IvelinRadkov

Introduction

PNC Financial Services Group (NYSE:PNC) recently reported decent Q3 earnings, topping expectations by a few cents per share. The immediate price reaction was negative after the report, with the price falling about -2% that day. Right now, the stock is down about -33% off its recent highs. It seems like a good time to review PNC’s valuation to see if it’s worth buying.

I always like to start my articles by reviewing any previous coverage or ownership I’ve had with a stock. In PNC’s case, I actually managed to bottom-tick this one in my marketplace service, The Cyclical Investor’s Club, during March 2020 COVID crash, and I wrote about it publicly several weeks later in my article “Stocks I Bought Dip: PNC Financial“. In that article, I explained how the same investing process I will use in today’s article led me to buy the stock on 3/23/20.

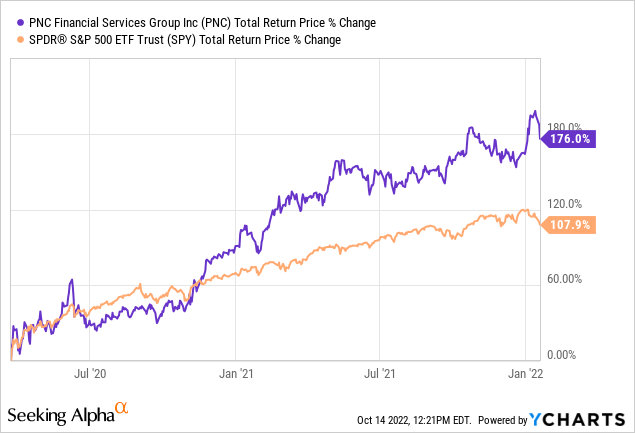

I held PNC from that point until I took profits earlier this year on 1/19/22. I wrote a follow-up article titled “6 Financial Stocks I Recently Sold, and 2 I Will Hold For The Long-term” a few days later where I explained my reasoning for selling PNC along with 5 other financial stocks at the time. Here was my return on the PNC investment compared to the S&P 500 over the same time period:

While over this time period the S&P 500 produced very good returns over 100%, PNC returned +176%. (Make sure to read the article I shared about why I decided to sell the stock in January for my reasoning regarding taking profits when I did.)

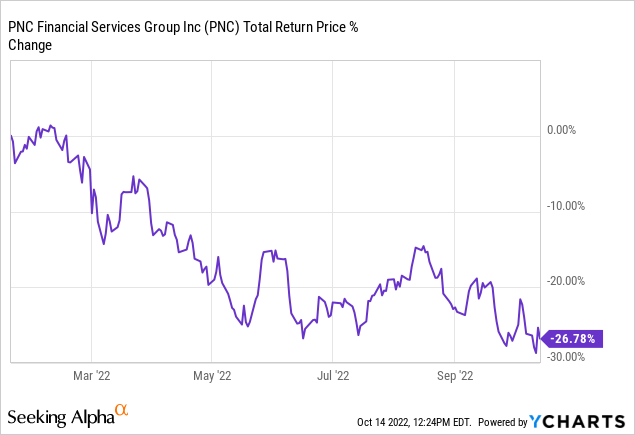

Since I sold PNC stock, here is how it has performed:

So, I’ve managed to avoid a big portion of the current decline, first by shifting to a more defensive position in late January, and then at the beginning of March, moving that money to cash after it became clear Russia had launched an all-out war on Ukraine.

In this article, I will reevaluate PNC stock using my standard “full-cycle” analysis, and then I will also include some adjustments that make for recessionary times, which is what I think we are headed towards in 2023. In the end, I’ll share both a standard and a recessionary buy price for PNC stock, depending on one’s macro perspective.

My Valuation Method For PNC Financial

The valuation method I use for PNC first checks to see how cyclical earnings have been historically. Once it is determined that earnings aren’t too cyclical, then I use a combination of earnings, earnings growth, and P/E mean reversion to estimate future returns based on previous earnings growth and sentiment patterns. I take those expectations and apply them 10 years into the future, and then convert the results into an expected CAGR percentage. If the expected return is really good, I will buy the stock, and if it’s really low, I will often sell the stock. In this article, I will take readers through each step of this process.

Importantly, once it is established that a business has a long history of relatively stable and predictable earnings growth, it doesn’t really matter to me what the business does. If it consistently makes more money over the course of each economic cycle, that’s what I care about – numbers over stories.

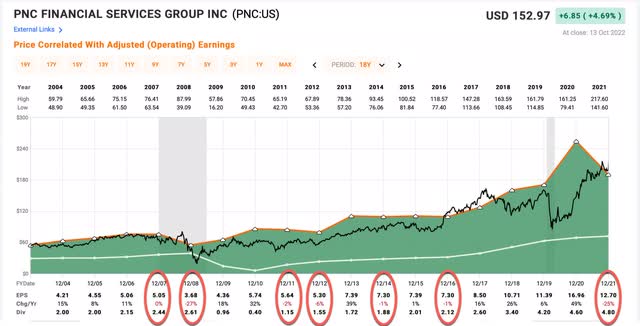

FAST Graphs

Since 2004, PNC has experienced 7 years where earnings growth was negative compared to the previous year. At first glance, this seems like a lot, but 5 of the 7 years were single-digit declines, and the most recent 2021 EPS decline came on the back of an unusually large growth year in 2020 which was likely partially the result of their selling their stake in BlackRock (BLK). Since 2021 EPS was higher than 2019, and 2022 is expected to be higher than 2021, I wouldn’t really count the 2021 EPS decline as a real decline. This leaves the only EPS growth decline of any real significance to be 2008 during the GFC. I have looked at hundreds of historical EPS graphs of banks and other financial businesses, and the truth is that to only have had a -27% decline in 2008, given the circumstances and compared to peers, was exceptionally good. Because of that, I classify PNC as a moderately cyclical business, and therefore it is appropriate to use historical earnings patterns to value the stock. (If earnings had been more cyclical, I would use a different valuation technique.)

PNC Stock – Market Sentiment Return Expectations

In order to estimate what sort of returns we might expect over the next 10 years, let’s begin by examining what return we could expect 10 years from now if the P/E multiple were to revert to its mean from the previous economic cycle. For this, I’m using a period that runs from 2015-2022.

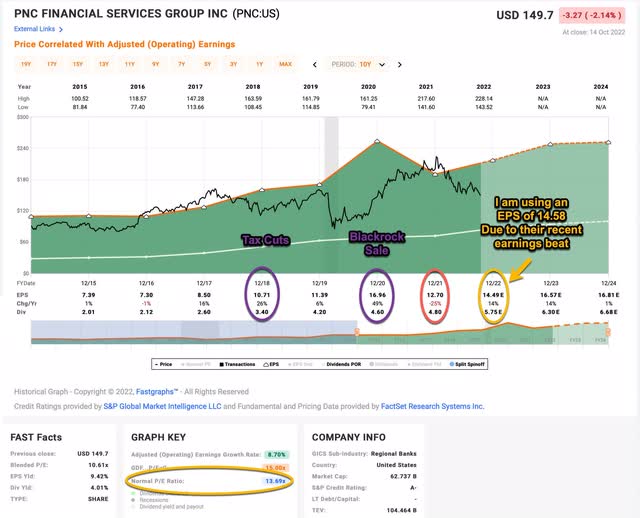

FAST Graphs

PNC’s average P/E from 2015 to the present has been about 13.69 (the blue number circled in gold near the bottom of the FAST Graph). Using 2022’s forward earnings estimates of $14.49, plus their recent $0.09 EPS beat, PNC is expected to earn around $14.58 per share this year. It has a current P/E of 10.27. If that 10.27 P/E were to revert to the average P/E of 13.69 over the course of the next 10 years and everything else was held the same, PNC’s price would rise and it would produce a 10-Year CAGR of +2.92%. That’s the annual return we can expect from sentiment mean reversion if it takes 10 years to revert. If it takes less time to revert, the return would be higher (as it was for me in 2020 and 2021 when it only took two years to revert).

Business Earnings Expectations

We previously examined what would happen if market sentiment reverted to the mean. This is entirely determined by the mood of the market and is quite often disconnected, or only loosely connected, to the performance of the actual business. In this section, we will examine the actual earnings of the business. The goal here is simple: We want to know how much money we would earn (expressed in the form of a CAGR %) over the course of 10 years if we bought the business at today’s prices and kept all of the earnings for ourselves.

There are two main components of this: the first is the earnings yield and the second is the rate at which the earnings can be expected to grow. Let’s start with the earnings yield (which is an inverted P/E ratio, so the Earnings/Price ratio). The current earnings yield is about +9.74%. The way I like to think about this is, if I bought the company’s whole business right now for $100, I would earn $9.74 per year on my investment if earnings remained the same for the next 10 years.

The next step is to estimate the company’s earnings growth during this time period. I do that by figuring out at what rate earnings grew during the last cycle and applying that rate to the next 10 years. This involves calculating the historical EPS growth rate, taking into account each year’s EPS growth or decline, and then backing out any share buybacks that occurred over that time period (because reducing shares will increase the EPS due to fewer shares).

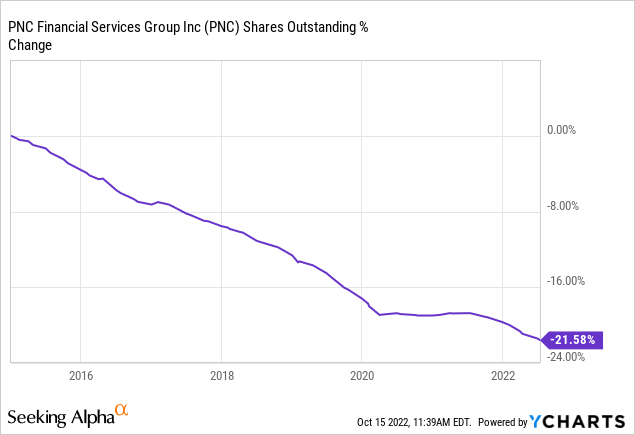

PNC has bought back quite a bit of stock since 2015, nearly 22% of the company. I make adjustments to control for the effects these repurchases have on EPS in order to get an estimate of what rate earnings are organically growing. I also include the -25% negative EPS growth year last year. In the end, I get an estimated earnings growth rate for PNC during this period of +5.55%, which seems pretty reasonable. However, it’s worth noting that this does include a big 26% growth year in 2018, boosted by tax cuts that are unlikely to happen again, and it doesn’t include a “real” recession drawdown as we saw in 2008. So, while I think my earnings estimate is reasonable (and more conservative than the FAST Graphs’ +8.70% EPS growth rate over this period), it’s possible that earnings during the next cycle could be lower if earnings fall during a recession next year. I will address this possibility later in the article.

Next, I’ll apply that growth rate to current earnings, looking forward 10 years in order to get a final 10-year CAGR estimate. The way I think about this is, if I bought PNC’s whole business for $100, it would pay me back $9.74 plus +5.55% growth the first year, and that amount would grow at +5.55% per year for 10 years after that. I want to know how much money I would have in total at the end of 10 years on my $100 investment, which I calculate to be about $232.67 including the original $100. When I plug that growth into a CAGR calculator, that translates to a +8.81% 10-year CAGR estimate for the expected business earnings returns.

10-Year, Full-Cycle CAGR Estimate

Potential future returns can come from two main places: market sentiment returns or business earnings returns. If we assume that market sentiment reverts to the mean from the last cycle over the next 10 years for PNC, it will produce a +2.92% CAGR. If the earnings yield and growth are similar to the last cycle, the company should produce somewhere around a +8.81% 10-year CAGR. If we put the two together, we get an expected 10-year, full-cycle CAGR of +11.73% at today’s price.

My Buy/Sell/Hold range for this category of stocks is: above a 12% CAGR is a Buy, below a 4% expected CAGR is a Sell, and in between 4% and 12% is a Hold. An 11.73% expected 10-year CAGR puts PNC stock right on the threshold of a ‘Buy’ if we assume there will be no recession in the near term. That buy price is about $147.30 per share. However, since I expect we will be heading into a recession next year, we need to do some additional work to account for the likely earnings declines that will happen.

Additional Considerations: Recession P/E

Due to an ending of federal government stimulus and the Federal Reserve raising interest rates, I think there is an above-average chance that the US economy experiences at least a mild recession as soon as Q1 2023. This can typically mean two things for a stock. First, it can mean that EPS disappoints, and instead of growing 14% in 2023 as analysts now expect (or growing near the average of 5.55% as I estimated), EPS could fall instead. Judging from PNC’s historical EPS declines, I think assuming a decline as large as -20% to -30% is reasonable. The second thing worth paying attention to is how much the market typically discounts these falling earnings. I call this metric the “Recession P/E” and it is the low monthly P/E that the stock has experienced during past recessions. This can help us predict how low the P/E might go in a future recession.

We have three different routes we can go with this. We can use the Recession P/E from 2008/9, or the one from March 2020, or an average of the two. The 2008/9 P/E was extremely low at 4.87, while the 2020 low was 6.65. Because the current downturn is not centered around the financial system, and banks are much better situated now than in 2008, I think it makes more sense to use the higher and more optimistic recession P/E from 2020 of 6.65. Currently, using forward earnings for this year, PNC’s price would need to drop about -35% more from here to meet that recession P/E, which is a price of about $97 per share.

For me, the recession P/E serves two functions. The main one is to keep me from buying the stock before earnings expectations disappoint. As I noted earlier, right now earnings are expected to grow next year at a 14% rate, if we have a recession, EPS will likely fall double-digits instead. Often the stock market will anticipate this decline in earnings before it is officially reported, and the stock price will drop, thereby making the valuation look very attractive at the beginning of a decline. However, those hopes of earnings holding up as expected should we have an economic slowdown, will be dashed if earnings growth goes negative, and often at that point, the stock price falls even deeper. So, using the “Recession P/E” as a guidepost often helps keep me from buying too early before those earnings and earnings growth expectations come down.

However, if the stock happens to get really cheap, even in the face of a recession, it would likely hit that recession P/E early and I could be a buyer well before any good news comes to the stock, yet hopefully with a significant margin of safety. This recently happened with Netflix (NFLX) stock back on May 6th of this year. It got so cheap that even if there was a recession, Netflix stock was a good deal, so I bought Netflix earlier this year using the same recession strategy I’m using with PNC. It’s possible that PNC’s earnings hold up going into next year, even while the market falls. Because the distance between the forward P/E and recession P/E is based on forward earnings, it is possible that if PNC’s earnings do grow a little bit next year (even if it’s not 14%) and the stock price falls a little bit, then the recession P/E buy price will rise higher than $97 in January or February of next year and the forward P/E and recession P/E would converge on a pretty good buying price that has a fairly high likelihood of actually occurring.

All these are based on estimates, of course, but really what we are aiming for here is to get the lowest price we can reasonably expect so that we can maximize our future returns. I got a bit lucky in March of 2020 when I essentially bottom-ticked the stock price. It was totally possible the stock price could have kept falling even further after I bought it, yet still have come back to produce great returns over time. So I want to emphasize that I’m not claiming to have precision here. I just want to get the odds in my favor. Similarly, I didn’t know that when sold PNC in January, it would end up being near the peak. As I explained in the article, it just looked like the macro odds had shifted dramatically and the market hadn’t yet priced that in, so I took profits. I had plenty of other stocks I missed buying in March 2020 that needed to fall just a little more in order to hit my buy prices, and, as I noted in my January article, I had a couple of financial stocks I decided to hang onto even though I knew the downside risk was relatively high (and those stocks are now much lower). So, we don’t want to let a quest for perfection get in the way of good returns. We just want to get a good price.

Conclusion

Generally speaking, I think banks are going to be very well-positioned over the medium term if they can be purchased at good prices. At least for the time being I think the Federal Reserve is likely to normalize interest rates from 2023 onward, and that will be favorable to most banks. The more difficult question is whether the stock prices of banks will fall low enough to provide a margin of safety for investors. I think they might, but investors will probably need to be very quick to act because I doubt bank stocks will trade at bargain prices for long if they do. I suggest reviewing your favorite high-quality banks now and establishing the prices at which you would be willing to buy so that you are ready to pull the trigger quickly if the time comes. I monitor a lot of high-quality banks, and in order to get the prices I would like, most of them still need to fall about -30% more from here. I give that about a 50/50 chance of occurring for any given bank. So, it’s best to follow and develop buy prices for as many banks that meet your quality standards as you can in order to increase your odds of getting a few of them during the current downturn.

If you don’t think the US will experience a recession in the next 12 months, then PNC stock is at an attractive price today. I think the odds of a 2023 recession are very high right now, though, so at least for the next 3 or 4 months, $97 is my buy price for PNC stock, assuming earnings estimates for the 4th quarter don’t come down considerably during this time, in which case, my buy price would go lower.

Be the first to comment