zoranm

Shares of ocular disease upstart EyePoint Pharmaceuticals (NASDAQ:EYPT) have lost over 25% of their value over the past 3 years. So far in 2022, they are in the red by about 15%.

Unintentionally, the past couple weeks my due diligence has led me to look at several competitors in the ophthalmology space including most recently gene therapy pioneer REGENXBIO (RGNX) and prior to that my update piece on Ocular Therapeutix (OCUL). Stock market research often works in this manner, where I’m digging into one name and it leads me to several others along the way.

At times following such a rabbit trail can lead to a dead end, but conversely once in a while it pays off with finding a new high conviction idea that prior escaped my notice.

As I was gaining a better understanding of the prospects of gene therapy to address the lucrative but highly contested wet AMD space, I was reminded that perhaps EyePoint’s EYP-1901 has a leg up on the competition as prior phase 1 data showed potential best-in-class efficacy along with excellent safety profile. This is highly important for a disease where the bar has been set so high in terms of tolerability profile.

Let’s take a closer look to determine what kind of upside potential we are looking at in coming years.

Chart

FinViz

Figure 1: EYPT weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see that share price has traversed a wide range from $4 level all the way up to $20 (and back again) over the past couple years. The last time share price spiked above $20 in late 2021, it was in response to positive phase 1 DAVIO study results for EYP-1901 in wet AMD in which they showed a pretty pristine safety profile coupled with promising rescue-free rates at 4 and 6 months following a single injection. From there, presumably due to lack of near-term catalysts, share price has fallen back to the $8 to $10 level. My initial take is that there have been no negative developments for the story, so long term investors who are interested could do well to accumulate dips in the second half of 2022.

Overview

Founded way back in 1987 with headquarters in Massachusetts (123 employees), EyePoint Pharmaceuticals currently sports enterprise value of below $200M and Q2 cash position of $$171M providing them operational runway into the second half of 2024.

Management’s presentation at Wainwright Healthcare Conference provided an excellent overview of where they’re at currently:

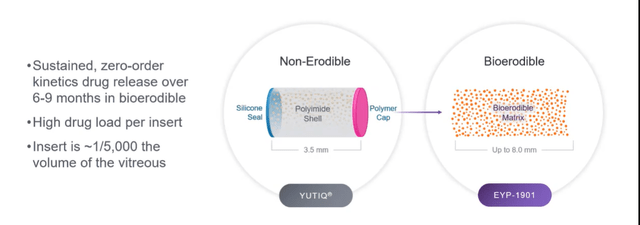

- CEO Nancy Lurker starts by describing EyePoint as a dedicated ocular company whose pipeline is driven by the proven Durasert technology. The focus primarily on diseases of the retina, the back of the eye. This is where the most serious eye diseases typically occur. It appears the tech has been significantly derisked as it’s already incorporated into four approved, non-erodible products (Yutiq commercialized by EyePoint, Iluvien with partner Alimera, Retisert & Vitrasert with Bausch & Lomb). Durasert is a proven intravitreal drug delivery platform that provides sustained ocular delivery (critically important in these retinal diseases). The other value it provides is zero-order kinetics (very steady constant, stable release of the drug in this case over 6 months). Competitor approaches (first-order kinetics) could be less healthy for the eye or provide weaker results. Durasert has been administered to over 80,000 patient eyes and again in 4 of the 6 FDA approved intravitreal products for back of the eye.

Corporate Slides

Figure 2: EYP-901 uses same Durasert tech but with bioerodible formulation (Source: corporate presentation)

- EYP-1901 is their key program, which uses an anti-VEGF (voloranib) in the bioerodible Durasert technology. The difference here is that the polyimide coating has been taken away and they get an initial drug burst from the surface of the insert. Also, as mentioned prior here they achieve constant, zero-order kinetic release over months. They can give a single IVT injection with up to 3 inserts and voloranib provides nice receptor binding at the TKI receptor (binds to all VEGF growth factors). Oral formulation was studied by partner in phase 1 and phase 2 studies which did show efficacy (were stopped due to well-known systemic toxicities). The insert utilized here is only 1/5000th of the vitreous so it’s very tiny in the eye (no incidents of floaters or problems with this form, a very safe product). Voloranib was chosen due to its design to reduce off-target TKI binding (no ocular toxicities in prior oral studies). Large molecule anti-VEGF agents don’t block at the receptor level and that’s where voloranib acts (binds to intracellular domain including R1, R2 and R3 which are implicated the most in these retinal eye diseases).

- Recently EyePoint dosed their first patient in the phase 2 DAVIO 2 clinical study for wet AMD and soon expect to dose the first patient in the phase 2 PAVIA study for non-proliferative diabetic retinopathy (NPDR). The company semi-recently announced positive phase 1 safety and efficacy data from the DAVIO study in wet AMD. They looked at four doses (low, low-mid, mid & high) but keep in mind the usual caveats due to low number of patients treated (3 at low, 1 at low-mid, 8 at mid, 5 at high). Primary efficacy endpoint was achieved at 12 months and more importantly for an indication such as this where bar for tolerability is very high, safety profile looked pristine. They saw no vitreous floaters, no endophthalmitis, no retinal detachment, no implant migration to vitreous chamber, no retinal vasculitis and no posterior segment inflammation. However, one eye did have mild asymptomatic anterior chamber cell/flare (injection related, treated with Maxitrol eye drops). One eye did have asymptomatic vitreous hemorrhage from the injection (patient was just observed).

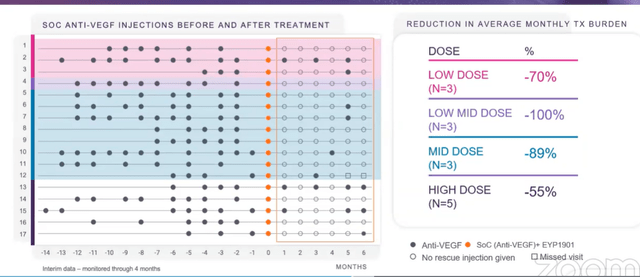

- Swim lane graph below is at 6 months (main readout point) and implant was designed to last for 6 months. Study went out to 12 months to test for ongoing safety. These patients were all prior treated (none were naive, where biggest vision gain typically occurs) and stable with goal of maintaining their vision (not improve it). Most patients were getting Eylea, some Lucentis prior to study. To right of orange dots is when they got EYP-1901. At first glance you can see significant reduction in supplemental anti-VEGF therapy they were getting (79% reduction over prior treatment at 6 months).

Corporate Slides

Figure 3: Promising reduction in treatment burden observed in DAVIO study (Source: corporate presentation)

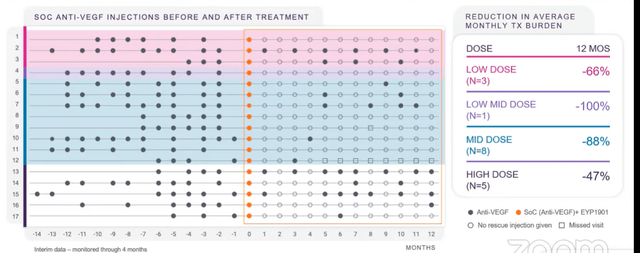

- Playing devil’s advocate, I never want to see an inverse dose response (possible red flag) and here the high dose was worse (-55%) than mid dose (-89%). CEO states that 2 of 5 high dose patients had to get rescued at month 1 (these were patients not doing well on standard of care either). Taking results out to 12 months (image below), keep in mind the implant starts to run out between 6 to 8 months. Patients who got rescued at 1 month continued to need care (bad eyes, already had poor BCVA and large thickness in retina with increased central subfield thickness). Other eyes continued to do very well, some going out to 12 months with no additional care needed (quite remarkable). Results show drug is clearly working and merits moving forward into phase 2.

Corporate Slides

Figure 4: Promising 74% reduction in treatment burden observed at 12 months as well (Source: corporate presentation)

- 53% of patients were rescue-free at 6 months (goal was at least 50%). Even after 12 months, 35% of patients were still ongoing with no additional supplemental care.

- As for where EYP-1901 would be used in treatment landscape, management’s motto is “treat to maintain”. It would be able to be used for the majority of patients (eliminate the sicker eyes with high CST on entry, will not enroll them in DAVIO 2 study). They expect to maintain eyes up to 6 months with baseline therapy of EYP-1901. So, doctors would treat patients initially with current standard of care until vision is maximally improved and retina as dry as possible (induction phase). Then, maintain with 1901 every 6 months (supplementing with current anti-VEGF biologics as needed). Based on phase 1 data, they believe over half of all wet AMD eyes may be able to be maintained visually and anatomically with 1901 alone (I think based on low number of patients treated, it’s too early for management to say that). Another large segment may require occasional supplemental anti-VEGF but at reduced interval.

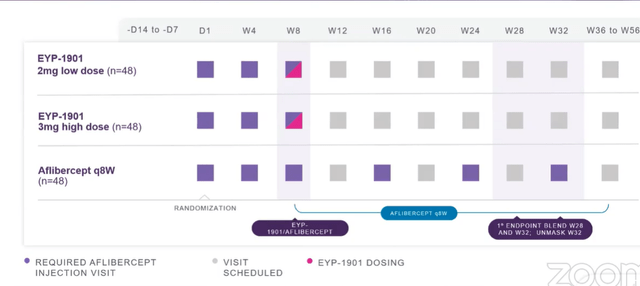

- Phase 2 DAVIO 2 study has similar design to phase 1 (3 doses), they will unmask at Week 32 (controlled trial versus aflibercept every 8 weeks). They are loading each patient first with 2 doses of aflibercept, then inject with 1901 and give 3rd dose. Aflibercept control arm goes out every 8 weeks per label and continue to monitor patients on blinded basis if need supplemental care.

Corporate Slides

Figure 5: Phase 2 DAVIO 2 study design (Source: corporate presentation)

- Phase 2 NPDR trial will dose first patient this year by end of Q3. They have 2 doses 2mg and 3 mg, control arm will be sham as there is no standard of care. First endpoint will be at week 36.

- YUTIQ is approved and on the market for treatment chronic non-infectious uveitis (3rd leading cause of blindness in the US). YUTIQ lasts for 3 years. Flares can come sporadically and unpredictably- YUTIQ provides continuous protection for these eyes. Kaplan Meier curve shows nice effect, sharp upward curve at 3 years as implant depleted by then and flares come back. Product is much better than standard of care out to 3 years.

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $171M as compared to operating expenses of nearly $31M (up 50% from same quarter prior year). Management is guiding for runway to 2H 2024, but keep in mind the company has $40M in short and long-term debt as well. Accumulated deficit is $569M, an outsized number for sure that is set to continue climbing as large scale mid and late-stage studies are necessary to take a shot at the lucrative but crowded wet AMD market.

Commercial franchise is poised for break-even this year ($11.3M in Q2 net product revenues, a 30% increase). 900 units of YUTIQ was 43% increase over Q1. 14,700 units of DEXYCU (Q2 over Q1), partner Imprimis commercializes DEXYCU.

On the conference call management notes that for the DAVIO 2 phase 2 study they will not be providing quarterly enrollment updates (just a press release when enrollment is complete). Physician engagement is high with over 100 sites interested in participating in the study, the result of the TKI and the delivery system resonating with doctors. Management has not publicly announced statistics around DAVIO 2, stating that they are descriptive only at this point and trial is not necessarily powered to a high enough level to be confident to the 95% level. Type C meeting with the FDA gave management a better idea of what structure for pivotal studies would look like, but again the goal of phase 2 is to inform pivotals around dosing and other aspects.

As for prior financings, in November of last year the company raised $100M at $13.75 per share (included a sweetener consisting of pre-funded warrants). This represents over 30% upside from current share price levels.

As for emerging competition especially in the wet AMD space, I suggest that readers check out my recent public update articles on Ocular Therapeutix and REGENXBIO.

As for institutional investors of note, Suvretta Capital owns a near 10% stake in the company. Adage Capital Partners owns 5.75% and RA Capital owns 5.6% stake (clustering is potentially a green flag). Moving on to insiders, CEO Nancy Lurker owns over 150,000 shares (nice to see she has some skin in the game, though in reality it’s still a small position).

As for relevant leadership experience, Chief Regulatory Officer Isabelle Lefebvre spent nearly a decade at eyecare giant Bausch Health where she led successful approvals for Lotemax gel and Vyzulta. She was hired in March and I consider that a green flag as the company needs to strengthen its C-suite.

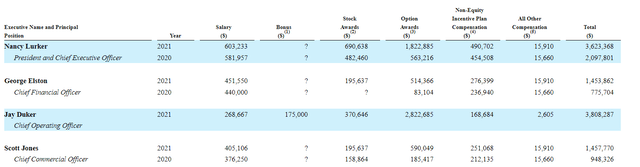

Moving on to executive compensation, cash portion of CEO salary is on the high side at over $600K (wish it were lower considering this is a small cap biotech stretching its resources to cover larger scale studies). Conversely, stock and options awards are definitely on the low side, which I appreciate given the poorly behaved peers we’ve come across that gift excessive pay packages to leadership.

Proxy Filing

Figure 6: Executive Compensation Table (Source: proxy filing)

The important thing is to avoid companies where the management team is clearly in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

Moving onto useful nuggets from members of the ROTY community, I felt that Biotech Phoenix gave me a crash course on the wet AMD space last year. Here are a few of his remarks from November 2021 on why he believes EYPT could be the key player in the long acting wet AMD space:

RGNX was the current leader. EYPT now matches them on 6-month efficacy, wins on safety/tolerability profile and administration (Injection vs. Surgical procedure). The approach across EYPT, OCUL,, ADVM and RGNX are basically the same to provide a long-acting base of therapy to complement the PRN mAbs. Although they each use slightly different technologies. EYPT just established themselves as the current leader. EYPT – 1901 data at AAO sets the bar with efficacy comparable to RGNX’s AAV without the need for a surgical procedure and associated better AE profile. ABBV just paid $370 M upfront for US co-promote and Ex-US rights. The current market is limited to short acting PRN therapies. However, I think it will likely transform similar to other markets like insulin and asthma where you combine a long-acting agent with a short- acting PRN rescue agent. The players in the long-acting space are EYPT, OCUL, and RGNX. EYPT was a compelling buy and underpriced prior to data but now post data and financing is now more or less fairly valued with regard to the competition.

Keep in mind that as Eylea chalked up nearly $6 billion in sales for 2021 and wet AMD market continues to grow steadily, these smaller upstarts such as EyePoint Pharmaceuticals and Ocular Therapeutix need to only penetrate a small % of the market to create value for shareholders.

As for IP, the company owns rights for YUTIQ in the US and all foreign jurisdictions with expiration not expected until August 2027 in the US (internationally dates ranging from October 2024 to May 2027). The last expiring patent covering the vorolanib compound licensed to them by Equinox Science and used in EYP-1901 expires in September 2037, but EyePoint has filed an additional patent application for EYP-1901 that would extend coverage until at least 2041.

Final Thoughts

To conclude, I’m surprised that I have ended up appreciating the company’s differentiated approach in tackling back of the eye diseases, particularly wet AMD, as Durasert technology allows for safer, longer-term retinal delivery which is critically important for achieving optimal outcomes for patients. 74% reduction in treatment burden out to 12 months for EYP-1901, some patients out to 12 with no additional injections needed was quite promising (usual caveats for low number of patients treated).

The company has robust initial data and now needs to replicate these results and confirm clinical profile in phase 2 to be able to move forward with the pivotal program. Being able to inject the drug candidate in office setting intravitreally is also important to improve convenience. I don’t think I could suggest probability of success is higher than 40% at this point, simply because I need to see results in higher number of patients. That said, current sub $200M enterprise value looks discounted as contrasted to blockbuster opportunity in wet AMD and other indications such as NPDR. However, on clinicaltrials.gov website I see that projected primary completion date is December 2023 (data 1H 2024 if there are not any delays) and that’s a long time to wait with catalyst desert likely in the meantime.

For readers who are interested in the story and have done their due diligence, EYPT is a Buy and I suggest patiently accumulating dips during potential catalyst desert over the next few quarters. This idea is only appropriate for long-term investors given key readouts are not expected until the 2024 to 2025 timeframe.

From an ROTY perspective (focus on next 12 months), I confess that I don’t have the necessary attention span and patience to buy this one in the near term. I prefer to stay on the sidelines for now and would like to revisit mid-2023 to determine how the story has progressed.

As for risks, I would expect another round of dilution by Q4 2023 or so. Disappointing phase 2 data would kill the bull thesis especially if any unexpected safety or tolerability concerns pop up (bar is very high for these crowded indications like wet AMD). Competition is fierce and in some cases stems from companies with much more in the way of resources than a tiny enterprise like EyePoint. Conversely, it merits mentioning that the Durasert tech has been administered to over 80,000 patient eyes and is well-characterized (target is also highly validated). Data sets across competitors, including Ocular Therapeutix and REGENXBIO, will determine first which companies even make it to late stage studies and approval, and from there strength of results to determine who has a shot at achieving meaningful market penetration. Delays in enrollment for phase 2 studies would also weigh on shares, as the company only has cash to last until 2024.

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. I look forward to your thoughts in the Comments section below.

Be the first to comment