Yobro10/iStock via Getty Images

When we last covered Reinsurance Group of America Inc. (NYSE:RGA) it was our largest position and one we backed for significant upside. This was despite not being too thrilled with the outlook for the general market. To us, RGA had enough positive factors to overcome the risks and deliver. Specifically, we said,

Our work suggests that COVID-19 pulled forward some mortality by 1-3 years in the oldest victim population. If this is true, earnings are likely to surprise on the upside in 2022-2023. The second factor here is that reinsurance rates are likely to move up as this has had a big impact on the industry. RGA should be a key beneficiary. Finally, rising interest rates should help RGA’s fixed income portfolio. Almost all of RGA’s portfolio is in bonds or bond-like instruments and higher rates would benefit the company as it reinvests maturing proceeds.

Source: Our Largest Position

While it was not as resounding a victory as we would have hoped for, it did work out. It also beat the S&P 500 (SPY) and completely dodged the disasters in “growth land.”

Seeking Alpha-Returns Since Last Article

We update our thesis today and look at one new issue from this firm which might appeal to some investors.

Q3-2022

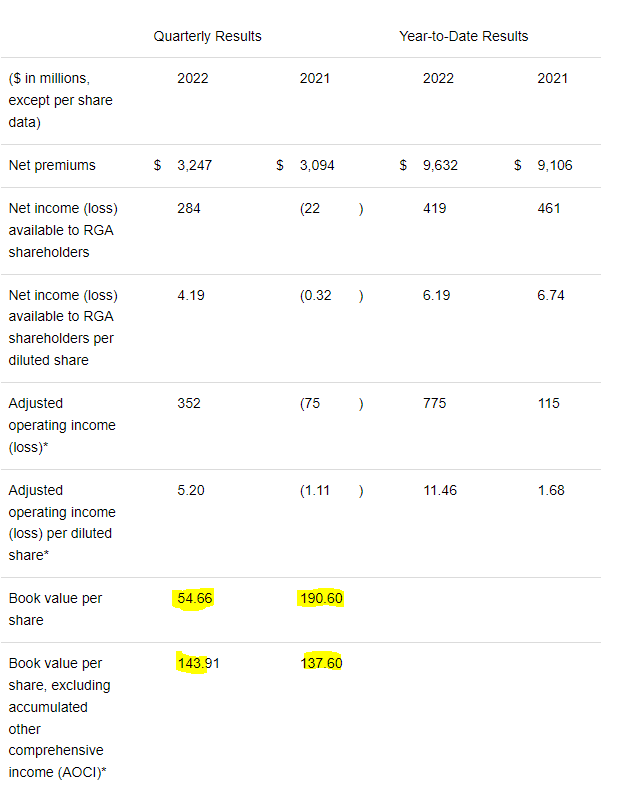

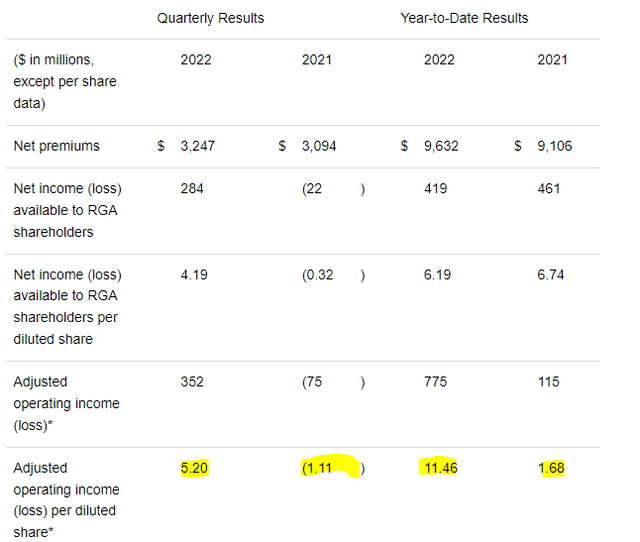

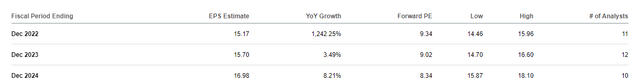

RGA was firing on all cylinders in Q3-2022 as adjusted operating income came in at $5.20 per share. You can see the sharp contrast from 2021 below as RGA began to see benefits from all three factors that we had cited in our older article.

Premium growth was modest at about 5%, but grew 10.1% on a constant currency basis. RGA rewarded investors with $54 million of dividends and $25 million of buybacks during the quarter.

What About That Drop In Tangible Book Value?

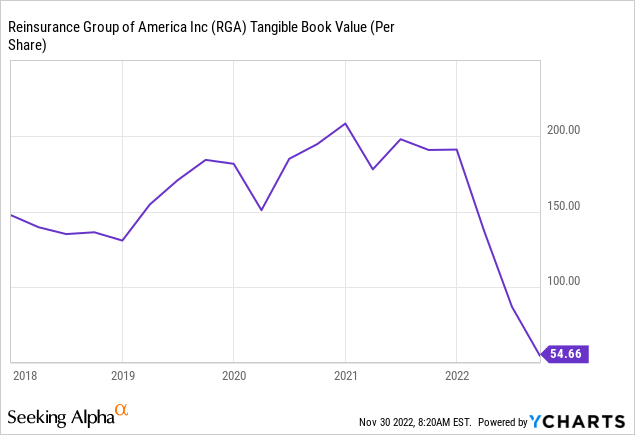

Astute investors might have noticed the extreme drop in tangible book value per share.

We always stress on making sure the underlying value is sound in an investment. Humming “I am happy to collect my dividends” theme song is a recipe for disaster. So of course, this bears investigating. What happened here?

With insurance and reinsurance stocks, the equity is invested in ultra-safe (think A-rated) bonds. On a mark-to-market level, the values fluctuate, and this has been the driver as interest rates have risen sharply. This is generally of little concern as for the most part these bonds are held to maturity. A good way to look at what the impact would be excluding these mark-to-market impacts would be to see book value excluding AOCI.

RGA Q3-2022 Press Release

While book value has fluctuated between $190.60 and $54.66, book value without AOCI has stayed in a far narrower zone and generally moved up.

Valuation and Outlook

With interest rates far higher than before and reinsurance rates headed in the right direction, RGA looks to be printing cash for the foreseeable future.

On a P/E basis the stock looks cheap, but we would not pay much above book value excluding AOCI. Based on that the stock is still slightly in the buy zone and that is our current rating on it.

Reinsurance Group of America, Inc. – FXDFR DB REDEEM 15/10/2052 (RZC)

While RGA has many positive qualities, a large yield is not one of them. With a 2.25% dividend, the stock will be passed on by almost income investors at this point. That is where RZC comes in. RZC was issued with a par value of $25 during a rather tumultuous period in the bond market. That led to perhaps a higher interest rate than what we would have seen if things were more sanguine. RZC started off with a 7.125% coupon. The baby bond matures about 30 years from now in 2052 but can be redeemed as early as October 17, 2027. The interesting aspect here is that you are not locked into the 7.125%, but the rate adjusts on October 17, 2027 if the bond is not called.

The Annual Fixed Dividend Rate will be 7.125% until the first redemption date, then it will be equal to the sum of the U.S. Five-Year Treasury Rate on the applicable fixed rate calculation date plus 3.456%, resetting every 5 years thereafter on applicable fixed rate calculation date.

Source: RZC Prospectus

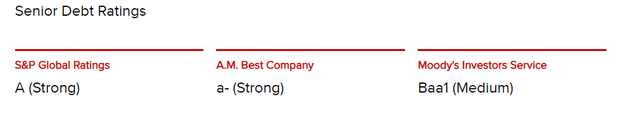

Right there is the key piece of what you need to know for this issue. The 7.125% is made up of 3.669% risk free component and 3.456% of “spread.” Tackling the “spread” part first, we think that is an excellent level for RGA the company and RZC the baby bond. RGA’s senior debt ratings are excellent.

The baby bonds are junior to the debt rated above and they get a BBB+ rating from S&P. We believe these ratings understate the actual strength as rating agencies have been cautious since COVID-19 when it comes to life and health insurance companies. Current outlook for the sector is extremely good and the earnings estimates are a good reflection of that. Investors also must keep in mind that the bond has a clause that allows for deferral of payments.

We may defer interest payments during one or more deferral periods for up to five consecutive years.

This is often seen in the case of insurance companies. Note that in such a case, RGA has to also stop dividends and common share repurchases until all deferred amounts are paid and regular payments on RZC are resumed.

Moving past that spread, it should be clear to investors that the reset will be determined by where the five-year Treasury bond is trading on that date. Hence this becomes an excellent issue for those wanting to position their portfolios for even higher rates. If you think longer term rates are making a secular move up, RZC is a fantastic bond for you. If you believe that we are about to go back to 1% interest rates, perhaps not so much.

RZC Current Pricing

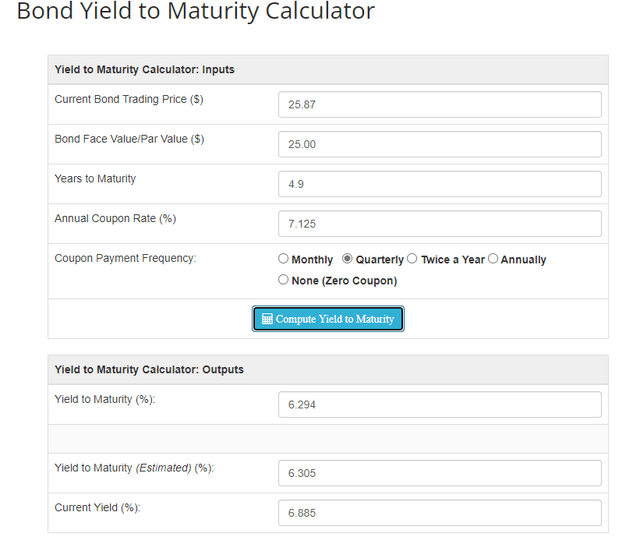

RZC currently trades a little over par, even adjusting for the 37 cents of accumulated interest.

This lowers your stripped yield to about 6.9% and yield to call (shown as yield to maturity below) drops even more (DQYDJ Link).

One other way to gauge value here is to examine the pricing relative to Reinsurance Group of America, Incorporated SB DB FX/FL56 (RZB), which is another baby bond by the same company. The key differences here are

1) The reset date is June 15, 2026.

2) The coupon is 5.75%.

3) The spread commencing on 6/15/2026 to the maturity date will be equal to three-month LIBOR, reset quarterly, plus 4.04%.

While the spread here is higher, it’s set to a shorter-term rate and a rate that is historically a good deal below the five-year Treasury rate. RZC is definitely the better relative value here.

Verdict

RGA gets a buy rating here but just barely. Part of our full disclosure here is that we don’t own it anymore. Insurance and reinsurance stocks tend to look cheap on P/E basis but using our tangible book value excluding AOCI metric, RGA looks only slightly undervalued. RZC is a good issue to keep your eyes on. We don’t think the bond is particularly expensive considering its fundamentals, but we think there are better opportunities out there and currently this just makes it to our watch list.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment