybrid and remote work. We expect this to drive growth and inspire competition in the video conferencing industry. Zoom is enduring significant competition from Cisco Webex, TeamViewer, Microsoft Teams, BlueJeans, and Google G Suite. Facebook (META) is the latest company to jump into the industry, introducing Messenger Rooms, which will be available to accommodate up to 50 users. Considering Facebook’s massive user base, we believe this will likely pressure Zoom further.

Enterprise demand tailwinds are still present, but demand is slowing

We believe Zoom still enjoys enterprise demand tailwinds from the remote-in-person hybrid work style, but believe demand is slowing down. Enterprise performance increased by 27% year-over-year, making up 54% of Zoom’s total revenue. We expect the company will likely benefit from a renewal cycle in its enterprise segment towards 1H23 but don’t believe the enterprise segment will offset post-pandemic headwinds and threats from competition.

The following graph shows Zoom’s total revenue and enterprise revenue.

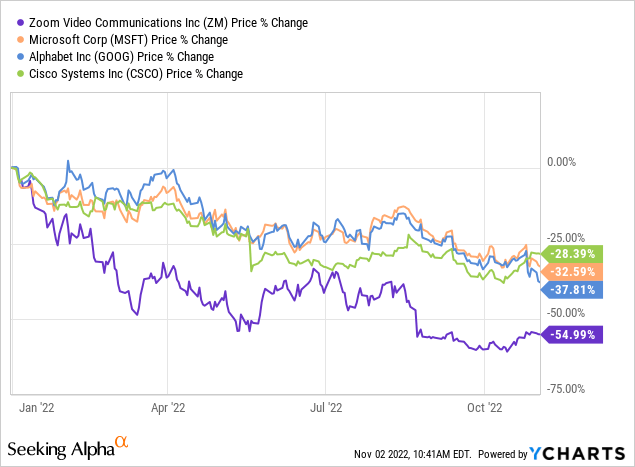

Stock Performance

Zoom is up around 33% over the past five years. Zoom went public in April 2019, a little over a year before the pandemic hit. At the height of the pandemic, Zoom was trading around $559 per share. In the post-pandemic environment, the stock is down around 55% YTD, underperforming competition: Cisco is down about 28%, TeamViewer around 13%, and Microsoft and Google, respectively, down by around 33% and 38%. It must be noted that Google and Microsoft have other streams of revenue that factor into their stock performance. We expect Zoom to continue to underperform the peer group towards 1H23 as the company struggles to find stable footing in the post-pandemic environment.

The following graphs show Zoom’s performance among its competitors over the past five years and YTD.

TechStockPros TechStockPros

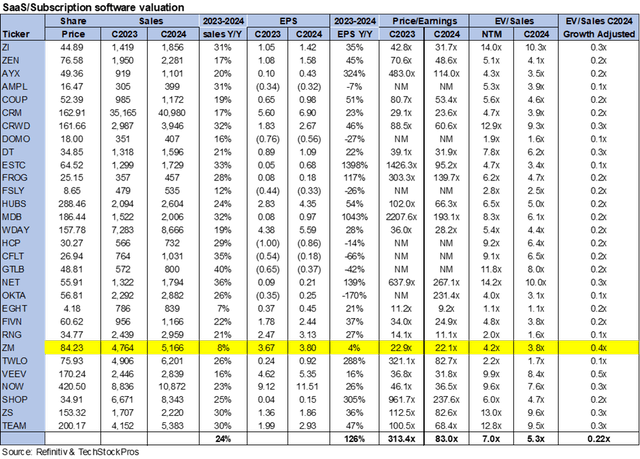

Valuation

Zoom is relatively cheap, but we recommend investors not buy the stock based on weakness as we expect more downside ahead. On a P/E basis, Zoom is trading at 22.1x C2024 EPS $3.80 compared to the peer group average at 83.0x. On an EV/Sales, the stock is trading at 3.8x C2024 sales versus the group average of 5.3x. While Zoom is trading at a discount compared to its peer group, we believe this is due to the major downside risks in the post-pandemic environment and as competition intensifies. We expect Zoom to suffer from increased competition in the video conferencing world as Microsoft, Cisco, Google, TeamViewer, BlueJeans, and other minor players dissect the market. We expect share gains and share shifts to be very difficult for Zoom and recommend investors sell the stock before it dips further.

The following chart illustrates Zoom’s valuation relative to its peer group.

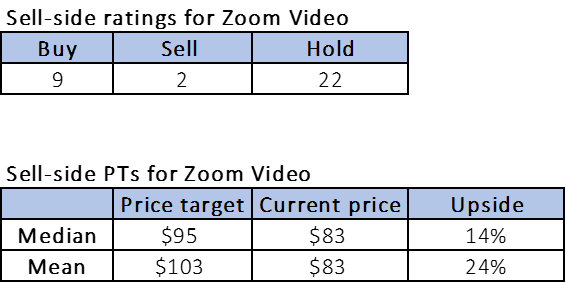

Word on Wall Street

Of the 33 analysts covering the stock, nine are buy-rated, 22 are hold-rated, and the remaining are sell-rated. Zoom is currently trading at around $83. The median price target is $95, and the mean price target is $103, with a potential upside of about 14-24%.

The following chart indicates the sell-side ratings and price targets.

TechStockPros

What to do with the stock

We are bearish on the Zoom stock in the post-pandemic environment. We believe the company will give back pandemic gains under the current macroeconomic headwinds and as alternative video-first communication platforms intersect the enterprise market. We recommend investors sell the stock before it dips further.

Be the first to comment