da-kuk/E+ via Getty Images

This article was first released to Systematic Income subscribers and free trials on Mar. 27

Welcome to another installment of our Preferreds Market Weekly Review where we discuss preferreds and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the fourth week of March.

Be sure to check out our other weekly updates covering the BDC as well as the CEF markets for perspectives across the broader income space.

Market Action

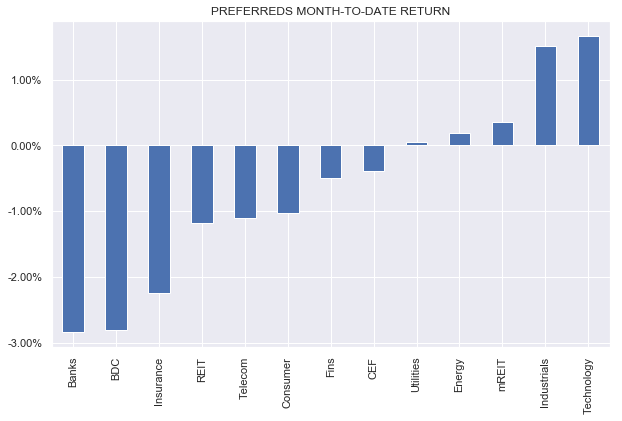

After a strong rally the previous week, preferreds were mostly lower this week as rising Treasury yields kept pressure on the market. A partial bounce back in stocks as well as strength in commodity prices supported convertible-heavy sectors like Technology as well as the Energy sector. Year-to-date only the Energy sector has eked out a small positive return.

Systematic Income

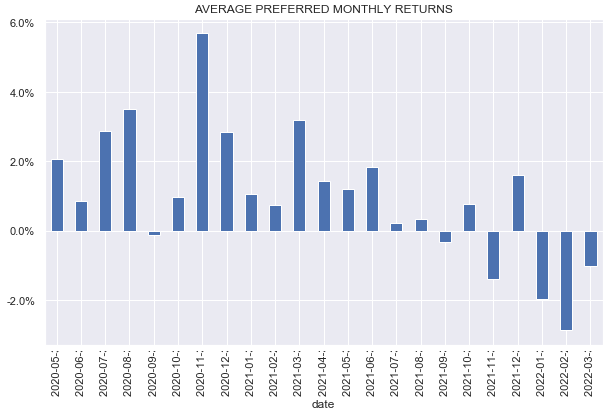

On a monthly basis, preferreds are down for the third month in a row, though the performance in March is not as bad as in the previous two months.

Systematic Income

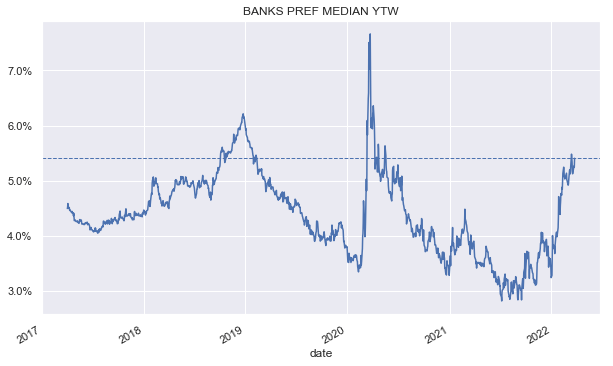

Higher-quality preferred sectors such as Banks and Insurance have underperformed this year and are trading at a historically elevated yield levels, having underperformed longer-term Treasuries. For instance, while 30-year Treasury yields are only 0.75% higher in the last six months, bank preferred yields are 1.4% higher.

Systematic Income

Market Themes

A pretty difficult preferreds market has finally delivered some good news for investors. The recently passed $1.5trn omnibus government spending packages that passed last week included federal legislation that overrides current Libor-related documentation in preferreds documentation.

For investors looking for a refresher of why this is necessary should have a look at our earlier weekly on this topic. In short, the potential, if, arguably very low, risk facing investors holding Libor Fix/Float securities was for Libor to become fixed at its previous value when it eventually disappears because typically, the preferreds contractual language did not anticipate the scenario of Libor disappearing.

The new law stipulates that preferred coupons linked to 3-month Libor (we have no other Libor terms in our exchange-traded preferreds database of 660 stocks) will be replaced with SOFR + 0.262% on 30-Jun-2023. Specifically, the law authorizes the Board of Governors of the Federal Reserve to select a SOFR-based replacement for Libor. Importantly, the law provides a safe-harbor provision to shield issuers from any litigation linked to the change.

The reason Libor is being replaced by SOFR is for the simple reason that Libor levels are made up by Banks. We don’t say this to sling mud at Banks – there is nothing else they can do. Essentially no short-term interbank lending takes place in unsecured format (which is what Libor represents) and so Banks are forced to, as best they can, estimate a rate where they think they could lend or borrow in an unsecured short-term format. Of course, because there are no hard numbers they can hang their hat onto many bank traders leaned into their market positions and wrote some fun-to-read messages to each other in chat rooms. Unlike Libor, SOFR is based actual transactions which makes it a real financial index. The only surprise here isn’t that Libor is being replaced but why it took Libor so long to go away.

The reason for the 0.262% additional spread investors will earn has to do primarily with the fact that SOFR has tended to trade below Libor. This is because SOFR is 1) a secured rate (by Treasuries) whereas Libor is unsecured i.e. SOFR less “risky” and 2) is a spot rate whereas 3-month Libor is a rate over 3-months – a “shorter” rate in a normal upward-sloping curve would be lower.

At this time, it’s not clear to us whether the Fed will choose a term SOFR i.e. 3-month SOFR to match the 3-month Libor term of the preferreds or whether they will stick with spot SOFR. It’s important to point out that the 90-Day Average SOFR rate available on FRED is not the same as 3-month term SOFR since the former is a historical average while the latter, like Libor, is a forward-looking rate.

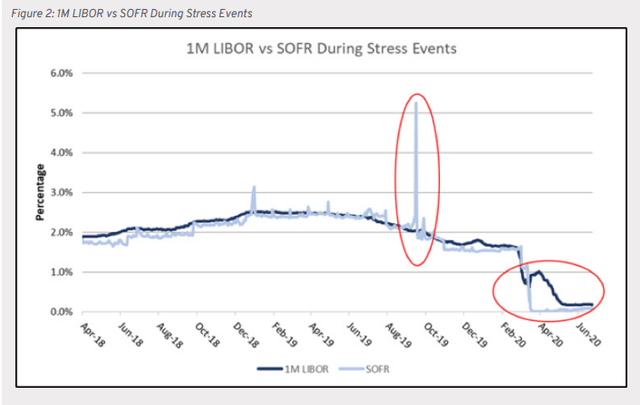

In our view, there are two primary mechanisms how this will affect investors. First, SOFR has tended to be “spikier” than Libor because it’s based on actual transactions and is more responsive to frictions in the repo market. The chart below shows that SOFR has tended to be more volatile than Libor. This was also the case during the COVID market shock though it’s harder to make out in the chart. This spikiness, is arguably, good for preferreds shareholders, especially if the spike happens when the period rate is fixed (we are assuming that the preferreds will not move to daily SOFR fixings otherwise this will have an impact but only a very marginal one).

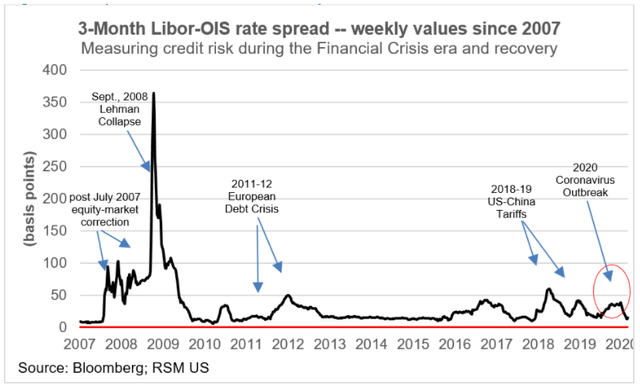

Second, the SOFR rate will be driven much less by counterparty creditworthiness worries. Libor has tended to be very sensitive to bank credit concerns which makes sense as it represents an unsecured loan to a bank. The best way to visualize this is via the Libor / OIS spread which is the difference between Libor and the equivalent term rate for Fed Funds (OIS stands for overnight index swap and is a way to turn the daily “floating” Fed Funds rate into a fixed term rate). This spread widened during periods of stress and, particularly, during the GFC when bank credit risk was questionable. The fact that this dynamic will not feed into preferreds coupons is bad for preferreds holders since today’s bank risk is perceived as being very low and so the 0.262% spread differential between SOFR and Libor may not reflect future bank stress which preferreds shareholders will not benefit from in the coupons they receive. In effect, preferreds shareholders got a small put on bank risk taken away from them.

Overall, this (mostly) clear path-forward is a good thing for the preferreds market as it removes a clear question mark on the future behavior of Libor Fix/Float securities which make up 19% of the exchange-traded market.

Stance & Takeaways

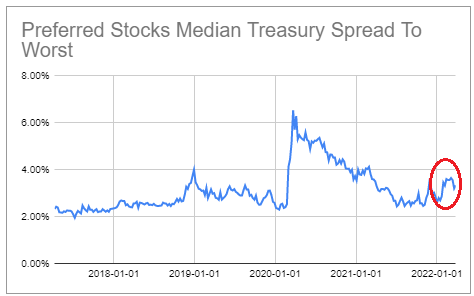

Although preferreds are likely to finish the third month in a row lower, March is actually a good result for the market. This is because March was responsible for more than two-thirds of the rise in 10-year Treasury yields and yet it boasts by far the best monthly return so far this year. This suggests that the bulk of the sell-off in January and February was more driven by a rise in preferred credit spreads rather than Treasury yields as also suggested by the chart below.

Systematic Income

This suggests that if credit spreads remain relatively stable from here, preferreds weakness relative to Treasury yields (i.e. the sector’s beta to Treasuries) should remain lower than in the earlier part of the year. The key risk remains that the Fed’s acknowledgement of the need to overtighten to bring inflation under control may result in a recession. However, in that case we wouldn’t expect Treasury yields to rise at the pace we have seen so far due to the cooling off of demand and the likely inversion of the yield curve.

Overall, rising Treasury yields remain a key headwind for the market. Powell has put 50bp hikes in play in future rate decisions, helping propel 10-year Treasury yields higher by 0.76% since March 1st. If the Fed does overtighten, as the new dot plot suggests it plans to, and the economy falls into a recession, the Treasury yield curve is likely to bull-flatten (i.e. where longer-term yields fall faster than short-term yields) in which case the 10-year Treasury yield is likely to move below its current level, supporting higher-quality preferreds.

For this reason, plus the fact that credit spreads are still expensive, we continue to like higher-quality securities as well as those with a consumer element such as mortgage REITs since consumer health is quite strong and the sector offers diversification to income portfolios that are traditionally overweight corporate credit and equity risk.

We covered our hybrid mortgage REIT picks in a recent consumer sector article. On the higher-quality side we like a couple of non-callable securities – the Wells Fargo 7.5% Series L (WFC.PL), a split non-callable investment-grade security trading at a 5.86% yield or 3.26% above the long bond (i.e. the 30-year Treasury) and the Liberty Broadband Series A (LBRDP) – an oddball business whose holdings consist primarily of Charter Communications (CHTR) stock – a giant telecom with a near-$100bn market cap, trading at a 6.42% yield.

Be the first to comment