jetcityimage

Leading the MRO distribution industry

W.W. Grainger (NYSE:GWW) is the leading broad-line distributor of Maintenance, Repair and Operation [MRO] products and services in North America. The company operates under the mission statement to ‘Keep the World Working’, showcasing its commitment to long-term customer relationships and allowing them to operate. The company recently held its first Investor Day since 2017, showing a clear strategy for long-term growth and outperformance.

Throughout this article, I’ll mostly refer to W.W. Grainger as Grainger or GWW.

Performance since the 2017 Investor Day

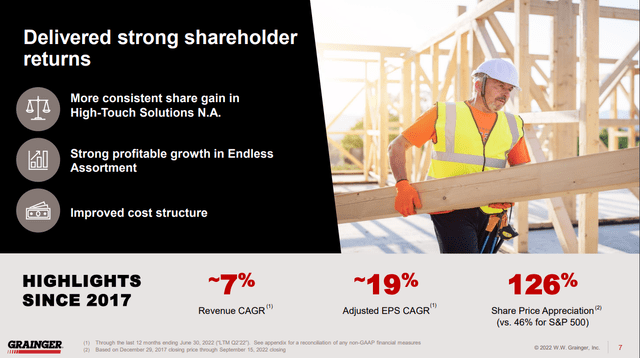

Since the last Investor Day, Grainger has managed to consistently gain market share in its High-Touch Solutions segment, achieve strong and profitable growth in its much smaller Endless Assortment segment and significantly increase its cost structure and margins. Over this period revenues grew 7% CAGR (keep in mind that Grainger divested some businesses like its Chinese business and did not acquire any companies in this period), Adjusted EPS by an impressive 19% CAGR and the share price increased by 126% versus the S&P 500 at 46% in the same period (not including dividends). The stock has been a great investment in the past, so let’s look at the two segments the company reports.

Performance since last Investor Day (GWW Investor Day)

Market Opportunity

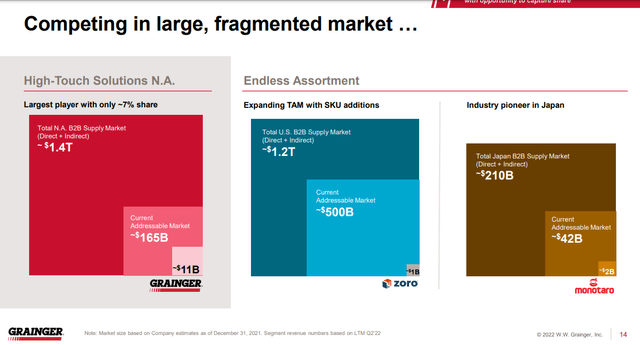

Grainger estimates the total addressable market for direct and indirect NA B2B supplies to be around $1.4 trillion, from which Grainger can serve around 11.7%. In its current addressable market for the High-Touch Solutions business, the company is the largest player with just a 7% market share, showing how fragmented the market is. This leaves a large opportunity for incremental market share gains in the future and to opportunistically buy up competitors, this could get especially interesting if we see struggling competitors if we get a longer downturn in the economy. The Endless Assortment segment is a new, faster-growing segment serving the US and Japan with a combined addressable market very similar to the NA market. Endless Assortment has a much larger current addressable market (we’ll get to why that is in the next two sections) with Grainger holding an insignificant 0.2% of the US market share and a 5% market share in Japan.

What makes this market interesting is that MRO products are resilient due to the nature of being mainly used to keep systems running and service them. This makes the segment much more resilient compared to for example the new construction business. New houses can be delayed, but if something breaks in your home you’ll get it done.

Total addressable market (GWW Investor Day)

High-Touch Solutions

The High-Touch Solutions (I’ll abbreviate it as HTS for this article) business focuses on large to mid-sized customers with highly complex operations and processes. These companies look for a trusted supplier that is reliable and can get them the products they need, where they need them and when they need them. Grainger can deliver on that promise with a supply chain and distribution network (most of the delivery is handled via partners) that can reach 99% of US and 80% of Canadian postal codes the next day. High-Touch Solutions is the vast majority of GWW’s revenues with 79% or $11.2 billion. This business is not a race to the bottom, so Grainger can keep a healthy margin.

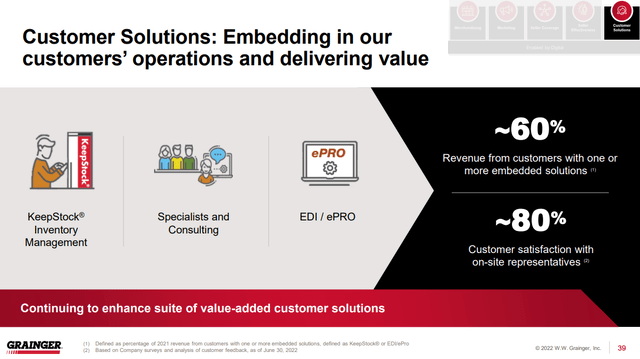

The goal is to develop long-term relationships with large customers and deepen these relationships. Grainger also offers services to its customers, including its Inventory Management solution KeepStock, Specialists and consulting and its eProcurement solution to make purchasing even easier. This is a big part of its competitive advantage because 60% of its uses at least one of these solutions. Grainger is a technology company, developing its own solutions to increase the value it brings to its customers. Here is a quote from the CEO:

So I don’t think we’re going to probably talk about specifics in terms of number of engineers. I will say that we have shifted our team pretty substantially from a team that was not sort of building software internally to one that is largely or partly at least building software internally. So we have had a huge shift. The team has done a nice job of – a lot of new leaders and a lot of new software engineers hired than other areas we’ve hired. So what I would say is we are making the transition. We’ll continue to make it as we build capabilities and find capabilities that we think we should build internally. So that will continue.

Value added services (GWW Investor Day)

Endless Assortment

The Endless Assortment [EA] caters to smaller businesses with less complex operations and processes. The main focus of this business unit is to create an easy and streamlined online buying process with a vast number of stock-keeping units (SKUs). EA has a different strategy that aims to expand its product assortment (already 10m SKU compared to 2m for HTS) to drive increased web traffic and attract new customers. EA goes beyond Grainger’s offering by offering categories like Restaurant supplies, Automotives and Ground Maintenance, but 80% of revenues are still derived from Grainger-stocked items.

Capital Allocation

Clear 2025 targets

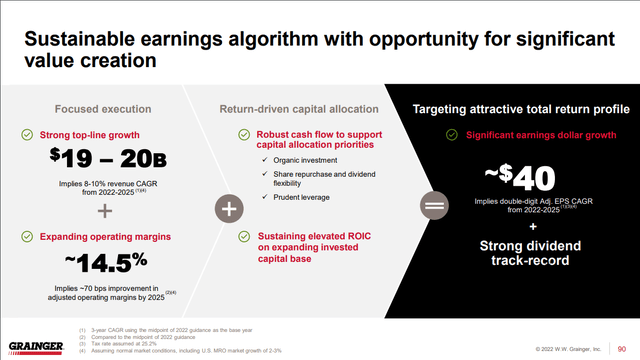

Grainger expects to generate between $19-20 billion in revenue at a 14.5% operating margin, an 8-10% revenue CAGR and a 70 bps improvement in operating margin in 2025. On an EPS base, they expect to reach $40 adjusted EPS, a 42% increase from its FY22 full-year guidance of $28 EPS (midpoint).

The company has a clear capital allocation strategy with the following priorities:

- Organic reinvestment

- A growing dividend

- Opportunistic Share repurchases or M&A

I like this capital allocation approach a lot, paired with modest leverage of 1.0x. In the past, the company generated strong Returns on Capital Employed around 30% and ROIC in the mid-30s. The company expects to remain in the same ballpark.

2025 target (GWW Investor Day)

Valuation

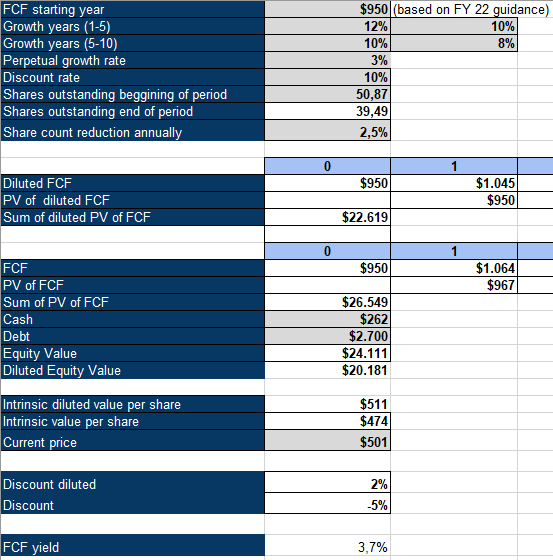

The company guides operating cash flows of $1250-1350 million and CapEx of $300-325 for FY 22, leaving us with FCF between $950 and $1050 million. I used the lower end of the guidance together with a 10% discount rate, a 3% perpetual growth rate and an assumption of 2.5% annual buybacks (based on historical trends and no change in capital allocation strategy for the company) for an inverse DCF analysis. The model tells us that the market is assuming between 8-10% annual FCF growth for Grainger on a diluted basis. This is in line with its revenue growth estimates and we can assume that FCF will grow faster due to margin improvement.

GWW Inverse DCF Analysis (Authors Model)

Conclusion

Grainger is a well-managed distributor with a lot of potential for incremental market share and margin gains due to a focus on technology to improve the customer experience. The company has a lot of similarities with Watsco (WSO) and Ferguson (FERG), both also in the distribution industry, check out my articles about them here: Watsco, Ferguson. The Investor Day shows a clear path for growth and incremental improvement and based on my inverse DCF shares are currently fairly valued. The stock has held up very well in this bear market, with a limited drawdown of 14%. I already own HVAC distributor Watsco, but I might consider dollar-cost-averaging into Grainger in the near future and potentially do a larger purchase if the stock trades down meaningfully.

Be the first to comment